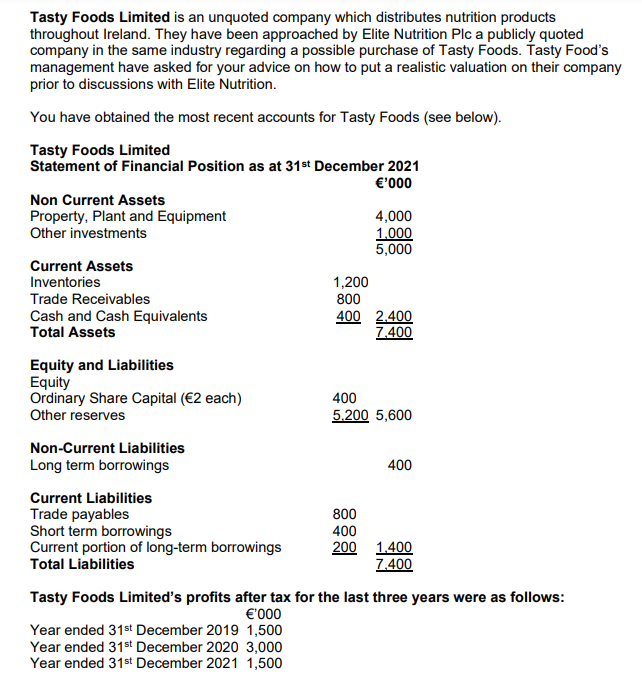

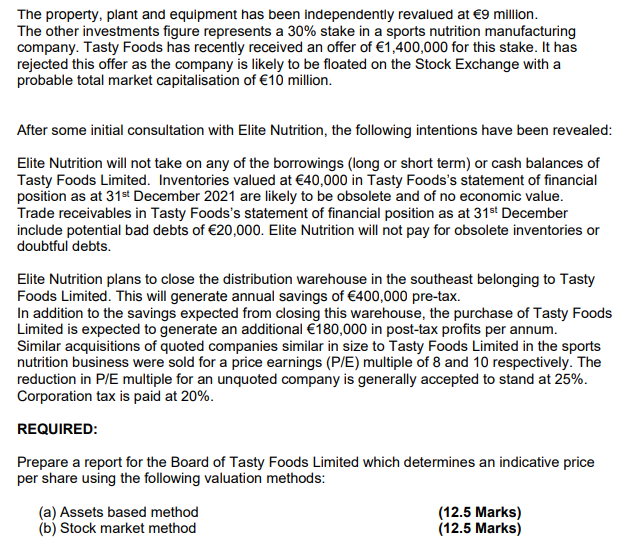

Tasty Foods Limited is an unquoted company which distributes nutrition products throughout Ireland. They have been approached by Elite Nutrition Plc a publicly quoted company in the same industry regarding a possible purchase of Tasty Foods. Tasty Food's management have asked for your advice on how to put a realistic valuation on their company prior to discussions with Elite Nutrition. You have obtained the most recent accounts for Tasty Foods (see below). Tasty Foods Limited Statement of Financial Position as at 31st December 2021 '000 Non Current Assets Property, Plant and Equipment 4,000 Other investments 1.000 5,000 Current Assets Inventories 1,200 Trade Receivables 800 Cash and Cash Equivalents 400 2.400 Total Assets 7.400 Equity and Liabilities Equity Ordinary Share Capital (2 each) 400 Other reserves 5.200 5,600 Non-Current Liabilities Long term borrowings 400 Current Liabilities Trade payables 800 Short term borrowings 400 Current portion of long-term borrowings 200 1,400 Total Liabilities 7,400 Tasty Foods Limited's profits after tax for the last three years were as follows: '000 Year ended 31st December 2019 1,500 Year ended 31st December 2020 3,000 Year ended 31st December 2021 1,500 The property, plant and equipment has been independently revalued at 9 million. The other investments figure represents a 30% stake in a sports nutrition manufacturing company. Tasty Foods has recently received an offer of 1,400,000 for this stake. It has rejected this offer as the company is likely to be floated on the Stock Exchange with a probable total market capitalisation of 10 million. After some initial consultation with Elite Nutrition, the following intentions have been revealed: Elite Nutrition will not take on any of the borrowings (long or short term) or cash balances of Tasty Foods Limited. Inventories valued at 40,000 in Tasty Foods's statement of financial position as at 31st December 2021 are likely to be obsolete and of no economic value. Trade receivables in Tasty Foods's statement of financial position as at 31st December include potential bad debts of 20,000. Elite Nutrition will not pay for obsolete inventories or doubtful debts. Elite Nutrition plans to close the distribution warehouse in the southeast belonging to Tasty Foods Limited. This will generate annual savings of 400,000 pre-tax. In addition to the savings expected from closing this warehouse, the purchase of Tasty Foods Limited is expected to generate an additional 180,000 in post-tax profits per annum. Similar acquisitions of quoted companies similar in size to Tasty Foods Limited in the sports nutrition business were sold for a price earnings (P/E) multiple of 8 and 10 respectively. The reduction in P/E multiple for an unquoted company is generally accepted to stand at 25%. Corporation tax is paid at 20%. REQUIRED: Prepare a report for the Board of Tasty Foods Limited which determines an indicative price per share using the following valuation methods: (a) Assets based method (12.5 