Answered step by step

Verified Expert Solution

Question

1 Approved Answer

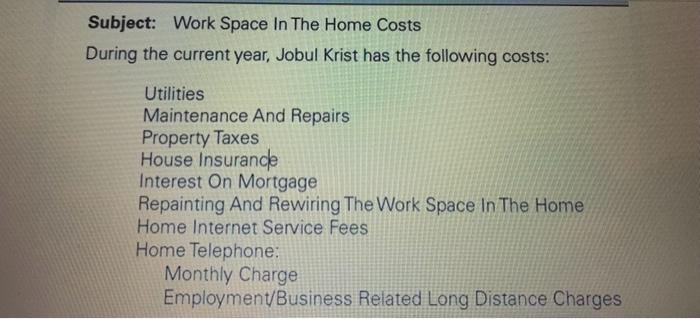

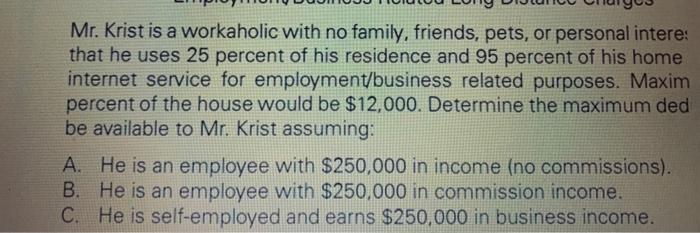

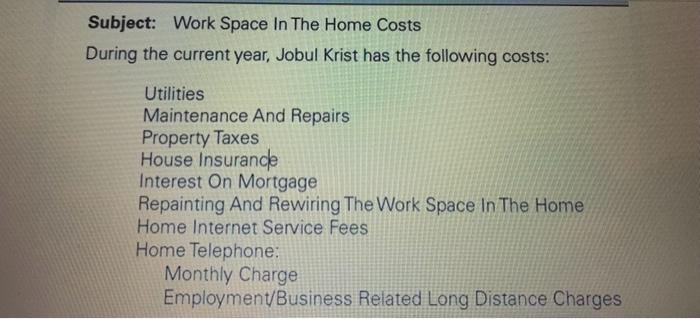

taxation business income Inclusions and limitaions Subject: Work Space In The Home Costs During the current year, Jobul Krist has the following costs: Mr. Krist

taxation

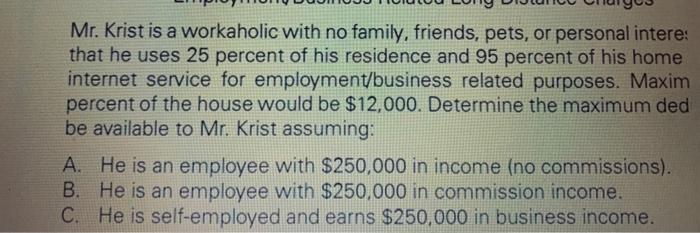

Subject: Work Space In The Home Costs During the current year, Jobul Krist has the following costs: Mr. Krist is a workaholic with no family, friends, pets, or personal intere: that he uses 25 percent of his residence and 95 percent of his home internet service for employment/business related purposes. Maxim percent of the house would be $12,000. Determine the maximum ded be available to Mr. Krist assuming: A. He is an employee with $250,000 in income (no commissions). B. He is an employee with $250,000 in commission income. C. He is self-employed and earns $250,000 in business income. Subject: Work Space In The Home Costs During the current year, Jobul Krist has the following costs: Mr. Krist is a workaholic with no family, friends, pets, or personal intere: that he uses 25 percent of his residence and 95 percent of his home internet service for employment/business related purposes. Maxim percent of the house would be $12,000. Determine the maximum ded be available to Mr. Krist assuming: A. He is an employee with $250,000 in income (no commissions). B. He is an employee with $250,000 in commission income. C. He is self-employed and earns $250,000 in business income business income Inclusions and limitaions

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started