Answered step by step

Verified Expert Solution

Question

1 Approved Answer

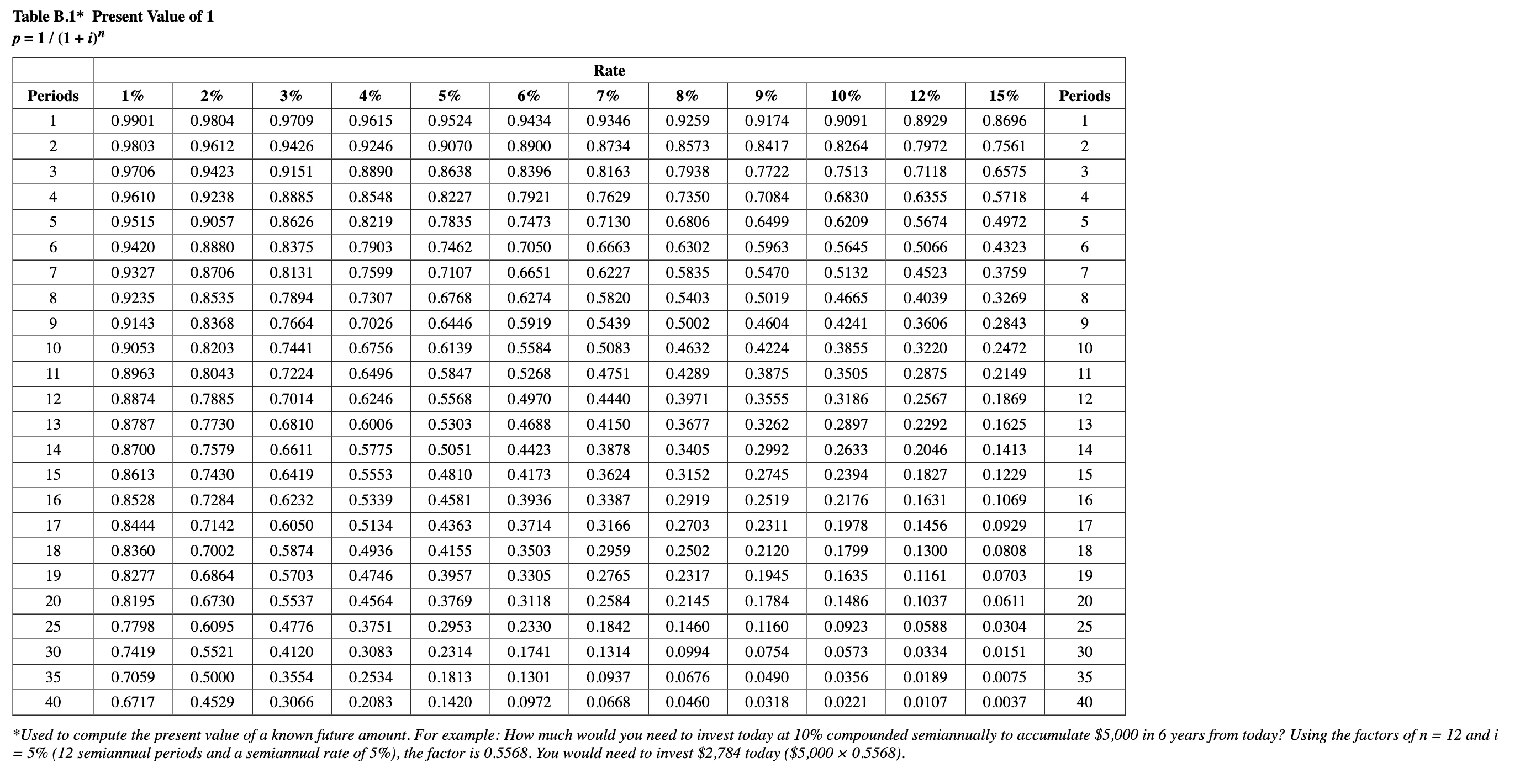

