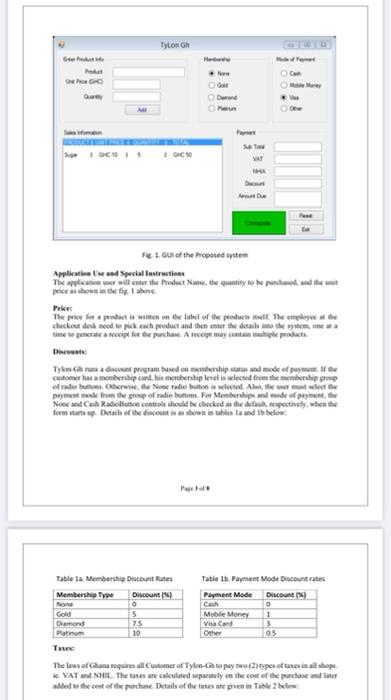

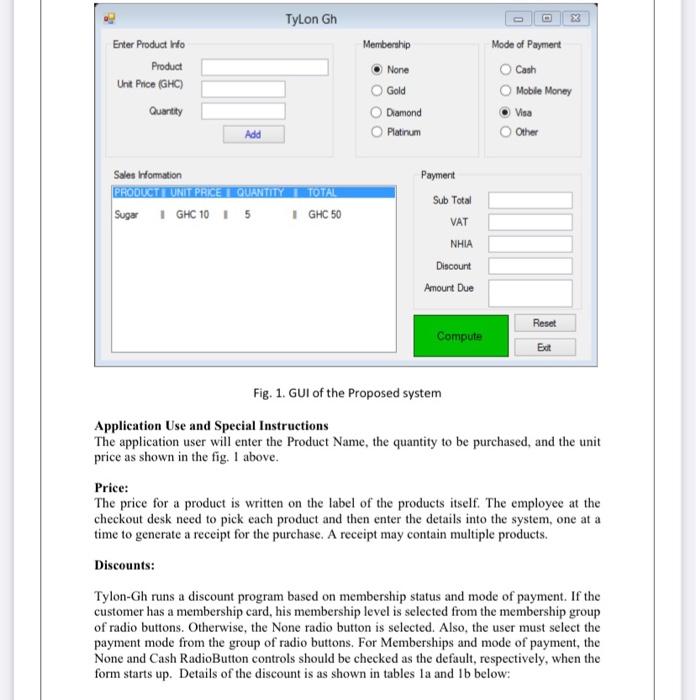

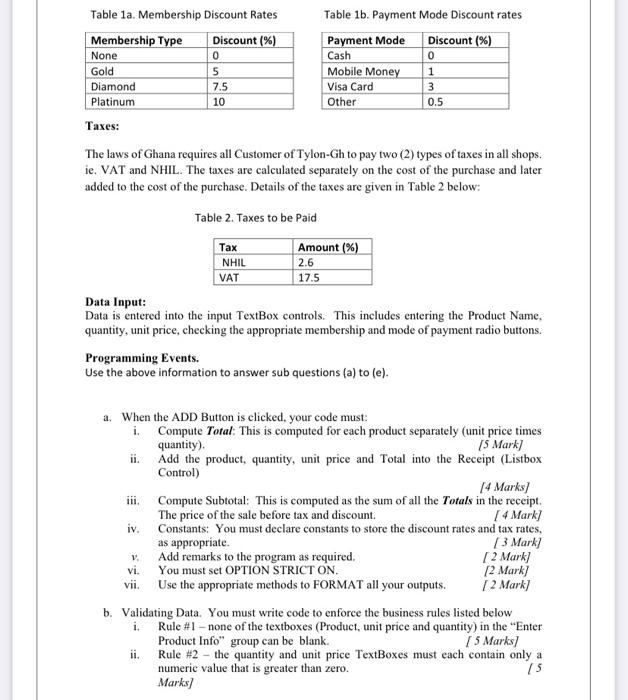

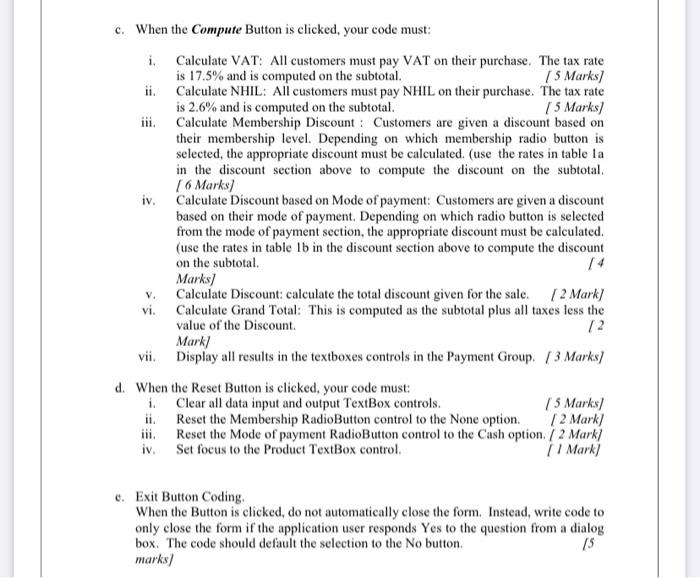

Tablet Membership Discount Rates Membership Type Discount) . Gold 5 Diamond 75 10 Te Table 1 Pet Mode Decountries Payment Mode Discount Cash . Mobile Money Visa Cane Other The two honroquire all Comer of Tylon Chopes to copertures VAT No. There are calculated separately detect the presenter dited to the cost of the shoe Details of the taxes are take Table 2. Taxes to be paid NHL VAT Data lapat: Duta fered in the spot Tester control. This incides the Hodet me quantity checking the death Programming Use the above information to answer sub question of tobel When the ADD in chicked your code mat Compute Total. This screputed for each product purely tapice times #Ako se product, guntity, unit price and Total de Receipe Luan Mb Compute Sol: This is computed as the Trap The price of the sale for and decount Mar # Constant You must declare constants to the discounts and textes are 3 Men As to the programare 72 Mar VE YOPTION STRICT ON the premis FORMAT Mark Validating Dua You must write onde te for the bed below Rules of the evene det, men Product can be blank 7 Mar Role quantity and per Teldecony misao that is greater than Rules - Quantity Tests wet preterano comerhould be 15 When the ComputeBuis clicked your eadem Calea VAT. Al com VAT the purchase. The is 125% is computed the wil 15 Mar Call NHL Alcoy Theme SM X Tylon Gh Enter Product Info Product Unit Price (GHC) Quartty Membership None Gold Diamond Platinum Mode of Payment O Cash Mobile Money Visa Other Add Payment Sales Infomation PRODUCT RUNT PREHOUANTITYDAL Sugar 1 GHC 105 GHC 50 Sub Total VAT NHIA Discount Amount Due Compute Reset Ect Fig. 1. GUI of the Proposed system Application Use and Special Instructions The application user will enter the Product Name, the quantity to be purchased, and the unit price as shown in the fig. I above. Price: The price for a product is written on the label of the products itself. The employee at the checkout desk need to pick each product and then enter the details into the system, one at a time to generate a receipt for the purchase. A receipt may contain multiple products. Discounts: Tylon-Gh runs a discount program based on membership status and mode of payment. If the customer has a membership card, his membership level is selected from the membership group of radio buttons. Otherwise, the None radio button is selected. Also, the user must select the payment mode from the group of radio buttons. For Memberships and mode of payment, the None and Cash RadioButton controls should be checked as the default, respectively, when the form starts up. Details of the discount is as shown in tables la and Ib below: 0 5 7.5 0 1 3 0.5 Table 1a. Membership Discount Rates Table 1b. Payment Mode Discount rates Membership Type Discount (%) Payment Mode Discount (%) None Cash Gold Mobile Money Diamond Visa Card Platinum 10 Other Taxes: The laws of Ghana requires all Customer of Tylon-Gh to pay two (2) types of taxes in all shops. ie. VAT and NHIL. The taxes are calculated separately on the cost