Answered step by step

Verified Expert Solution

Question

1 Approved Answer

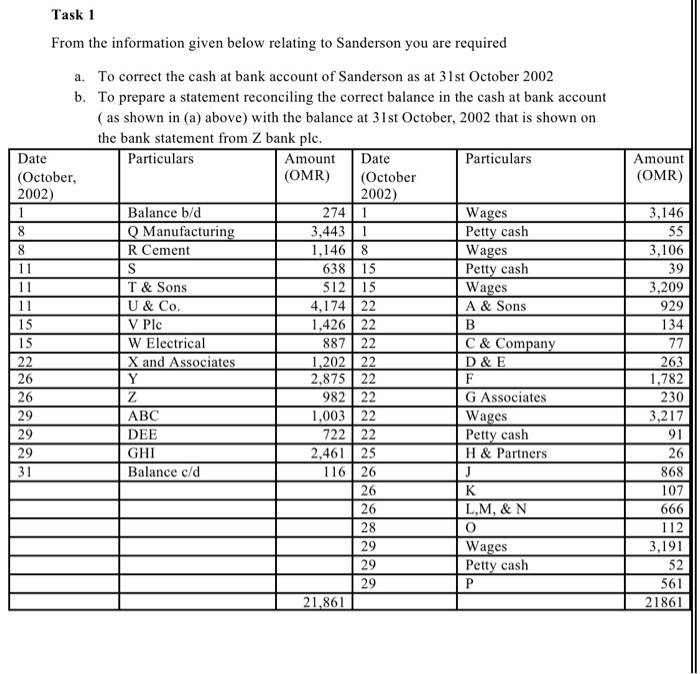

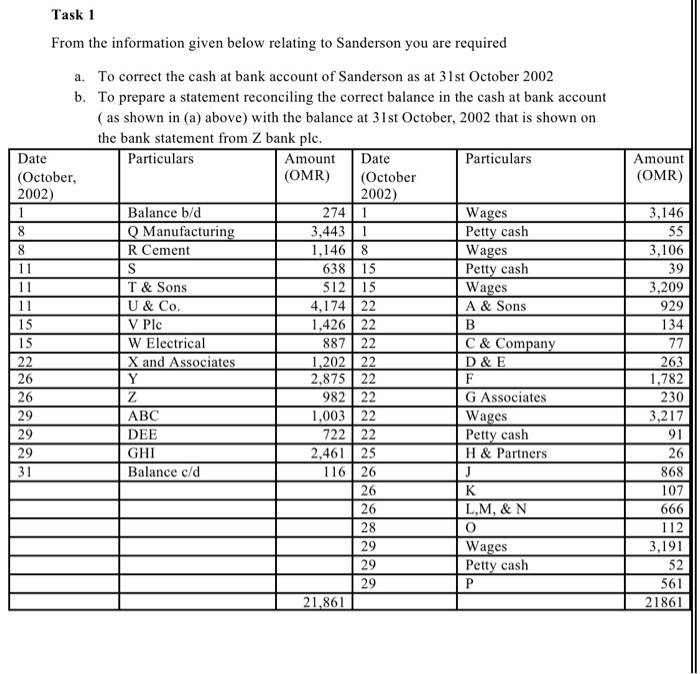

Task 1 From the information given below relating to Sanderson you are required Amount (OMR) a. To correct the cash at bank account of Sanderson

