Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Tax Return #1 Complete the 2020 federal income tax return for Steve and Julie Duling. You are not required to prepare the Duling's state tax

Tax Return #1 Complete the 2020 federal income tax return for Steve and Julie Duling. You are not required to prepare the Duling's state tax return. Consider the following information as well as the attached ta documents as you prepare their individual tax return:

The tax return should be provided in pdf form. Thanks for the help guys! I appreciate it!

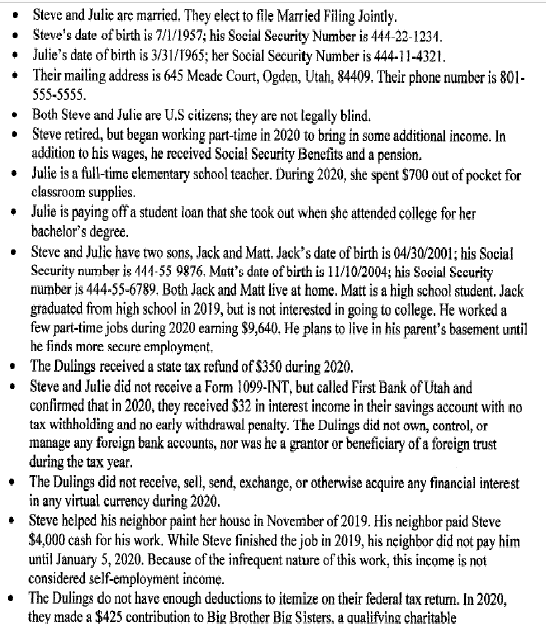

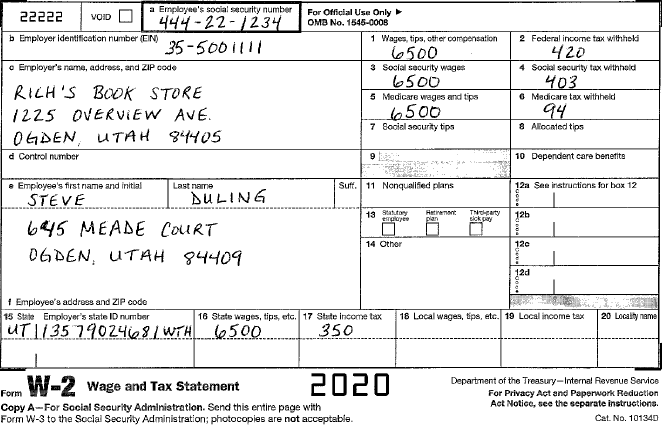

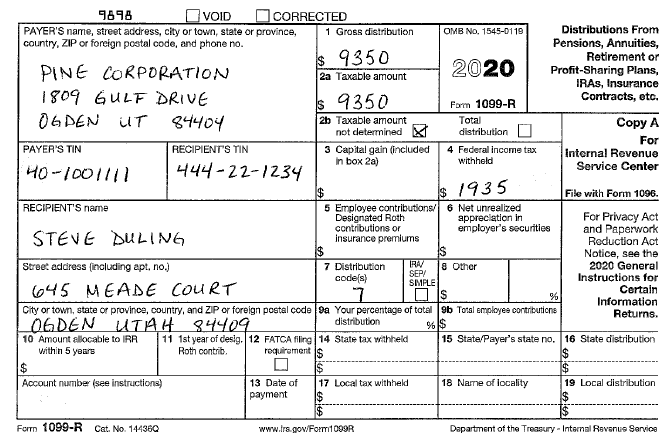

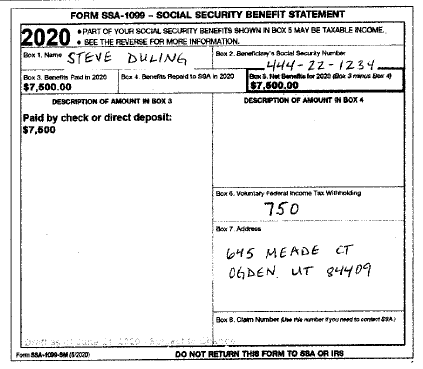

Steve and Juli are married. They elect to file Married Filing Jointly. Steve's date of birth is 7/1/1937; his Social Security Number is 444-22-1234. Julie's date of birth is 3/31/1965; her Social Security Number is 444-11-4321. Their mailing address is 645 Meade Court, Ogden, Utah, 84409. Their phone number is 801- 555-5555. Both Steve and Julie are U.S citizens; they are not legally blind. Steve retired, but began working part-time in 2020 to bring in some additional income. In addition to his wages, he received Social Security Benefits and a pension. Julie is a full-time elementary school teacher. During 2020, she spent $700 out of pocket for classroom supplies. Julie is paying off a student loan that she took out when she attended college for her bachelor's degree. Steve and Julic have two sons, Jack and Mat. Jack's date of birth is 04/30/2001; his Social Security number is 114-55 9876, Matt's date of birth is 11/10/2004; his Social Security number is 444-55-6789. Both Jack and Matt live at home. Matt is a high school student. Jack graduated from high school in 2019, but is not interested in going to college. He worked a few part-time jobs during 2020 earning $9,640. He plans to live in his parent's basement until he finds more secure employment. The Dulings received a state tax refund of 330 during 2020. Steve and Julie did not receive a Form 1099-INT, but called First Bank of Utah and confirmed that in 2020, they received $32 in interest income in their savings account with no tax withholding and no early withdrawal penalty. The Dulings did not own, control, or manage any foreign bank accounts, nor was he a grantor or beneficiary of a foreign trust during the tax year. The Dulings did not receive, sell, send, exchange, or otherwise acquire any financial interest in any virtual currency during 2020. Steve helped his neighbor paint her housc in November of 2019. His neighbor paid Steve $4,000 cash for his work. While Steve finished the job in 2019, his neighbor did not pay him until January 5, 2020. Because of the infrequent nature of this work, this income is not considered self-employment income. The Dulings do not have enough deductions to itemize on their federal tax return. In 2020, they made a $425 contribution to Big Brother Big Sisters, a qualifying charitable 22222 a Employee's social security number VOID 444-22-1234 b Employer identification number (EN) 35-5001111 Employer's name, address, and ZIP code RICH'S BOOK STORE 1225 OVERVIEW AVE. OGDEN UTAH 8416405 d Control number For Official Use Only OMB No. 1546-0008 1 Wages, tips, other compensation 6500 3 Social security wages 6500 5 Medicare vrages and tips 2 Federal income tax withhold 420 4 Social Security tax withhold 403 Medicare tax withheld 94 8 Allocated tips 6500 7 social security tips 10 Dependent care benefits Last naine Suff. 11 Nenqualified plans 12a See instructions