Answered step by step

Verified Expert Solution

Question

1 Approved Answer

TASK PERFORMANCE Instructions: Determine the requirements for each of the independent cases. Show your computations (20 items x 5 points) Case 1 LOVE INC.

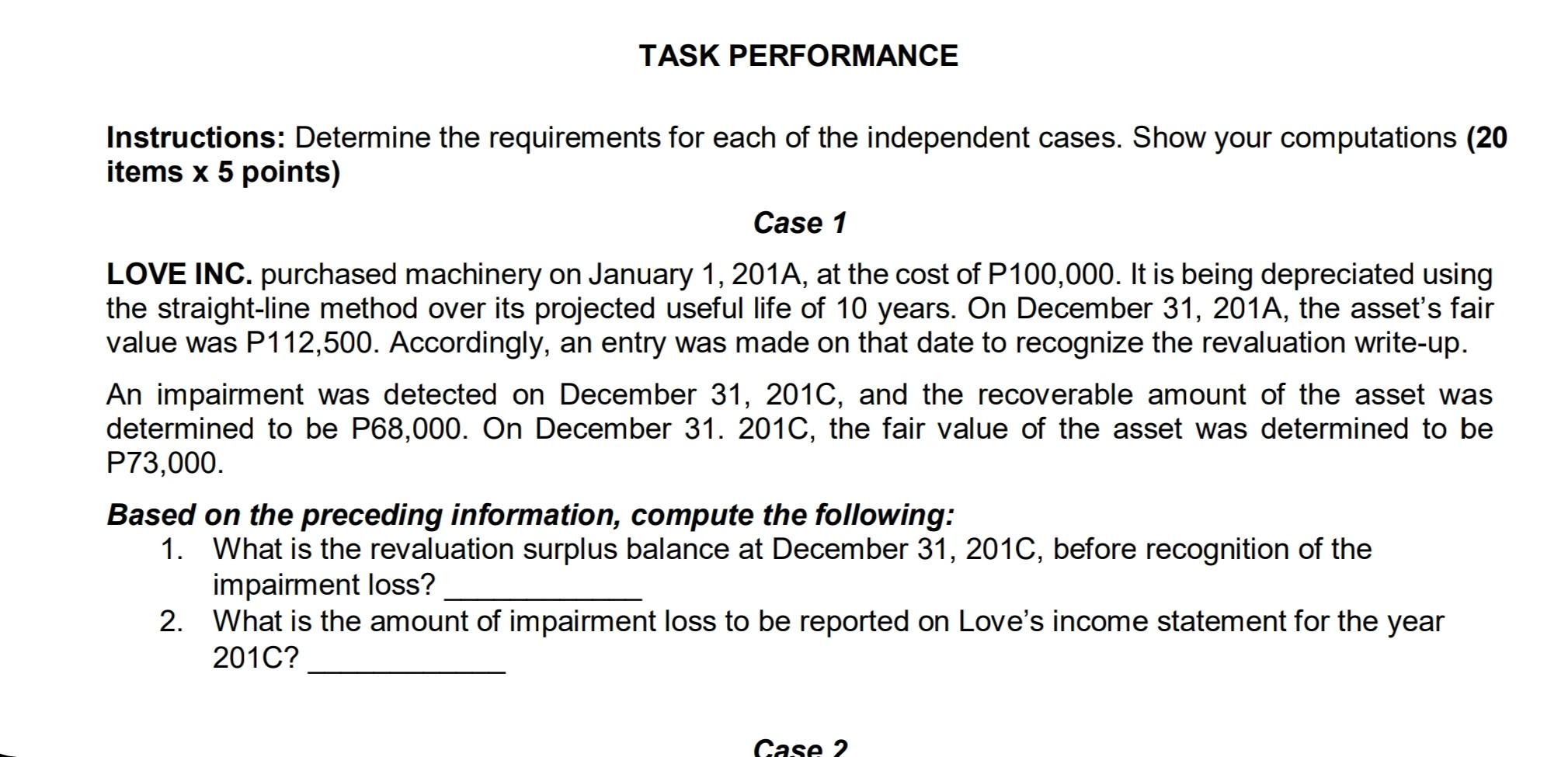

TASK PERFORMANCE Instructions: Determine the requirements for each of the independent cases. Show your computations (20 items x 5 points) Case 1 LOVE INC. purchased machinery on January 1, 201A, at the cost of P100,000. It is being depreciated using the straight-line method over its projected useful life of 10 years. On December 31, 201A, the asset's fair value was P112,500. Accordingly, an entry was made on that date to recognize the revaluation write-up. An impairment was detected on December 31, 201C, and the recoverable amount of the asset was determined to be P68,000. On December 31. 201C, the fair value of the asset was determined to be P73,000. Based on the preceding information, compute the following: 1. What is the revaluation surplus balance at December 31, 201C, before recognition of the impairment loss? 2. What is the amount of impairment loss to be reported on Love's income statement for the year 201C? Case 2

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Case 1 Revaluation Surplus Balance at December 31 201C before recognition of the impairment loss The ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started