Answered step by step

Verified Expert Solution

Question

1 Approved Answer

B. TAX PLANING FOR COMPANIES - 10% The Burger Group comprises of Food Bhd and four wholly-owned subsidiaries as at 30 June 2015. The

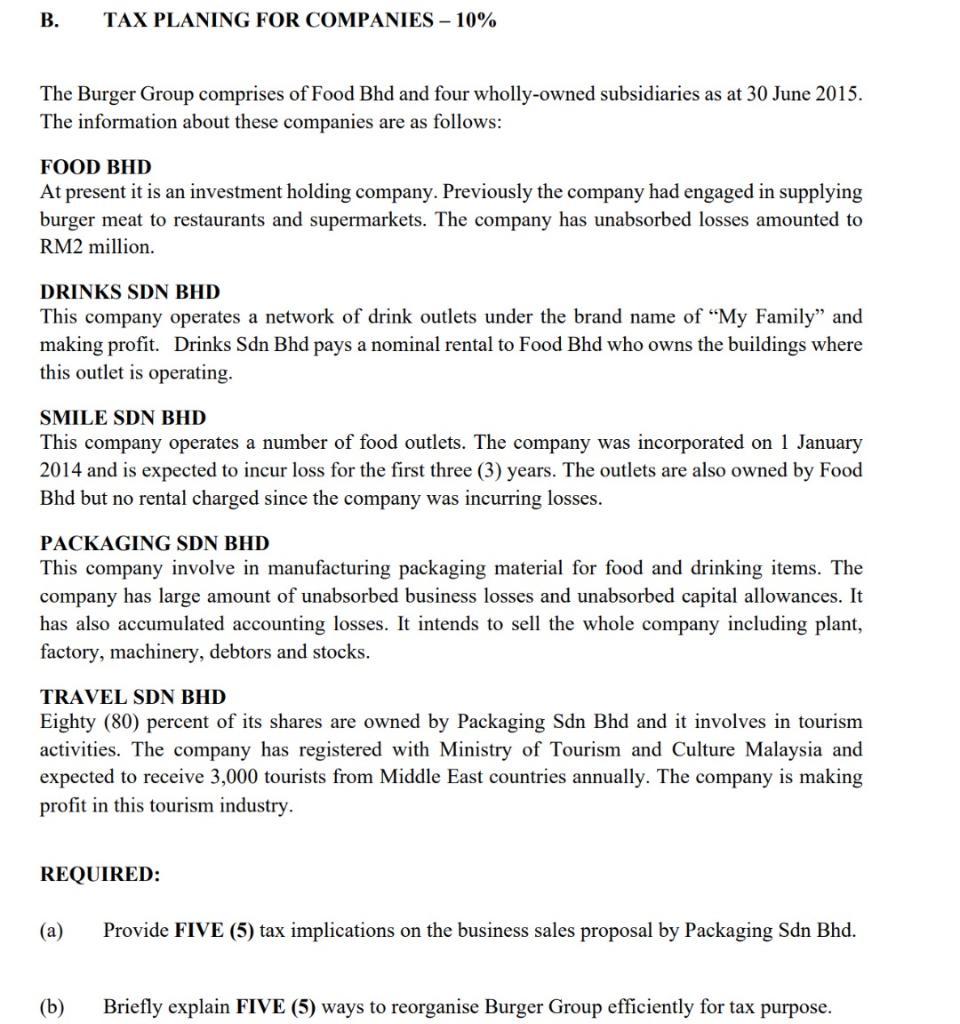

B. TAX PLANING FOR COMPANIES - 10% The Burger Group comprises of Food Bhd and four wholly-owned subsidiaries as at 30 June 2015. The information about these companies are as follows: FOOD BHD At present it is an investment holding company. Previously the company had engaged in supplying burger meat to restaurants and supermarkets. The company has unabsorbed losses amounted to RM2 million. DRINKS SDN BHD This company operates a network of drink outlets under the brand name of "My Family" and making profit. Drinks Sdn Bhd pays a nominal rental to Food Bhd who owns the buildings where this outlet is operating. SMILE SDN BHD This company operates a number of food outlets. The company was incorporated on 1 January 2014 and is expected to incur loss for the first three (3) years. The outlets are also owned by Food Bhd but no rental charged since the company was incurring losses. PACKAGING SDN BHD This company involve in manufacturing packaging material for food and drinking items. The company has large amount of unabsorbed business losses and unabsorbed capital allowances. It has also accumulated accounting losses. It intends to sell the whole company including plant, factory, machinery, debtors and stocks. TRAVEL SDN BHD Eighty (80) percent of its shares are owned by Packaging Sdn Bhd and it involves in tourism activities. The company has registered with Ministry of Tourism and Culture Malaysia and expected to receive 3,000 tourists from Middle East countries annually. The company is making profit in this tourism industry. REQUIRED: (a) (b) Provide FIVE (5) tax implications on the business sales proposal by Packaging Sdn Bhd. Briefly explain FIVE (5) ways to reorganise Burger Group efficiently for tax purpose.

Step by Step Solution

★★★★★

3.33 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

a Provide F IVE 5 tax implications on the business sales proposal by Pack aging S dn Bh d ANS WER 1 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started