of the purchase and later added to the cost of the purchase. Details of the taxes are given in Table 2 below: Table 2. Taxes to be paid Tax Amount (%) NHIL 2.6 VAT 17.5 Data Input: Data is entered into the input TextBox controls. This includes entering the Product Name, quantity, unit price, checking the appropriate membership and mode of payment radio buttons. Programming Events. Use the above information to answer sub questions (a) to (e). a. When the ADD Button is clicked, your code must: i. Compute Total: This is computed for each product separately (unit price times quantity). (5 Mark) Add the product, quantity, unit price and Total into the receipt (Listbox Control) [4 Marks) iii. Compute Subtotal: This is computed as the sum of all the Totals in the receipt. The price of the sale before tax and discount. [ 4 Mark) iv. Constants: You must declare constants to store the discount rates and tax rates, as appropriate. (3 Mark) Add remarks to the program as required. [ 2 Mark) vi. You must set OPTION STRICT ON. 12 Mark] vii. Use the appropriate methods to FORMAT all your outputs. 2 Mark) b. Validating Data. You must write code to enforce the business rules listed below Rule #1 - none of the textboxes (Product, unit price and quantity) in the "Enter Product Info" group can be blank. ( 5 Marks/ ii. Rule #2 - the quantity and unit price TextBoxes must each contain only a numerie value that is greater than zero. 75 Marks/ c. When the Compute Button is clicked, your code must: i. Calculate VAT: All customers must pay VAT on their purchase. The tax rate is 17.5% and is computed on the subtotal. 5 Marks/ ii. Calculate NHIL: All customers must pay NHIL on their purchase. The tax rate is 2.6% and is computed on the subtotal. ( 5 Marks/ iii. Calculate Membership Discount : Customers are given a discount based on their membership level. Depending on which membership radio button is selected, the appropriate discount must be calculated. (use the rates in table la in the discount section above to compute the discount on the subtotal. [ 6 Marks/ iv. Calculate Discount based on Mode of payment: Customers are given a discount based on their mode of payment. Depending on which radio button is selected from the mode of payment section, the appropriate discount must be calculated. (use the rates in table lb in the discount section above to compute the discount on the subtotal. Marks/ v. Calculate Discount calculate the total discount given for the sale 2 Mark) vi. Calculate Grand Total: This is computed as the subtotal plus all taxes less the value of the Discount Mark/ vii. Display all results in the textboxes controls in the Payment Group (3 Marks/ d. When the Reset Button is clicked, your code must: 1. Clear all data input and output TextBox controls. ( 5 Marks/ ii. Reset the Membership RadioButton control to the None option 1 2 Mark] Reset the Mode of payment RadioButton control to the Cash option 2 Mark iv. Set focus to the Product TextBox control. (Mark) 12 o. Exit Button Coding When the Button is clicked, do not automatically close the form. Instead, write code to only close the form if the application user responds Yes to the question from a dialog box. The code should default the selection to the No button. 