Question

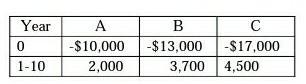

Take into consideration three mutually exclusive alternatives A, B, C, and also do-nothing alternative. The cash flows for the alternatives over 10 years are given

Take into consideration three mutually exclusive alternatives A, B, C, and also do-nothing alternative. The cash flows for the alternatives over 10 years are given in the table:

Do a Graphical Analysis to evaluate the alternatives by following the steps:

a) Calculate all the candidates for changeover points.

b) Determine a reasonably large range of interest rates based on your findings in part a) and plot NPW(i) for each alternative for this range of interest rates.

c) Identify the changeover points and construct the choice table.

d) If do-nothing alternative was not an option, what would be the changeover points? Remake the choice table under this speculation.

Year 0 1-10 A B $10,000-$13,000 -$17,000 2,000 3,700 4,500 Year 0 1-10 A B $10,000-$13,000 -$17,000 2,000 3,700 4,500Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started