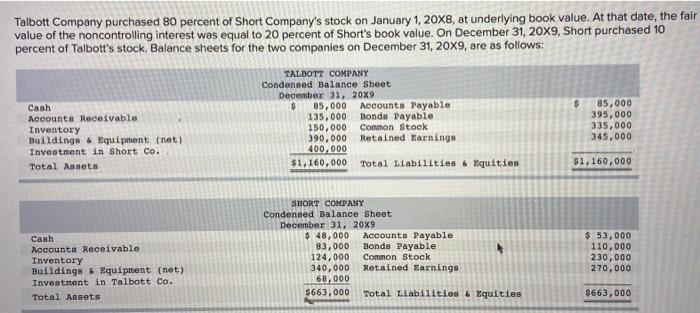

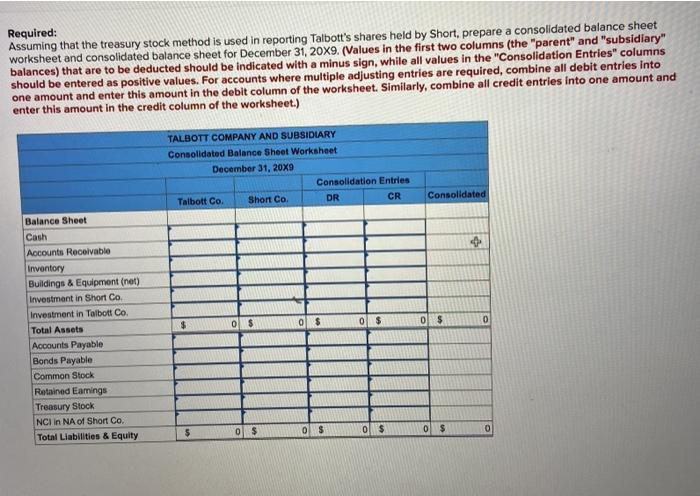

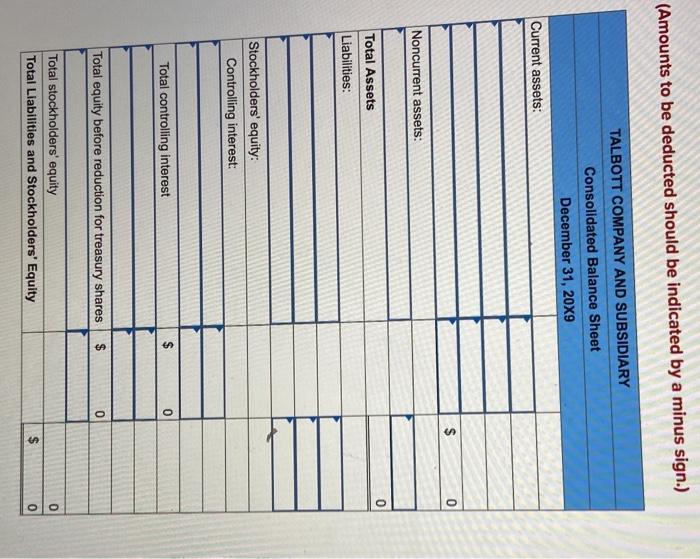

Talbott Company purchased 80 percent of Short Company's stock on January 1, 20x8, at underlying book value. At that date, the fair value of the noncontrolling interest was equal to 20 percent of Short's book value. On December 31, 20X9, Short purchased 10 percent of Talbott's stock. Balance sheets for the two companies on December 31, 20X9, are as follows: $ Cash Accounts Receivable Inventory Buildings & Equipment (net) Investment in Short Co. Total Assets TALBOTT COMPANY Condensed Balance Sheet December 31, 2009 $ 85,000 Accounts Payable 135,000 Bonde Payablo 150,000 Connon Stock 390,000 Retained Earnings 400.000 $1,160,000 Total Liabilities & Equities 85,000 395,000 335,000 345,000 $1,160,000 Cash Accounts Receivable Inventory Buildings & Equipment (net) Investment in Talbott Co. Total Assets SHORT COMPANY Condensed Balance Sheet December 31, 20x9 $ 48,000 Accounts Payable 83,000 Bonds Payable 124.000 Common Stock 340,000 Retained Earnings 68,000 $663,000 Total Liabilities & Equities $ 53,000 110,000 230,000 270,000 $663,000 Required: Assuming that the treasury stock method is used in reporting Talbott's shares held by Short, prepare a consolidated balance sheet worksheet and consolidated balance sheet for December 31, 20X9. (Values in the first two columns (the "parent" and "subsidiary" balances) that are to be deducted should be indicated with a minus sign, while all values in the "Consolidation Entries" columns should be entered as positive values. For accounts where multiple adjusting entries are required, combine all debit entries into one amount and enter this amount in the debit column of the worksheet. Similarly, combine all credit entries into one amount and enter this amount in the credit column of the worksheet.) TALBOTT COMPANY AND SUBSIDIARY Consolidated Balance Sheet Worksheet December 31, 20X9 Consolidation Entries Talbott Co. Short Co. DR CR Consolidated $ 0 $ 0 $ 0 0 $ 0 $ Balance Sheet Cash Accounts Receivable Inventory Buildings & Equipment (net) Investment in Short Co Investment in Tolbott Co. Total Assets Accounts Payable Bonds Payable Common Stock Retained Earnings Treasury Stock NCI in NA of Short Co. Total Liabilities & Equity 5 0 $ 0 $ 0 $ 0 $ 0 (Amounts to be deducted should be indicated by a minus sign.) TALBOTT COMPANY AND SUBSIDIARY Consolidated Balance Sheet December 31, 20X9 Current assets: $ 0 Noncurrent assets: 0 Total Assets Liabilities: Stockholders' equity: Controlling interest: Total controlling interest $ 0 Total equity before reduction for treasury shares $ O 0 Total stockholders' equity Total Liabilities and Stockholders' Equity $ 0