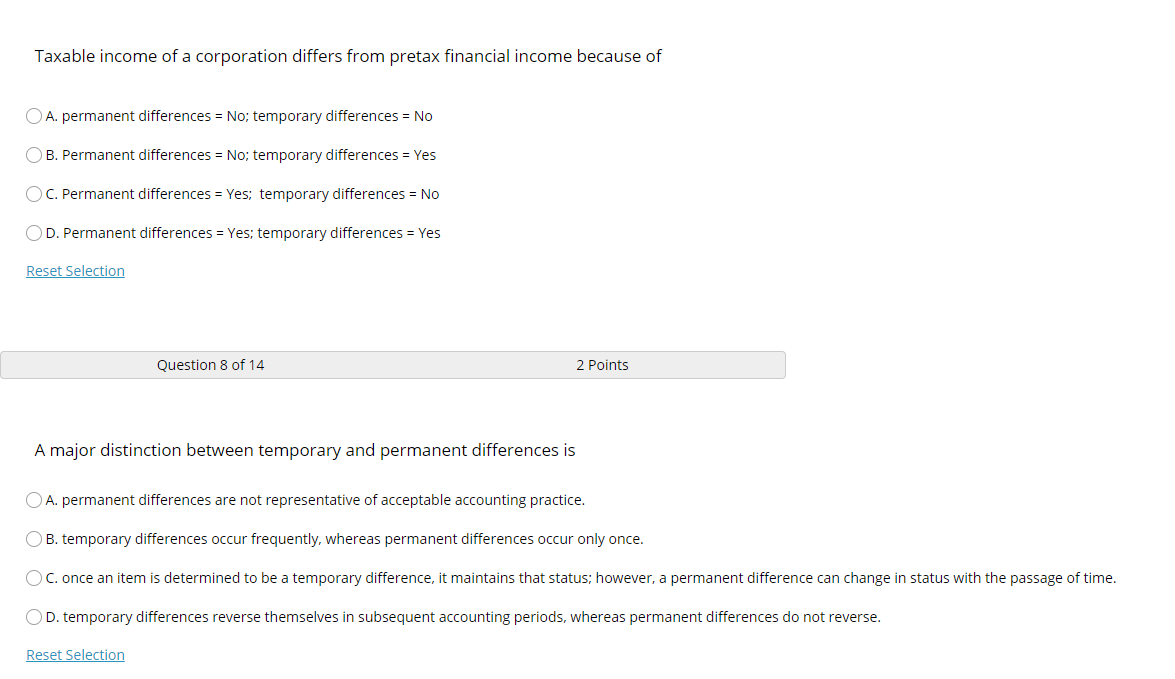

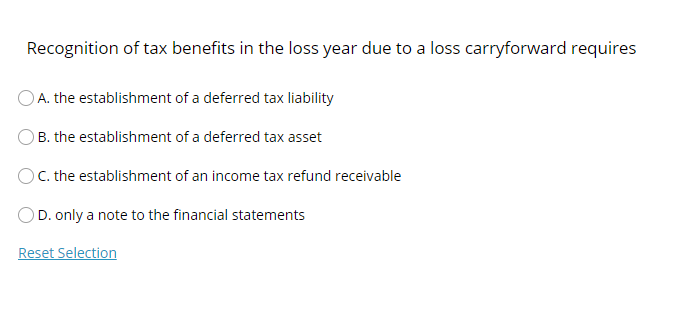

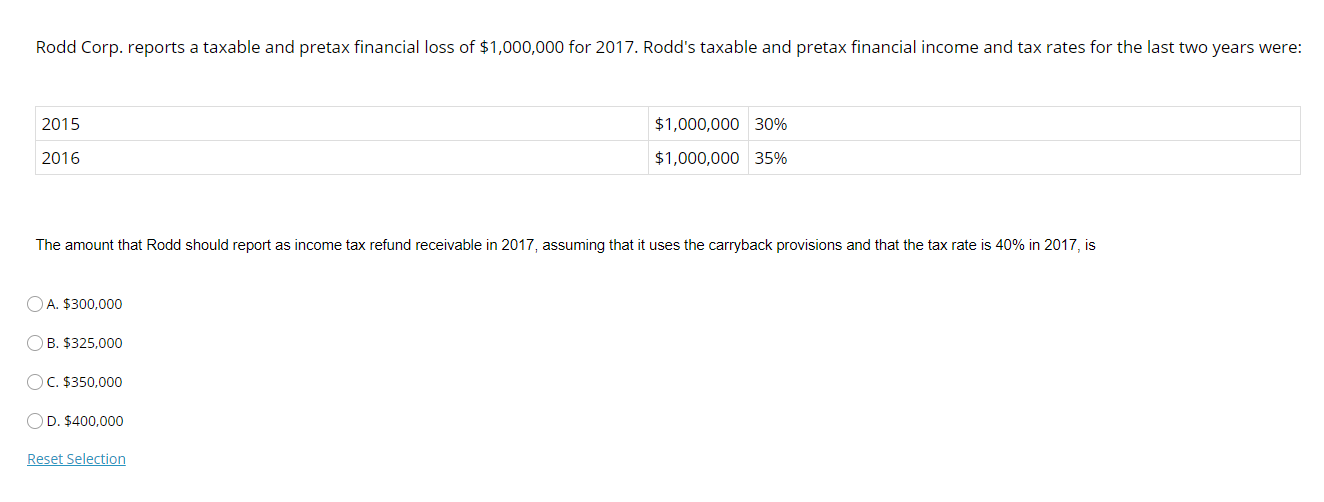

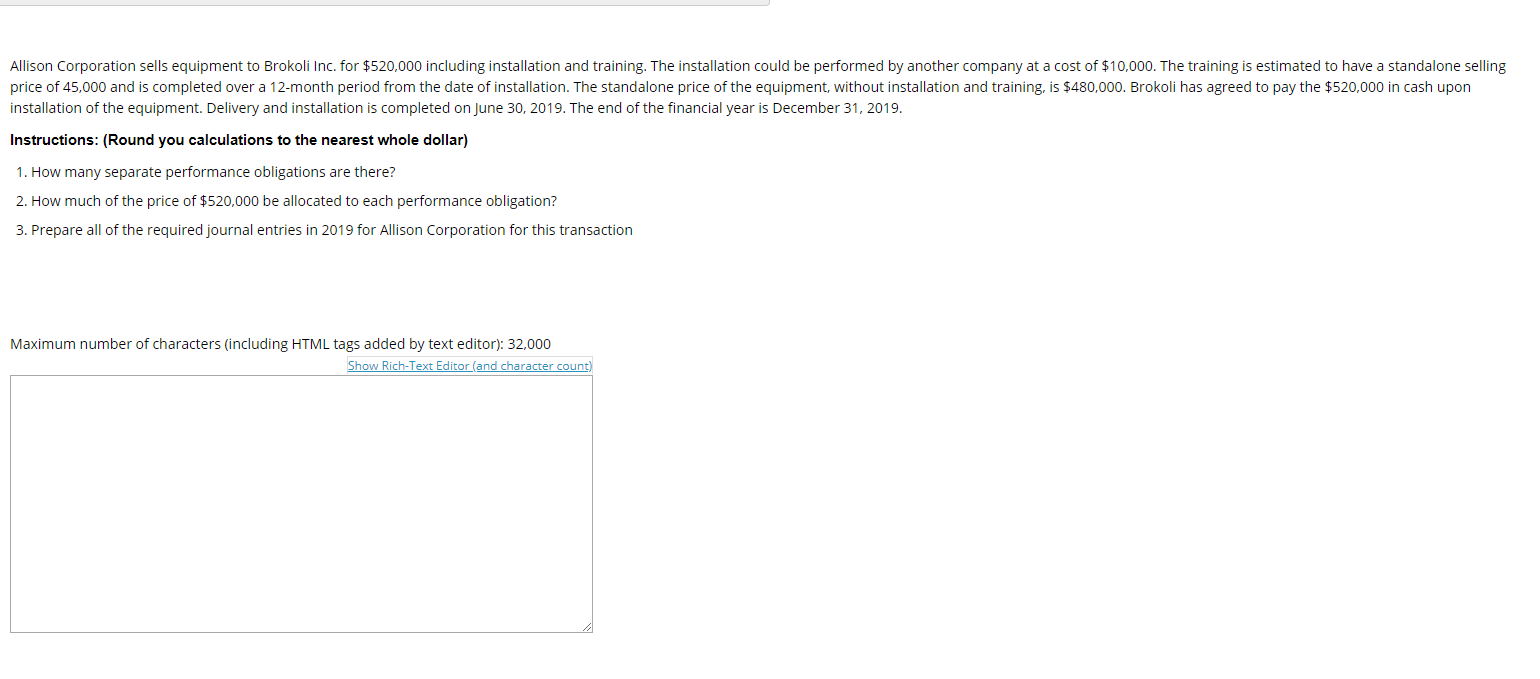

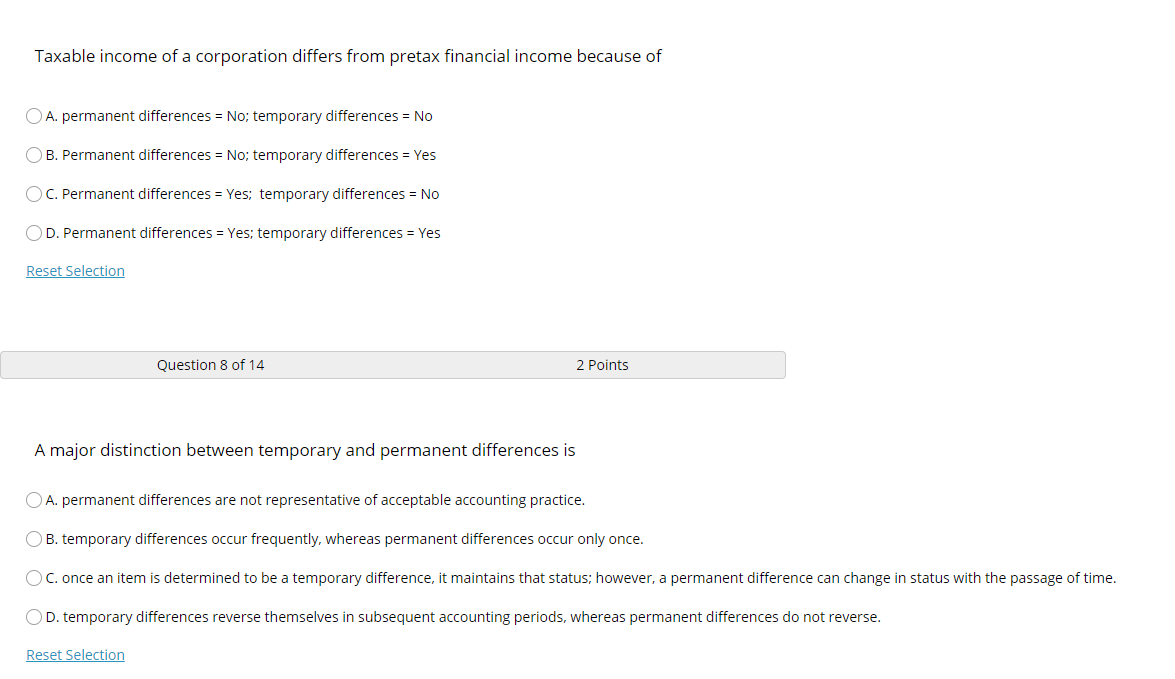

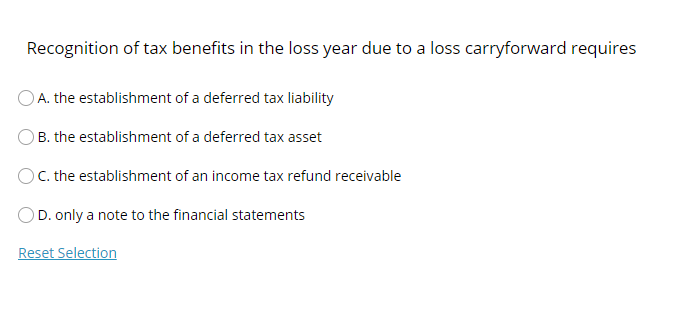

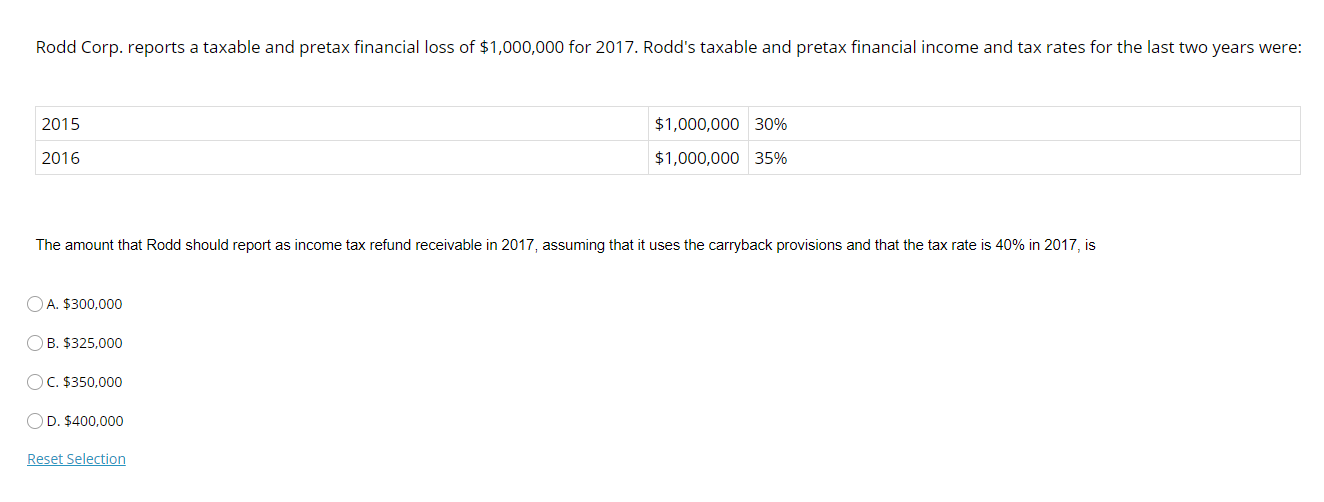

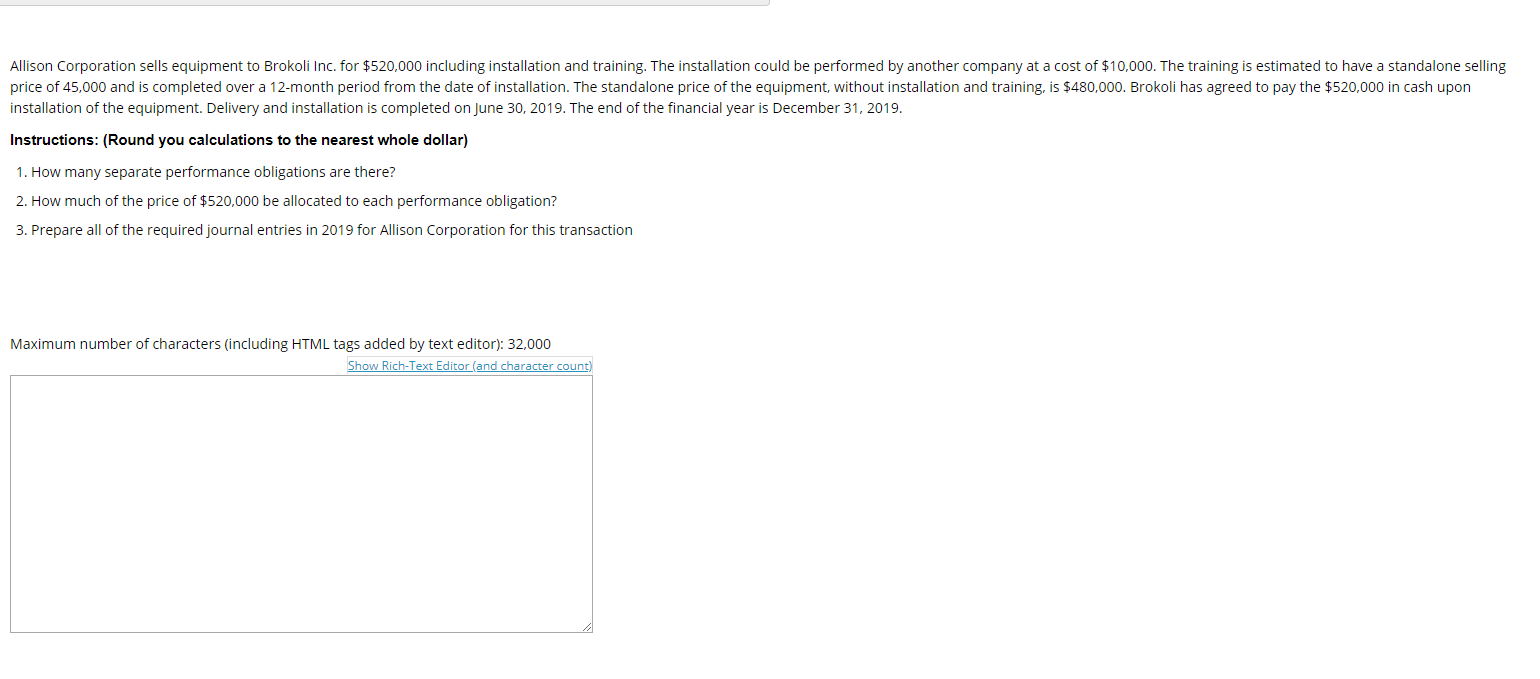

Taxable income of a corporation differs from pretax financial income because of O A. permanent differences = No; temporary differences = No O B. Permanent differences = No; temporary differences = Yes OC. Permanent differences = Yes; temporary differences = No