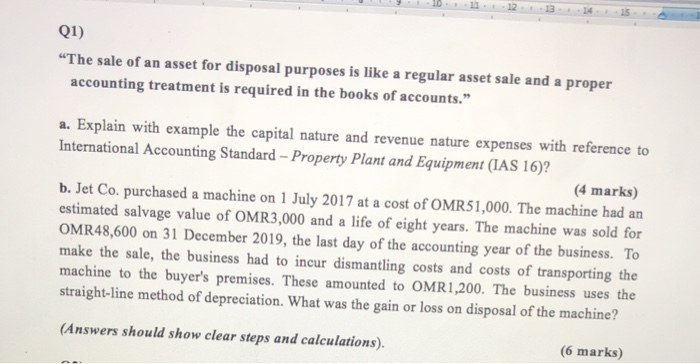

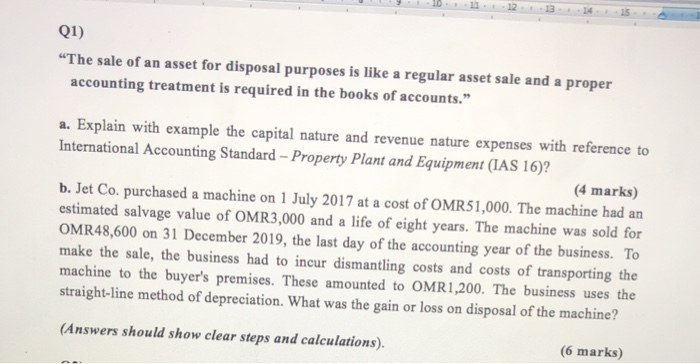

Task 1 From the information given below relating to Sanderson you are required Amount (OMR) a. To correct the cash at bank account of Sanderson as at 31st October 2002 b. To prepare a statement reconciling the correct balance in the cash at bank account ( as shown in (a) above) with the balance at 31st October, 2002 that is shown on the bank statement from Z bank plc. Date Particulars Amount Date Particulars (October, (OMR) (October 2002) 2002) Balance b/d 2741 Wages 8 Q Manufacturing I 3,4431 Petty cash 8 R Cement I 1,1468 Wages 11 S 638 15 Petty cash T & Sons 512 15 Wages U & Co. 4,174 | 22 A & Sons V Plc 1,426 | 22 W Electrical 88722 C & Company X and Associates I 1,202 | 22 D&E 2,875 22 Z 982 22 G Associates ABC 1,00322 Wages DEE 722 | 22 Petty cash GHI 2,46125 H & Partners Balance c/d 116 26 3,146 55 3,106 39 3,209 929 134 11 B 263 F 1.782 230 3,217 K 107 666 L,M,& N o 3,191 Wages Petty cash 21,861 561 21861 Q1) "The sale of an asset for disposal purposes is like a regular asset sale and a proper accounting treatment is required in the books of accounts." a. Explain with example the capital nature and revenue nature expenses with reference to International Accounting Standard - Property Plant and Equipment (IAS 16)? (4 marks) b. Jet Co. purchased a machine on 1 July 2017 at a cost of OMR51,000. The machine had an estimated salvage value of OMR3,000 and a life of eight years. The machine was sold for OMR48,600 on 31 December 2019, the last day of the accounting year of the business. To make the sale, the business had to incur dismantling costs and costs of transporting the machine to the buyer's premises. These amounted to OMR1,200. The business uses the straight-line method of depreciation. What was the gain or loss on disposal of the machine? (Answers should show clear steps and calculations). (6 marks)

Task 1 From the information given below relating to Sanderson you are required Amount (OMR) a. To correct the cash at bank account of Sanderson as at 31st October 2002 b. To prepare a statement reconciling the correct balance in the cash at bank account ( as shown in (a) above) with the balance at 31st October, 2002 that is shown on the bank statement from Z bank plc. Date Particulars Amount Date Particulars (October, (OMR) (October 2002) 2002) Balance b/d 2741 Wages 8 Q Manufacturing I 3,4431 Petty cash 8 R Cement I 1,1468 Wages 11 S 638 15 Petty cash T & Sons 512 15 Wages U & Co. 4,174 | 22 A & Sons V Plc 1,426 | 22 W Electrical 88722 C & Company X and Associates I 1,202 | 22 D&E 2,875 22 Z 982 22 G Associates ABC 1,00322 Wages DEE 722 | 22 Petty cash GHI 2,46125 H & Partners Balance c/d 116 26 3,146 55 3,106 39 3,209 929 134 11 B 263 F 1.782 230 3,217 K 107 666 L,M,& N o 3,191 Wages Petty cash 21,861 561 21861 Q1) "The sale of an asset for disposal purposes is like a regular asset sale and a proper accounting treatment is required in the books of accounts." a. Explain with example the capital nature and revenue nature expenses with reference to International Accounting Standard - Property Plant and Equipment (IAS 16)? (4 marks) b. Jet Co. purchased a machine on 1 July 2017 at a cost of OMR51,000. The machine had an estimated salvage value of OMR3,000 and a life of eight years. The machine was sold for OMR48,600 on 31 December 2019, the last day of the accounting year of the business. To make the sale, the business had to incur dismantling costs and costs of transporting the machine to the buyer's premises. These amounted to OMR1,200. The business uses the straight-line method of depreciation. What was the gain or loss on disposal of the machine? (Answers should show clear steps and calculations). (6 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started