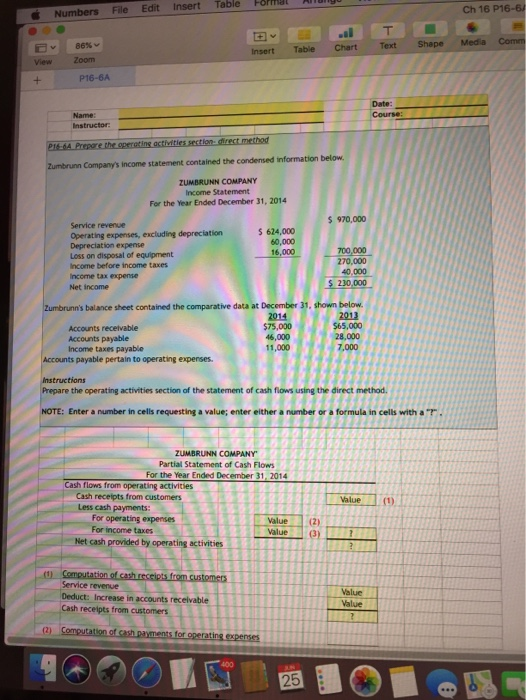

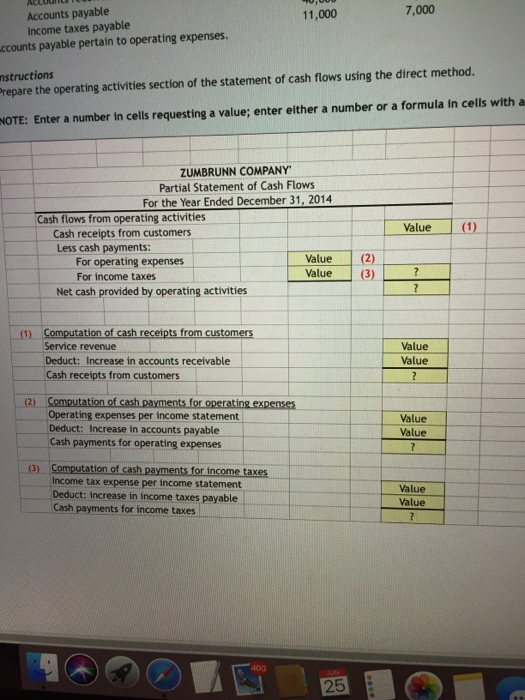

Table Forma Insert Edit File Ch 16 P16-6A Numbers T Media Comm 86 % v Shape Text Table Chart Insert Zoom View P16-6A + Date: Course: Name: Instructor P16-6A Prepare the operating activities section- direct method Zumbrunn Company's income statement contained the condensed information below ZUMBRUNN COMPANY Income Statement For the Year Ended December 31, 2014 S 970,000 Service revenue S 624,00 Operating expenses, excluding depreciation Depreciation expense Loss on disposal of equipment 60,000 16,000 700,000 270,000 Income before income taxes 40.000 Income tax expense S 230,000 Net income Zumbrunn's balance sheet contained the comparative data at December 31, shown below 2013 $65,000 28,000 2014 $75,000 Accounts recelvable 46,000 Accounts payable Income taxes payable Accounts payable pertain to operating expenses 11,000 7,000 Instructions Prepare the operating activities section of the statement of cash flows using the direct method. NOTE: Enter a number in cells requesting a value; enter either a number or a formula in cells with a ". ZUMBRUNN COMPANY Partial Statement of Cash Flows For the Year Ended December 31, 2014 Cash flows from operating activities Cash receipts from customers Less cash payments: For operating expenses For income taxes Value (1) Value (2) Value (3) Net cash provided by operating activities (1) Computation of cash receipts from.customers Service revenue Deduct: Increase in accounts receivable Cash receipts from customers Value Value Computation of cash payments for operating expenses (2) 400 25 7,000 Accounts payable Income taxes payable ccounts payable pertain to operating expenses. 11,000 nstructions Prepare the operating activities section of the statement of cash flows using the direct method. NOTE: Enter a number in cells requesting a value; enter either a number or a formula in cells with a ZUMBRUNN COMPANY Partial Statement of Cash Flows For the Year Ended December 31, 2014 Cash flows from operating activities Cash receipts from customers Less cash payments: For operating expenses (1) Value Value (2) Value (3) For income taxes Net cash provided by operating activities Computation of cash receipts from customers (1) Service revenue Value Deduct: Increase in accounts receivable Cash receipts from customers Value ? Computation of cash payments for operating expenses (2) Operating expenses per income statement Deduct: Increase in accounts payable Cash payments for operating expenses Value Value ? (3) Computation of cash payments for income taxes Income tax expense per income statement Deduct: increase in income taxes payable Value Value Cash payments for income taxes 7 400 N 25 31 LO