Question

Tatoo Inc. reported a net capital loss of $15,000 in 2018. The company had a net capital gain of $6,300 in 2016 and $5,000

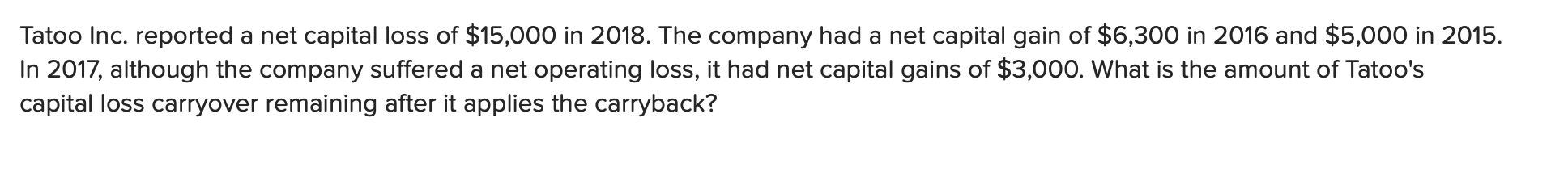

Tatoo Inc. reported a net capital loss of $15,000 in 2018. The company had a net capital gain of $6,300 in 2016 and $5,000 in 2015. In 2017, although the company suffered a net operating loss, it had net capital gains of $3,000. What is the amount of Tatoo's capital loss carryover remaining after it applies the carryback?

Step by Step Solution

3.56 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

Under the tax law a capital loss can be carried back up to three years and carrie...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Taxation Of Individuals And Business Entities 2019 Edition

Authors: Brian C. Spilker, Benjamin C. Ayers, John Robinson, Edmund Outslay, Ronald G. Worsham, John A. Barrick, Connie Weaver

10th Edition

1259918394, 978-1259918391

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App