Answered step by step

Verified Expert Solution

Question

1 Approved Answer

table [ [ , ( Inflow / Outflow ) / ( Noncash ) , Operating, Investing, or ] , [ table [ [

table InflowOutflow Noncash Operating, Investing, ortableReceinancingreceivableSold land for $Paid $ of its accounts payable,,Sold issued shares of common stock,,depreciation expense of $tableBorrowed $ from Green Bank and signed anotetablePurchased equipment costing $cash by payingPaid interest expense of $Received dividend revenue of $ Ex : T Company had the following transactions during the year.

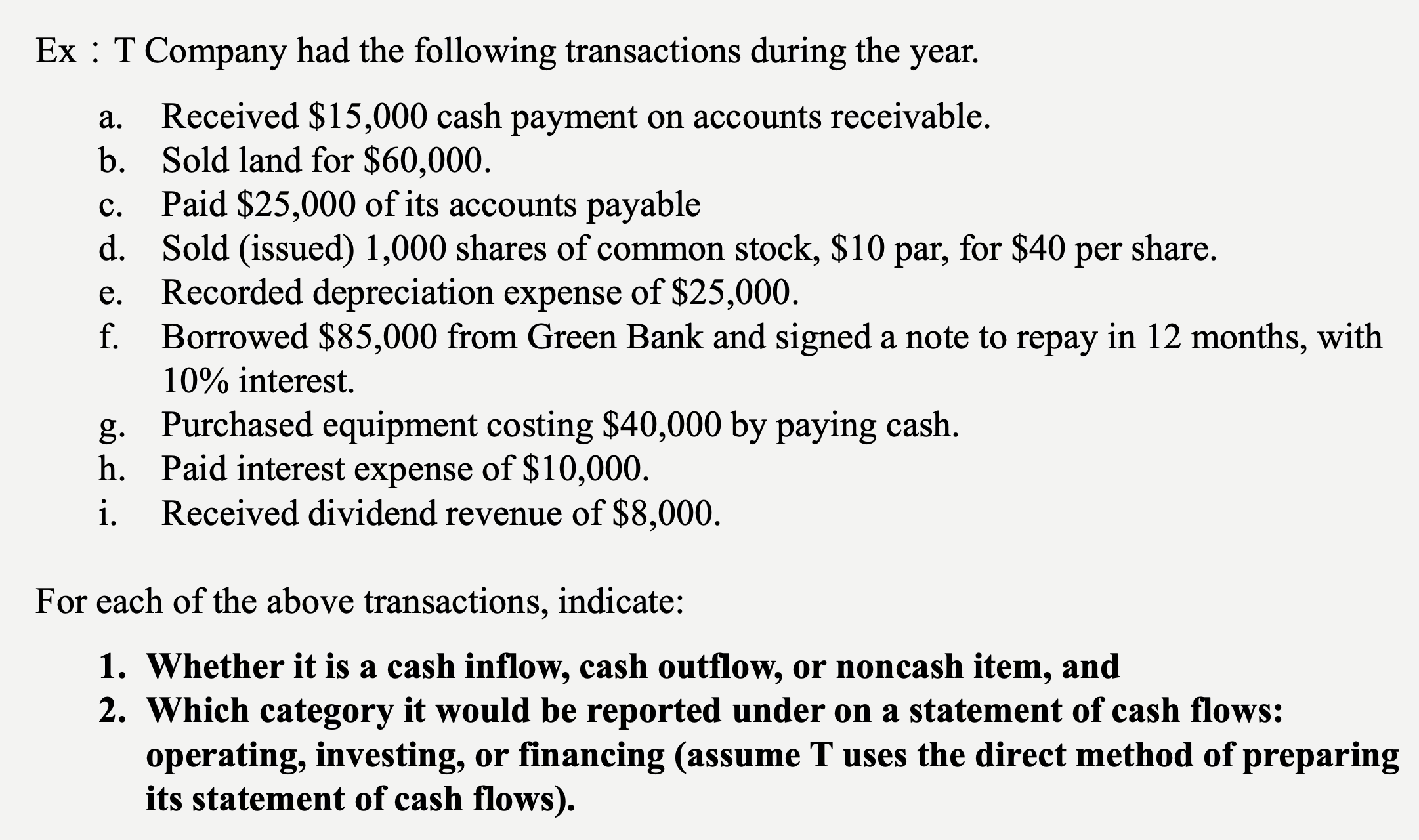

a Received $ cash payment on accounts receivable.

b Sold land for $

c Paid $ of its accounts payable

d Sold issued shares of common stock, $ par, for $ per share.

e Recorded depreciation expense of $

f Borrowed $ from Green Bank and signed a note to repay in months, with

interest.

g Purchased equipment costing $ by paying cash.

h Paid interest expense of $

i Received dividend revenue of $

For each of the above transactions, indicate:

Whether it is a cash inflow, cash outflow, or noncash item, and

Which category it would be reported under on a statement of cash flows:

operating, investing, or financing assume uses the direct method of preparing

its statement of cash flows

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started