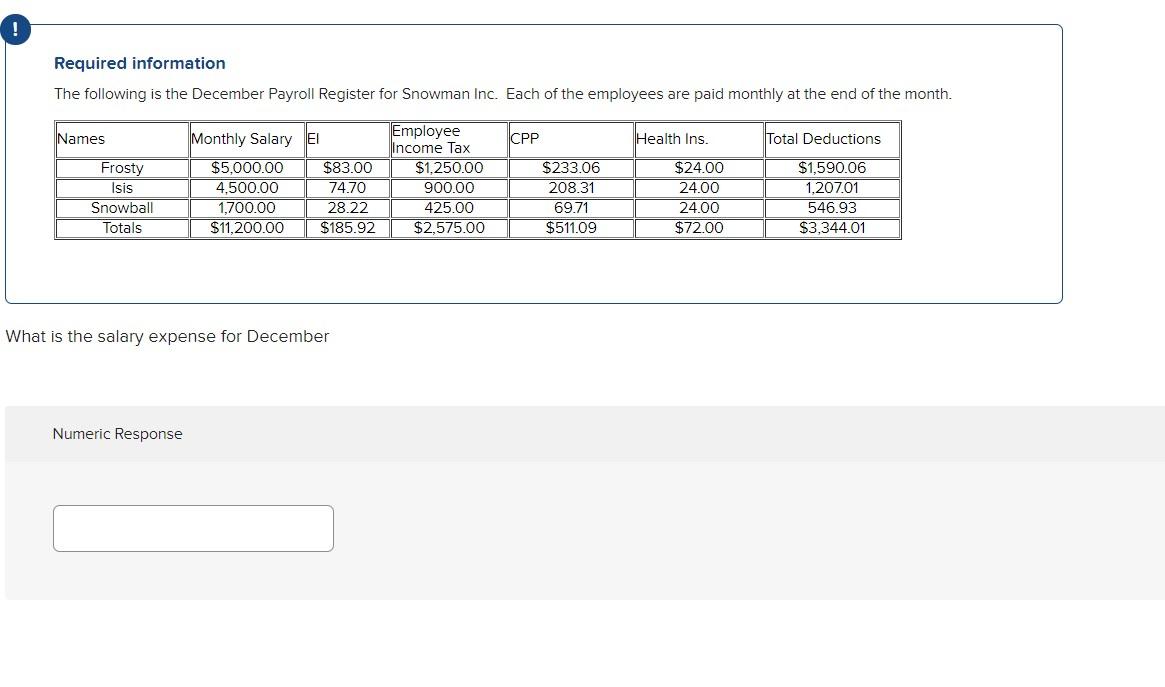

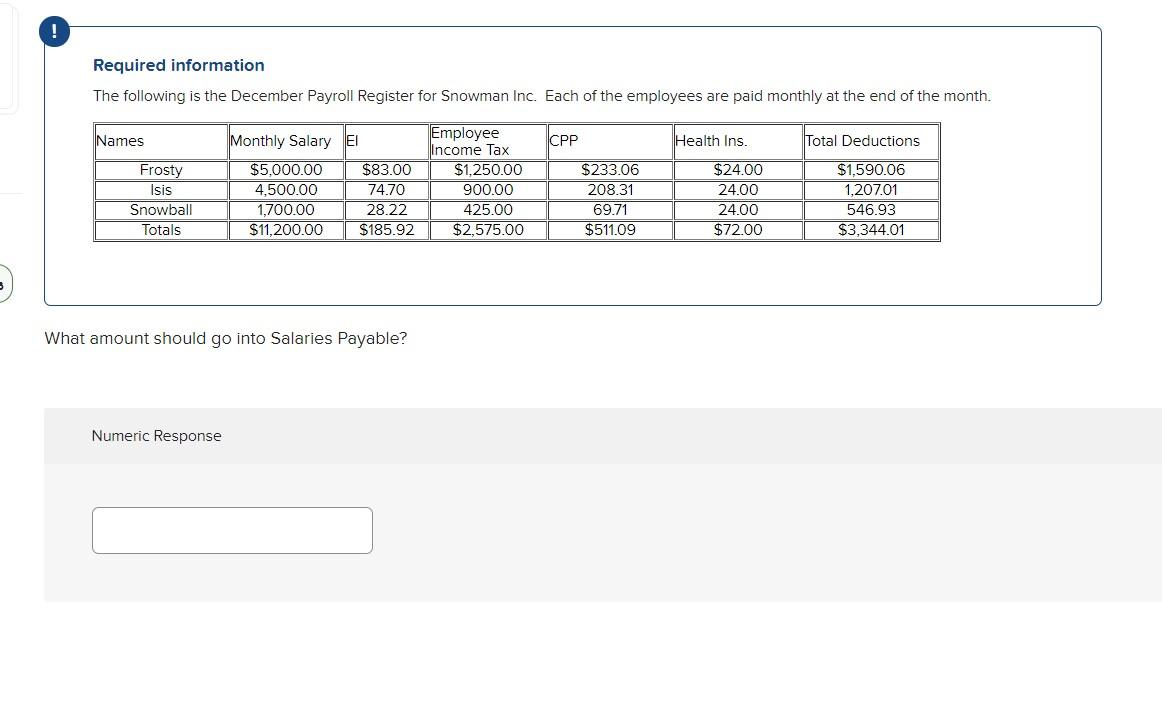

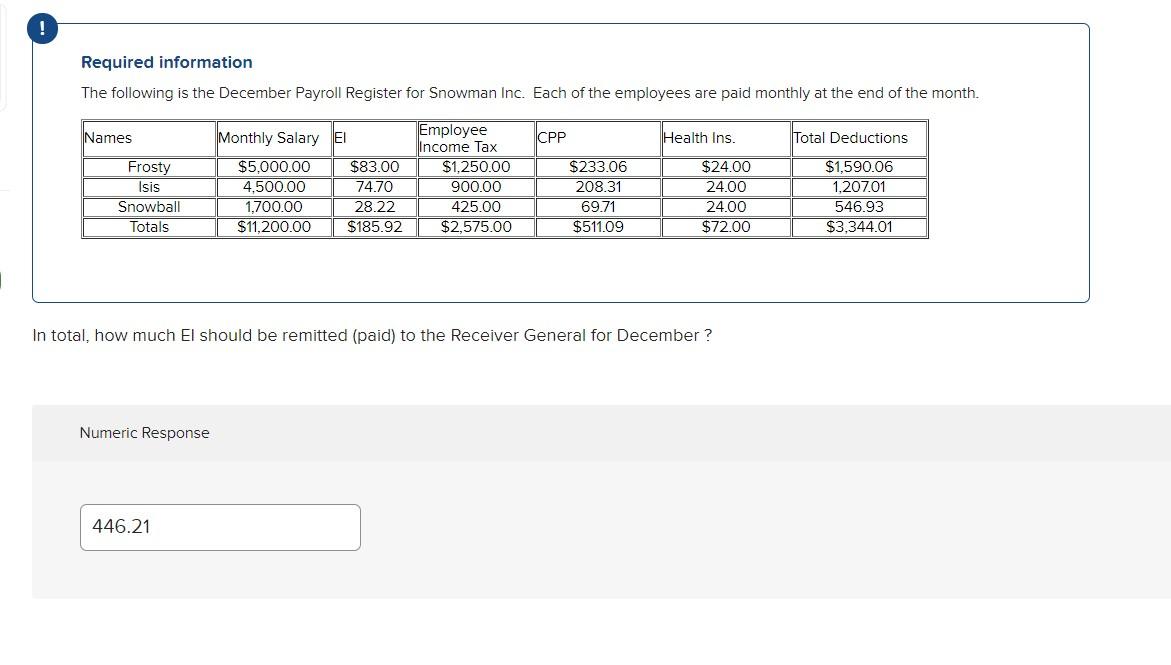

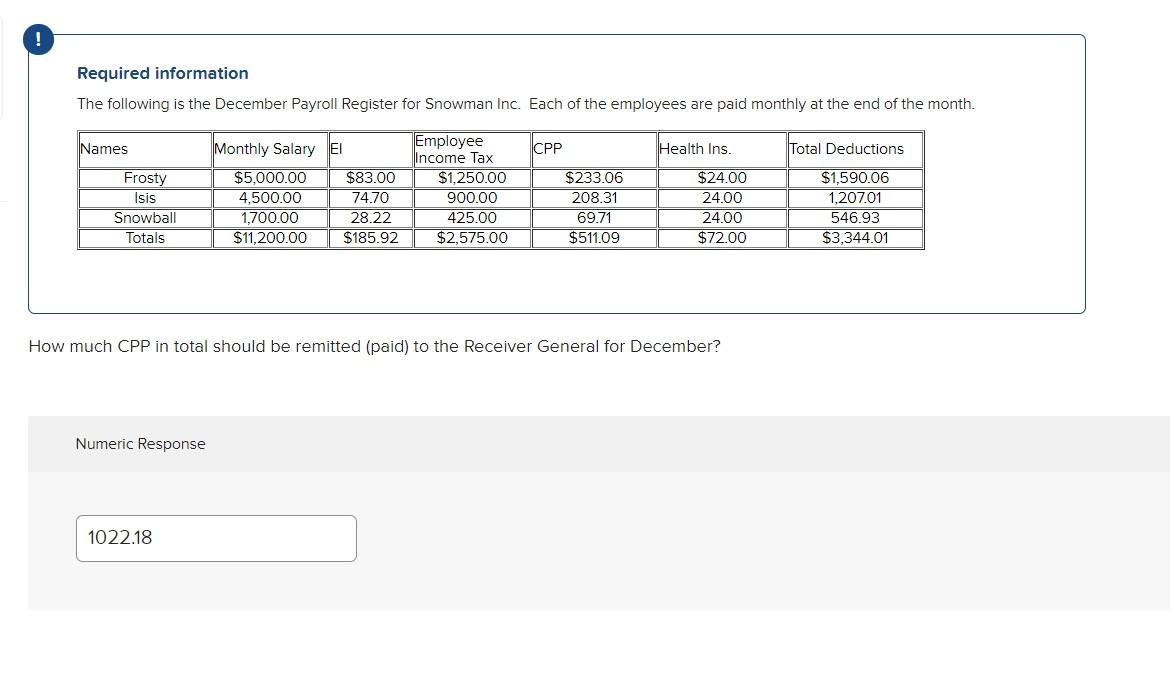

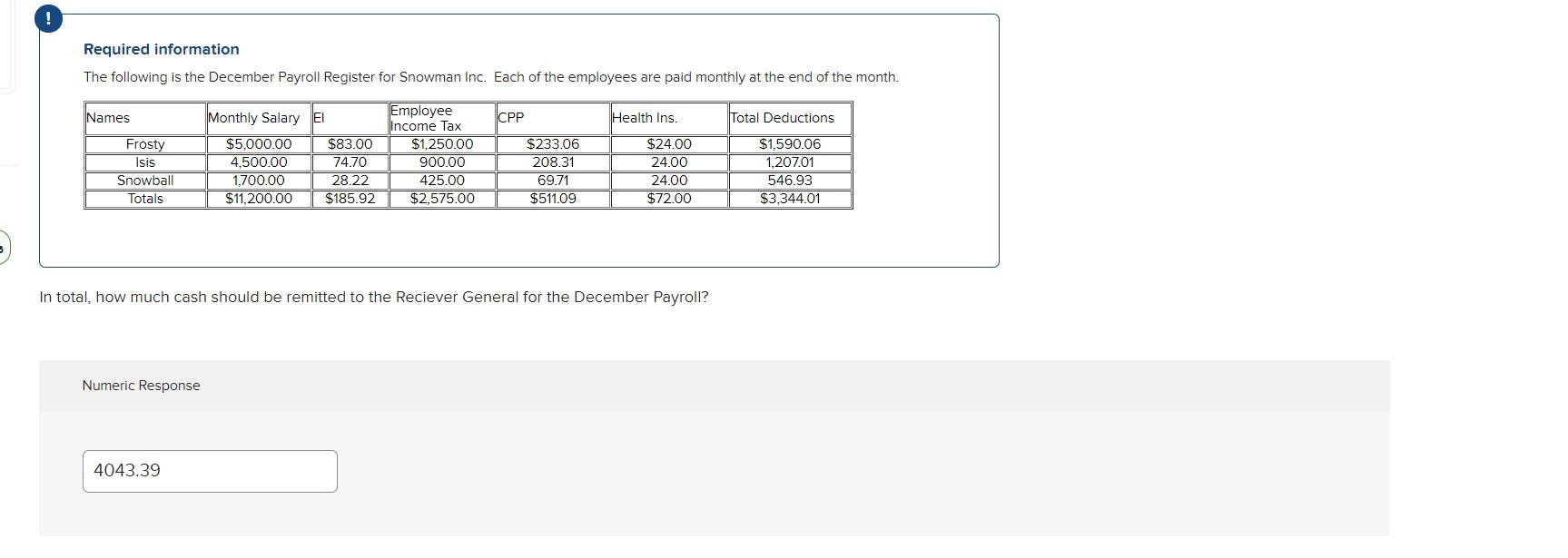

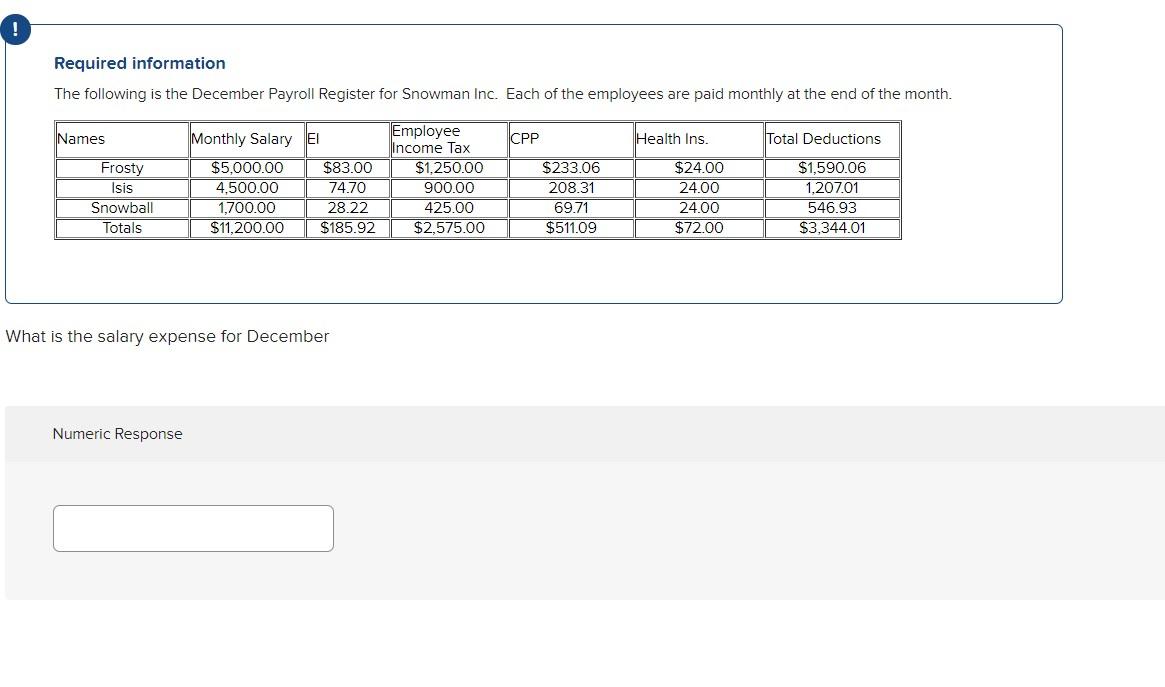

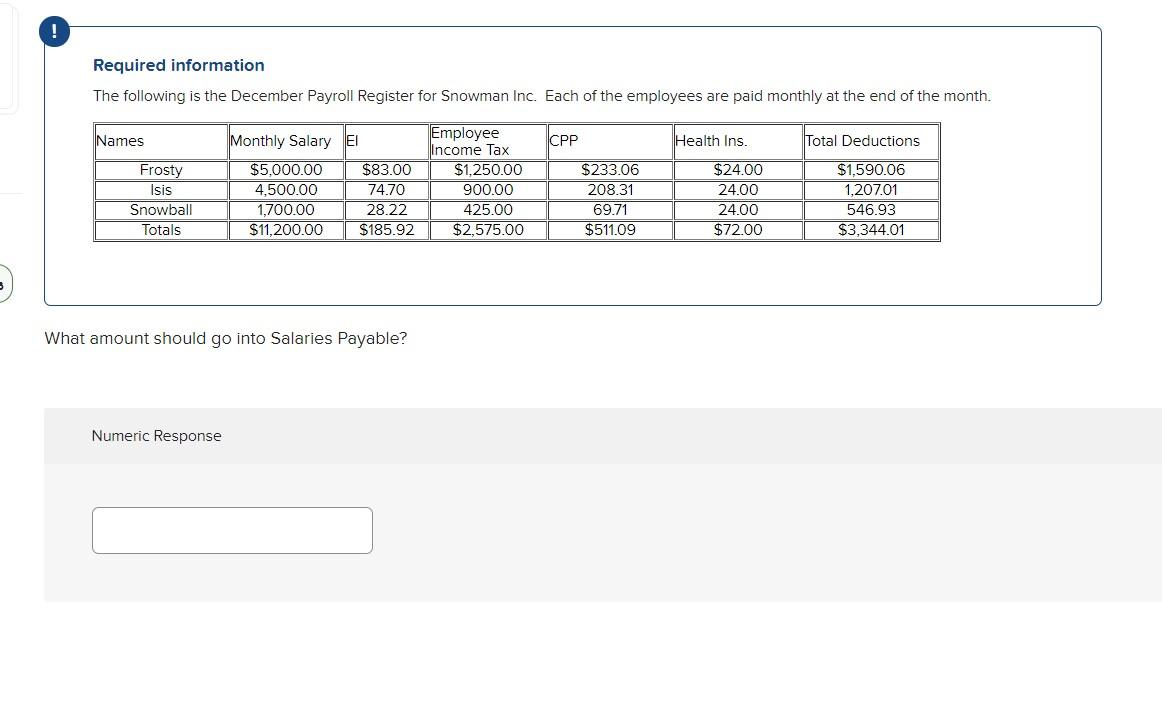

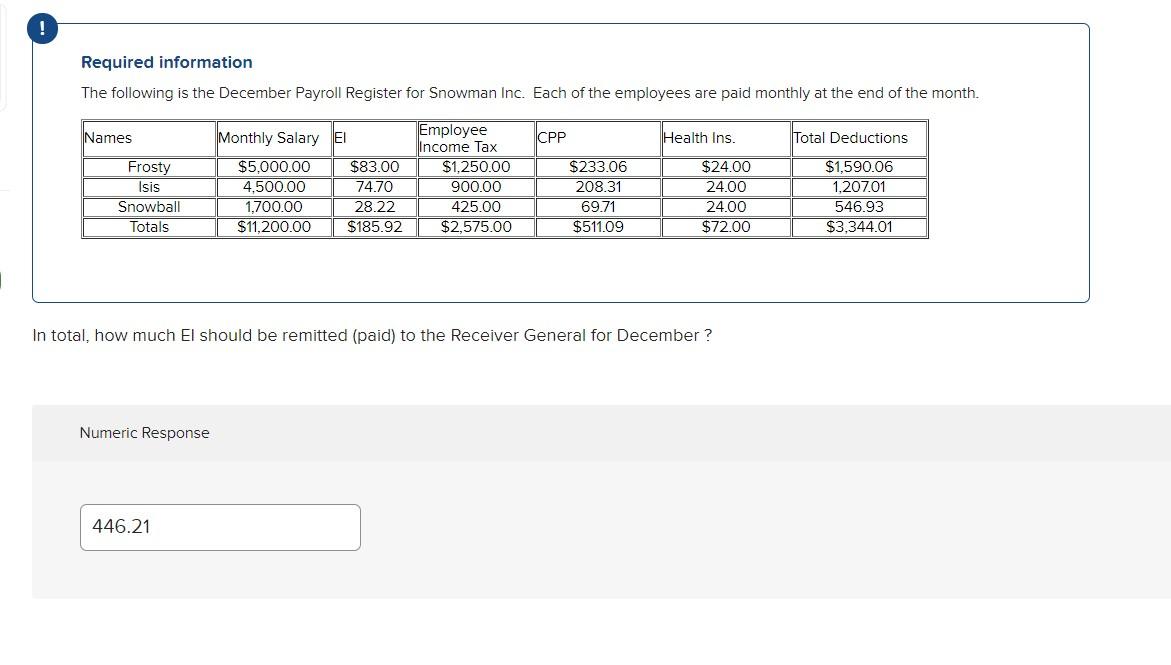

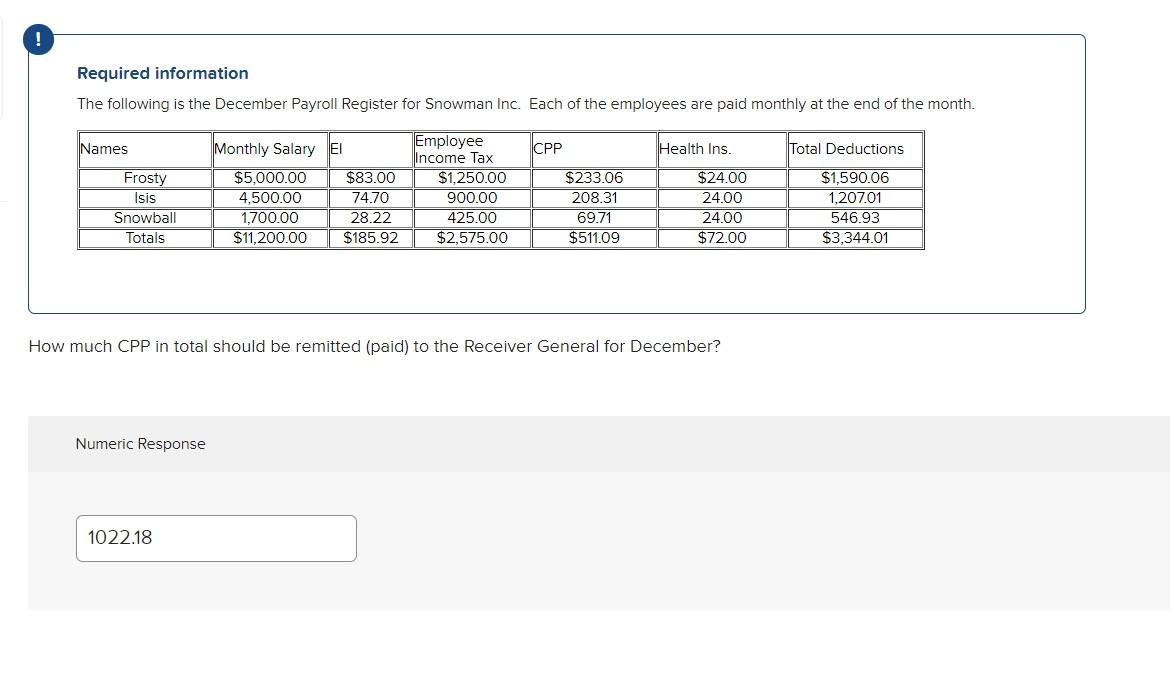

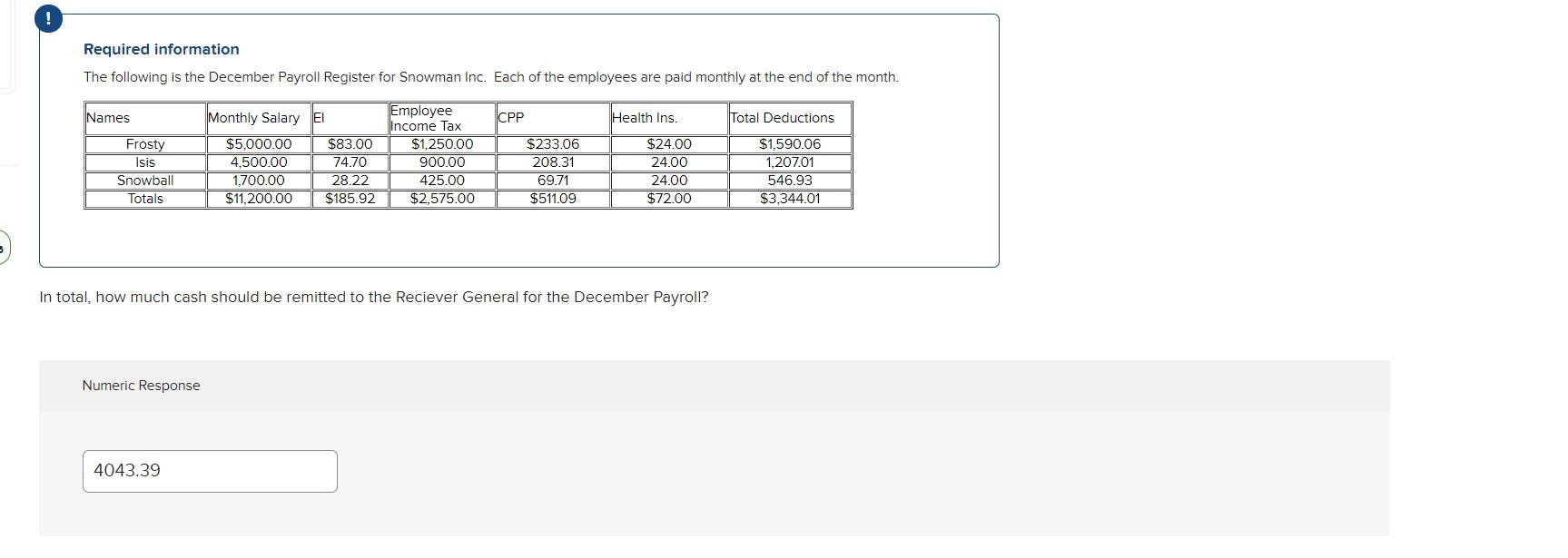

