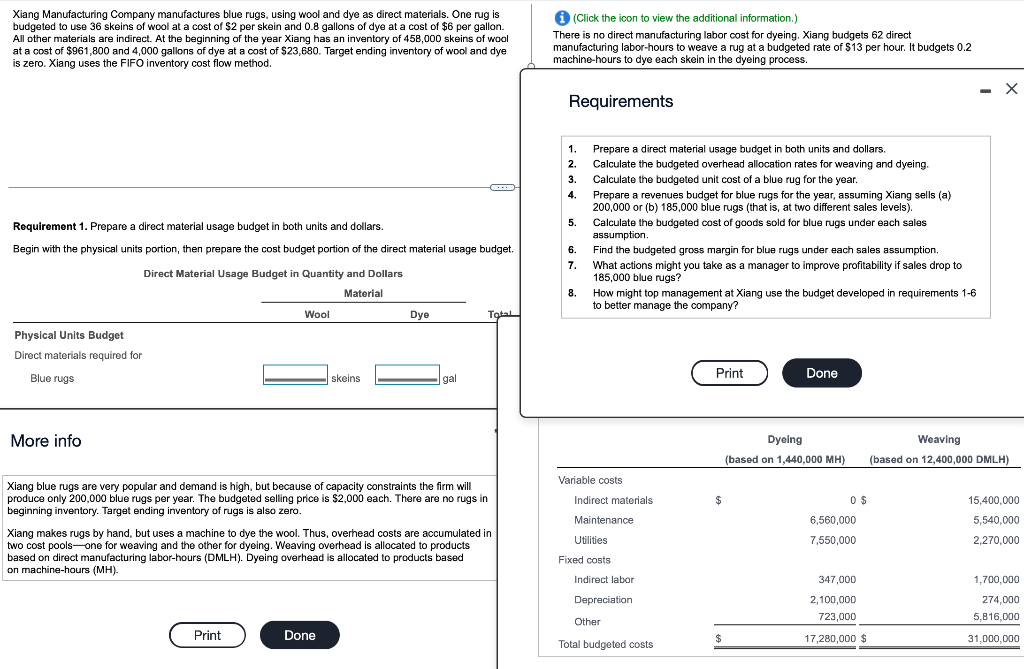

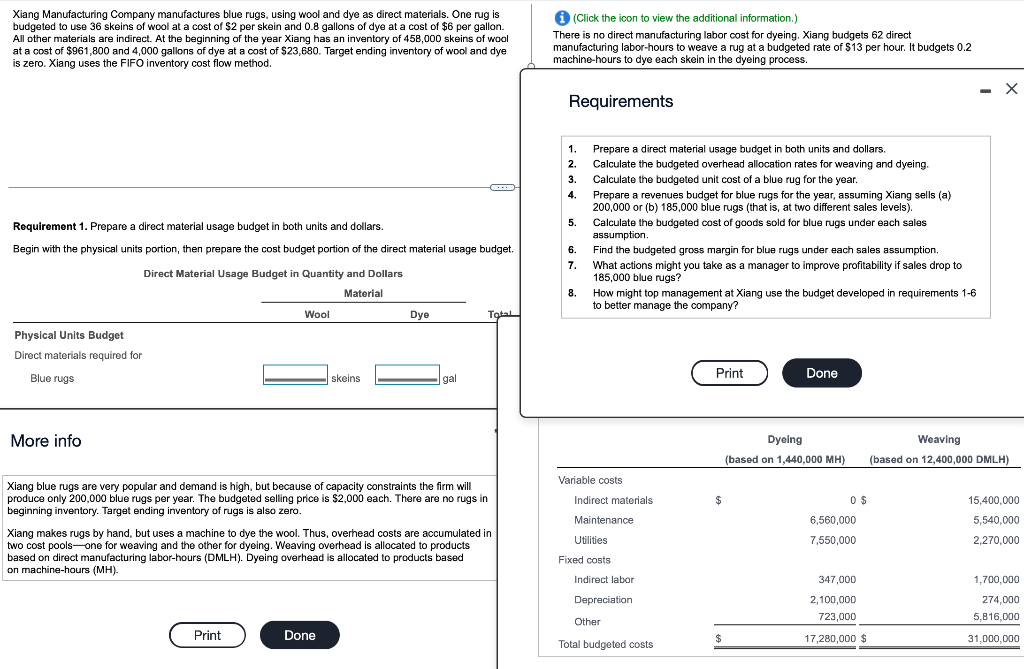

Xiang Manufacturing Company manufactures blue rugs, using wool and dye as direct materials. One rug is (i) (Click the icon to view the additional information.) budgeted to use 36 skeins of wool at a cost of $2 per skein and 0.8 gallons of dye at a cost of $6 per gallon. All other materials are indirect. At the beginning of the year Xiang has an inventory of 458,000 skeins of wool There is no direct manufacturing labor cost for dyeing. Xiang budgets 62 direct at a cost of $961,800 and 4,000 gallons of dye at a cost of $23,680. Target ending inventory of wool and dye manufacturing labor-hours to weave a rug at a budgeted rate of $13 per hour. It budgets 0.2 is zero. Xiang uses the FIFO inventory cost flow method. machine-hours to dye each skein in the dyeing process. Requirements 1. Prepare a direct material usage budget in both units and dollars. 2. Calculate the budgeted overhead allocation rates for weaving and dyeing. 3. Calculate the budgeted unit cost of a blue rug for the year. 4. Prepare a revenues budget for blue rugs for the year, assuming Xiang sells (a) 200,000 or (b) 185,000 blue rugs (that is, at two different sales levels). Requirement 1. Prepare a direct material usage budget in both units and dollars. 5. Calculate the budgeted cost of goods sold for blue rugs under each sales assumption. Begin with the physical units portion, then prepare the cost budget portion of the direct material usage budget. 6. Find the budgeted gross margin for blue rugs under each sales assumption. 7. What actions might you take as a manager to improve profitability if sales drop to Direct Material Usage Budget in Quantity and Dollars 185,000 blue rugs? 8. How might top management at Xiang use the budget developed in requirements 1-6 to better manage the company? More info Xiang blue rugs are very popular and demand is high, but because of capacity constraints the firm will produce only 200,000 blue rugs per year. The budgeted selling price is $2,000 each. There are no rugs in beginning inventory. Target ending inventory of rugs is also zero. Xiang makes rugs by hand, but uses a machine to dye the wool. Thus, overhead costs are accumulated in two cost pools - one for weaving and the other for dyeing. Weaving overhead is allocated to products based on direct manufacturing labor-hours (DMLH). Dyeing overhead is allocated