Answered step by step

Verified Expert Solution

Question

1 Approved Answer

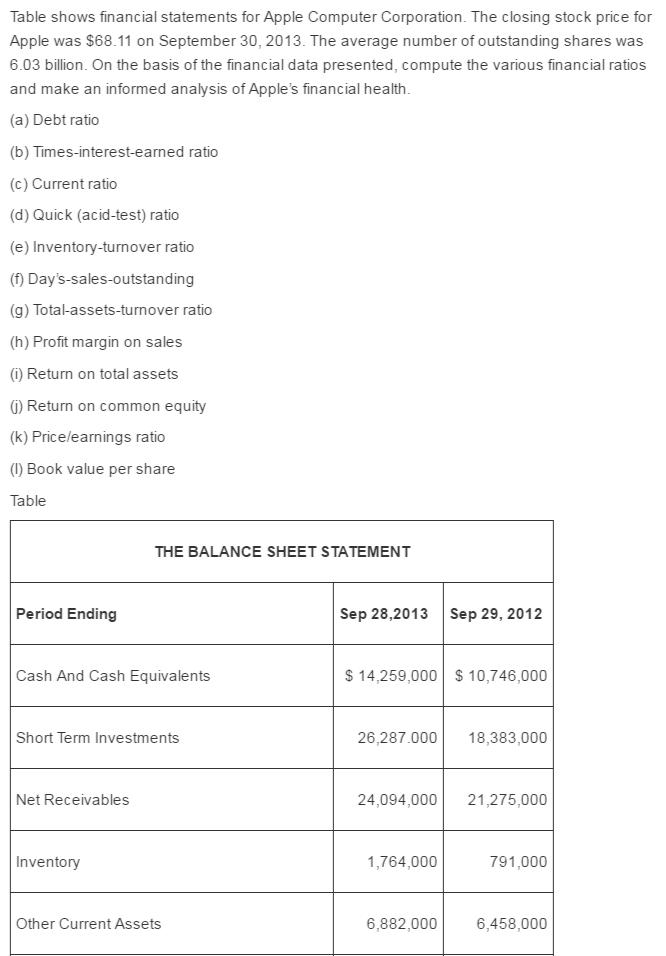

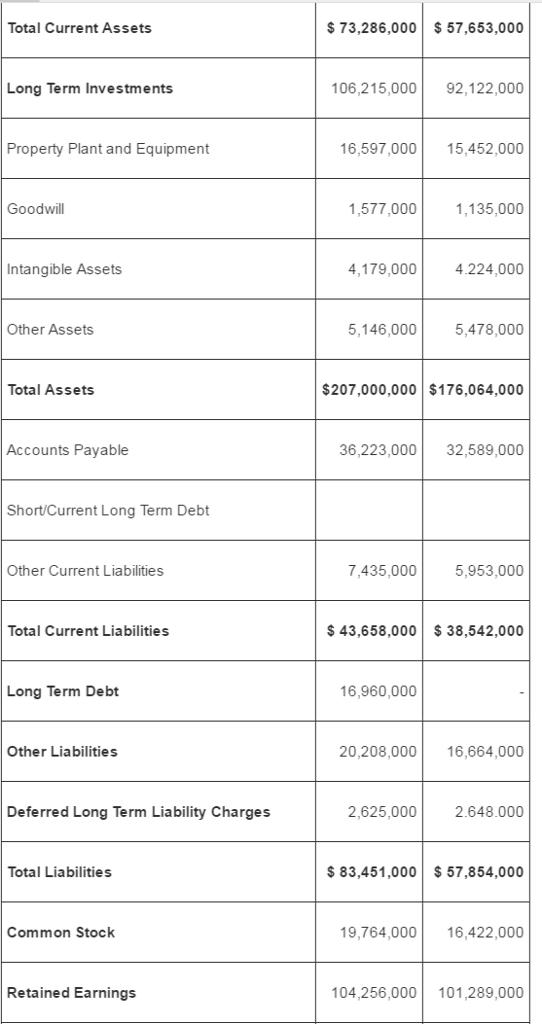

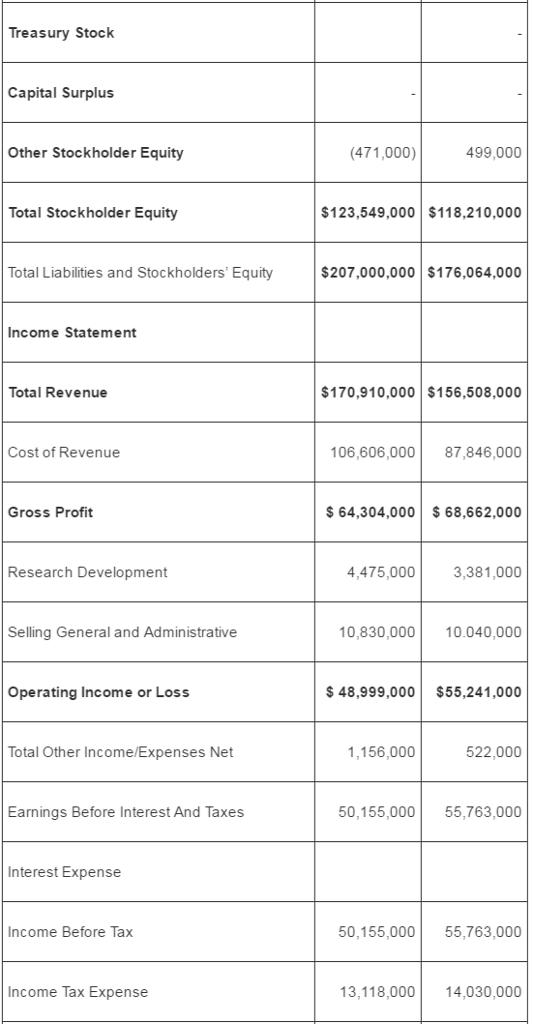