for bax 12 Employee's first name and initial STEVE DULING 13 Story Hetineant plan Taty tity 12b 645 MEADE COURT 06 DEN, UTAH 84409 14 Other 12c 12d 1 Employee's address and ZIP code 15 State Employer's state ID number 16 State Wages, tips, etc. 17 State income tax UT1/35 7902468/ WH 6500 350 18 Local wages, tips, etc. 19 Local income tex 20 Locality name Form W-2 Wage and Tax Statement 2020 Copy A-For Social Security Administration. Send this entire page with Form W-3 to the Social Security Administration; photocopies are not acceptable. Department of the Treasury-Internal Revenue Service For Privacy Act and Paperwork Reduction Act Notice, see the separate instructions. Cat. No. 101340 a Employee's social security number 22222 444-11-4321 b Employer identification number EN 35-6002222 c Employer's name, address, and ZIP code OMB No. 1545-0008 1 Wages, tips, other compensation 30.000 3 Social security wagas 30.000 5 Medicare wages and tips 30.000 7 Social security tips 2 Federal income tax withheld 2450 4 Social Security tax withheld 1860 6 Medicare tax withheld SALEM ELEMENTARY SCHOOL 1270 POLK AVE OGDEN UTAH 84403 435 & Allocated tips d Control number 9 10 Deperdent care benefits e Employee's first name and initial Last name Suff. 11 Nonqualified plans 12a DDT 3800 13 ry Patient plan Thaty encore 12b JULIE DULING 645 MEADE CT OGDEN UTAH 84409 14 Other 12c 120 f Employee's address and ZIP code 15 State Employer's state ID number 16 State wages, tips, etc. 17 State income tax UT 11245789361LWTHL 30.000 1.200 18 Local wages, tips, etc. 19 Local income tax 20 Locality name Form W-2 wage and Tax Statement Copy 1 -- For State, City, or Local Tax Department 2020 Department of the Treasury-Intemal Revenue Service 9698 VOID CORRECTED PAYER'S name, street address, city or town, state or province, 1 Gross distribution OMB No. 1545-0119 Distributions From country, ZIP or foreign postal code, and phone no. Pensions, Annuities, s 9350 Retirement or PINE CORPORATION 2020 2a Taxable amount Profit-Sharing Plans, IRAS, Insurance 1809 GULF DRIVE Is 9350 Contracts, etc. Form 1099-R 06 DEN iT 84404 2b Taxable amount Total Copy A not determined X distribution For PAYER'S TIN RECIPIENTS TIN 3 Capital gain (included 4 Federal income tax Internal Revenue in box 2a) withheld 40-1001111 444-22-1234 Service Center Is 1935 File with Form 1096. RECIPIENT'S name 5 Employee contributions 6 Net unrealized Designated Roth appreciation in For Privacy Act contributions or employer's securities and Paperwork STEVE DULING insurance premiums Reduction Act IS Notice, see the Street address (including apt, no.) 7 Distribution IRA 8 Other 2020 General SEP/ code(s) SIMPLE Instructions for 645 MEADE COURT S Certain Information City or town, state or province, country, and ZIP or foreign postal code 9a Your percentage of total 96 Total employee contributions Returns. LOGDEN UTAH 84409 distribution %$ 10 Amount allocable to RR 11 1st year of desig. 12 FATCA filing 14 State tax withheld 15 State/Payer's state no. 16 State distribution within 5 years Roth contrib requirement $ IS $ Account number (see instructions) 13 Date of 17 Local tax withheld 18 Name of locality 19 Local distribution payment $ Form 1099-R Cat No. 144360 www.lrs.gov/Form1099R Dapartment of the Treasury - Internal Ravsnus Service 2020 FORM SSA-1099 - SOCIAL SECURITY BENEFIT STATEMENT .PART OF YOUR SOCIAL SECURITY BENEFITS SHOWN IN BOX 5 MAY BE TAXABLE NCOME SEE THE REVERSE FOR MORE INFORMATION. Box 1. Here STEVE DULING Box 2.Bereich Bolecuray Met -444-22 - 1234 Bok 3. Beethin Padi 2020 Bca 4. Benefits Poped to SOA in 2020 