to products based on machine-hours (MH). Xiang Manufacturing Company manufactures blue rugs, using wool and dye as direct materials. One rug is (i) (Click the icon to view the additional information.) budgeted to use 36 skeins of wool at a cost of $2 per skein and 0.8 gallons of dye at a cost of $6 per gallon. All other materials are indirect. At the beginning of the year Xiang has an inventory of 458,000 skeins of wool There is no direct manufacturing labor cost for dyeing. Xiang budgets 62 direct at a cost of $961,800 and 4,000 gallons of dye at a cost of $23,680. Target ending inventory of wool and dye manufacturing labor-hours to weave a rug at a budgeted rate of $13 per hour. It budgets 0.2 is zero. Xiang uses the FIFO inventory cost flow method. machine-hours to dye each skein in the dyeing process. Requirements 1. Prepare a direct material usage budget in both units and dollars. 2. Calculate the budgeted overhead allocation rates for weaving and dyeing. 3. Calculate the budgeted unit cost of a blue rug for the year. 4. Prepare a revenues budget for blue rugs for the year, assuming Xiang sells (a) 200,000 or (b) 185,000 blue rugs (that is, at two different sales levels). Requirement 1. Prepare a direct material usage budget in both units and dollars. 5. Calculate the budgeted cost of goods sold for blue rugs under each sales assumption. Begin with the physical units portion, then prepare the cost budget portion of the direct material usage budget. 6. Find the budgeted gross margin for blue rugs under each sales assumption. 7. What actions might you take as a manager to improve profitability if sales drop to Direct Material Usage Budget in Quantity and Dollars 185,000 blue rugs? 8. How might top management at Xiang use the budget developed in requirements 1-6 to better manage the company? More info Xiang blue rugs are very popular and demand is high, but because of capacity constraints the firm will produce only 200,000 blue rugs per year. The budgeted selling price is $2,000 each. There are no rugs in beginning inventory. Target ending inventory of rugs is also zero. Xiang makes rugs by hand, but uses a machine to dye the wool. Thus, overhead costs are accumulated in two cost pools - one for weaving and the other for dyeing. Weaving overhead is allocated to products based on direct manufacturing labor-hours (DMLH). Dyeing overhead is allocated to products based on machine-hours (MH)