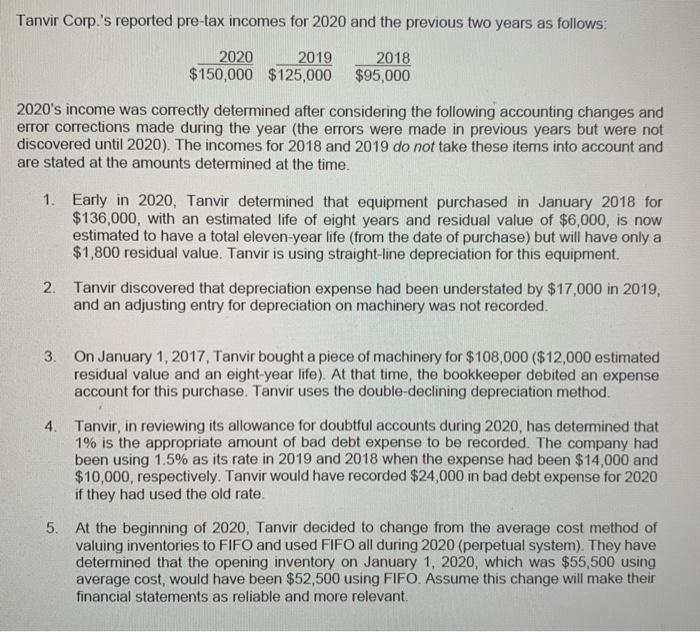

Tanvir Corp.'s reported pre-tax incomes for 2020 and the previous two years as follows: 2020 2019 $150,000 $125,000 2018 $95,000 2020's income was correctly determined after considering the following accounting changes and error corrections made during the year (the errors were made in previous years but were not discovered until 2020). The incomes for 2018 and 2019 do not take these items into account and are stated at the amounts determined at the time. 1. Early in 2020, Tanvir determined that equipment purchased in January 2018 for $136,000, with an estimated life of eight years and residual value of $6,000, is now estimated to have a total eleven-year life (from the date of purchase) but will have only a $1,800 residual value. Tanvir is using straight-line depreciation for this equipment 2. Tanvir discovered that depreciation expense had been understated by $17,000 in 2019, and an adjusting entry for depreciation on machinery was not recorded. 3. On January 1, 2017, Tanvir bought a piece of machinery for $108,000 ($12,000 estimated residual value and an eight-year life). At that time, the bookkeeper debited an expense account for this purchase. Tanvir uses the double-declining depreciation method. 4. Tanvir, in reviewing its allowance for doubtful accounts during 2020, has determined that 1% is the appropriate amount of bad debt expense to be recorded. The company had been using 1.5% as its rate in 2019 and 2018 when the expense had been $14,000 and $10,000, respectively. Tanvir would have recorded $24,000 in bad debt expense for 2020 if they had used the old rate. 5. At the beginning of 2020, Tanvir decided to change from the average cost method of valuing inventories to FIFO and used FIFO all during 2020 (perpetual system). They have determined that the opening inventory on January 1, 2020, which was $55,500 using average cost, would have been $52,500 using FIFO. Assume this change will make their financial statements as reliable and more relevant. For each of the situations above, prepare the journal entry or entries Tanvir Corp. would have prepared to adjust for them during 2020. If you think no entry was prepared, write "none." Ignore income taxes. After recording each situation in part a), prepare the appropriate year-end adjusting entry (entries) that should have been made at December 31, 2020. If you think no entry would be required, write none." Ignore income taxes