Answered step by step

Verified Expert Solution

Question

1 Approved Answer

tax q3 please help Xabiso Makeba, 59 years old, has lived in Johannesburg for the past 20 years. After accepting a promotion, he was transferred

tax q3 please help

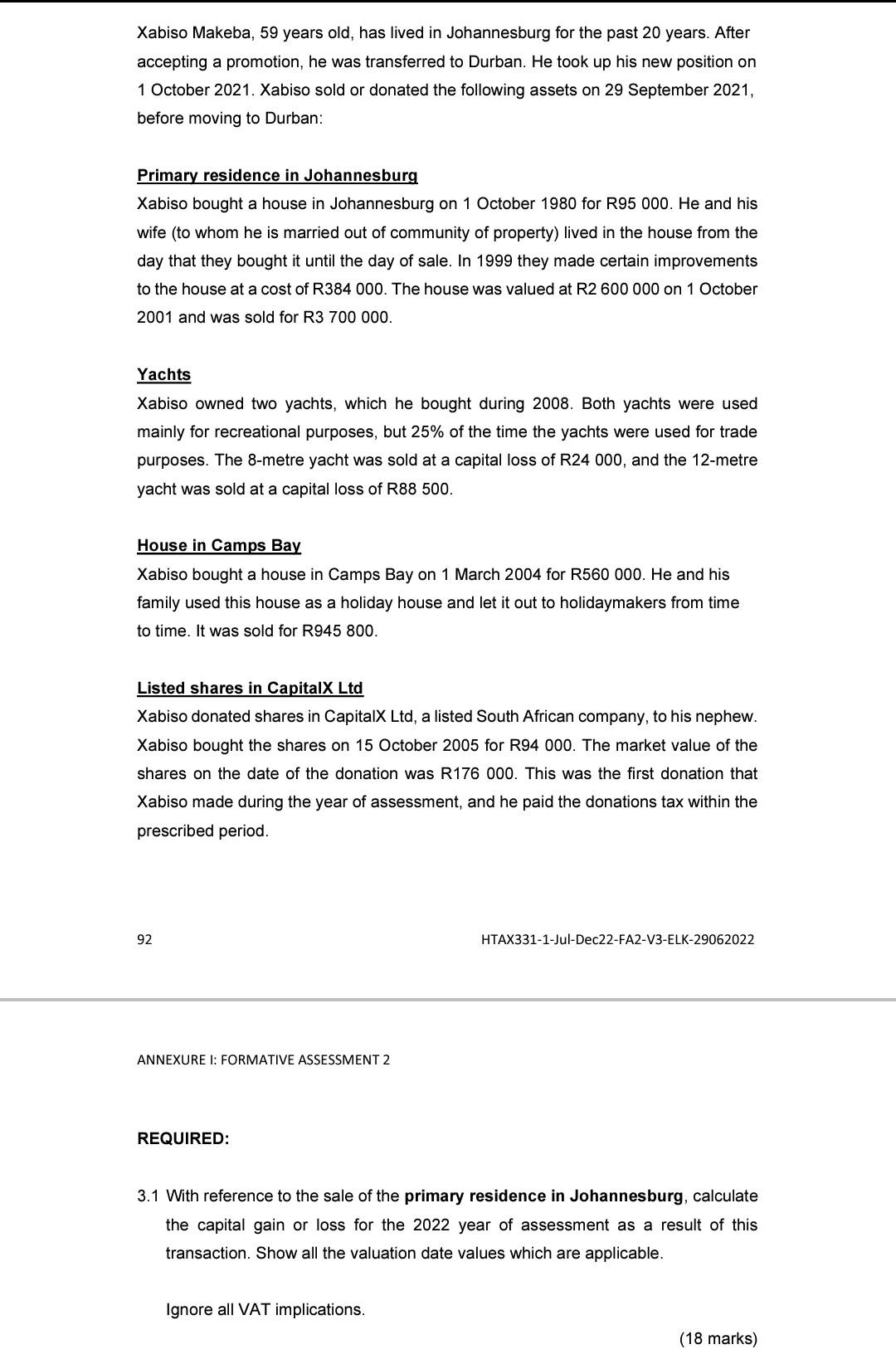

Xabiso Makeba, 59 years old, has lived in Johannesburg for the past 20 years. After accepting a promotion, he was transferred to Durban. He took up his new position on 1 October 2021 . Xabiso sold or donated the following assets on 29 September 2021 , before moving to Durban: Primary residence in Johannesburg Xabiso bought a house in Johannesburg on 1 October 1980 for R95 000. He and his wife (to whom he is married out of community of property) lived in the house from the day that they bought it until the day of sale. In 1999 they made certain improvements to the house at a cost of R384000. The house was valued at R2600000 on 1 October 2001 and was sold for R3 700000 . Yachts Xabiso owned two yachts, which he bought during 2008. Both yachts were used mainly for recreational purposes, but 25% of the time the yachts were used for trade purposes. The 8-metre yacht was sold at a capital loss of R24 000, and the 12-metre yacht was sold at a capital loss of R88 500. House in Camps Bay Xabiso bought a house in Camps Bay on 1 March 2004 for R560 000. He and his family used this house as a holiday house and let it out to holidaymakers from time to time. It was sold for R945 800 . Listed shares in CapitalX Ltd Xabiso donated shares in CapitalX Ltd, a listed South African company, to his nephew. Xabiso bought the shares on 15 October 2005 for R94 000 . The market value of the shares on the date of the donation was R176 000. This was the first donation that Xabiso made during the year of assessment, and he paid the donations tax within the prescribed period. 