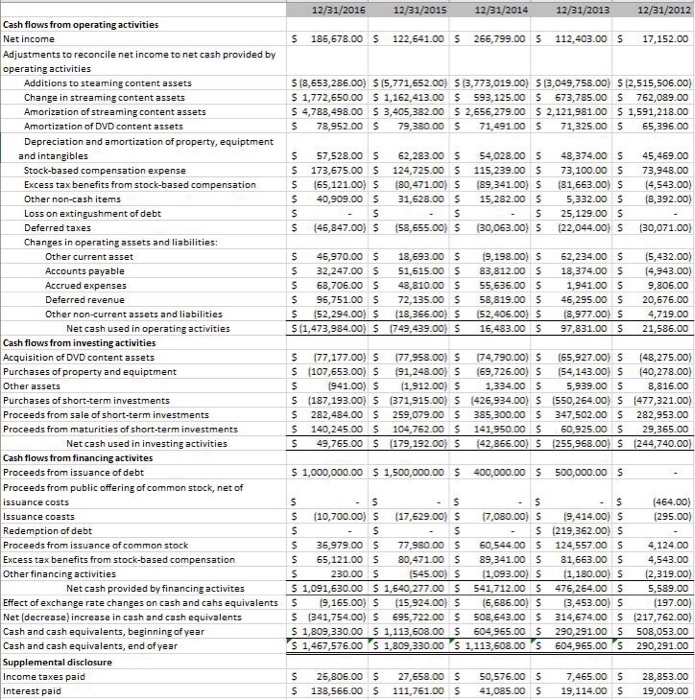

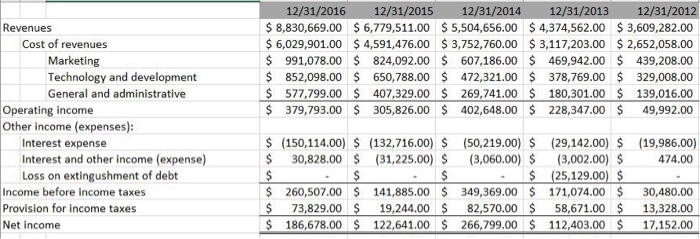

Take each statement and state the key parts in words. Tell a story from each of the financial statements.

This is a statement anaysis over time.

