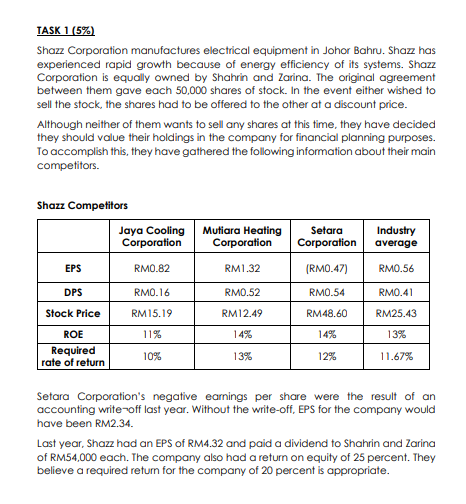

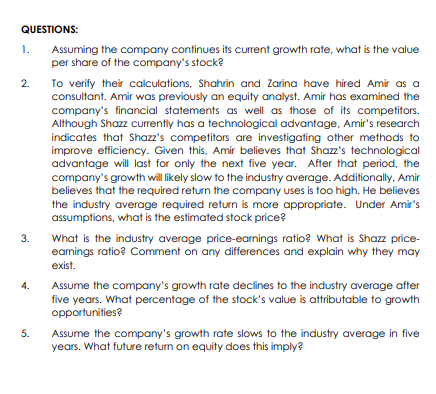

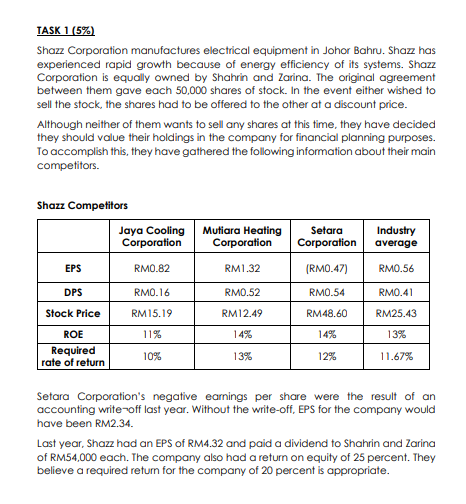

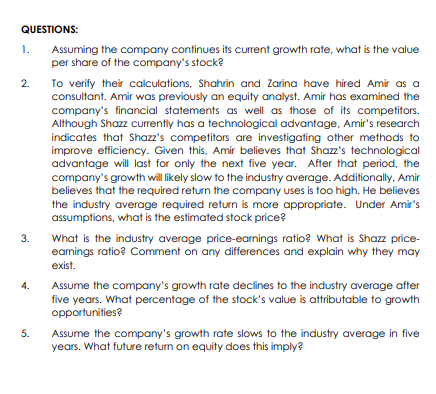

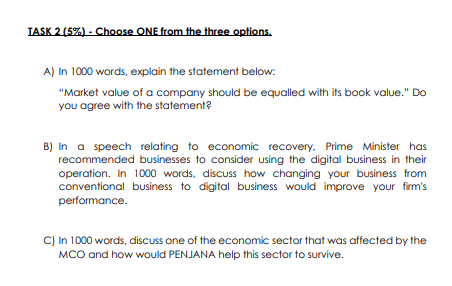

TASK 1 (5%) Shazz Corporation manufactures electrical equipment in Johor Bahru. Shaz has experienced rapid growth because of energy efficiency of its systems. Shazz Corporation is equally owned by Shahrin and Zarina. The original agreement between them gave each 50,000 shares of stock. In the event either wished to sell the stock, the shares had to be offered to the other at a discount price. Although neither of them wants to sell any shares at this time, they have decided they should value their holdings in the company for financial planning purposes. To accomplish this, they have gathered the following information about their main competitors. Shazz Competitors Jaya Cooling Mutiara Heating Corporation Corporation Setara Corporation Industry average EPS RM 0.82 RM1.32 (RMO.47) RM0.56 DPS R0.16 RM0.52 RM0.54 RM0.41 Stock Price RM15.19 RM12.49 RM48.60 RM25.43 11% 14% 14% 13% ROE Required rate of return 10% 13% 12% 11.67% Setara Corporation's negative earnings per share were the result of an accounting write-off last year. Without the write-off, EPS for the company would have been RM2.34. Last year, Shazz had an EPS of RM4.32 and paid a dividend to Shahrin and Zarina of RM54,000 each. The company also had a return on equity of 25 percent. They believe a required return for the company of 20 percent is appropriate. QUESTIONS: . 1. Assuming the company continues its current growth rate, what is the value per share of the company's stock 2. To verify their calculations, Shahrin and Zarina have hired Amir as a consultant. Amir was previously an equity analyst. Amir has examined the company's financial statements as well as those of its competitors. Although Shazz currently has a technological advantage, Amir's research indicates that Shazz's competitors are investigating other methods to improve efficiency. Given this. Amir believes that Shazz's technological advantage will last for only the next five year. After that period, the company's growth will likely slow to the industry average. Additionally, Amir believes that the required return the company uses is too high. He believes the industry average required return is more appropriate. Under Amir's assumptions, what is the estimated stock price? 3. What is the industry average price-earnings ratio? What is Shazz price- earnings ratio? Comment on any differences and explain why they may exist. 4. Assume the company's growth rate declines to the industry average after five years. What percentage of the stock's value is attributable to growth opportunities 5. Assume the company's growth rate slows to the industry average in five years. What future return on equity does this imply TASK 2 (5%) - Choose ONE from the three options. A) In 1000 words, explain the statement below: "Market value of a company should be equalled with its book value." Do you agree with the statement B) In a speech relating to economic recovery, Prime Minister has recommended businesses to consider using the digital business in their operation. In 1000 words, discuss how changing your business from conventional business to digital business would improve your firm's performance. C) In 1000 words, discuss one of the economic sector that was affected by the MCO and how would PENJANA help this sector to survive