15 marks/ Tablet Membership Discount Rates Membership Type Discount) . Gold 5 Diamond 75 10 Te Table 1 Pet Mode Decountries Payment Mode Discount Cash . Mobile Money Visa Cane Other The two honroquire all Comer of Tylon Chopes to copertures VAT No. There are calculated separately detect the presenter dited to the cost of the shoe Details of the taxes are take Table 2. Taxes to be paid NHL VAT Data lapat: Duta fered in the spot Tester control. This incides the Hodet me quantity checking the death Programming Use the above information to answer sub question of tobel When the ADD in chicked your code mat Compute Total. This screputed for each product purely tapice times #Ako se product, guntity, unit price and Total de Receipe Luan Mb Compute Sol: This is computed as the Trap The price of the sale for and decount Mar # Constant You must declare constants to the discounts and textes are 3 Men As to the programare 72 Mar VE YOPTION STRICT ON the premis FORMAT Mark Validating Dua You must write onde te for the bed below Rules of the evene det, men Product can be blank 7 Mar Role quantity and per Teldecony misao that is greater than Rules - Quantity Tests wet preterano comerhould be 15 When the ComputeBuis clicked your eadem Calea VAT. Al com VAT the purchase. The is 125% is computed the wil 15 Mar Call NHL Alcoy Theme SM X Tylon Gh Enter Product Info Product Unit Price (GHC) Quartty Membership None Gold Diamond Platinum Mode of Payment O Cash Mobile Money Visa Other Add Payment Sales Infomation PRODUCT RUNT PREHOUANTITYDAL Sugar 1 GHC 105 GHC 50 Sub Total VAT NHIA Discount Amount Due Compute Reset Ect Fig. 1. GUI of the Proposed system Application Use and Special Instructions The application user will enter the Product Name, the quantity to be purchased, and the unit price as shown in the fig. I above. Price: The price for a product is written on the label of the products itself. The employee at the checkout desk need to pick each product and then enter the details into the system, one at a time to generate a receipt for the purchase. A receipt may contain multiple products. Discounts: Tylon-Gh runs a discount program based on membership status and mode of payment. If the customer has a membership card, his membership level is selected from the membership group of radio buttons. Otherwise, the None radio button is selected. Also, the user must select the payment mode from the group of radio buttons. For Memberships and mode of payment, the None and Cash RadioButton controls should be checked as the default, respectively, when the form starts up. Details of the discount is as shown in tables la and Ib below: 0 5 7.5 0 1 3 0.5 Table 1a. Membership Discount Rates Table 1b. Payment Mode Discount rates Membership Type Discount (%) Payment Mode Discount (%) None Cash Gold Mobile Money Diamond Visa Card Platinum 10 Other Taxes: The laws of Ghana requires all Customer of Tylon-Gh to pay two (2) types of taxes in all shops. ie. VAT and NHIL. The taxes are calculated separately on the cost of the purchase and later added to the cost of the purchase. Details of the taxes