Answered step by step

Verified Expert Solution

Question

1 Approved Answer

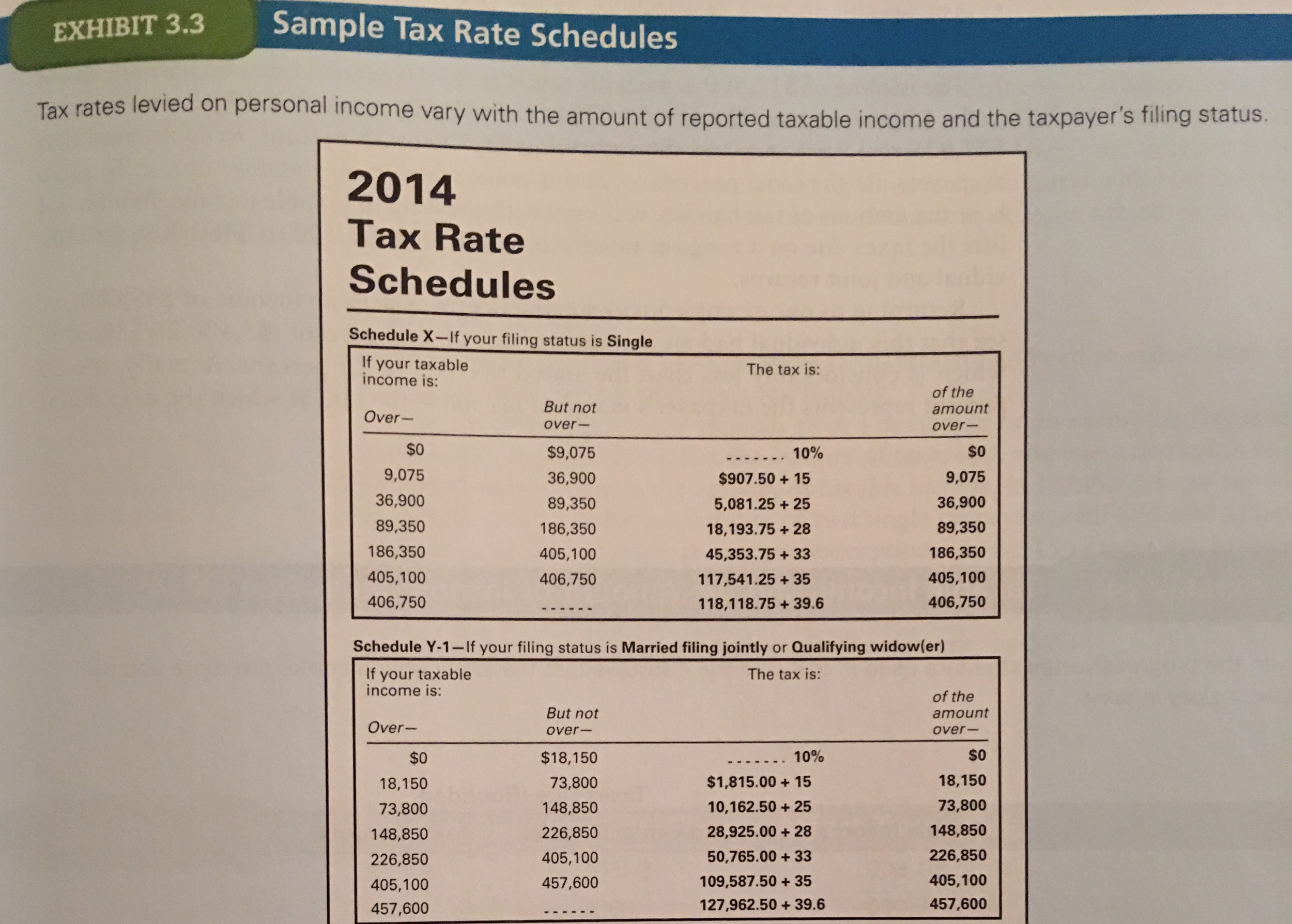

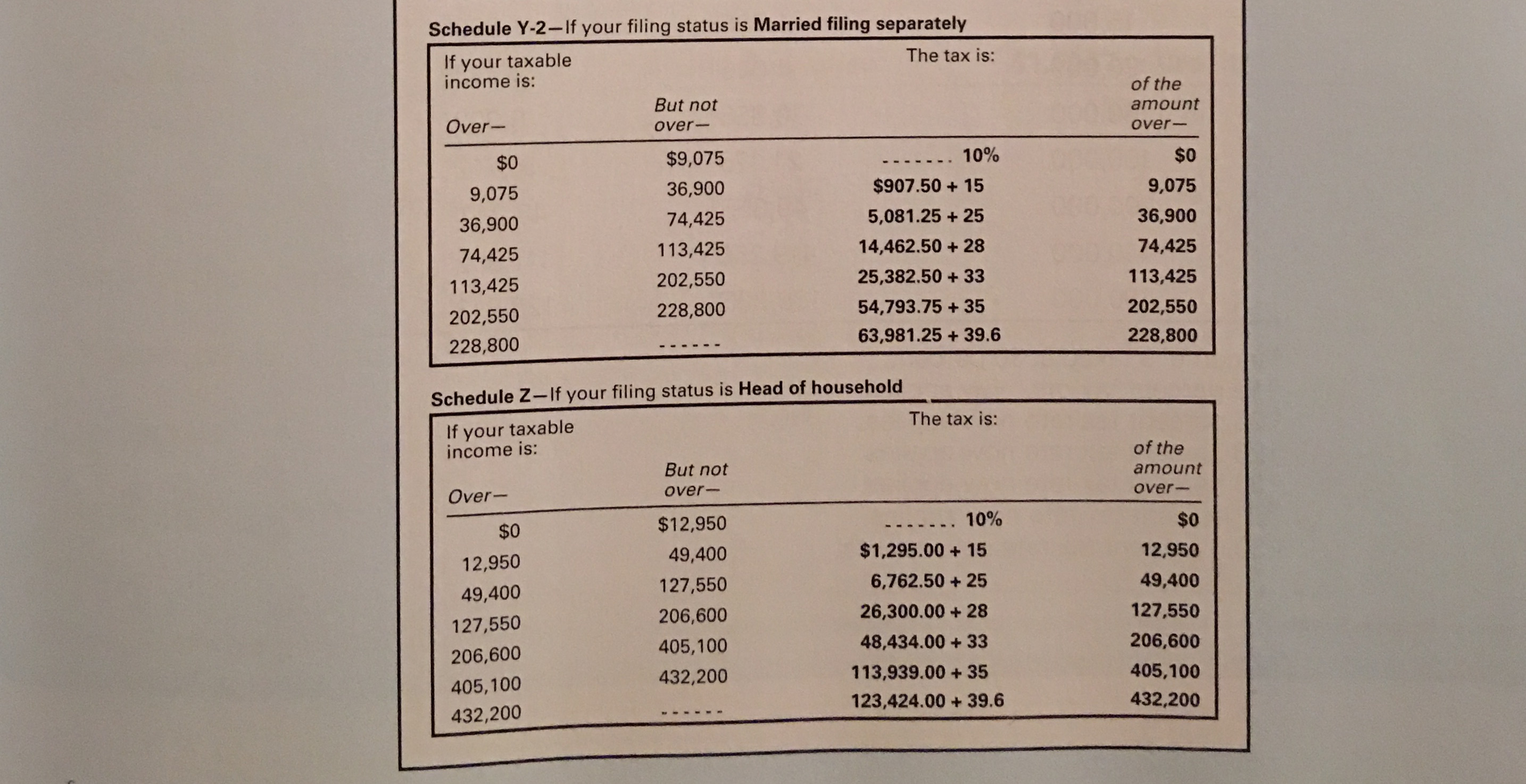

Tax rates levied on personal income vary with the amount of reported taxable income and the taxpayer's filing status. Schedule X - If your filing

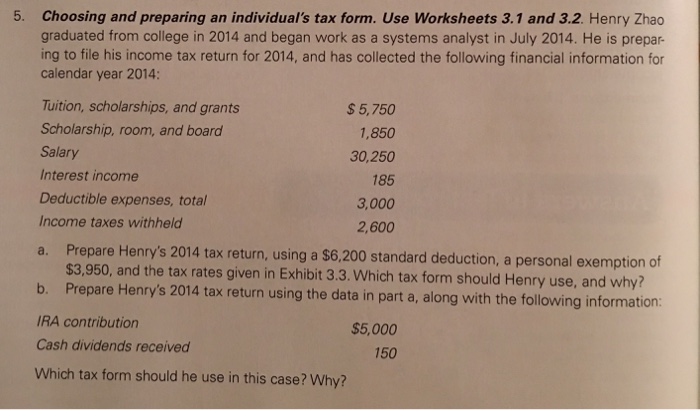

Tax rates levied on personal income vary with the amount of reported taxable income and the taxpayer's filing status. Schedule X - If your filing status is Single Schedule Y - 1 - If your filing status is Married filing jointly or Qualifying widow(er) Schedule Y - 2-If your filing status is Married filing separately Schedule Z - If your filing status is Head of household If your taxable income is: Henry Zhao graduated from college in 2014 and began work as a systems analyst in July 2014. He is preparing to file his income tax return for 2014, and has collected the following financial information for calendar year 2014: Prepare Henry's 2014 tax return, using a $6, 200 standard deduction, a personal exemption of $3, 950, and the tax rates given in Exhibit 3.3. Which tax form should Henry use, and why? Prepare Henry's 2014 tax return using the data in part a, along with the following information Which tax form should he use in this case? Why

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started