Answered step by step

Verified Expert Solution

Question

1 Approved Answer

-------------------------------------------------------------------------------------------------------------------------- Take a look at the apple inventory example. The tests reveal a difference of $2,000. Why would an auditor think that the inventory (i.e.,

--------------------------------------------------------------------------------------------------------------------------

Take a look at the apple inventory example. The tests reveal a difference of $2,000. Why would an auditor think that the inventory (i.e., entire population to be reported on balance sheet) is misstated by more than just the $2,000 from their findings?

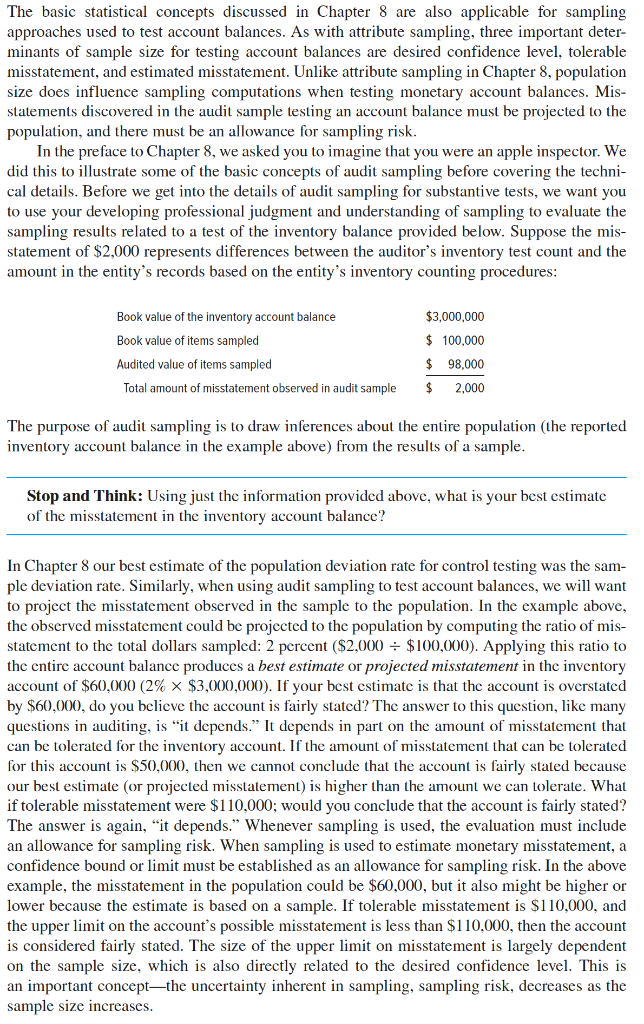

The basic statistical concepts discussed in Chapter 8 are also applicable for sampling approaches used to test account balances. As with attribute sampling, three important deter- minants of sample size for testing account balances are desired confidence level, tolerable misstatement, and estimated misstatement. Unlike attribute sampling in Chapter 8, population size does influence sampling computations when testing monetary account balances. Mis- statements discovered in the audit sample testing an account balance must be projected to the population, and there must be an allowance for sampling risk. In the preface to Chapter 8, we asked you to imagine that you were an apple inspector. We did this to illustrate some of the basic concepts of audit sampling before covering the techni- cal details. Before we get into the details of audit sampling for substantive tests, we want you to use your developing professional judgment and understanding of sampling to evaluate the sampling results related to a test of the inventory balance provided below. Suppose the mis- statement of $2,000 represents differences between the auditor's inventory test count and the amount in the entity's records based on the entity's inventory counting procedures: $3,000,000 $ 100.000 Book value of the inventory account balance Book value of items sampled Audited value of items sampled Total amount of misstatement observed in audit sample $ 98,000 $ 2,000 The purpose of audit sampling is to draw inferences about the entire population (the reported inventory account balance in the example above) from the results of a sample. Stop and Think: Using just the information provided above, what is your best estimate of the misstatement in the inventory account balance? In Chapter 8 our best estimate of the population deviation rate for control testing was the sam- ple deviation rate. Similarly, when using audit sampling to test account balances, we will want to project the misstatement observed in the sample to the population. In the example above, the observed misstatement could be projected to the population by computing the ratio of mis- statement to the total dollars sampled: 2 percent ($2,000 = $100,000). Applying this ratio to the entire account balance produces a best estimate or projected misstatement in the inventory account of $60,000 (2% $3,000,000). If your best estimate is that the account is overstated by $60,000, do you believe the account is fairly stated? The answer to this question, like many questions in auditing, is it depends." It depends in part on the amount of misstatement that can be tolerated for the inventory account. If the amount of misstatement that can be tolerated for this account is $50,000, then we cannot conclude that the account is fairly stated because our best estimate (or projected misstatement) is higher than the amount we can tolerate. What if tolerable misstatement were $110,000; would you conclude that the account is fairly stated? The answer is again, it depends." Whenever sampling is used, the evaluation must include an allowance for sampling risk. When sampling is used to estimate monetary misstatement, a confidence bound or limit must be established as an allowance for sampling risk. In the above example, the misstatement in the population could be $60,000, but it also might be higher or lower because the estimate is based on a sample. If tolerable misstatement is $110,000, and the upper limit on the account's possible misstatement is less than $110.000, then the account is considered fairly stated. The size of the upper limit on misstatement is largely dependent on the sample size, which is also directly related to the desired confidence level. This is an important conceptthe uncertainty inherent in sampling, sampling risk, decreases as the sample size increases. You may remember from your statistics courses using concepts such as a standard devi- ation and a normal distribution (i.e., Z scores or confidence coefficients) to compute con- fidence limits and intervals. This traditional statistical approach is used for classical variables sampling, which is covered in Advanced Module 1. In response to the difficult mathematical calculations involved in classical variable sampling and due to other limitations discussed later, auditors developed an audit sampling approach for testing balances called monetary-unit sampling. Monetary-unit sampling is based on attribute-sampling concepts. While the compu- tations involved in classical variables sampling can now easily be performed with a personal computer or handheld calculator, auditors have found that monetary-unit sampling provides other important advantages. However, monetary-unit sampling is not the best approach for all substantive tests of details; therefore, in this chapter we also cover nonstatistical sampling and classical variables samplingStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started