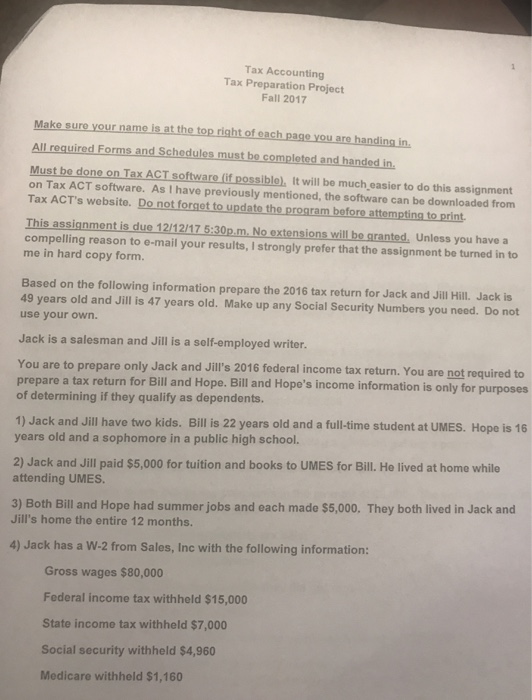

Tax Accounting Tax Preparation Project Fall 2017 Make sure your name is at the top right of each page you are handing in. All required Forms and Schedules must be completed and handed in. Must be done on Tax ACT software (if possible), It will be much easier to do this assignment on Tax ACT software. As I have previously mentioned, the software can be downloaded from Tax ACT's website. Do not forget to update the program before attempting to print. This assignment is due 12/12/17 5:30p.m. No extensions will be granted. Unless you have a compelling reason to e-mail your results,I strongly prefer that the assignment be turned in to me in hard copy form. Based on the following information prepare the 2016 tax return for Jack and Jill Hill. Jack is 49 years old and Jill is 47 years old. Make up any Social Security Numbers you need. Do not use your own. Jack is a salesman and Jill is a self-employed writer. federal income tax return.You are not required to You are to prepare only Jack and Jill's 2016 prepare a tax return for Bill and Hope. Bill and Hope's income information is only for purposes of determining if they qualify as dependents. 1) Jack and Jill have two kids. Bill is 22 years old and a full-time student at UMES. Hope is 16 years old and a sophomore in a public high school. 2) Jack and Jill paid $5,000 for tuition and books to UMES for Bill. He lived at home while attending UMES. 3) Both Bill and Hope had summer jobs and each made $5,000. They both lived in Jack and Jill's home the entire 12 months. 4) Jack has a W-2 from Sales, Inc with the following information: Gross wages $80,000 Federal income tax withheld $15,000 State income tax withheld $7,000 Social security withheld $4,960 Medicare withheld $1,160 Tax Accounting Tax Preparation Project Fall 2017 Make sure your name is at the top right of each page you are handing in. All required Forms and Schedules must be completed and handed in. Must be done on Tax ACT software (if possible), It will be much easier to do this assignment on Tax ACT software. As I have previously mentioned, the software can be downloaded from Tax ACT's website. Do not forget to update the program before attempting to print. This assignment is due 12/12/17 5:30p.m. No extensions will be granted. Unless you have a compelling reason to e-mail your results,I strongly prefer that the assignment be turned in to me in hard copy form. Based on the following information prepare the 2016 tax return for Jack and Jill Hill. Jack is 49 years old and Jill is 47 years old. Make up any Social Security Numbers you need. Do not use your own. Jack is a salesman and Jill is a self-employed writer. federal income tax return.You are not required to You are to prepare only Jack and Jill's 2016 prepare a tax return for Bill and Hope. Bill and Hope's income information is only for purposes of determining if they qualify as dependents. 1) Jack and Jill have two kids. Bill is 22 years old and a full-time student at UMES. Hope is 16 years old and a sophomore in a public high school. 2) Jack and Jill paid $5,000 for tuition and books to UMES for Bill. He lived at home while attending UMES. 3) Both Bill and Hope had summer jobs and each made $5,000. They both lived in Jack and Jill's home the entire 12 months. 4) Jack has a W-2 from Sales, Inc with the following information: Gross wages $80,000 Federal income tax withheld $15,000 State income tax withheld $7,000 Social security withheld $4,960 Medicare withheld $1,160