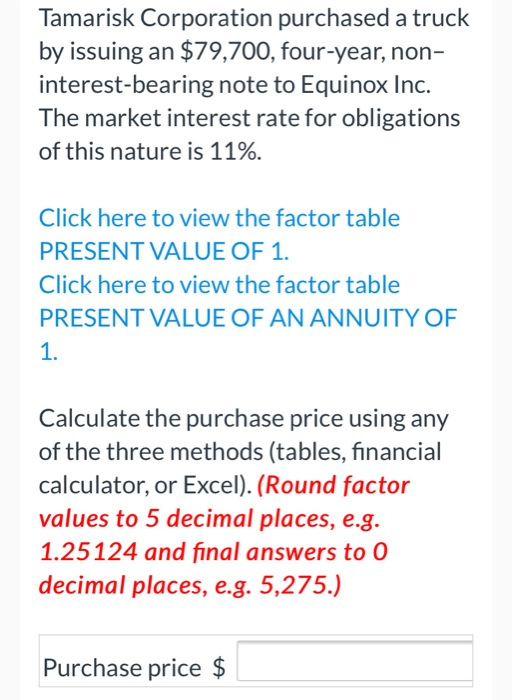

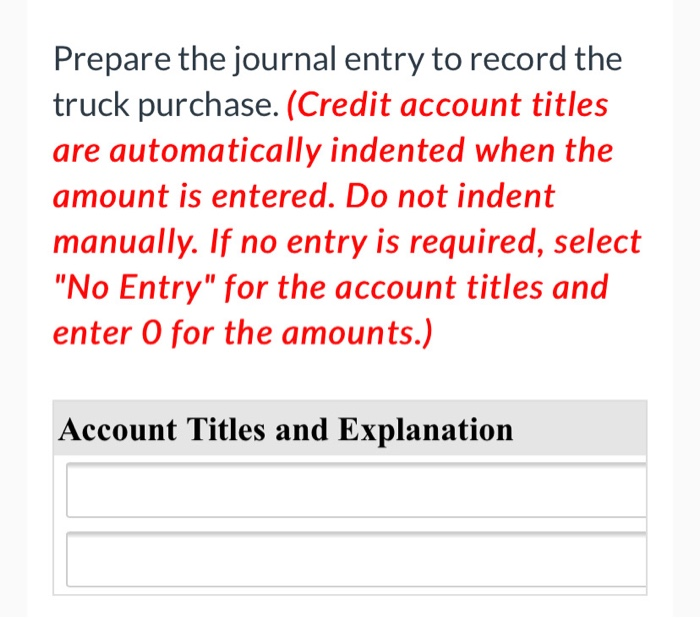

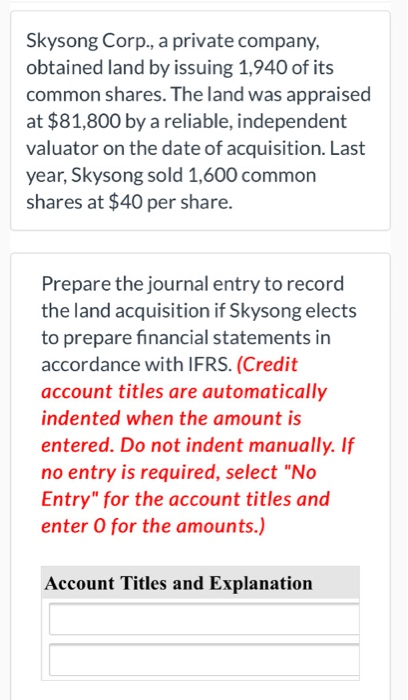

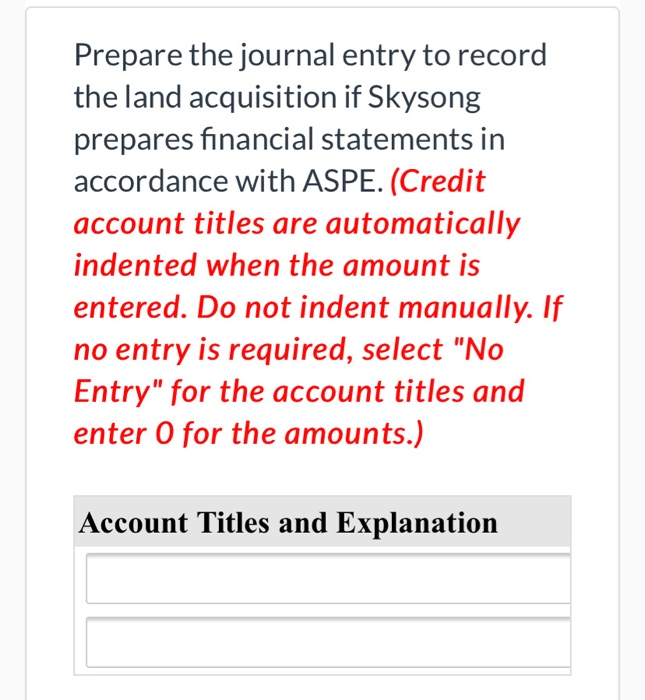

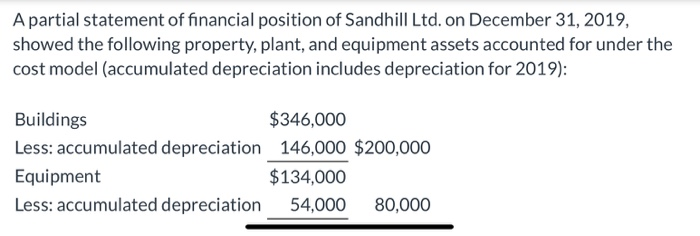

Tamarisk Corporation purchased a truck by issuing an $79,700, four-year, non- interest-bearing note to Equinox Inc. The market interest rate for obligations of this nature is 11%. Click here to view the factor table PRESENT VALUE OF 1. Click here to view the factor table PRESENT VALUE OF AN ANNUITY OF 1. Calculate the purchase price using any of the three methods (tables, financial calculator, or Excel). (Round factor values to 5 decimal places, e.g. 1.25124 and final answers to O decimal places, e.g. 5,275.) Purchase price $ Prepare the journal entry to record the truck purchase. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Account Titles and Explanation Skysong Corp., a private company, obtained land by issuing 1,940 of its common shares. The land was appraised at $81,800 by a reliable, independent valuator on the date of acquisition. Last year, Skysong sold 1,600 common shares at $40 per share. Prepare the journal entry to record the land acquisition if Skysong elects to prepare financial statements in accordance with IFRS. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Account Titles and Explanation Prepare the journal entry to record the land acquisition if Skysong prepares financial statements in accordance with ASPE. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts.) Account Titles and Explanation A partial statement of financial position of Sandhill Ltd. on December 31, 2019, showed the following property, plant, and equipment assets accounted for under the cost model (accumulated depreciation includes depreciation for 2019): Buildings $346,000 Less: accumulated depreciation 146,000 $200,000 Equipment $134,000 Less: accumulated depreciation 54,000 80,000