92 HTAX331-1-Jul-Dec22-FA2-V3-ELK-29062022 ANNEXURE I: FORMATIVE ASSESSMENT 2 REQUIRED: 3.1 With reference to the sale of the primary residence in Johannesburg, calculate the capital gain or loss for the 2022 year of assessment as a result of this transaction. Show all the valuation date values which are applicable. Ignore all VAT implications. (18 marks) Xabiso Makeba, 59 years old, has lived in Johannesburg for the past 20 years. After accepting a promotion, he was transferred to Durban. He took up his new position on 1 October 2021 . Xabiso sold or donated the following assets on 29 September 2021 , before moving to Durban: Primary residence in Johannesburg Xabiso bought a house in Johannesburg on 1 October 1980 for R95 000. He and his wife (to whom he is married out of community of property) lived in the house from the day that they bought it until the day of sale. In 1999 they made certain improvements to the house at a cost of R384000. The house was valued at R2600000 on 1 October 2001 and was sold for R3 700000 . Yachts Xabiso owned two yachts, which he bought during 2008. Both yachts were used mainly for recreational purposes, but 25% of the time the yachts were used for trade purposes. The 8-metre yacht was sold at a capital loss of R24 000, and the 12-metre yacht was sold at a capital loss of R88 500. House in Camps Bay Xabiso bought a house in Camps Bay on 1 March 2004 for R560 000. He and his family used this house as a holiday house and let it out to holidaymakers from time to time. It was sold for R945 800 . Listed shares in CapitalX Ltd Xabiso donated shares in CapitalX Ltd, a listed South African company, to his nephew. Xabiso bought the shares on 15 October 2005 for R94 000 . The market value of the shares on the date of the donation was R176 000. This was the first donation that Xabiso made during the year of assessment, and he paid the donations tax within the prescribed period. 92 HTAX331-1-Jul-Dec22-FA2-V3-ELK-29062022 ANNEXURE I: FORMATIVE ASSESSMENT 2 REQUIRED: 3.1 With reference to the sale of the primary residence in Johannesburg, calculate the capital gain or loss for the 2022 year of assessment as a result of this transaction. Show all the valuation date values which are applicable. Ignore all VAT implications. (18 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started