Question

Taking into account the data in Exhibit 1, form a table that calculates when a hen is spent (after week 78) under normal conditions such

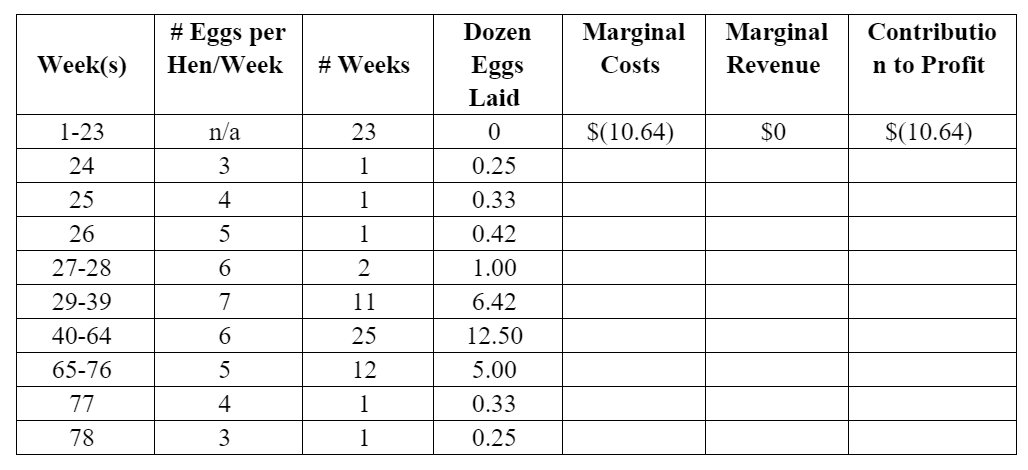

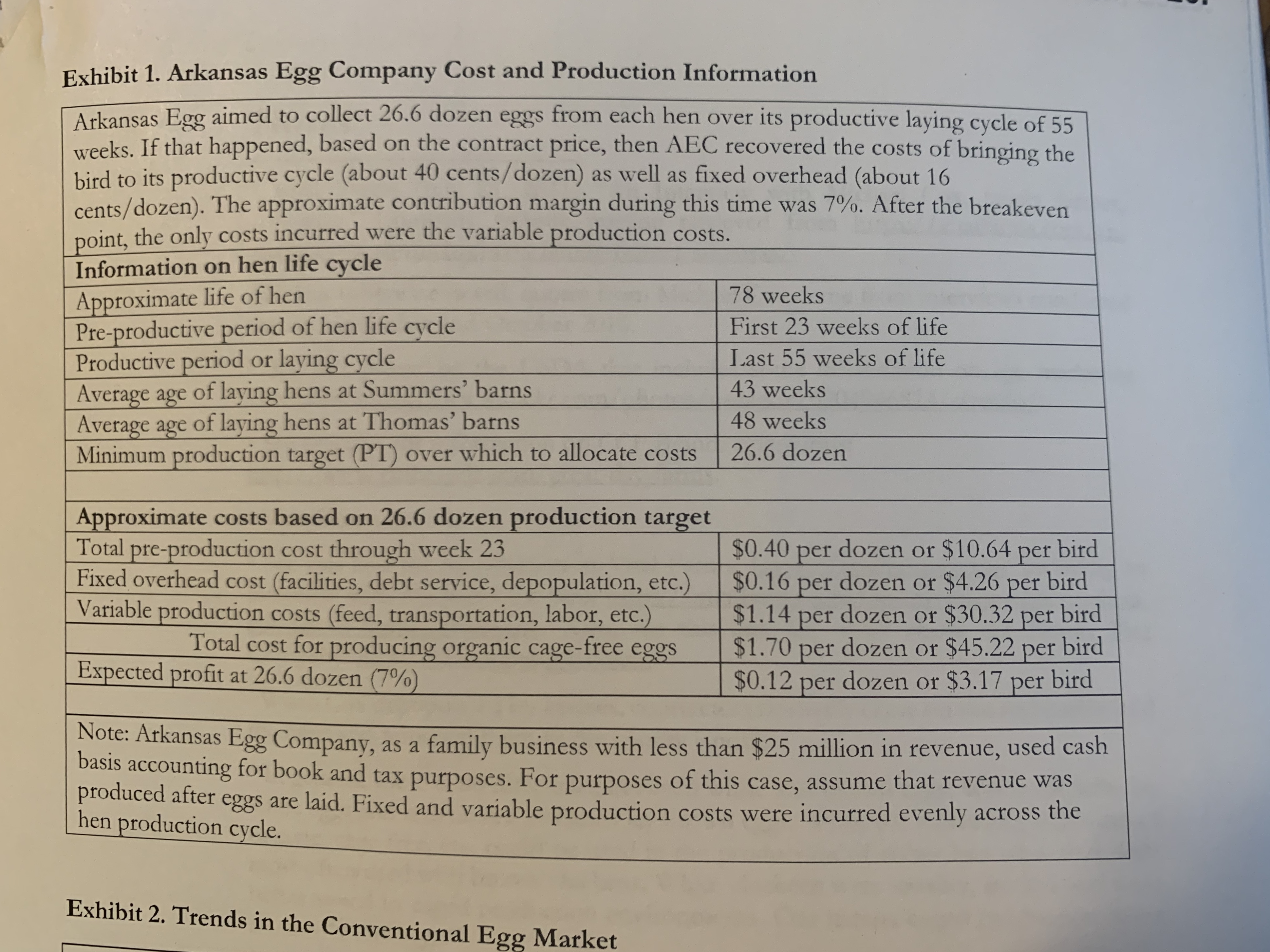

Taking into account the data in Exhibit 1, form a table that calculates when a hen is "spent" (after week 78) under normal conditions such as the CCF Brands contract, or that could be used to decide when it is no longer profitable to continue egg production. That is, construct a model with formulas for which you can easily vary inputs, such as price, profit, or variable costs. Use the output template provided below. (Hint: Distinguish between relevant and non-relevant costs. Determine the estimated revenue per dozen and weekly production costs first.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started