Required information The following is the December Payroll Register for Snowman Inc. Each of the employees are paid monthly at the end of the month. CPP Health Ins. Total Deductions Names Frosty Isis Snowball Totals Monthly Salary EI $5,000.00 $83.00 4,500.00 74.70 1.700.00 28.22 $11.200.00 $185.92 Employee Income Tax $1,250.00 900.00 425.00 $2.575.00 $233.06 208.31 69.71 $511.09 $24.00 24.00 24.00 $72.00 $1.590.06 1,207.01 546.93 $3,344.01 What is the salary expense for December Numeric Response ! Required information The following is the December Payroll Register for Snowman Inc. Each of the employees are paid monthly at the end of the month. Names CPP Health Ins. Total Deductions Frosty Isis Snowball Totals Monthly Salary EI $5,000.00 $83.00 4,500.00 74.70 1.700.00 28.22 $11,200.00 $185.92 Employee Income Tax $1,250.00 900.00 425.00 $2,575.00 $233.06 208.31 69.71 $511.09 $24.00 24.00 24.00 $72.00 $1,590.06 1,207.01 546.93 $3,344.01 What amount should go into Salaries Payable? Numeric Response ! Required information The following is the December Payroll Register for Snowman Inc. Each of the employees are paid monthly at the end of the month. Names CPP Health Ins. Total Deductions Frosty Monthly Salary EI $5,000.00 $83.00 4,500.00 74.70 1,700.00 28.22 $11,200.00 $185.92 Employee Income Tax $1,250.00 900.00 425.00 $2,575.00 Isis Snowball