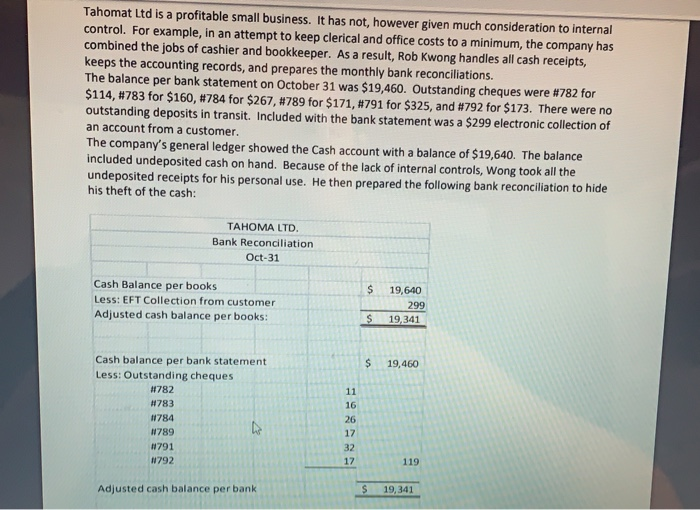

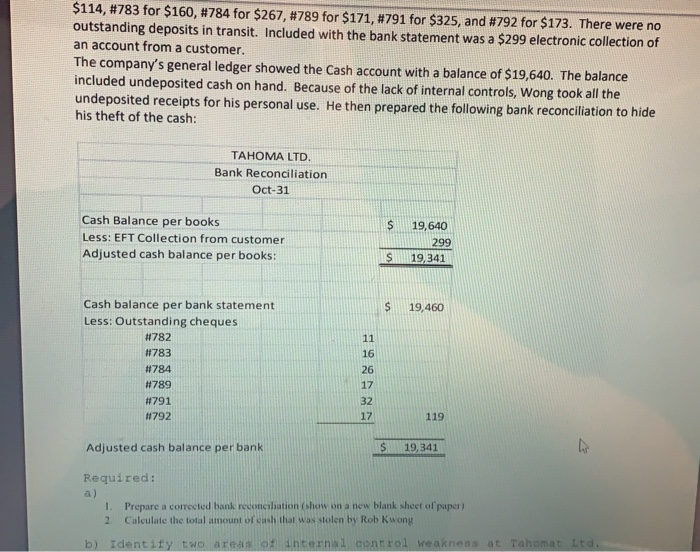

Tahomat Ltd is a profitable small business. It has not, however given much consideration to internal control. For example, in an attempt to keep clerical and office costs to a minimum, the company has combined the jobs of cashier and bookkeeper. As a result, Rob Kwong handles all cash receipts, keeps the accounting records, and prepares the monthly bank reconciliations. The balance per bank statement on October 31 was $19,460. Outstanding cheques were #782 for $114, #783 for $160, #784 for $267, #789 for $171, #791 for $325, and #792 for $173. There were no outstanding deposits in transit. Included with the bank statement was a $299 electronic collection of an account from a customer. The company's general ledger showed the Cash account with a balance of $19,640. The balance included undeposited cash on hand. Because of the lack of internal controls, Wong took all the undeposited receipts for his personal use. He then prepared the following bank reconciliation to hide his theft of the cash: TAHOMA LTD. Bank Reconciliation Oct-31 $ Cash Balance per books Less: EFT Collection from customer Adjusted cash balance per books: 19,640 299 19,341 $ $ 19,460 Cash balance per bank statement Less: Outstanding cheques #1782 #783 #1784 #789 791 N792 11 16 26 17 32 17 119 Adjusted cash balance per bank $ 19,341 $114, #783 for $160, #784 for $267, #789 for $171, #791 for $325, and #792 for $173. There were no outstanding deposits in transit. Included with the bank statement was a $299 electronic collection of an account from a customer. The company's general ledger showed the Cash account with a balance of $19,640. The balance included undeposited cash on hand. Because of the lack of internal controls, Wong took all the undeposited receipts for his personal use. He then prepared the following bank reconciliation to hide his theft of the cash: TAHOMA LTD Bank Reconciliation Oct-31 $ Cash Balance per books Less: EFT Collection from customer Adjusted cash balance per books: 19,640 299 19,341 $ 19,460 Cash balance per bank statement Less: Outstanding cheques #782 #783 #784 #789 11 16 26 17 32 17 #791 #792 119 Adjusted cash balance per bank $ 19.341 Required: 1. Prepare a corrected bank reconciliation (show on a new blank sheet of paper) 2 Calculate the total amount of cash that was stolen by Rob Kwong b) Identify two areas of internal control weakness at Tahomat Ltd