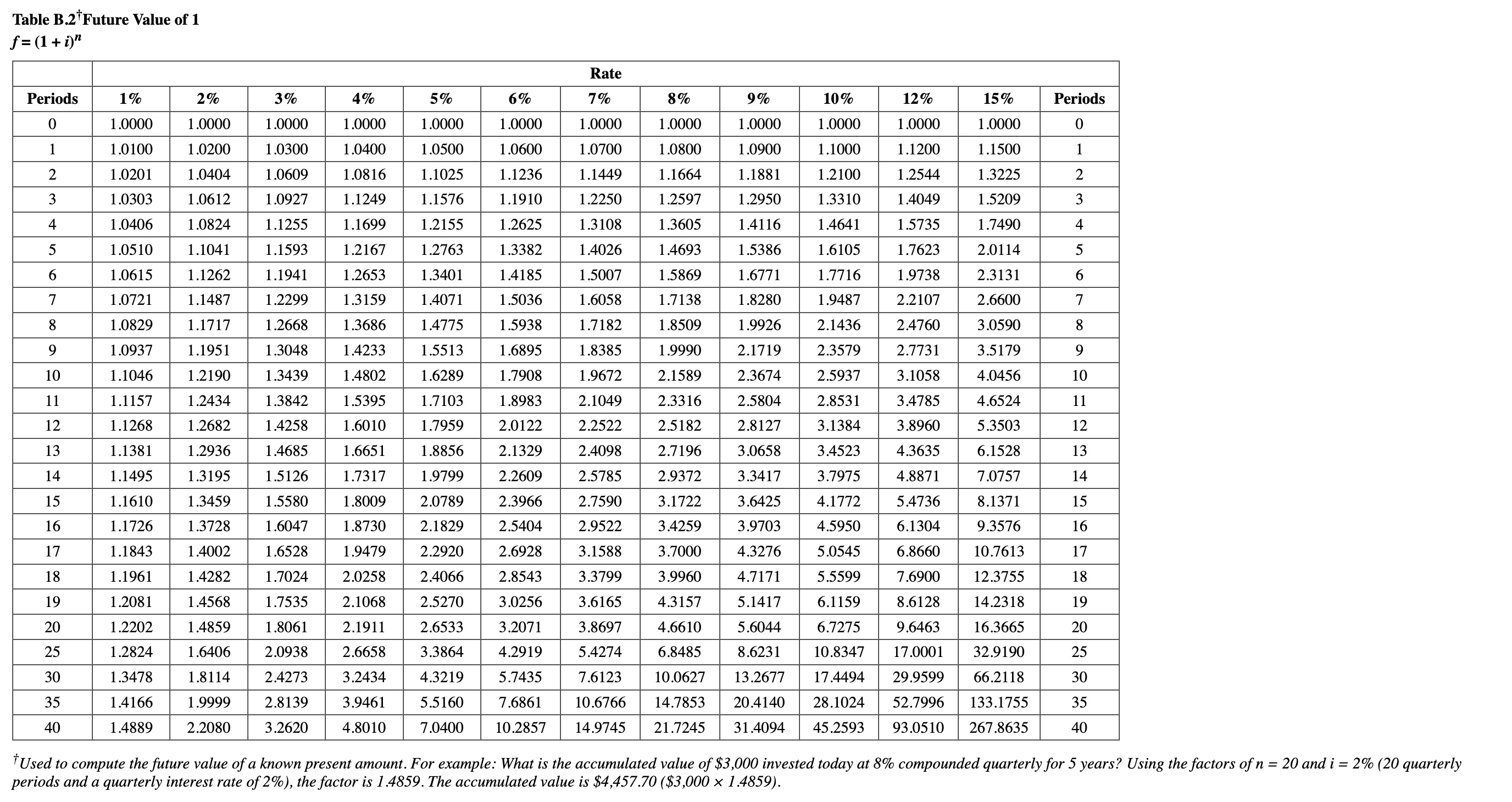

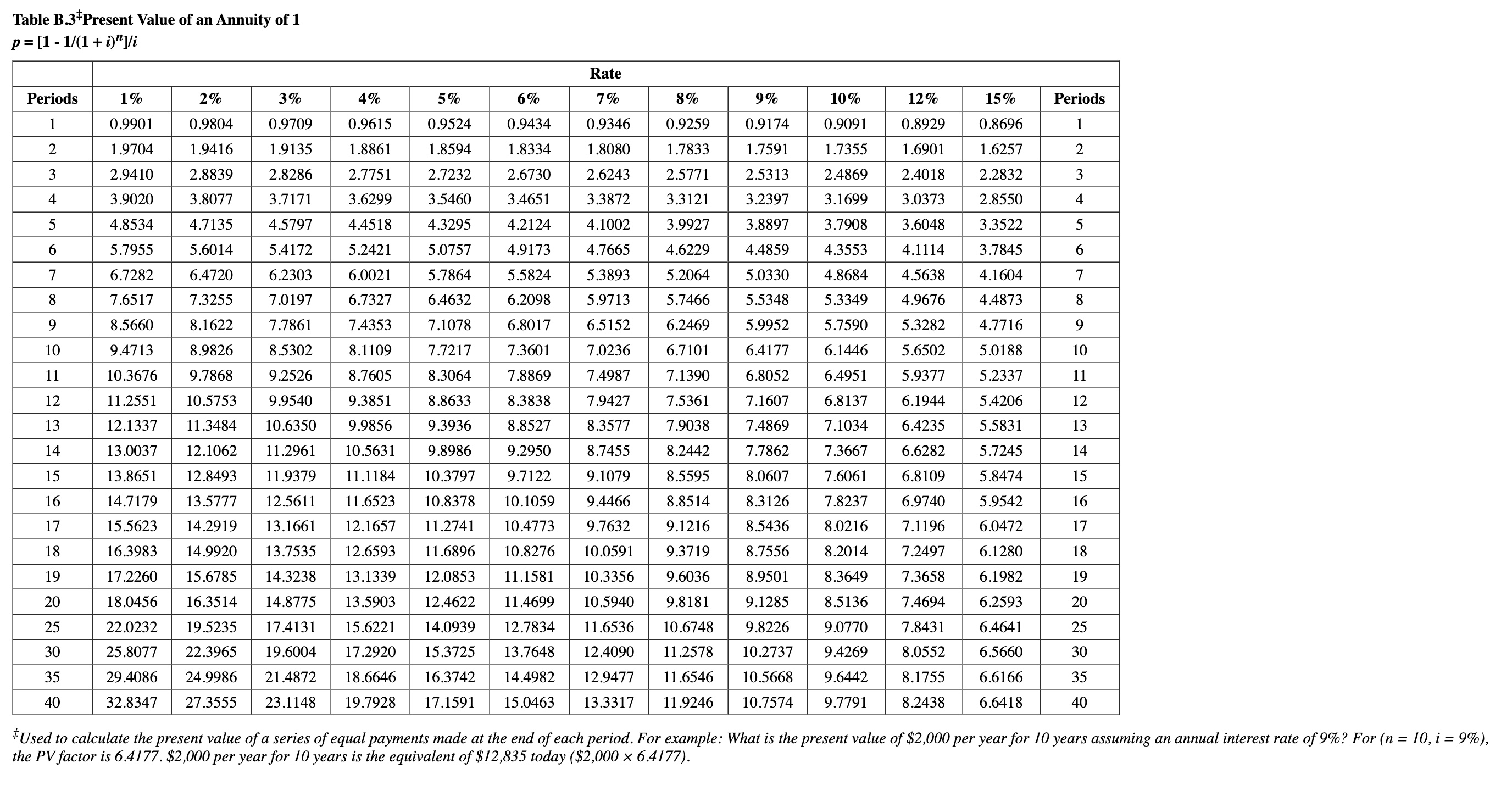

Table B.1* Present Value of 1 p=1/(1+i)n =5%(12 semiannual periods and a semiannual rate of 5%), the factor is 0.5568. You would need to invest

