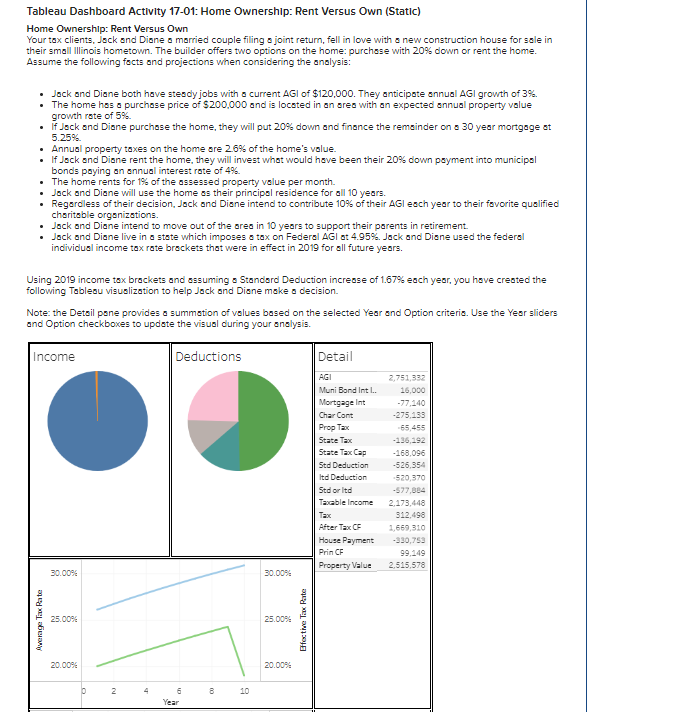

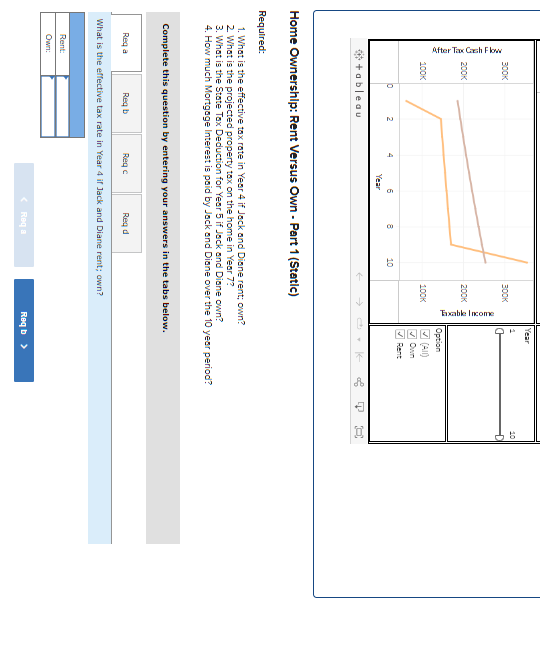

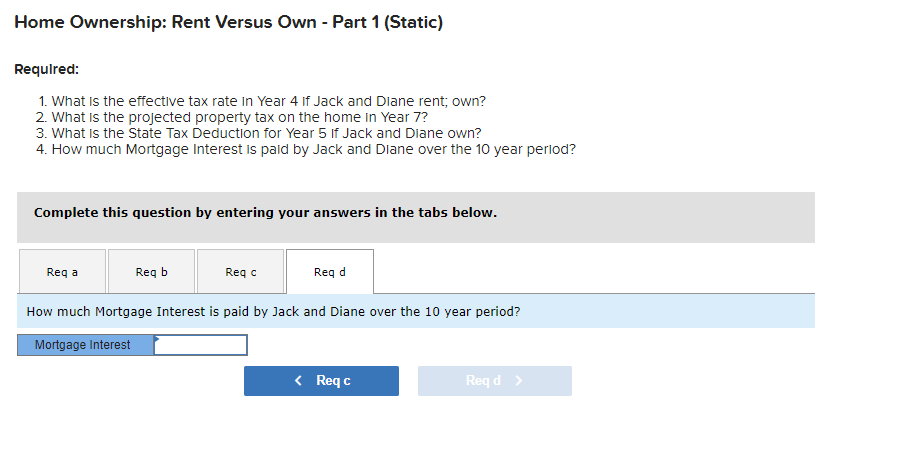

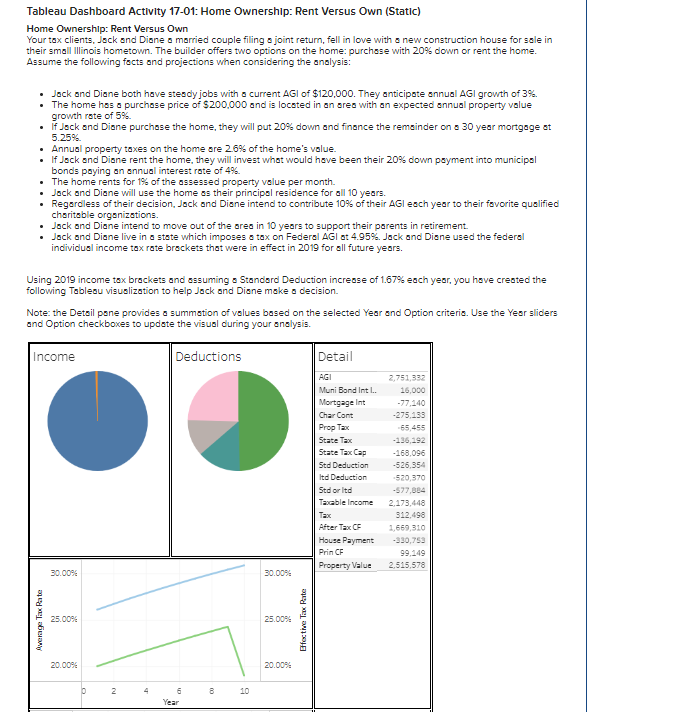

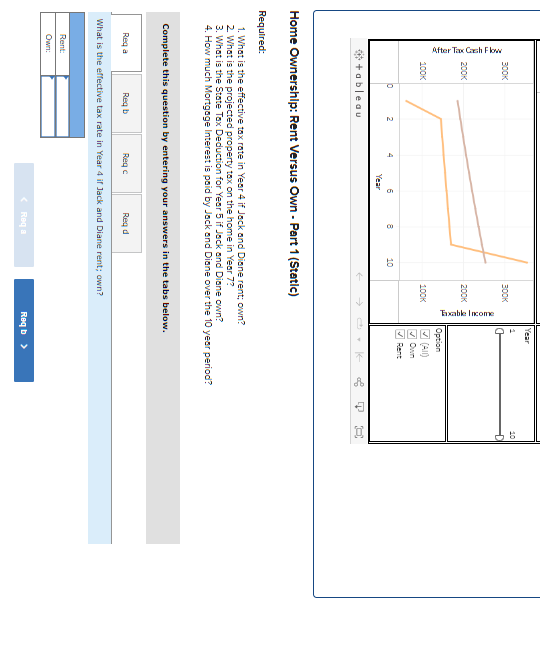

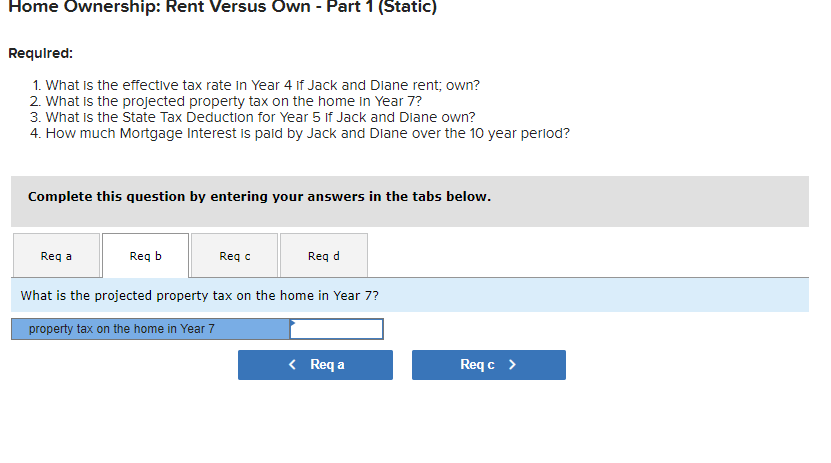

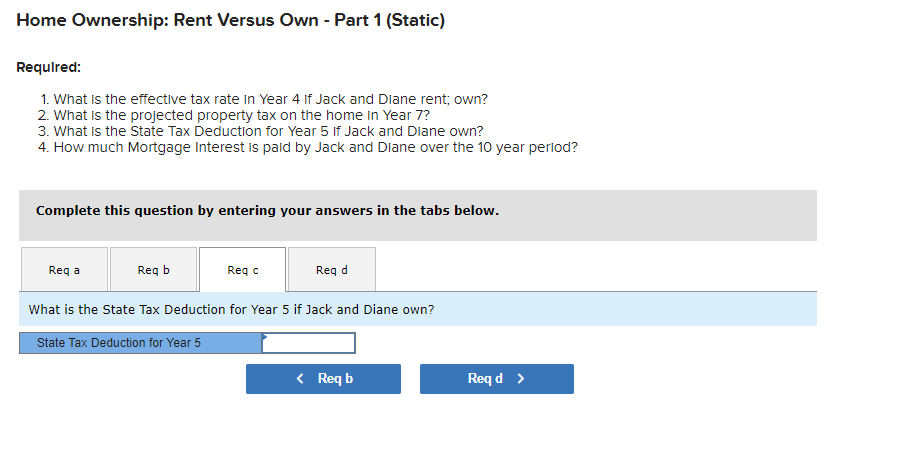

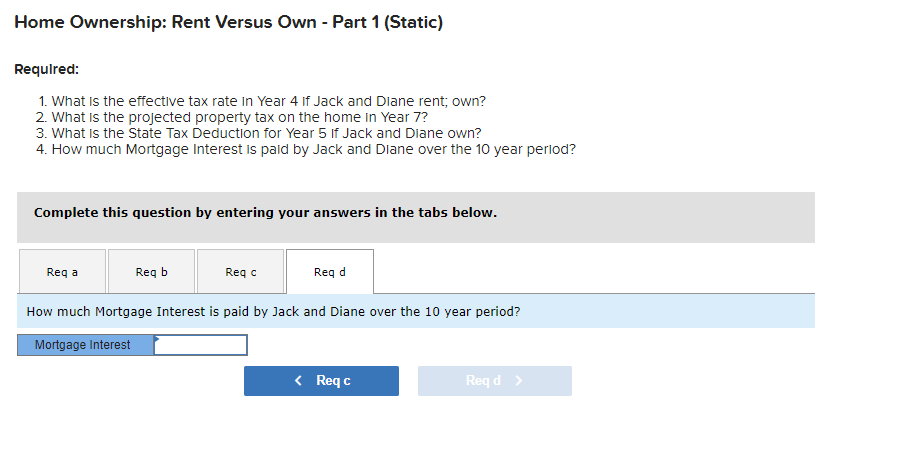

Tableau Dashboard Activity 17-01: Home Ownership: Rent Versus Own (Static) Home Ownership: Rent Versus Own Your tax clients, Jack and Diane a married couple filing a joint return, fell in love with a new construction house for sale in their small Illinois hometown. The builder offers two options on the home: purchase with 20% down or rent the home. Assume the following facts and projections when considering the analysis: - Jack and Diane both have stesdy jobs with o current AGI of $120,000. They anticipote annual AGI grovth of 3%. - The home has a purchase price of $200,000 and is located in an area with an expected annual property value growth rate of 5%. - If Juck and Diane purchase the home, they will put 20% down and finance the remainder on a 30 year mortgage at 5.25% - Annual property taxes on the home are 2.6% of the home's value. - If Juck and Diane rent the home, they will invest what would have been their 20% down payment into municipal bonds poying an annual intereat rate of 4%. - The home rents for 1% of the assessed property value per month. - Jack and Diane will use the home as their princips residence for all 10 years. - Regarcless of their decision, Jock and Diane intend to contribute 10% of their AGI each year to their fovorite qualified charitable organizations. - Jock and Diane intend to move out of the ares in 10 years to support their porents in retirement. - Jack and Diane live in a state which imposes a tax on Federal AGI at 4.95%. Jack and Diane used the federal individual income tax rate brackets that were in effect in 2019 for all future years. Using 2019 income tax brackets and assuming s Standsrd Deduction increase of 1.67% each year, you have created the