Answered step by step

Verified Expert Solution

Question

1 Approved Answer

tax accounting help Jamarcus, a full-time student, earned $2,750 this year from a summer job. He had no other income this year and will have

tax accounting help

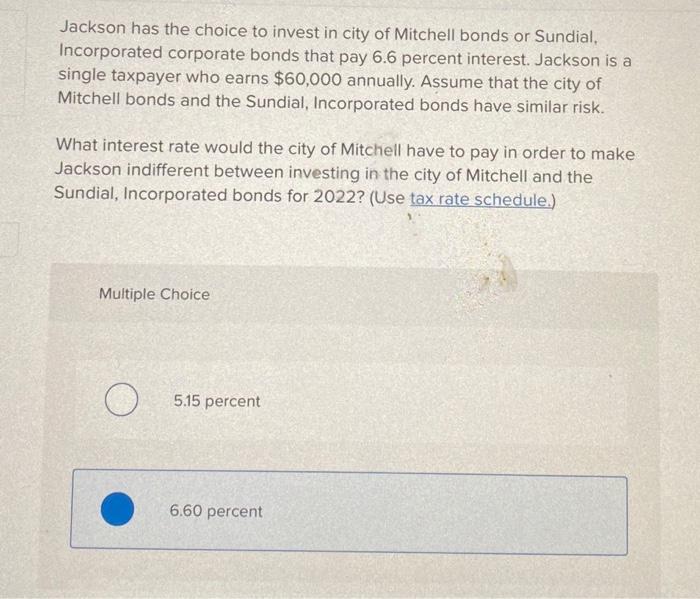

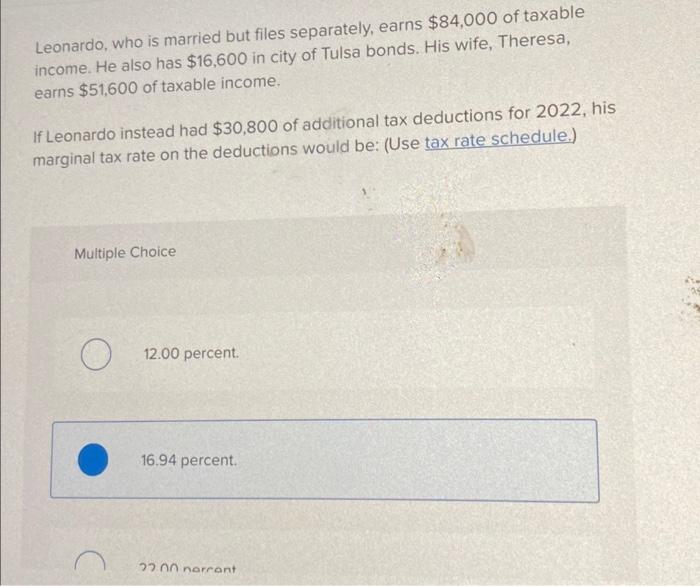

Jamarcus, a full-time student, earned $2,750 this year from a summer job. He had no other income this year and will have zero federal income tax liability this year. His employer withheld $385 of federal income tax from his summer pay. Is Jamarcus required to file a tax return? Should Jamarcus file a tax return? He is not required to file an income tax return because his gross income of $2750 is well below the gross income threshold for a single taxpayer ($12950 for 2022 ). He should still file a tax return to receive a refund of the $385 previously withheld. He is not required to file a tax return as the refund of $385 previously withheld will be automatically credited to his bank account. He is required to file an income tax return regardless of income and should file a tax return. He should compulsorily file a tax return because his gross income of $2,750 is well below the gross income threshold for a single taxpayer. Jackson has the choice to invest in city of Mitchell bonds or Sundial, Incorporated corporate bonds that pay 6.6 percent interest. Jackson is a single taxpayer who earns $60,000 annually. Assume that the city of Mitchell bonds and the Sundial, Incorporated bonds have similar risk. What interest rate would the city of Mitchell have to pay in order to make Jackson indifferent between investing in the city of Mitchell and the Sundial, Incorporated bonds for 2022 ? (Use tax rate schedule.) Multiple Choice 5.15 percent 6.60 percent Leonardo, who is married but files separately, earns $84,000 of taxable income. He also has $16,600 in city of Tulsa bonds. His wife, Theresa, earns $51,600 of taxable income. If Leonardo instead had $30,800 of additional tax deductions for 2022 , his marginal tax rate on the deductions would be: (Use tax rate schedule.) Multiple Choice 12.00 percent. 16.94 percent. 3nn nerrant

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started