Answered step by step

Verified Expert Solution

Question

1 Approved Answer

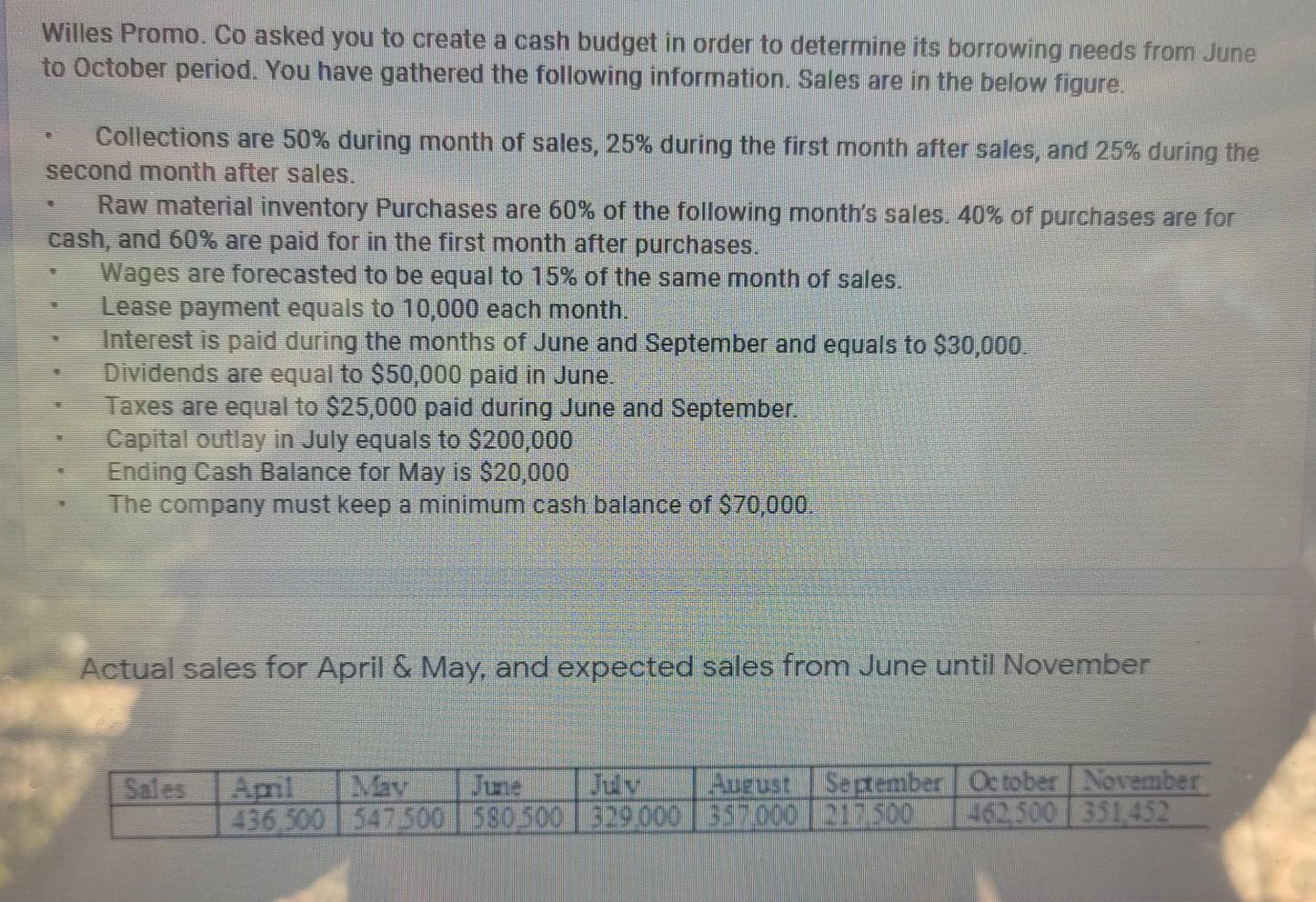

Willes Promo. Co asked you to create a cash budget in order to determine its borrowing needs from June to October period. You have gathered

