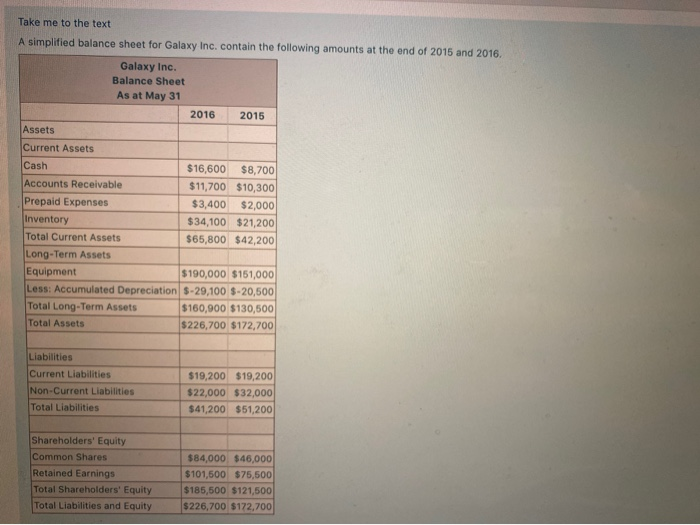

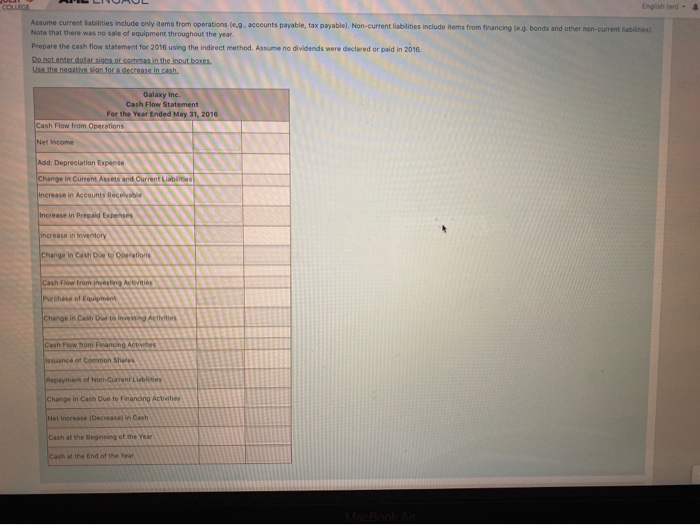

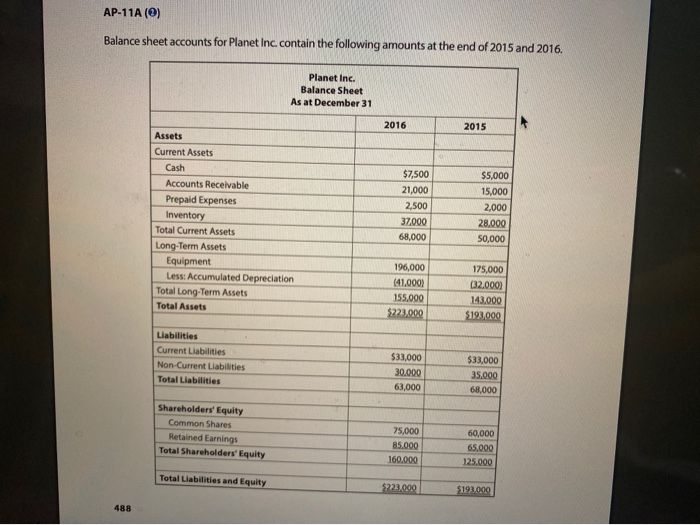

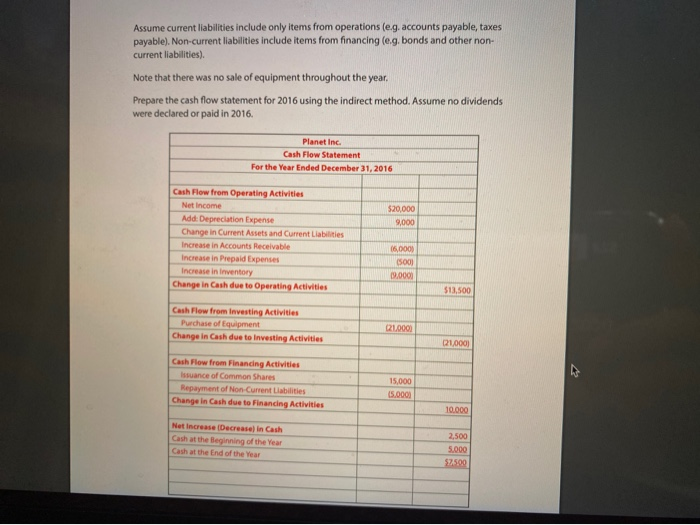

Take me to the text A simplified balance sheet for Galaxy Inc. contain the following amounts at the end of 2015 and 2016 Galaxy Inc. Balance Sheet As at May 31 2016 2015 Assets Current Assets Cash $16,600 $8,700 Accounts Receivable $11,700 $10,300 Prepaid Expenses $3,400 $2,000 Inventory $34,100 $21,200 Total Current Assets $65,800 $42,200 Long-Term Assets Equipment $190,000 $151,000 Less: Accumulated Depreciation -29,100 $-20,500 Total Long-Term Assets $160,000 $130,500 Total Assets $226,700 $172,700 Liabilities Current Liabilities Non-Current Liabilities Total Liabilities $19,200 $19,200 $22,000 $32,000 $41,200 $51,200 Shareholders' Equity Common Shares Retained Earnings Total Shareholders' Equity Total Liabilities and Equity $84,000 $46,000 $101,500 $75,500 $185,500 $121,500 $226,700 $172,700 COLLEGE English (en) - Assume current abilities include only items from operations (eg, accounts payable, tax payable). Non-current liabilities include items from financing leg bonds and other non-current liabilities Note that there was no sale of equipment throughout the year Prepare the cash flow statement for 2016 using the Indirect method. Assume no dividends were declared or paid in 2016. Do not enter dotac signs or comes in the input boxes Use the negative ion for a decrease in cash Galaxy Ine. Cash Flow Statement For the Year Ended May 31, 2016 Cash Flow from Operations Net Income Add: Depreciation Experte Change in Current Assets and Current Liabilities Increase in Accounts Receivable Increase in Prepaid Expenses Increase in invertory Change in Cash Due to Operations Cash Flow from investing Activities Purchase of Equipment Charge in Cash Das to investing Activities Cash Flow from Financing Activities issuance of Common Shares Repayment of Non Current Lisblities Change in Cash Due to Financing Activities