Totals $233.06 208.31 69.71 $511.09 $24.00 24.00 24.00 $72.00 $1,590.06 1,207.01 546.93 $3.344.01 In total, how much El should be remitted (paid) to the Receiver General for December? Numeric Response 446.21 ! Required information The following is the December Payroll Register for Snowman Inc. Each of the employees are paid monthly at the end of the month. Names CPP Health Ins. Total Deductions Frosty Isis Snowball Totals Monthly Salary EI Employee Income Tax $5.000.00 $83.00 $1,250.00 4,500.00 74.70 900.00 1,700.00 28.22 425.00 $11,200.00 $185.92 $2.575.00 $233.06 208.31 69.71 $511.09 $24.00 24.00 24.00 $72.00 $1,590.06 1,207.01 546.93 $3,344.01 How much CPP in total should be remitted (paid) to the Receiver General for December? Numeric Response 1022.18 ! Required information The following is the December Payroll Register for Snowman Inc. Each of the employees are paid monthly at the end of the month. Names CPP Health Ins. Frosty Isis Snowball Totals Monthly Salary EI $5.000.00 $83.00 4,500.00 74.70 1,700.00 28.22 $11,200.00 $185.92 Employee Income Tax $1,250.00 900.00 425.00 $2,575.00 $233.06 208.31 69.71 $511.09 $24.00 24.00 24.00 $72.00 Total Deductions $1,590.06 1.207.01 546.93 $3,344.01 In total, how much cash should be remitted to the Reciever General for the December Payroll? Numeric Response 4043.39