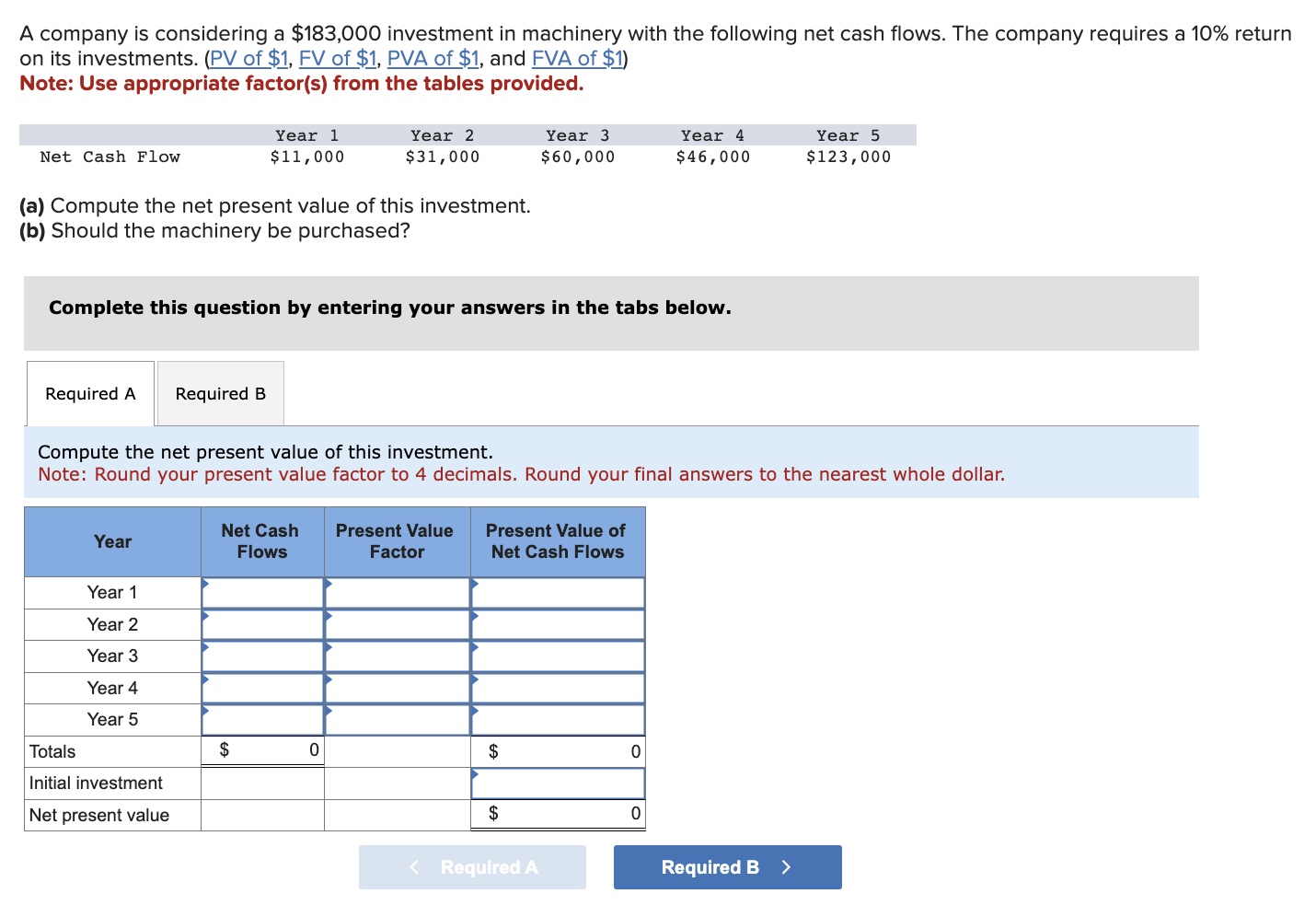

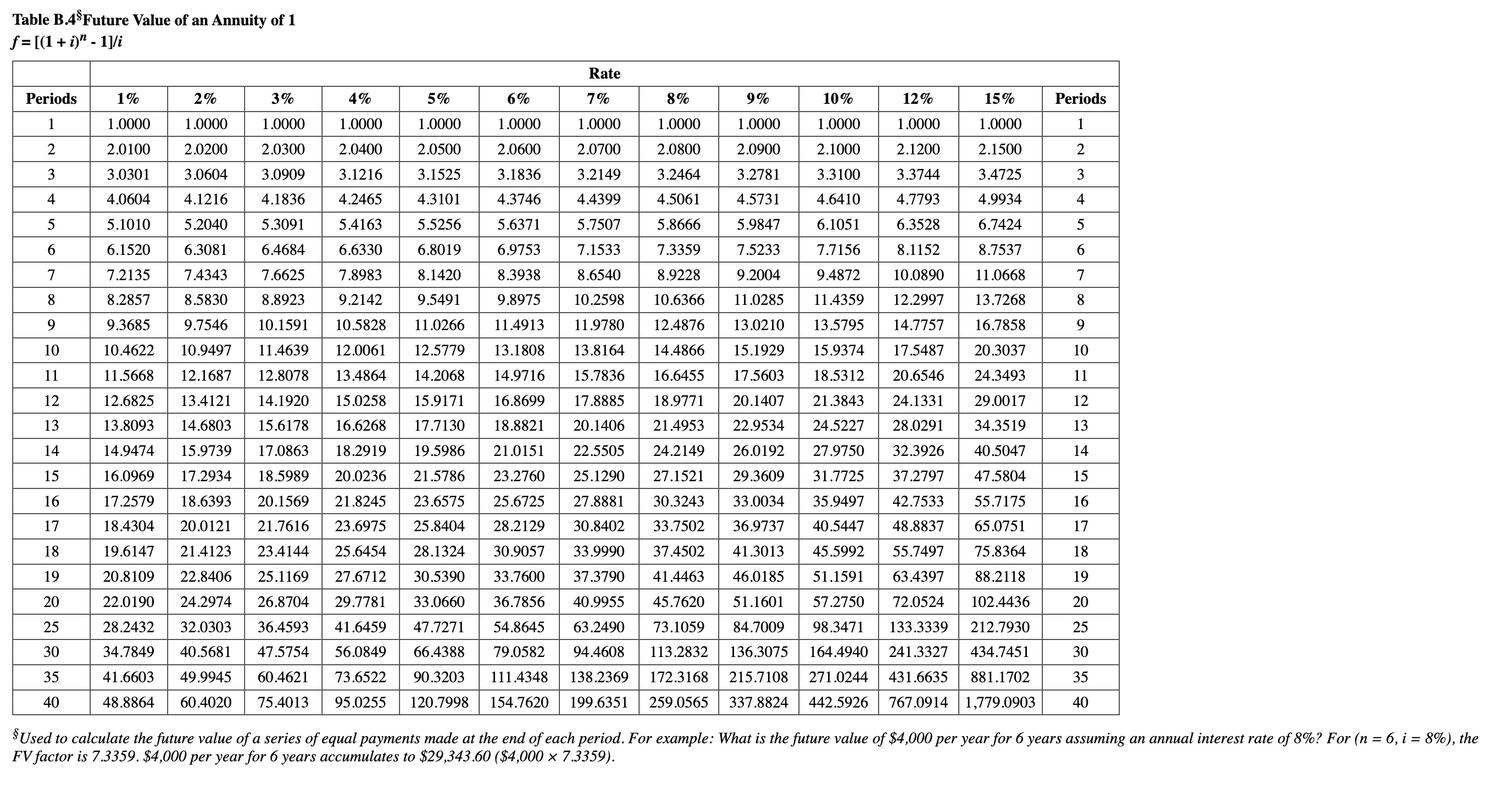

Table B.1* Present Value of 1 p=1/(1+i)n =5%(12 semiannual periods and a semiannual rate of 5%), the factor is 0.5568. You would need to invest $2,784 today ($5,0000.5568) Table B. 3 Present Value of an Annuity of 1 p=[11/(1+i)n]/i the PV factor is 6.4177.$2,000 per year for 10 years is the equivalent of $12,835 today ($2,0006.4177). A company is considering a $183,000 investment in machinery with the following net cash flows. The company requires a 10% return on its investments. (PV of $1, FV of $1, PVA of $1, and FVA of $1 ) Note: Use appropriate factor(s) from the tables provided. (a) Compute the net present value of this investment. (b) Should the machinery be purchased? Complete this question by entering your answers in the tabs below. Compute the net present value of this investment. Note: Round your present value factor to 4 decimals. Round your final answers to the nearest whole dollar. Complete this question by entering your answers in the tabs below. Should the machinery be purchased? Table B. 2 Future Value of 1 f=(1+i)n Table B. 4 Future Value of an Annuity of 1 f=[(1+i)n1]/i FV factor is 7.3359. $4,000 per year for 6 years accumulates to $29,343.60($4,0007.3359)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started