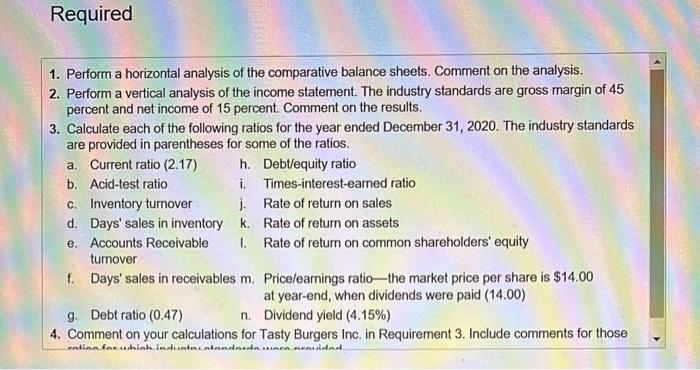

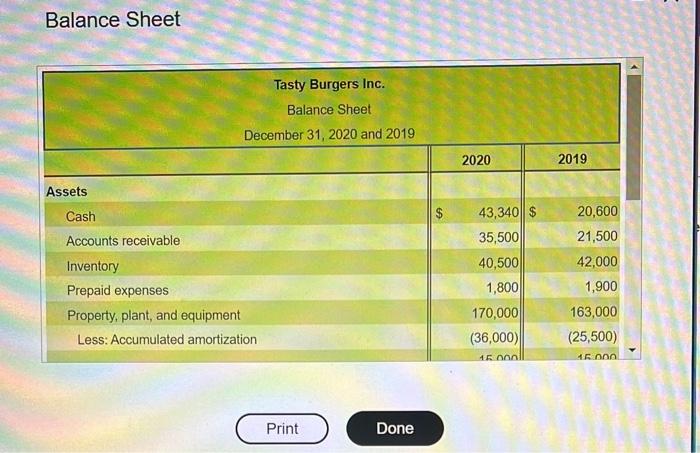

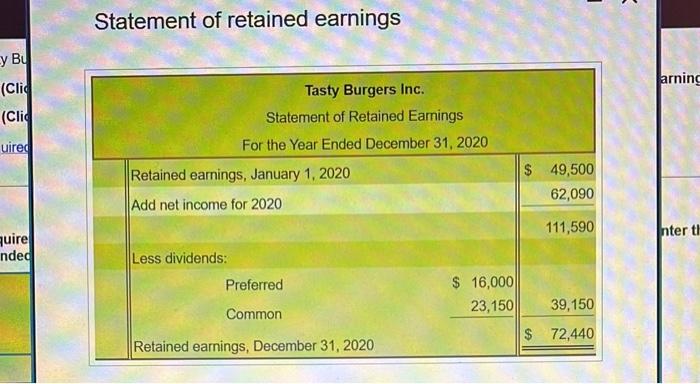

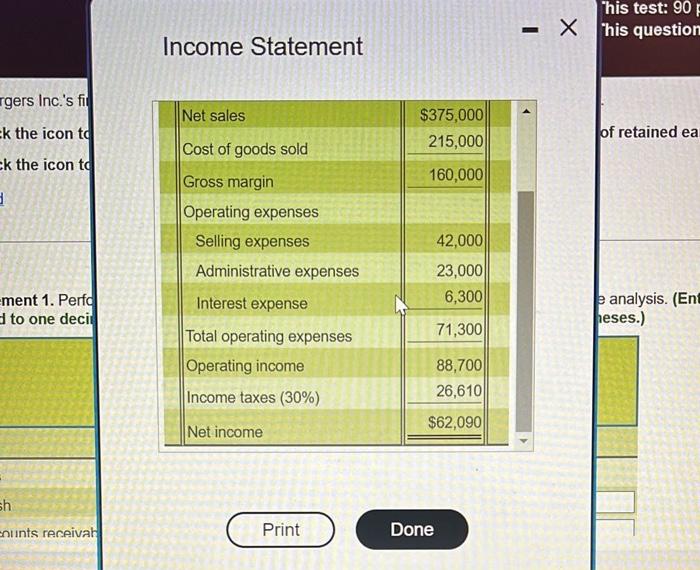

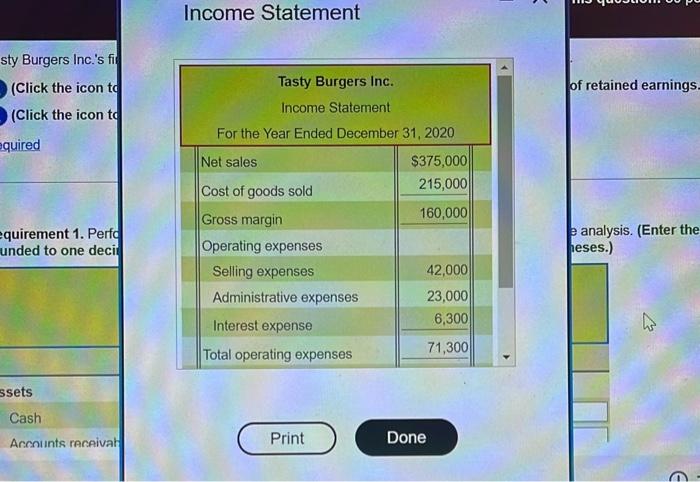

Tasty Burgers Inc.'s financial statements for the year ended December 31, 2020, are shown below. (Click the icon to view the income statement.) (C) (Click the icon to view the statement of retained earnings.) (Click the icon to view the balance sheet.) Requirement 1. Perform a horizontal analysis of the comparative balance sheets. Comment on the analysis. (Enter the percent change as a whole rounded to one decimal place. Enter numbers to be subtracted with a minus sign or parentheses.) 1. Perform a horizontal analysis of the comparative balance sheets. Comment on the analysis. 2. Perform a vertical analysis of the income statement. The industry standards are gross margin of 45 percent and net income of 15 percent. Comment on the results. 3. Calculate each of the following ratios for the year ended December 31, 2020. The industry standards are provided in parentheses for some of the ratios. a. Current ratio (2.17) h. Debtlequity ratio b. Acid-test ratio i. Times-interest-earned ratio c. Inventory turnover j. Rate of return on sales d. Days' sales in inventory k. Rate of return on assets e. Accounts Receivable I. Rate of return on common shareholders' equity turnover f. Days' sales in receivables m. Price/earnings ratio-the market price per share is $14.00 at year-end, when dividends were paid (14.00) g. Debt ratio (0.47) n. Dividend yield (4.15%) 4. Comment on your calculations for Tasty Burgers Inc. in Requirement 3. Include comments for those Balance Sheet Statement of retained earnings his question Income Statement of retained ea k the icon to ment 1. Perfo e analysis. (En d to one deci heses.) Income Statement (Click the icon to of retained