Pex. Net Brelor 2020 onus Box $7,500.00 $7.500.00 DESCRIPTION OF AMOUNT W BOX a DESCRIPTION OF AMOUNT IN BOX 4 Paid by check or direct deposit: $7,500 Box 6. VORVM Fadere werking 750 dok 7 Address 645 MEADE CT OGDEN UT 84409 Blow B.Com Number while water you need to contert 684 FormA-00-SM 2000 DO NOT RETURN THE FORM TO SEA OR IRS Steve and Juli are married. They elect to file Married Filing Jointly. Steve's date of birth is 7/1/1937; his Social Security Number is 444-22-1234. Julie's date of birth is 3/31/1965; her Social Security Number is 444-11-4321. Their mailing address is 645 Meade Court, Ogden, Utah, 84409. Their phone number is 801- 555-5555. Both Steve and Julie are U.S citizens; they are not legally blind. Steve retired, but began working part-time in 2020 to bring in some additional income. In addition to his wages, he received Social Security Benefits and a pension. Julie is a full-time elementary school teacher. During 2020, she spent $700 out of pocket for classroom supplies. Julie is paying off a student loan that she took out when she attended college for her bachelor's degree. Steve and Julic have two sons, Jack and Mat. Jack's date of birth is 04/30/2001; his Social Security number is 114-55 9876, Matt's date of birth is 11/10/2004; his Social Security number is 444-55-6789. Both Jack and Matt live at home. Matt is a high school student. Jack graduated from high school in 2019, but is not interested in going to college. He worked a few part-time jobs during 2020 earning $9,640. He plans to live in his parent's basement until he finds more secure employment. The Dulings received a state tax refund of 330 during 2020. Steve and Julie did not receive a Form 1099-INT, but called First Bank of Utah and confirmed that in 2020, they received $32 in interest income in their savings account with no tax withholding and no early withdrawal penalty. The Dulings did not own, control, or manage any foreign bank accounts, nor was he a grantor or beneficiary of a foreign trust during the tax year. The Dulings did not receive, sell, send, exchange, or otherwise acquire any financial interest in any virtual currency during 2020. Steve helped his neighbor paint her housc in November of 2019. His neighbor paid Steve $4,000 cash for his work. While Steve finished the job in 2019, his neighbor did not pay him until January 5, 2020. Because of the infrequent nature of this work, this income is not considered self-employment income. The Dulings do not have enough deductions to itemize on their federal tax return. In 2020, they made a $425 contribution to Big Brother Big Sisters, a qualifying charitable 22222 a Employee's social security number VOID 444-22-1234 b Employer identification number (EN) 35-5001111 Employer's name, address, and ZIP code RICH'S BOOK STORE 1225 OVERVIEW AVE. OGDEN UTAH 8416405 d Control number For Official Use Only OMB No. 1546-0008 1 Wages, tips, other compensation 6500 3 Social security wages 6500 5 Medicare vrages and tips 2 Federal income tax withhold 420 4 Social Security tax withhold 403 Medicare tax withheld 94 8 Allocated tips 6500 7 social security tips 10 Dependent care benefits Last naine Suff. 11 Nenqualified plans 12a See instructions for bax 12 Employee's first name and initial STEVE DULING 13 Story Hetineant plan Taty tity 12b 645 MEADE COURT 06 DEN, UTAH 84409 14 Other 12c 12d 1 Employee's address and ZIP code 15 State Employer's state ID number 16 State Wages, tips, etc. 17 State income tax UT1/35 7902468/ WH 6500 350 18 Local wages, tips, etc. 19 Local income tex 20 Locality name Form W-2 Wage and Tax Statement 2020 