are given in Table 2 below: Table 2. Taxes to be paid Tax Amount (%) NHIL 2.6 VAT 17.5 Data Input: Data is entered into the input TextBox controls. This includes entering the Product Name, quantity, unit price, checking the appropriate membership and mode of payment radio buttons. Programming Events. Use the above information to answer sub questions (a) to (e). a. When the ADD Button is clicked, your code must: i. Compute Total: This is computed for each product separately (unit price times quantity). (5 Mark) Add the product, quantity, unit price and Total into the receipt (Listbox Control) [4 Marks) iii. Compute Subtotal: This is computed as the sum of all the Totals in the receipt. The price of the sale before tax and discount. [ 4 Mark) iv. Constants: You must declare constants to store the discount rates and tax rates, as appropriate. (3 Mark) Add remarks to the program as required. [ 2 Mark) vi. You must set OPTION STRICT ON. 12 Mark] vii. Use the appropriate methods to FORMAT all your outputs. 2 Mark) b. Validating Data. You must write code to enforce the business rules listed below Rule #1 - none of the textboxes (Product, unit price and quantity) in the "Enter Product Info" group can be blank. ( 5 Marks/ ii. Rule #2 - the quantity and unit price TextBoxes must each contain only a numerie value that is greater than zero. 75 Marks/ c. When the Compute Button is clicked, your code must: i. Calculate VAT: All customers must pay VAT on their purchase. The tax rate is 17.5% and is computed on the subtotal. 5 Marks/ ii. Calculate NHIL: All customers must pay NHIL on their purchase. The tax rate is 2.6% and is computed on the subtotal. ( 5 Marks/ iii. Calculate Membership Discount : Customers are given a discount based on their membership level. Depending on which membership radio button is selected, the appropriate discount must be calculated. (use the rates in table la in the discount section above to compute the discount on the subtotal. [ 6 Marks/ iv. Calculate Discount based on Mode of payment: Customers are given a discount based on their mode of payment. Depending on which radio button is selected from the mode of payment section, the appropriate discount must be calculated. (use the rates in table lb in the discount section above to compute the discount on the subtotal. Marks/ v. Calculate Discount calculate the total discount given for the sale 2 Mark) vi. Calculate Grand Total: This is computed as the subtotal plus all taxes less the value of the Discount Mark/ vii. Display all results in the textboxes controls in the Payment Group (3 Marks/ d. When the Reset Button is clicked, your code must: 1. Clear all data input and output TextBox controls. ( 5 Marks/ ii. Reset the Membership RadioButton control to the None option 1 2 Mark] Reset the Mode of payment RadioButton control to the Cash option 2 Mark iv. Set focus to the Product TextBox control. (Mark) 12 o. Exit Button Coding When the Button is clicked, do not automatically close the form. Instead, write code to only close the form if the application user responds Yes to the question from a dialog box. The code should default the selection to the No button. 15 marks/