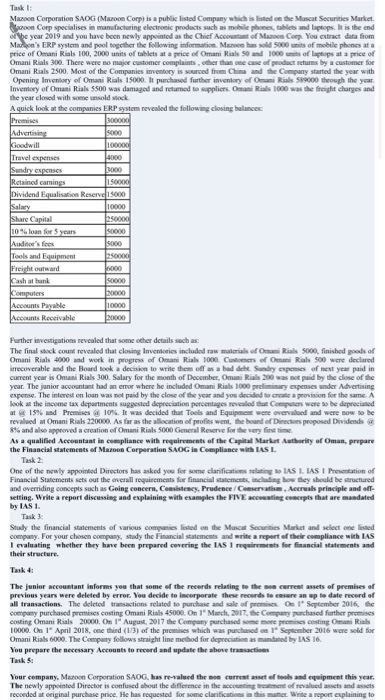

Tak Marco Corporation SAOG (Maroon Corp) is a public listed Company which is the M Series Market Corp specialises in manufacturing clectic products such m ehe d is the end he year 2019 d you have been newly appointed as the Chief A M Care You Cact data from Mad 's ERP system and pologether the following informatie Mar o ephes price of Omani Rials 100, 2000 units of a price of Omani Rial 1000 price of Omani Rials 300. There were comer compartho t e Omani Rials 2500. Most of the Companies inventory is sourced from China and the Company the you with Opening Investory of Omani Rials 15000. purchased furthern S h e Invey of Omani Rial 5500 was damaged andmed oli 1000w hard the year come with moldak A quick lock the ERP system reveled the f i e I SODE Telepon Dividend Equatic Reser Sale Tools and Equipment s Sco baco C uiers Accounts Paya Accounts Receivable Further investigations revealed that some other details such as: The final seck oun revealed that closing Inventies included w ater of Rs 5000 finished as of Omani Rials 4000 and work in progress of R s 1000 Ral 900 were declared recoverable and the Board Book a decision to write the off a hadde Sudy expenses of met yen paid in current year is Omani Rials 300. Salary for the month of December. Omani Rials 200 paid by the one of the year. The unior account bader where he included Omani Rial 1000 expenses under Advertising expense. The interest on loan was not paid by the close of the year and you decided o the same. A look at the income tax departments suggested depreciation percentages revealed that were the depreciated 15% Promises 10%. It was decided that Tools and Equip w ere over and were now she reved Omani Rials 220000. As far as the action of power the head of Direct e d Dries and a pproved a rationer Omani Rial 5000 General Reserve for the very find As a qualified Accountant in compliance with requires of the Market Authority of Oman, prepare the Financia m ent of Mas Corporation SAOG in Compliance with ASL Task One of the ruly appointed Director has asked you for we dance AS L IASI Present of Financial Statements to the overall room for financial c h eche nd and overriding concept wachas Going concer, Cory. Proce s priped welling. Write a report din g and explaining with amples the FINE is that are mandated by LASI. e w LAS Say the financials of companies is the M S M copy. For your chosen the col d weath Irating whether they have been prepared w ith IASI the structure Tak The forse that of the r igh t s of press of prwis years were dette byer. Vedecide to wore the de p te date and of wil transact . The deleted w i t h Swer 2016 de e puedes costing Omani Rials 400 On Munch 2017 he c hased further proses costing Omani Rials 200 OA 2017 Co m ing O Rial 10000 Ol " Apel 2018, thind 13 of the which w e d e r 2016 weed for Omani Rials 000 The Copy follows wright line method for deprec a ted by IAS 16. Vue prepare the necessary to urdu update the s e a Your company, Mon Corporation SAOG, ha d the cr The newly appointed Director is confused about the difference in the ceeded at original purchase price. He has requested for some clarific o w a ti w ipment this year o rld o n explaining to Tak Marco Corporation SAOG (Maroon Corp) is a public listed Company which is the M Series Market Corp specialises in manufacturing clectic products such m ehe d is the end he year 2019 d you have been newly appointed as the Chief A M Care You Cact data from Mad 's ERP system and pologether the following informatie Mar o ephes price of Omani Rials 100, 2000 units of a price of Omani Rial 1000 price of Omani Rials 300. There were comer compartho t e Omani Rials 2500. Most of the Companies inventory is sourced from China and the Company the you with Opening Investory of Omani Rials 15000. purchased furthern S h e Invey of Omani Rial 5500 was damaged andmed oli 1000w hard the year come with moldak A quick lock the ERP system reveled the f i e I SODE Telepon Dividend Equatic Reser Sale Tools and Equipment s Sco baco C uiers Accounts Paya Accounts Receivable Further investigations revealed that some other details such as: The final seck oun revealed that closing Inventies included w ater of Rs 5000 finished as of Omani Rials 4000 and work in progress of R s 1000 Ral 900 were declared recoverable and the Board Book a decision to write the off a hadde Sudy expenses of met yen paid in current year is Omani Rials 300. Salary for the month of December. Omani Rials 200 paid by the one of the year. The unior account bader where he included Omani Rial 1000 expenses under Advertising expense. The interest on loan was not paid by the close of the year and you decided o the same. A look at the income tax departments suggested depreciation percentages revealed that were the depreciated 15% Promises 10%. It was decided that Tools and Equip w ere over and were now she reved Omani Rials 220000. As far as the action of power the head of Direct e d Dries and a pproved a rationer Omani Rial 5000 General Reserve for the very find As a qualified Accountant in compliance with requires of the Market Authority of Oman, prepare the Financia m ent of Mas Corporation SAOG in Compliance with ASL Task One of the ruly appointed Director has asked you for we dance AS L IASI Present of Financial Statements to the overall room for financial c h eche nd and overriding concept wachas Going concer, Cory. Proce s priped welling. Write a report din g and explaining with amples the FINE is that are mandated by LASI. e w LAS Say the financials of companies is the M S M copy. For your chosen the col d weath Irating whether they have been prepared w ith IASI the structure Tak The forse that of the r igh t s of press of prwis years were dette byer. Vedecide to wore the de p te date and of wil transact . The deleted w i t h Swer 2016 de e puedes costing Omani Rials 400 On Munch 2017 he c hased further proses costing Omani Rials 200 OA 2017 Co m ing O Rial 10000 Ol " Apel 2018, thind 13 of the which w e d e r 2016 weed for Omani Rials 000 The Copy follows wright line method for deprec a ted by IAS 16. Vue prepare the necessary to urdu update the s e a Your company, Mon Corporation SAOG, ha d the cr The newly appointed Director is confused about the difference in the ceeded at original purchase price. He has requested for some clarific o w a ti w ipment this year o rld o n explaining to