Marks) (b) Stock market method (12.5 Marks) Tasty Foods Limited is an unquoted company which distributes nutrition products throughout Ireland. They have been approached by Elite Nutrition Plc a publicly quoted company in the same industry regarding a possible purchase of Tasty Foods. Tasty Food's management have asked for your advice on how to put a realistic valuation on their company prior to discussions with Elite Nutrition. You have obtained the most recent accounts for Tasty Foods (see below). Tasty Foods Limited Statement of Financial Position as at 31st December 2021 '000 Non Current Assets Property, Plant and Equipment 4,000 Other investments 1.000 5,000 Current Assets Inventories 1,200 Trade Receivables 800 Cash and Cash Equivalents 400 2.400 Total Assets 7.400 Equity and Liabilities Equity Ordinary Share Capital (2 each) 400 Other reserves 5.200 5,600 Non-Current Liabilities Long term borrowings 400 Current Liabilities Trade payables 800 Short term borrowings 400 Current portion of long-term borrowings 200 1,400 Total Liabilities 7,400 Tasty Foods Limited's profits after tax for the last three years were as follows: '000 Year ended 31st December 2019 1,500 Year ended 31st December 2020 3,000 Year ended 31st December 2021 1,500 The property, plant and equipment has been independently revalued at 9 million. The other investments figure represents a 30% stake in a sports nutrition manufacturing company. Tasty Foods has recently received an offer of 1,400,000 for this stake. It has rejected this offer as the company is likely to be floated on the Stock Exchange with a probable total market capitalisation of 10 million. After some initial consultation with Elite Nutrition, the following intentions have been revealed: Elite Nutrition will not take on any of the borrowings (long or short term) or cash balances of Tasty Foods Limited. Inventories valued at 40,000 in Tasty Foods's statement of financial position as at 31st December 2021 are likely to be obsolete and of no economic value. Trade receivables in Tasty Foods's statement of financial position as at 31st December include potential bad debts of 20,000. Elite Nutrition will not pay for obsolete inventories or doubtful debts. Elite Nutrition plans to close the distribution warehouse in the southeast belonging to Tasty Foods Limited. This will generate annual savings of 400,000 pre-tax. In addition to the savings expected from closing this warehouse, the purchase of Tasty Foods Limited is expected to generate an additional 180,000 in post-tax profits per annum. Similar acquisitions of quoted companies similar in size to Tasty Foods Limited in the sports nutrition business were sold for a price earnings (P/E) multiple of 8 and 10 respectively. The reduction in P/E multiple for an unquoted company is generally accepted to stand at 25%. Corporation tax is paid at 20%. REQUIRED: Prepare a report for the Board of Tasty Foods Limited which determines an indicative price per share using the following valuation methods: (a) Assets based method (12.5 Marks) (b) Stock market method (12.5 Marks)