earnings. (Click the icon to quired quirement 1. Perff unded to one deci analysis. (Enter the peses.) Tasty Burgers Inc.'s financial statements for the year ended December 31, 2020, are shown below. (Click the icon to view the income statement.) (C) (Click the icon to view the statement of retained earnings.) (Click the icon to view the balance sheet.) Requirement 1. Perform a horizontal analysis of the comparative balance sheets. Comment on the analysis. (Enter the percent change as a whole rounded to one decimal place. Enter numbers to be subtracted with a minus sign or parentheses.) 1. Perform a horizontal analysis of the comparative balance sheets. Comment on the analysis. 2. Perform a vertical analysis of the income statement. The industry standards are gross margin of 45 percent and net income of 15 percent. Comment on the results. 3. Calculate each of the following ratios for the year ended December 31, 2020. The industry standards are provided in parentheses for some of the ratios. a. Current ratio (2.17) h. Debtlequity ratio b. Acid-test ratio i. Times-interest-earned ratio c. Inventory turnover j. Rate of return on sales d. Days' sales in inventory k. Rate of return on assets e. Accounts Receivable I. Rate of return on common shareholders' equity turnover f. Days' sales in receivables m. Price/earnings ratio-the market price per share is $14.00 at year-end, when dividends were paid (14.00) g. Debt ratio (0.47) n. Dividend yield (4.15%) 4. Comment on your calculations for Tasty Burgers Inc. in Requirement 3. Include comments for those Balance Sheet Statement of retained earnings his question Income Statement of retained ea k the icon to ment 1. Perfo e analysis. (En d to one deci heses.) Income Statement (Click the icon to of retained earnings. (Click the icon to quired quirement 1. Perff unded to one deci analysis. (Enter the peses.)