Answered step by step

Verified Expert Solution

Question

1 Approved Answer

taxation Balancing charges are not taxable income True False I.M.A. Weed has incurred a debt of an amount which was not yet calculable whilst conducting

taxation

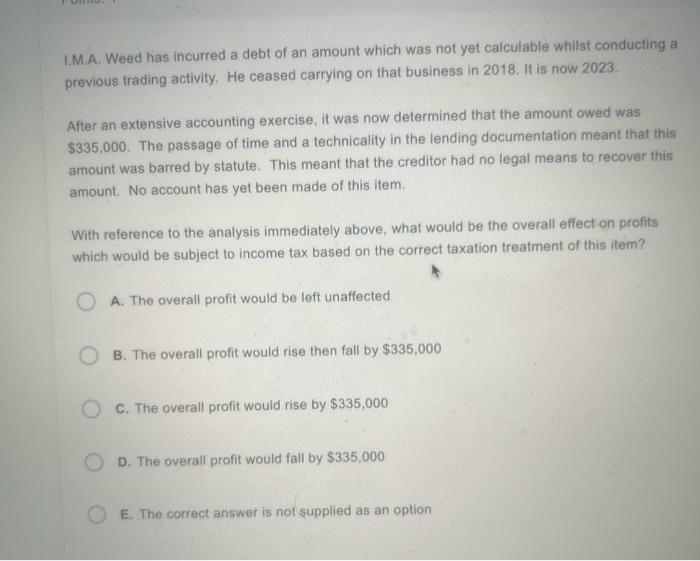

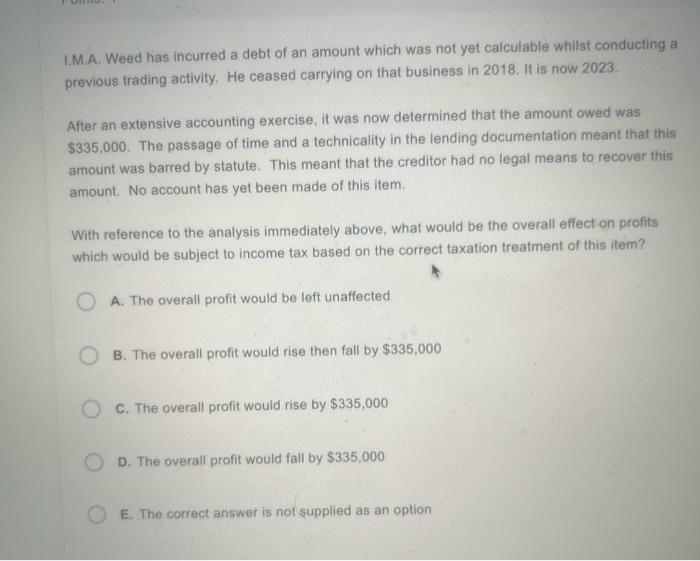

Balancing charges are not taxable income True False I.M.A. Weed has incurred a debt of an amount which was not yet calculable whilst conducting a previous trading activity. He ceased carrying on that business in 2018. It is now 2023. After an extensive accounting exercise, it was now determined that the amount owed was $335,000. The passage of time and a technicality in the lending documentation meant that this amount was barred by statute. This meant that the creditor had no legal means to recover this amount. No account has yet been made of this item. With reference to the analysis immediately above, what would be the overall effect on profits which would be subject to income tax based on the correct taxation treatment of this item? A. The overall profit would be left unaffected B. The overall profit would rise then fall by $335,000 C. The overall profit would rise by $335,000 D. The overall profit would fall by $335,000 E. The correct answer is not supplied as an option

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started