Net Increase Decreasi Cash Cash at the Beginning of the Year Cash at the End of the Year AP-11A (0) Balance sheet accounts for Planet Inc. contain the following amounts at the end of 2015 and 2016. Planet Inc. Balance Sheet As at December 31 2016 2015 Assets Current Assets Cash Accounts Receivable Prepaid Expenses Inventory Total Current Assets Long-Term Assets Equipment Less: Accumulated Depreciation Total Long Term Assets Total Assets $7,500 21,000 2,500 37.000 68,000 $5,000 15,000 2,000 28.000 50,000 196,000 (41.0001 155.000 $223.000 175,000 (32.0002 143.000 5193,000 Liabilities Current Liabilities Non-Current Liabilities Total Liabilities $33,000 30.000 63,000 $33,000 35.000 68,000 Shareholders' Equity Common Shares Retained Earnings Total Shareholders' Equity 75,000 85.000 160.000 60,000 65.000 125.000 Total Liabilities and Equity $223.000 $190.000 488 Assume current liabilities include only items from operations (eg, accounts payable, taxes payable). Non-current liabilities include items from financing (e.g. bonds and other non- current liabilities) Note that there was no sale of equipment throughout the year. Prepare the cash flow statement for 2016 using the indirect method. Assume no dividends were declared or paid in 2016, Planet Inc. Cash Flow Statement For the Year Ended December 31, 2016 $20,000 9,000 Cash Flow from Operating Activities Net Income Add: Depreciation Expense Change in Current Assets and Current Liabilities Increase in Accounts Receivable Increase in Prepaid Expenses Increase in inventory Change in Cash due to Operating Activities 16,000) (500) 19.0001 $13,500 Cash Flow from investing Activities Purchase of Equipment Change in Cash due to investing Activities 021.000 021,000) Cash Flow from Financing Activities Issuance of Common Shares Repayment of Non Current Liabilities Change in Cash due to Financing Activities 15.000 15.0001 10.000 Net Increase (Decrease in Cash Cash at the Beginning of the Year Cash at the End of the Year 2,500 5.000 $2509