Copy A-For Social Security Administration. Send this entire page with Form W-3 to the Social Security Administration; photocopies are not acceptable. Department of the Treasury-Internal Revenue Service For Privacy Act and Paperwork Reduction Act Notice, see the separate instructions. Cat. No. 101340 a Employee's social security number 22222 444-11-4321 b Employer identification number EN 35-6002222 c Employer's name, address, and ZIP code OMB No. 1545-0008 1 Wages, tips, other compensation 30.000 3 Social security wagas 30.000 5 Medicare wages and tips 30.000 7 Social security tips 2 Federal income tax withheld 2450 4 Social Security tax withheld 1860 6 Medicare tax withheld SALEM ELEMENTARY SCHOOL 1270 POLK AVE OGDEN UTAH 84403 435 & Allocated tips d Control number 9 10 Deperdent care benefits e Employee's first name and initial Last name Suff. 11 Nonqualified plans 12a DDT 3800 13 ry Patient plan Thaty encore 12b JULIE DULING 645 MEADE CT OGDEN UTAH 84409 14 Other 12c 120 f Employee's address and ZIP code 15 State Employer's state ID number 16 State wages, tips, etc. 17 State income tax UT 11245789361LWTHL 30.000 1.200 18 Local wages, tips, etc. 19 Local income tax 20 Locality name Form W-2 wage and Tax Statement Copy 1 -- For State, City, or Local Tax Department 2020 Department of the Treasury-Intemal Revenue Service 9698 VOID CORRECTED PAYER'S name, street address, city or town, state or province, 1 Gross distribution OMB No. 1545-0119 Distributions From country, ZIP or foreign postal code, and phone no. Pensions, Annuities, s 9350 Retirement or PINE CORPORATION 2020 2a Taxable amount Profit-Sharing Plans, IRAS, Insurance 1809 GULF DRIVE Is 9350 Contracts, etc. Form 1099-R 06 DEN iT 84404 2b Taxable amount Total Copy A not determined X distribution For PAYER'S TIN RECIPIENTS TIN 3 Capital gain (included 4 Federal income tax Internal Revenue in box 2a) withheld 40-1001111 444-22-1234 Service Center Is 1935 File with Form 1096. RECIPIENT'S name 5 Employee contributions 6 Net unrealized Designated Roth appreciation in For Privacy Act contributions or employer's securities and Paperwork STEVE DULING insurance premiums Reduction Act IS Notice, see the Street address (including apt, no.) 7 Distribution IRA 8 Other 2020 General SEP/ code(s) SIMPLE Instructions for 645 MEADE COURT S Certain Information City or town, state or province, country, and ZIP or foreign postal code 9a Your percentage of total 96 Total employee contributions Returns. LOGDEN UTAH 84409 distribution %$ 10 Amount allocable to RR 11 1st year of desig. 12 FATCA filing 14 State tax withheld 15 State/Payer's state no. 16 State distribution within 5 years Roth contrib requirement $ IS $ Account number (see instructions) 13 Date of 17 Local tax withheld 18 Name of locality 19 Local distribution payment $ Form 1099-R Cat No. 144360 www.lrs.gov/Form1099R Dapartment of the Treasury - Internal Ravsnus Service 2020 FORM SSA-1099 - SOCIAL SECURITY BENEFIT STATEMENT .PART OF YOUR SOCIAL SECURITY BENEFITS SHOWN IN BOX 5 MAY BE TAXABLE NCOME SEE THE REVERSE FOR MORE INFORMATION. Box 1. Here STEVE DULING Box 2.Bereich Bolecuray Met -444-22 - 1234 Bok 3. Beethin Padi 2020 Bca 4. Benefits Poped to SOA in 2020 Pex. Net Brelor 2020 onus Box $7,500.00 $7.500.00 DESCRIPTION OF AMOUNT W BOX a DESCRIPTION OF AMOUNT IN BOX 4 Paid by check or direct deposit: $7,500 Box 6. VORVM Fadere werking 750 dok 7 Address 645 MEADE CT OGDEN UT 84409 Blow B.Com Number while water you need to contert 684 FormA-00-SM 2000 DO NOT RETURN THE FORM TO SEA OR IRSStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started