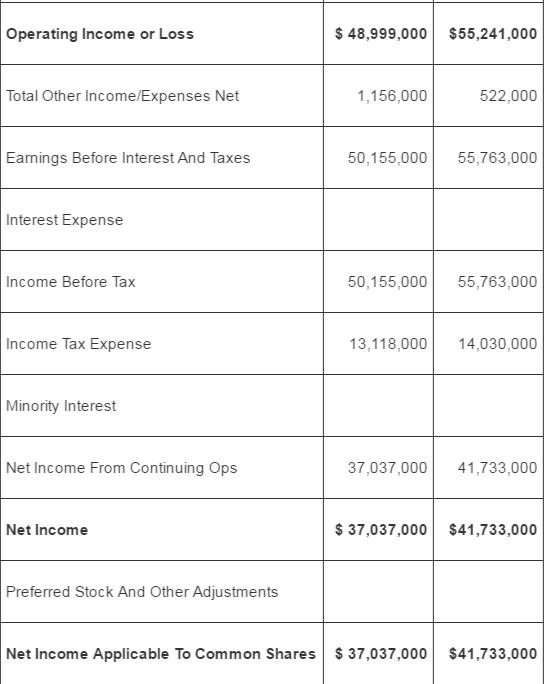

Table shows financial statements for Apple Computer Corporation. The closing stock price for Apple was $68.11 on September 30, 2013. The average number of