following Tableau visualization to help Jack and Diane make o decision. Note: the Detail pone provides a summation of volues based on the selected Year and Option criteris. Use the Year sliders and Option checkboxes to update the visual during your analysis. Home Ownership: Rent Versus Own - Part 1 (Statlc) Required: 1. What is the effective tox rate in Yes 4 if Jack and Diane rent; own? 2. What is the projected property tax on the home in Year 7 ? 3. What is the State Tax Deduction for Year 5 if Juck and Diane own? 4. How much Mortgage Interest is poid by Jock and Diane over the 10 year perioo? Complete this question by entering your answers in the tabs below. What is the effective tax rate in Year 4 if Jack and Diane rent; own? \begin{tabular}{|l|l|} \hline & \\ \hline Rent: & \\ \hline Own: & \\ \hline \end{tabular} Required: 1. What is the effective tax rate in Year 4 If Jack and Diane rent; own? 2. What is the projected property tax on the home in Year 7 ? 3. What Is the State Tax Deduction for Year 5 If Jack and Diane own? 4. How much Mortgage Interest is pard by Jack and Diane over the 10 year perlod? Complete this question by entering your answers in the tabs below. What is the projected property tax on the home in Year 7 ? Home Ownership: Rent Versus Own - Part 1 (Static) Required: 1. What is the effective tax rate in Year 4 If Jack and Diane rent; own? 2. What is the projected property tax on the home in Year 7 ? 3. What is the State Tax Deduction for Year 5 If Jack and Diane own? 4. How much Mortgage Interest is pard by Jack and Diane over the 10 year perlod? Complete this question by entering your answers in the tabs below. What is the State Tax Deduction for Year 5 if Jack and Diane own? Home Ownership: Rent Versus Own - Part 1 (Static) Requlred: 1. What is the effective tax rate in Year 4 If Jack and Diane rent; own? 2. What is the projected property tax on the home in Year 7 ? 