Answered step by step

Verified Expert Solution

Question

1 Approved Answer

target targwt walmart Refer to the financial statements of Target (Appendix B) and Walmart Required: 1. (a) Compute return on assets for the most recent

target

target  targwt walmart

targwt walmart

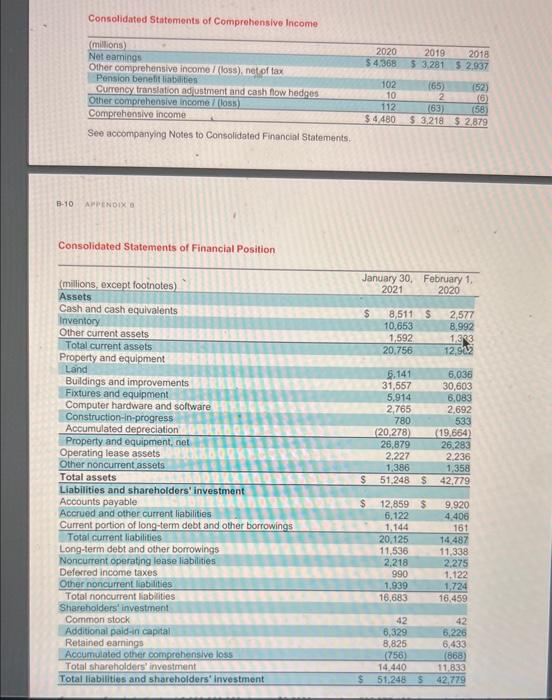

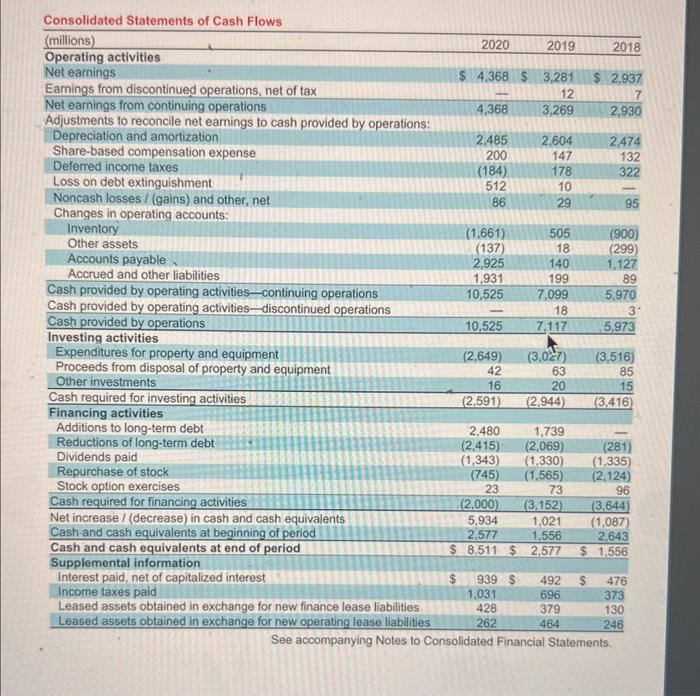

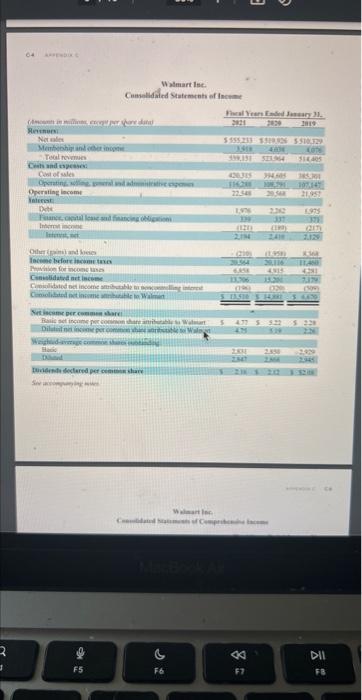

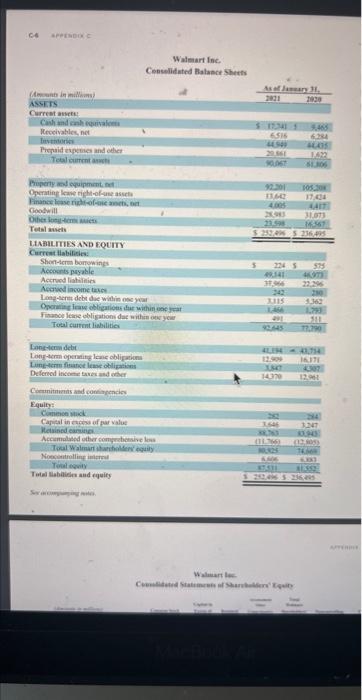

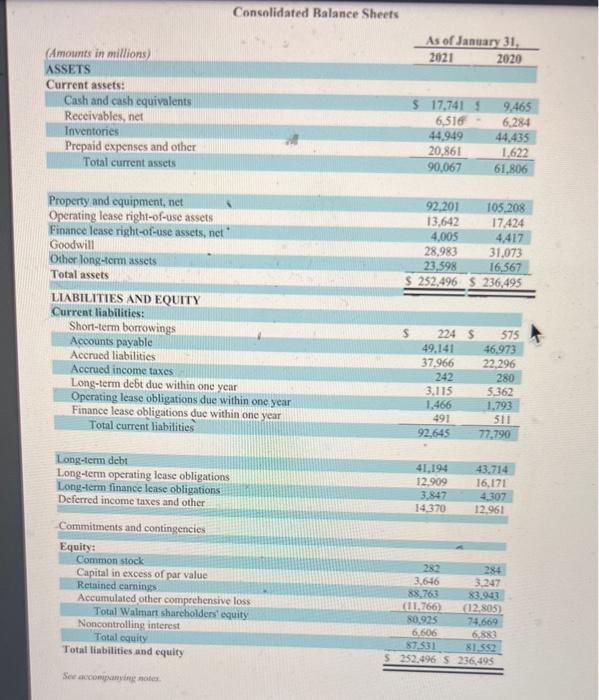

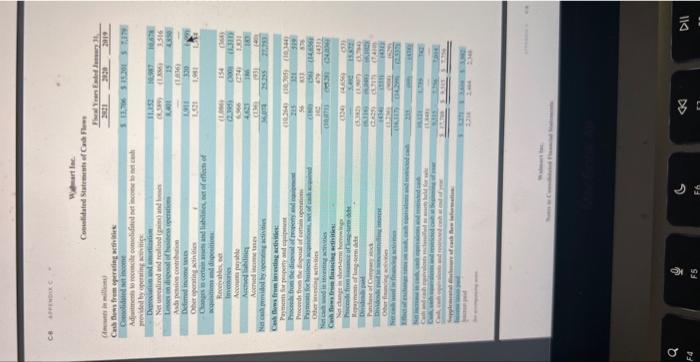

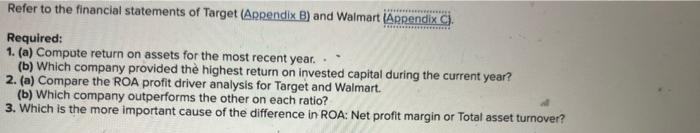

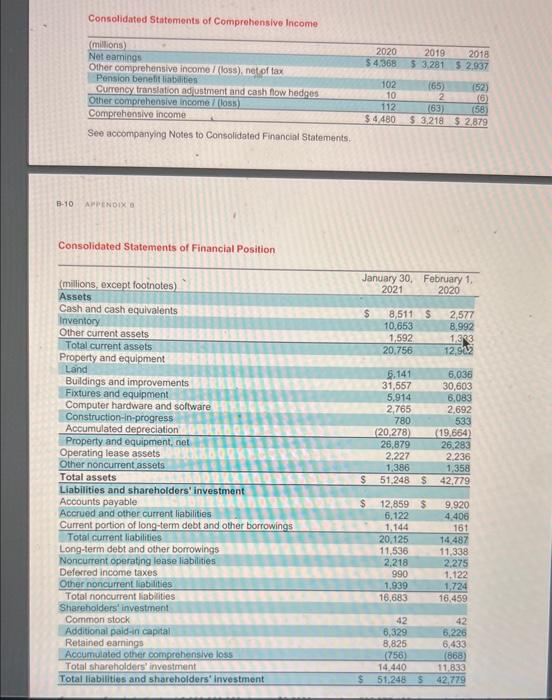

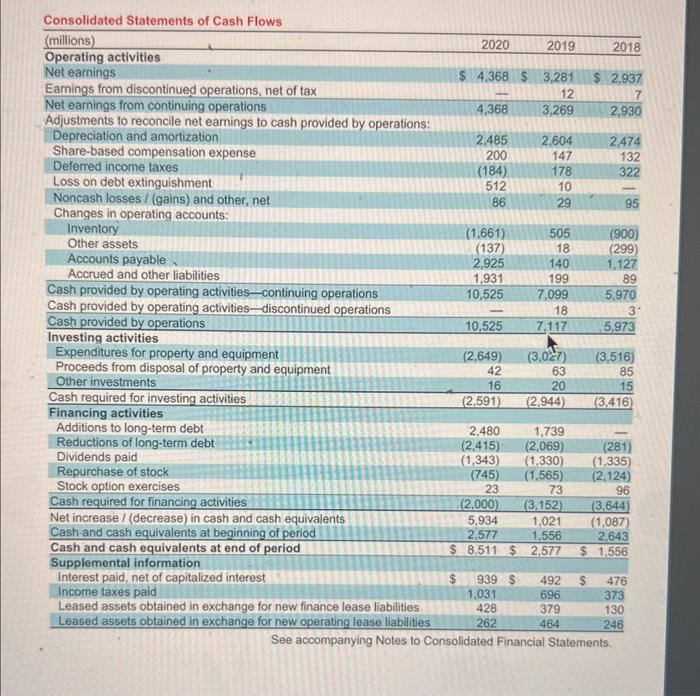

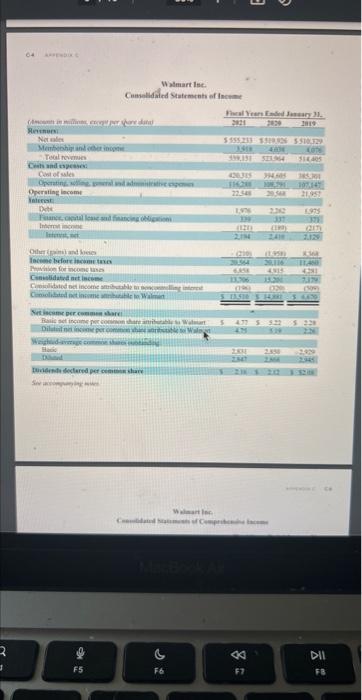

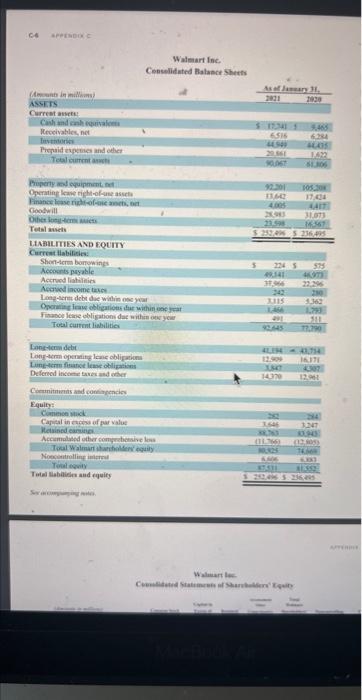

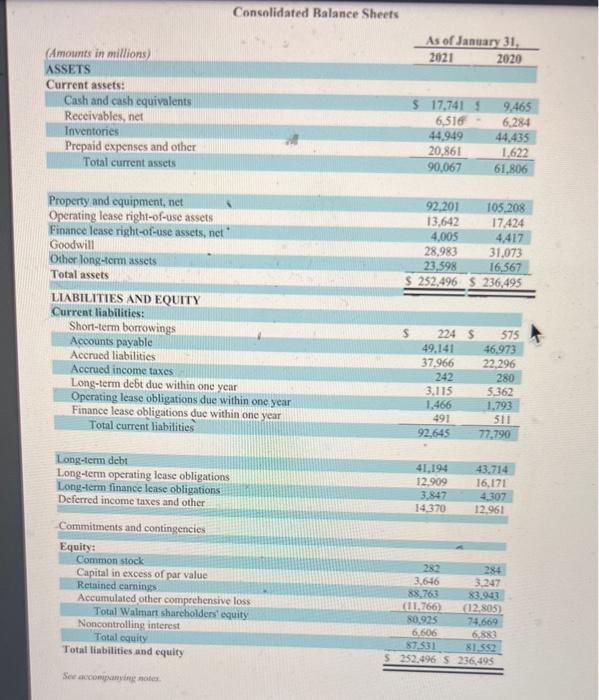

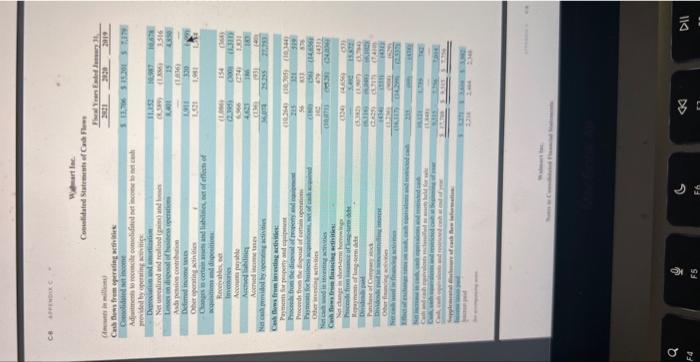

Refer to the financial statements of Target (Appendix B) and Walmart Required: 1. (a) Compute return on assets for the most recent year. (b) Which company provided