Question

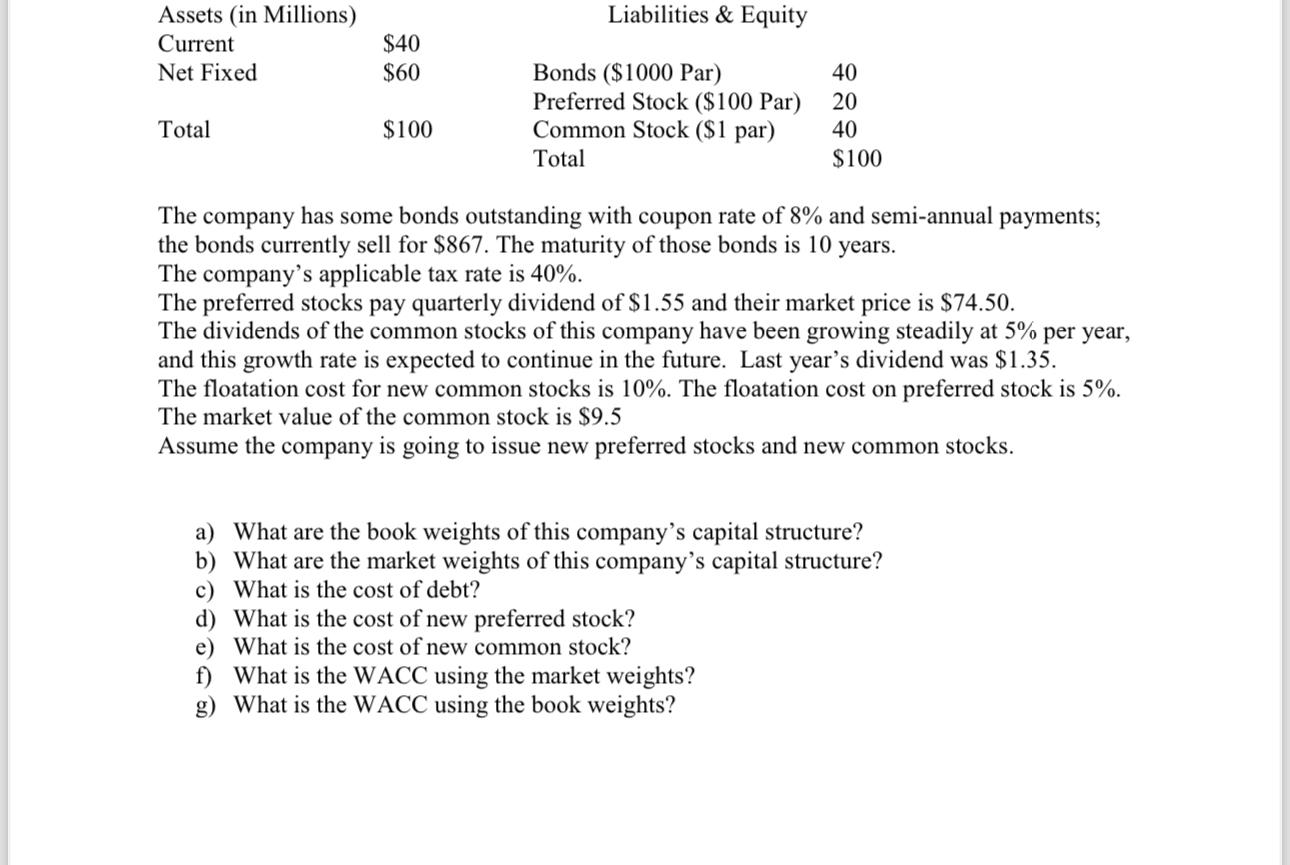

table[[Assets (in Millions),Liabilities & Equity,],[Current, $40 ,Bonds ($1000 Par),40],[Net Fixed, $60 ,Preferred Stock ($100 Par),20],[,,Common Stock ($1 par),40],[Total, $100 ,table[[Total]],]] The company has some bonds

\\\\table[[Assets (in Millions),Liabilities & Equity,],[Current,

$40,Bonds ($1000 Par),40],[Net Fixed,

$60,Preferred Stock ($100 Par),20],[,,Common Stock ($1 par),40],[Total,

$100,\\\\table[[Total]],]]\ The company has some bonds outstanding with coupon rate of

8%and semi-annual payments; the bonds currently sell for

$867. The maturity of those bonds is 10 years.\ The company's applicable tax rate is

40%.\ The preferred stocks pay quarterly dividend of

$1.55and their market price is

$74.50.\ The dividends of the common stocks of this company have been growing steadily at

5%per year, and this growth rate is expected to continue in the future. Last year's dividend was

$1.35.\ The floatation cost for new common stocks is

10%. The floatation cost on preferred stock is

5%.\ The market value of the common stock is

$9.5\ Assume the company is going to issue new preferred stocks and new common stocks.\ a) What are the book weights of this company's capital structure?\ b) What are the market weights of this company's capital structure?\ c) What is the cost of debt?\ d) What is the cost of new preferred stock?\ e) What is the cost of new common stock?\ f) What is the WACC using the market weights?\ g) What is the WACC using the book weights?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started