3. What is the State Tax Deduction for Year 5 if Jack and Diane own? 4. How much Mortgage Interest is pard by Jack and Diane over the 10 year perlod? Complete this question by entering your answers in the tabs below. How much Mortgage Interest is paid by Jack and Diane over the 10 year period? Tableau Dashboard Activity 17-01: Home Ownership: Rent Versus Own (Static) Home Ownership: Rent Versus Own Your tax clients, Jack and Diane a married couple filing a joint return, fell in love with a new construction house for sale in their small Illinois hometown. The builder offers two options on the home: purchase with 20% down or rent the home. Assume the following facts and projections when considering the analysis: - Jack and Diane both have stesdy jobs with o current AGI of $120,000. They anticipote annual AGI grovth of 3%. - The home has a purchase price of $200,000 and is located in an area with an expected annual property value growth rate of 5%. - If Juck and Diane purchase the home, they will put 20% down and finance the remainder on a 30 year mortgage at 5.25% - Annual property taxes on the home are 2.6% of the home's value. - If Juck and Diane rent the home, they will invest what would have been their 20% down payment into municipal bonds poying an annual intereat rate of 4%. - The home rents for 1% of the assessed property value per month. - Jack and Diane will use the home as their princips residence for all 10 years. - Regarcless of their decision, Jock and Diane intend to contribute 10% of their AGI each year to their fovorite qualified charitable organizations. - Jock and Diane intend to move out of the ares in 10 years to support their porents in retirement. - Jack and Diane live in a state which imposes a tax on Federal AGI at 4.95%. Jack and Diane used the federal individual income tax rate brackets that were in effect in 2019 for all future years. Using 2019 income tax brackets and assuming s Standsrd Deduction increase of 1.67% each year, you have created the following Tableau visualization to help Jack and Diane make o decision. Note: the Detail pone provides a summation of volues based on the selected Year and Option criteris. Use the Year sliders and Option checkboxes to update the visual during your analysis. Home Ownership: Rent Versus Own - Part 1 (Statlc) Required: 1. What is the effective tox rate in Yes 4 if Jack and Diane rent; own? 2. What is the projected property tax on the home in Year 7 ? 