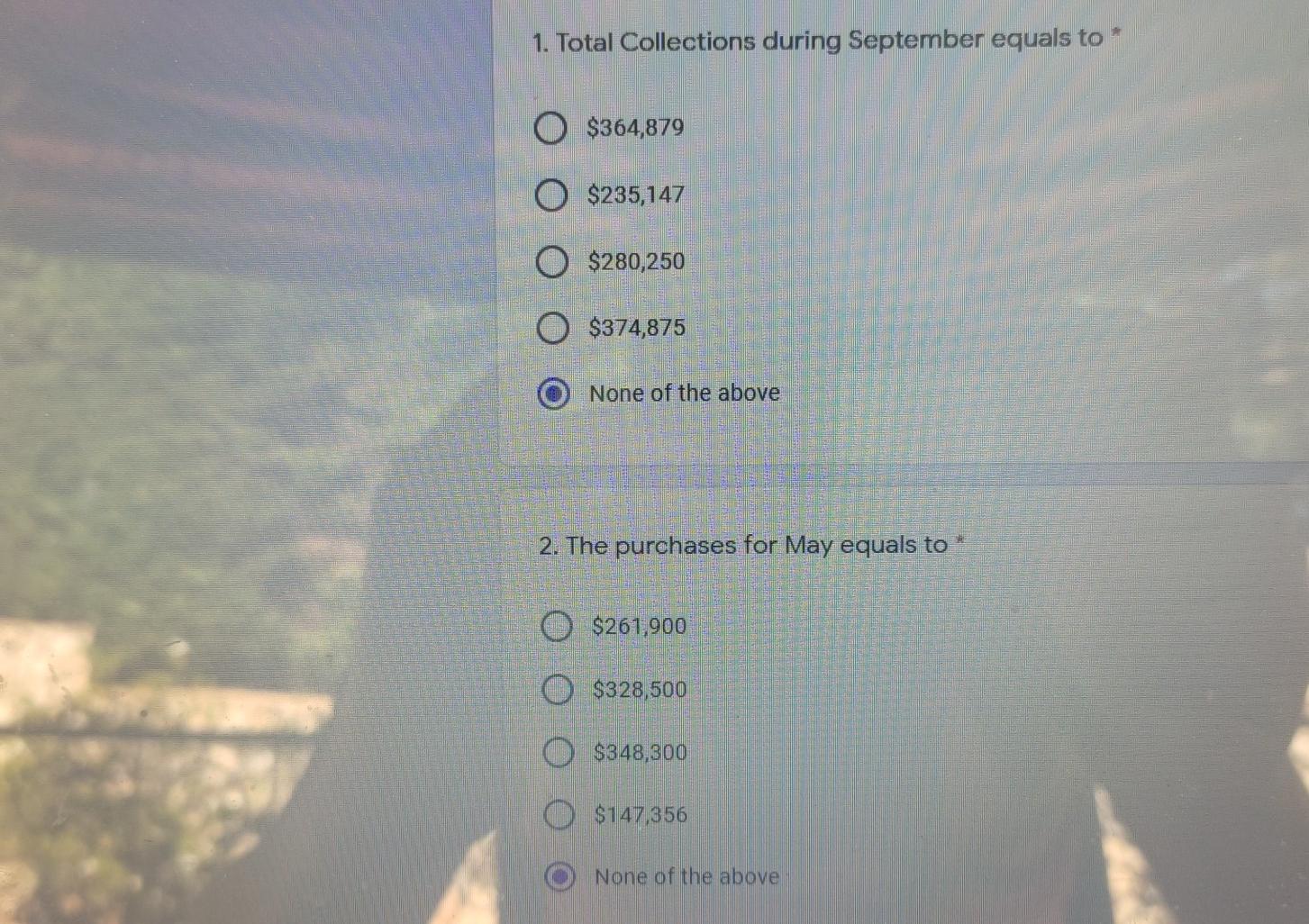

Willes Promo. Co asked you to create a cash budget in order to determine its borrowing needs from June to October period. You have gathered the following information. Sales are in the below figure. Collections are 50% during month of sales, 25% during the first month after sales, and 25% during the second month after sales. Raw material inventory Purchases are 60% of the following month's sales. 40% of purchases are for cash, and 60% are paid for in the first month after purchases. Wages are forecasted to be equal to 15% of the same month of sales. Lease payment equals to 10,000 each month. Interest is paid during the months of June and September and equals to $30,000. Dividends are equal to $50,000 paid in June. Taxes are equal to $25,000 paid during June and September. Capital outlay in July equals to $200,000 Ending Cash Balance for May is $20,000 The company must keep a minimum cash balance of $70,000. Actual sales for April & May, and expected sales from June until November Sales May August September October November 496.500 541500 | 580500 329.000 357000 17300 -6300 ) 351 452 1. Total Collections during September equals to O $364,879 O $235,147 O $280,250 O $374,875 O None of the above 2. The purchases for May equals to $261,900 0 $328,500 $348,300 $147,356 None of the above

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started