OD. Permanent differences = Yes; temporary differences = Yes Reset Selection Question 8 of 14 2 Points A major distinction between temporary and permanent differences is O A. permanent differences are not representative of acceptable accounting practice OB. temporary differences occur frequently, whereas permanent differences occur only once. OC. once an item is determined to be a temporary difference, it maintains that status; however, a permanent difference can change in status with the passage of time OD. temporary differences reverse themselves in subsequent accounting periods, whereas permanent differences do not reverse. Reset Selection Recognition of tax benefits in the loss year due to a loss carryforward requires O A. the establishment of a deferred tax liability O B. the establishment of a deferred tax asset OC. the establishment of an income tax refund receivable OD. only a note to the financial statements Reset Selection Rodd Corp. reports a taxable and pretax financial loss of $1,000,000 for 2017. Rodd's taxable and pretax financial income and tax rates for the last two years were: 2015 $1,000,000 30% $1,000,000 35% 2016 The amount that Rodd should report as income tax refund receivable in 2017, assuming that it uses the carryback provisions and that the tax rate is 40% in 2017, is O A. $300,000 OB. $325,000 OC. $350,000 OD. $400,000 Reset Selection Allison Corporation sells equipment to Brokoli Inc. for $520,000 including installation and training. The installation could be performed by another company at a cost of $10,000. The training is estimated to have a standalone selling price of 45,000 and is completed over a 12-month period from the date of installation. The standalone price of the equipment, without installation and training, is $480,000. Brokoli has agreed to pay the $520,000 in cash upon installation of the equipment. Delivery and installation is completed on June 30, 2019. The end of the financial year is December 31, 2019. Instructions: (Round you calculations to the nearest whole dollar) 1. How many separate performance obligations are there? 2. How much of the price of $520,000 be allocated to each performance obligation? 3. Prepare all of the required journal entries in 2019 for Allison Corporation for this transaction Maximum number of characters (including HTML tags added by text editor): 32,000 Show Rich-Text Editor (and character count)