-----------------------

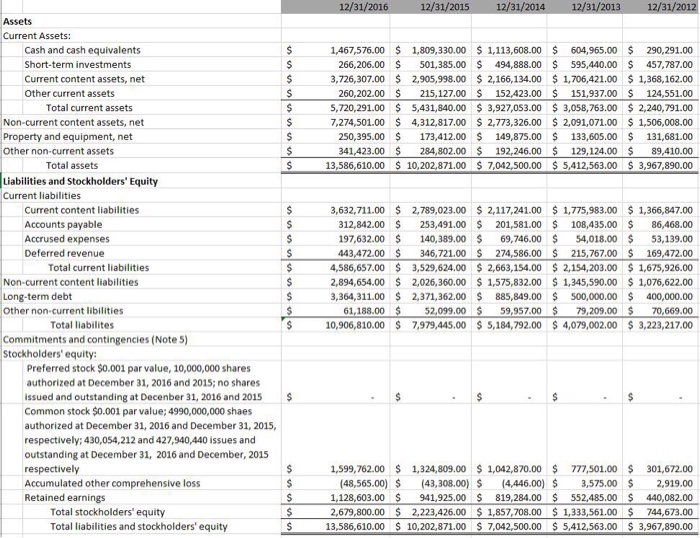

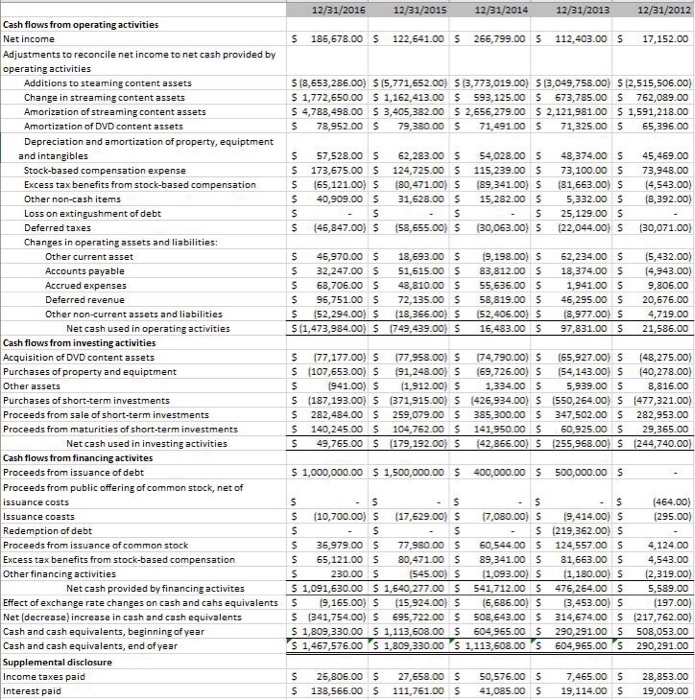

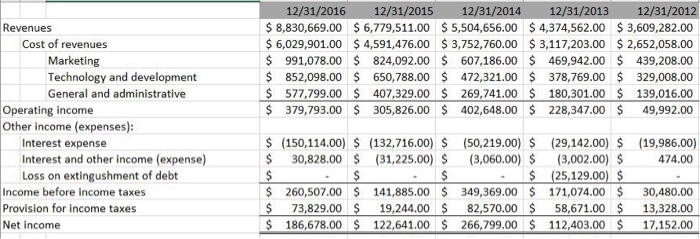

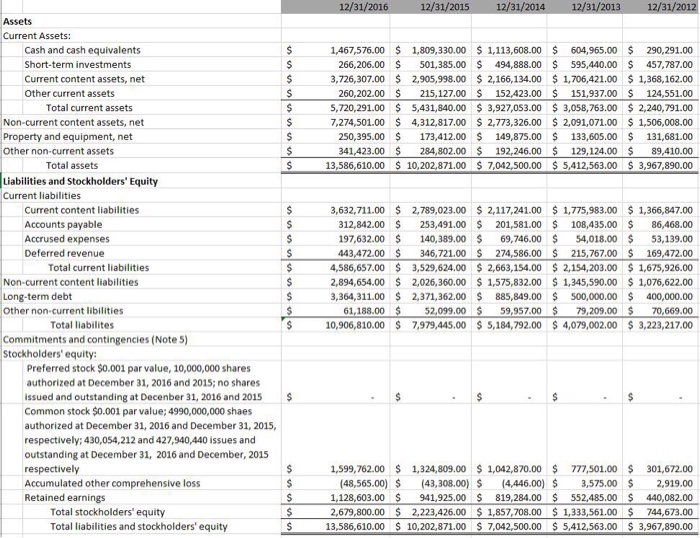

Here are the balance sheet, statement of cash flows, and income statement for Netflix over the past 5 years.

Assets Current Assets: Cash and cash equivalents Short-term investments Current content assets, net Other current assets Total current assets Non-current content assets, net Property and equipment, net Other non-current assets Total assets Liabilities and Stockholders' Equity Current liabilities Current content liabilities Accounts payable Accrused expenses Deferred revenue Total current liabilities Non-current content liabilities Long-term debt Other non-current libilities Total abilites Commitments and contingencies (Note 5 Stockholders' equity: Preferred stock $0.001 par value, 10,000,000 shares authorized at December 31, 2016 and 2015; shares ssued and outstanding at Decenber 31 2016 and 2015 Common stock $0.001 par value; 4990,000,000 shaes authorized at December 3, 2016 and December 31, 2015 respectively; 430,054,212 and 427,940,440 issues and outstanding at December 31, 2016 and December, 2015 respectively Accumulated other comprehensive loss Retained earnings Total stockholders' equity Total liabilities and stockholders' equity 12/3 1/2016 12/3 1/2015 12/3/2014 12/3 1/2013 12/31/2012 1,467,576.00 1.809,330.00 1.113,608.00 604,965.00 290,291.00 266,206.00 501.385.00 494,888.00 s 595,440.00 457,787.00 3,726,307.00 2,905,998.00 2,166,134.00 1.706,421.00 1,368,162.00 215,127.00 152,423.00 151,937.00 124,551.00 260,202.00 5,720,291.00 5,431.840.00 3,927,053.00 3,058,763.00 2,240,791.00 7,274,501.00 4,312,817.00 2,773,326.00 2,091,071.00 1,506,008.00 250,395.00 173,412.00 149,875.00 133,605.00 131,681.00 341,423.00 284,802.00 192,246.00 129,124.00 89,410.00 13,586,610.00 10,202,871.00 7,042,500.00 5,412,563.00 3,967,890.00 3,632,711.00 2,789,023.00 2,117,241.00 1.775,983.00 1,366,847.00 312,842.00 253,491.00 201,581.00 108,435.00 86,468.00 197,632.00 140,389.00 69,746.00 54,018.00 53,139.00 443,472.00 346,721.00 274,586.00 215,767.00 169,472.00 4,586,657.00 3,529,624.00 2,663,154.00 2,154,203.00 1.675,926.00 2,894,654.00 2,026,360.00 1,575,832.00 1.345,590.00 1,076,622.00 3,364,311.00 2,371.362.00 885,849.00 500,000.00 400,000.00 61,188.00 52,099.00 59,957.00 79,209.00 70,669.00 10,906,810.00 7,979,445.00 5,184,792.00 4,079,002.00 3,223,217.00 1,599,762.00 1.324,809.00 1,042,870.00 777,501.00 301,672.00 (48,565.00) (43,308.00) (4,446.00) 3,575.00 2,919.00 1,128,603.00 941.925.00 819,284.00 552,485.00 440,082.00 2,679,800.00 2,223,426.00 1,857,708.00 1,333,561.00 744,673.00 13,586,610.00 10,202,871.00 7,042,500.00 5,412,563.00 3,967,890.00