Table shows financial statements for Apple Computer Corporation. The closing stock price for Apple was $68.11 on September 30, 2013. The average number of outstanding shares was 6.03 billion. On the basis of the financial data presented, compute the various financial ratios and make an informed analysis of Apple's financial health. (a) Debt ratio (b) Times-interest-earned ratio (c) Current ratio (d) Quick (acid-test) ratio (e) Inventory-turnover ratio (f) Day's-sales-outstanding (g) Total-assets-turnover ratio (h) Profit margin on sales (i) Return on total assets G) Return on common equity (k) Pricelearnings ratio (1) Book value per share Table THE BALANCE SHEET STATEMENT Period Ending Sep 28,2013 Sep 29, 2012 Cash And Cash Equivalents $ 14,259,000 $ 10,746,000 Short Term Investments 26,287.000 18,383,000 Net Receivables 24,094,000 21,275,000 Inventory 1,764,000 791,000 Other Current Assets 6,882,000 6,458,000 Total Current Assets $ 73,286,000 $ 57,653,000 Long Term Investments 106,215,000 92,122,000 Property Plant and Equipment 16,597,000 15,452,000 Goodwill 1,577,000 1,135,000 Intangible Assets 4,179,000 4.224,000 Other Assets 5,146,000 5,478,000 Total Assets $207,000,000 $176,064,000 Accounts Payable 36,223,000 32,589,000 Short/Current Long Term Debt Other Current Liabilities 7,435,000 5,953,000 Total Current Liabilities $ 43,658,000 $ 38,542,000 Long Term Debt 16,960,000 Other Liabilities 20,208,000 16,664,000 Deferred Long Term Liability Charges 2,625,000 2.648.000 Total Liabilities $ 83,451,000 $ 57,854,000 Common Stock 19,764,000 16,422,000 Retained Earnings 104,256,000 101,289,000 Treasury Stock Capital Surplus Other Stockholder Equity (471,000) 499,000 Total Stockholder Equity $123,549,000 $118,210,000 Total Liabilities and Stockholders' Equity $207,000,000 $176,064,000 Income Statement Total Revenue $170,910,000 $156,508,000 Cost of Revenue 106,606,000 87,846,000 Gross Profit $ 64,304,000 $ 68,662,000 Research Development 4,475,000 3,381,000 Selling General and Administrative 10,830,000 10.040,000 Operating Income or Loss $ 48,999,000 $55,241,000 Total Other Income/Expenses Net 1,156,000 522,000 Earnings Before Interest And Taxes 50,155,000 55,763,000 Interest Expense Income Before Tax 50,155,000 55,763,000 Income Tax Expense 13,118,000 14,030,000 Operating Income or Loss $ 48,999,000 $55,241,000 Total Other Income/Expenses Net 1,156,000 522,000 Earnings Before Interest And Taxes 50,155,000 55,763,000 Interest Expense Income Before Tax 50,155,000 55,763,000 Income Tax Expense 13,118,000 14,030,000 Minority Interest Net Income From Continuing Ops 37,037,000 41,733,000 Net Income $ 37,037,000 $41,733,000 Preferred Stock And Other Adjustments Net Income Applicable To Common Shares $ 37,037,000 $41,733,000 Table shows financial statements for Apple Computer Corporation. The closing stock price for Apple was $68.11 on September 30, 2013. The average number of outstanding shares was 6.03 billion. On the basis of the financial data presented, compute the various financial ratios and make an informed analysis of Apple's financial health. (a) Debt ratio (b) Times-interest-earned ratio (c) Current ratio (d) Quick (acid-test) ratio (e) Inventory-turnover ratio (f) Day's-sales-outstanding (g) Total-assets-turnover ratio (h) Profit margin on sales (i) Return on total assets G) Return on common equity (k) Pricelearnings ratio (1) Book value per share Table THE BALANCE SHEET STATEMENT Period Ending Sep 28,2013 Sep 29, 2012 Cash And Cash Equivalents $ 14,259,000 $ 10,746,000 Short Term Investments 26,287.000 18,383,000 Net Receivables 24,094,000 21,275,000 Inventory 1,764,000 791,000 Other Current Assets 6,882,000 6,458,000 Total Current Assets $ 73,286,000 $ 57,653,000 Long Term Investments 106,215,000 92,122,000 Property Plant and Equipment 16,597,000 15,452,000 Goodwill 1,577,000 1,135,000 Intangible Assets 4,179,000 4.224,000 Other Assets 5,146,000 5,478,000 Total Assets $207,000,000 $176,064,000 Accounts Payable 36,223,000 32,589,000 Short/Current Long Term Debt Other Current Liabilities 7,435,000 5,953,000 Total Current Liabilities $ 43,658,000 $ 38,542,000 Long Term Debt 16,960,000 Other Liabilities 20,208,000 16,664,000 Deferred Long Term Liability Charges 2,625,000 2.648.000 Total Liabilities $ 83,451,000 $ 57,854,000 Common Stock 19,764,000 16,422,000 Retained Earnings 104,256,000 101,289,000 Treasury Stock Capital Surplus Other Stockholder Equity (471,000) 499,000 Total Stockholder Equity $123,549,000 $118,210,000 Total Liabilities and Stockholders' Equity $207,000,000 $176,064,000 Income Statement Total Revenue $170,910,000 $156,508,000 Cost of Revenue 106,606,000 87,846,000 Gross Profit $ 64,304,000 $ 68,662,000 Research Development 4,475,000 3,381,000 Selling General and Administrative 10,830,000 10.040,000 Operating Income or Loss $ 48,999,000 $55,241,000 Total Other Income/Expenses Net 1,156,000 522,000 Earnings Before Interest And Taxes 50,155,000 55,763,000 Interest Expense Income Before Tax 50,155,000 55,763,000 Income Tax Expense 13,118,000 14,030,000 Operating Income or Loss $ 48,999,000 $55,241,000 Total Other Income/Expenses Net 1,156,000 522,000 Earnings Before Interest And Taxes 50,155,000 55,763,000 Interest Expense Income Before Tax 50,155,000 55,763,000 Income Tax Expense 13,118,000 14,030,000 Minority Interest Net Income From Continuing Ops 37,037,000 41,733,000 Net Income $ 37,037,000 $41,733,000 Preferred Stock And Other Adjustments Net Income Applicable To Common Shares $ 37,037,000 $41,733,000

Step by Step Solution

★★★★★

3.32 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Ans Apple Computer Corporation Calculation of various financial ratios and making an informed analysis of Apples financial health a Debt ratio Total Debt Total Assets Total longterm Liabilities Total ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started