3. What is the State Tax Deduction for Year 5 if Juck and Diane own? 4. How much Mortgage Interest is poid by Jock and Diane over the 10 year perioo? Complete this question by entering your answers in the tabs below. What is the effective tax rate in Year 4 if Jack and Diane rent; own? \begin{tabular}{|l|l|} \hline & \\ \hline Rent: & \\ \hline Own: & \\ \hline \end{tabular} Required: 1. What is the effective tax rate in Year 4 If Jack and Diane rent; own? 2. What is the projected property tax on the home in Year 7 ? 3. What Is the State Tax Deduction for Year 5 If Jack and Diane own? 4. How much Mortgage Interest is pard by Jack and Diane over the 10 year perlod? Complete this question by entering your answers in the tabs below. What is the projected property tax on the home in Year 7 ? Home Ownership: Rent Versus Own - Part 1 (Static) Required: 1. What is the effective tax rate in Year 4 If Jack and Diane rent; own? 2. What is the projected property tax on the home in Year 7 ? 3. What is the State Tax Deduction for Year 5 If Jack and Diane own? 4. How much Mortgage Interest is pard by Jack and Diane over the 10 year perlod? Complete this question by entering your answers in the tabs below. What is the State Tax Deduction for Year 5 if Jack and Diane own? Home Ownership: Rent Versus Own - Part 1 (Static) Requlred: 1. What is the effective tax rate in Year 4 If Jack and Diane rent; own? 2. What is the projected property tax on the home in Year 7 ? 3. What is the State Tax Deduction for Year 5 if Jack and Diane own? 4. How much Mortgage Interest is pard by Jack and Diane over the 10 year perlod? Complete this question by entering your answers in the tabs below. How much Mortgage Interest is paid by Jack and Diane over the 10 year period