Question

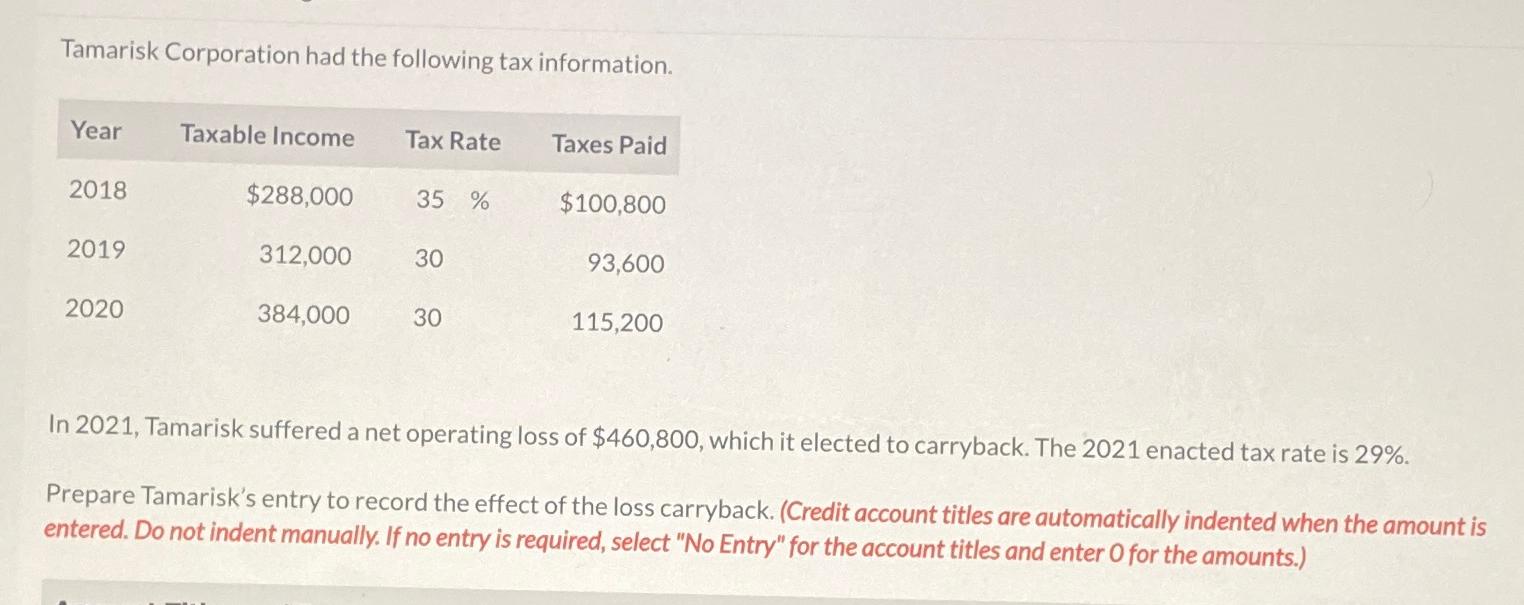

Tamarisk Corporation had the following tax information. Year 2018 2019 2020 Taxable Income $288,000 312,000 384,000 Tax Rate 35 % 30 30 Taxes Paid

Tamarisk Corporation had the following tax information. Year 2018 2019 2020 Taxable Income $288,000 312,000 384,000 Tax Rate 35 % 30 30 Taxes Paid $100,800 93,600 115,200 In 2021, Tamarisk suffered a net operating loss of $460,800, which it elected to carryback. The 2021 enacted tax rate is 29%. Prepare Tamarisk's entry to record the effect of the loss carryback. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Here are the full workings for Tamarisks entry to record the effect of the loss carryback 2021 Net O...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting Volume 2

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield, Irene M. Wiecek, Bruce J. McConomy

12th Canadian Edition

1119497043, 978-1119497042

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App