Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Taxation 2 AJ Barns sold a piece of land at a significant gain, shown below, during the year to a developer. He has agreed to

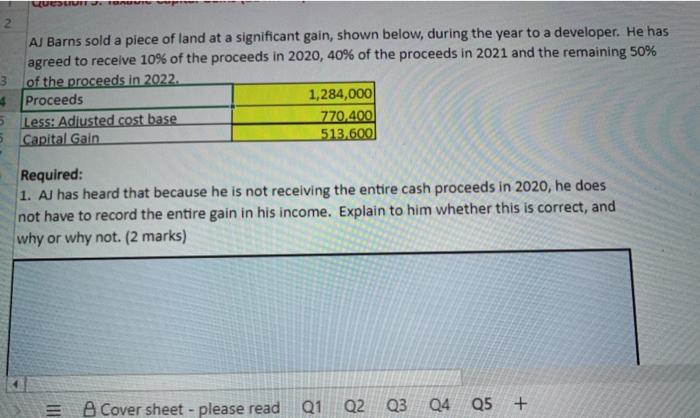

Taxation

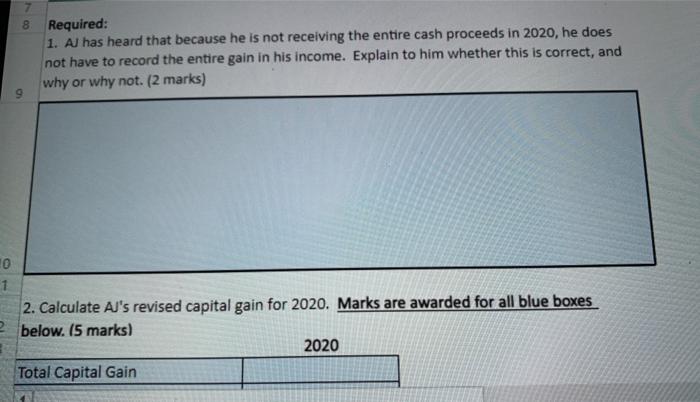

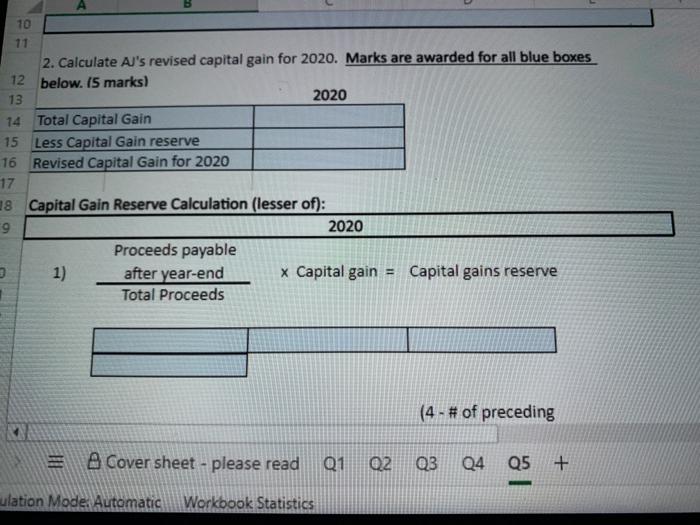

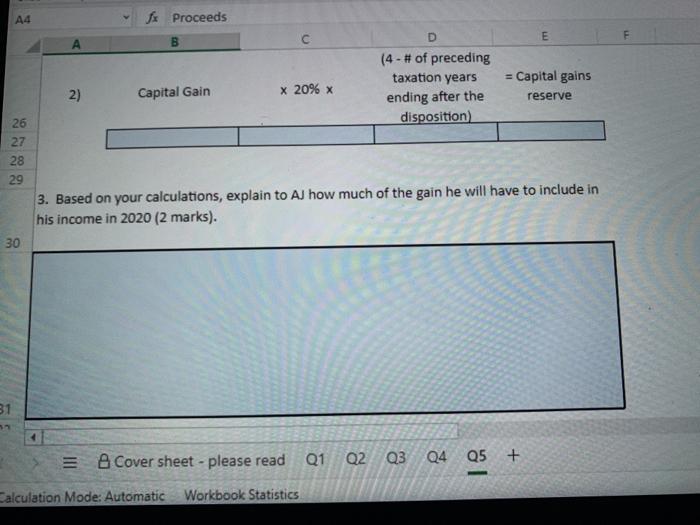

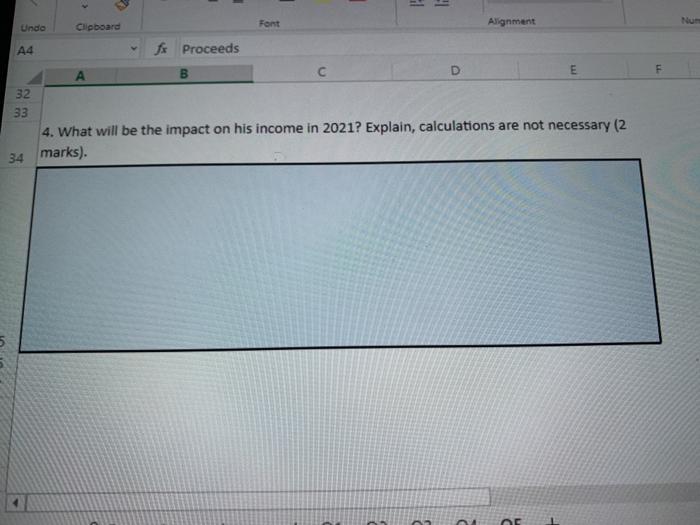

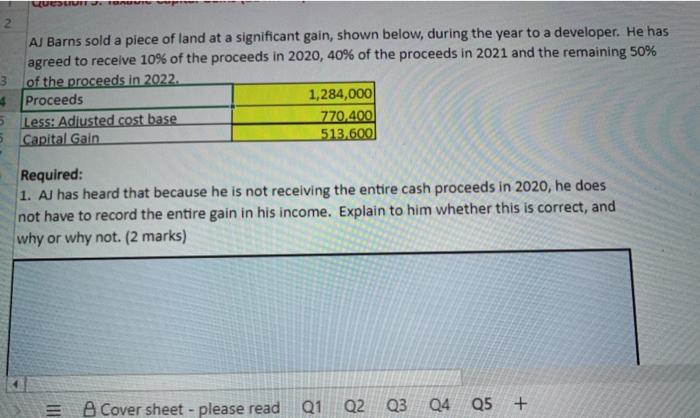

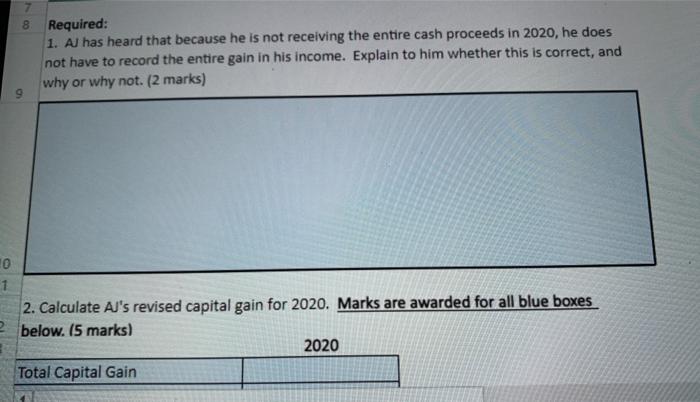

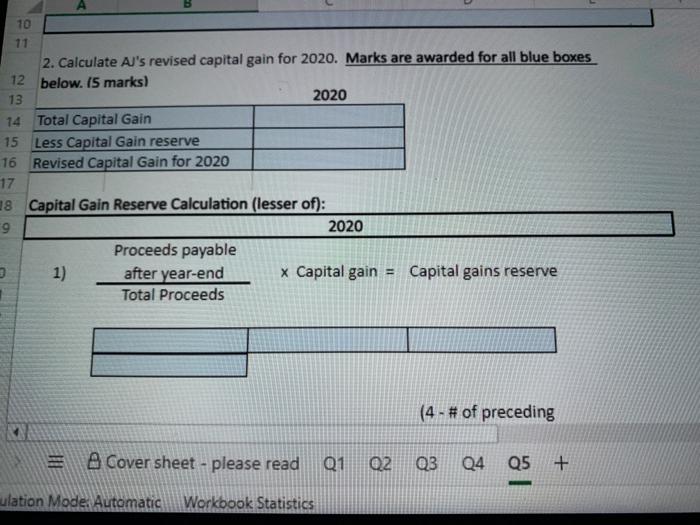

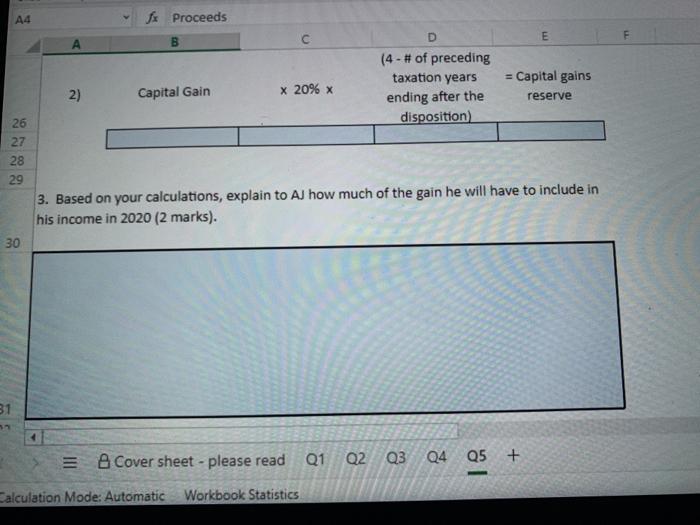

2 AJ Barns sold a piece of land at a significant gain, shown below, during the year to a developer. He has agreed to receive 10% of the proceeds in 2020, 40% of the proceeds in 2021 and the remaining 50% 3 of the proceeds in 2022. 4 Proceeds 1,284,000 5 Less: Adjusted cost base 770.400 5 Capital Gain 513,600] Required: 1. AJ has heard that because he is not receiving the entire cash proceeds in 2020, he does not have to record the entire gain in his income. Explain to him whether this is correct, and why or why not. (2 marks) Q1 = A Cover sheet - please read Q2 Q3 Q4 Q5 + 8 Required: 1. AJ has heard that because he is not receiving the entire cash proceeds in 2020, he does not have to record the entire gain in his income. Explain to him whether this is correct, and why or why not. (2 marks) 0 1 2. Calculate AJ's revised capital gain for 2020. Marks are awarded for all blue boxes below. (5 marks) 2020 Total Capital Gain A4 fx Proceeds B D E (4 - # of preceding taxation years = Capital gains 2) Capital Gain X 20% x ending after the reserve 26 disposition) 27 28 29 3. Based on your calculations, explain to AJ how much of the gain he will have to include in his income in 2020 (2 marks). 30 31 Q1 A Cover sheet - please read Q2 Q3 Q4 Q5 + Calculation Mode: Automatic Workbook Statistics - TE Undo Clipboard Font Alignment A4 fx Proceeds E 32 33 4. What will be the impact on his income in 2021? Explain, calculations are not necessary (2 34 marks). OC

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started