Answered step by step

Verified Expert Solution

Question

1 Approved Answer

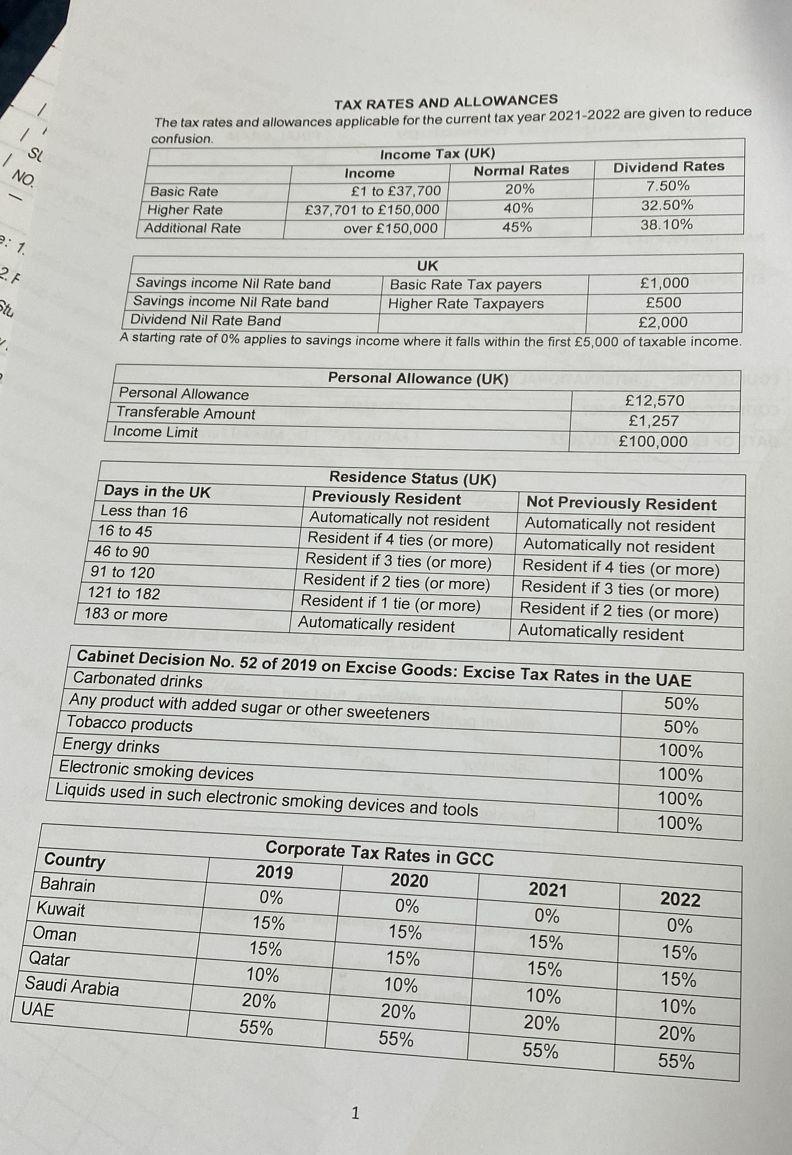

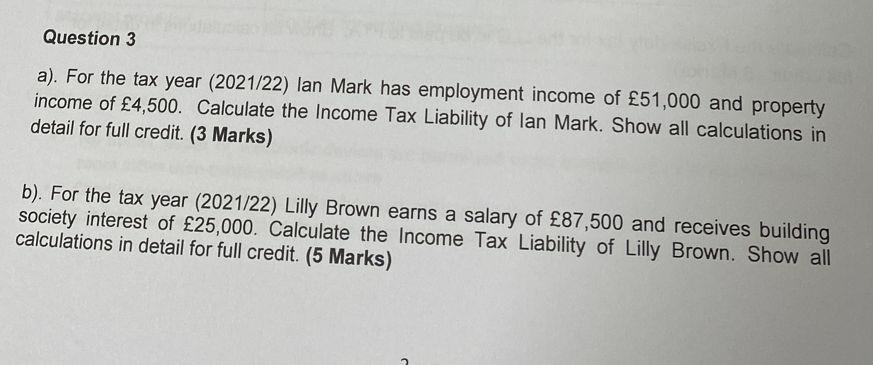

TAX RATES AND ALLOWANCES The tax rates and allowances applicable for the current tax year 2021-2022 are given to reduce a). For the tax year

TAX RATES AND ALLOWANCES The tax rates and allowances applicable for the current tax year 2021-2022 are given to reduce a). For the tax year (2021/22) lan Mark has employment income of 51,000 and property income of 4,500. Calculate the Income Tax Liability of lan Mark. Show all calculations in detail for full credit. (3 Marks) b). For the tax year (2021/22) Lilly Brown earns a salary of 87,500 and receives building society interest of 25,000. Calculate the Income Tax Liability of Lilly Brown. Show all calculations in detail for full credit. (5 Marks) TAX RATES AND ALLOWANCES The tax rates and allowances applicable for the current tax year 2021-2022 are given to reduce a). For the tax year (2021/22) lan Mark has employment income of 51,000 and property income of 4,500. Calculate the Income Tax Liability of lan Mark. Show all calculations in detail for full credit. (3 Marks) b). For the tax year (2021/22) Lilly Brown earns a salary of 87,500 and receives building society interest of 25,000. Calculate the Income Tax Liability of Lilly Brown. Show all calculations in detail for full credit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started