th highest return on invested capital during the current year? 2. (a) Compare the ROA profit driver analysis for Target and Walmart. (b) Which company outperforms the other on each ratio? 3. Which is the more important cause of the difference in ROA: Net profit margin or Total asset turnover? Consolidated Statements of Comprehensive Income See accompanying Notes to Consolidated Financial Statements: B-10 AFEENDIX a Consolidated Statements of Financial Position Consolidated Statements of Cash Flows W simart lece. C umpelidalod watrments of Inevane Whateart Inc. Consolidated Ralance Sheets Refer to the financial statements of Target (Appendix B) and Walmart Required: 1. (a) Compute return on assets for the most recent year. (b) Which company provided th highest return on invested capital during the current year? 2. (a) Compare the ROA profit driver analysis for Target and Walmart. (b) Which company outperforms the other on each ratio? 3. Which is the more important cause of the difference in ROA: Net profit margin or Total asset turnover? Consolidated Statements of Comprehensive Income See accompanying Notes to Consolidated Financial Statements: B-10 AFEENDIX a Consolidated Statements of Financial Position Consolidated Statements of Cash Flows W simart lece. C umpelidalod watrments of Inevane Whateart Inc. Consolidated Ralance Sheets

Refer to the financial statements of Target (Appendix B) and Walmart Required: 1. (a) Compute return on assets for the most recent year. (b) Which company provided th highest return on invested capital during the current year? 2. (a) Compare the ROA profit driver analysis for Target and Walmart. (b) Which company outperforms the other on each ratio? 3. Which is the more important cause of the difference in ROA: Net profit margin or Total asset turnover? Consolidated Statements of Comprehensive Income See accompanying Notes to Consolidated Financial Statements: B-10 AFEENDIX a Consolidated Statements of Financial Position Consolidated Statements of Cash Flows W simart lece. C umpelidalod watrments of Inevane Whateart Inc. Consolidated Ralance Sheets Refer to the financial statements of Target (Appendix B) and Walmart Required: 1. (a) Compute return on assets for the most recent year. (b) Which company provided th highest return on invested capital during the current year? 2. (a) Compare the ROA profit driver analysis for Target and Walmart. (b) Which company outperforms the other on each ratio? 3. Which is the more important cause of the difference in ROA: Net profit margin or Total asset turnover? Consolidated Statements of Comprehensive Income See accompanying Notes to Consolidated Financial Statements: B-10 AFEENDIX a Consolidated Statements of Financial Position Consolidated Statements of Cash Flows W simart lece. C umpelidalod watrments of Inevane Whateart Inc. Consolidated Ralance Sheets

target

target targwt

targwtwalmart

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started