Answered step by step

Verified Expert Solution

Question

1 Approved Answer

TAXATION FINAL EXAMINATION PART 2 INCOME TAX RETURN HUSBAND First name: MIKE Last name: AMIR Birthdate: June 6 , 1 9 9 0 SIN: 6

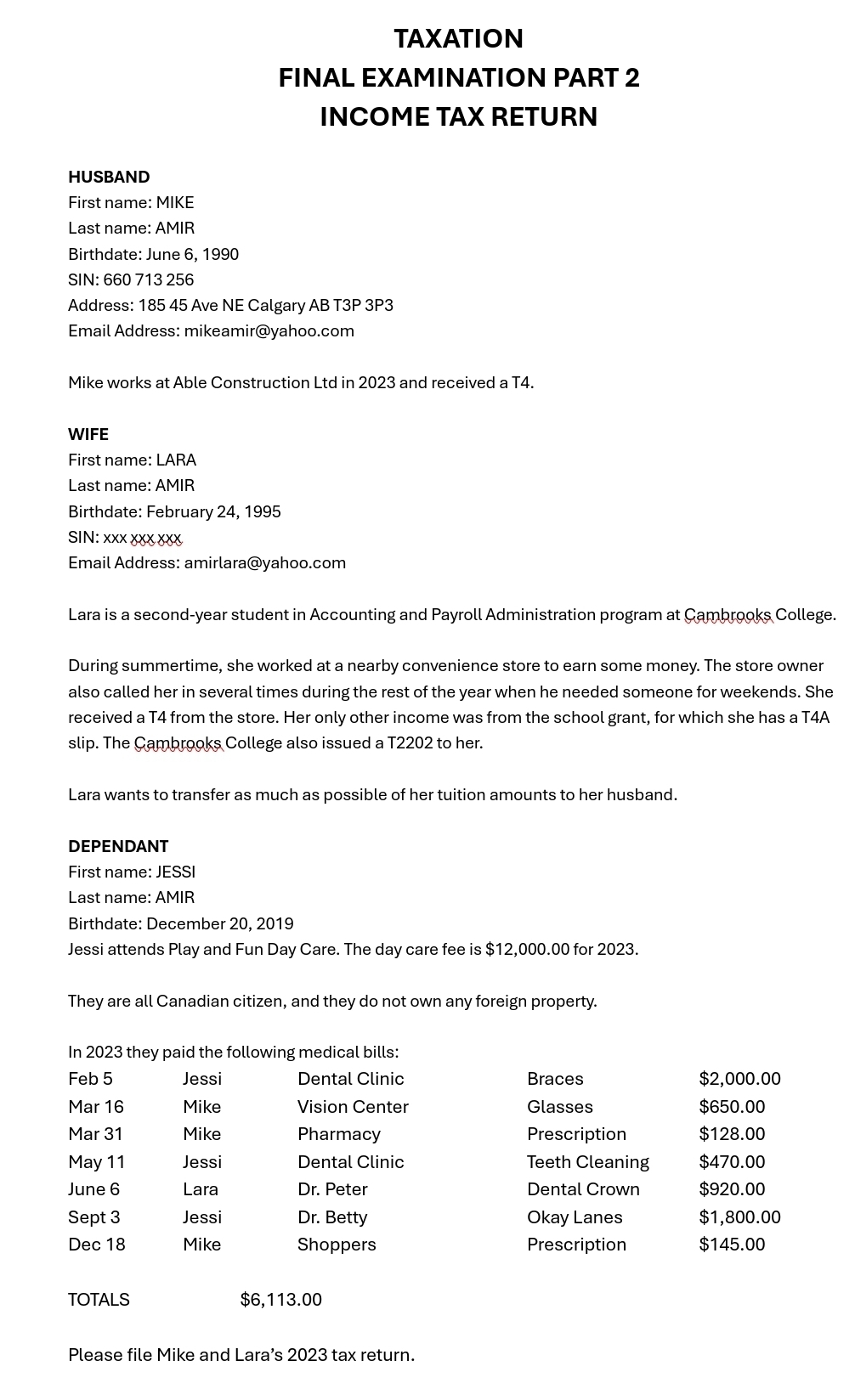

TAXATION

FINAL EXAMINATION PART INCOME TAX RETURN

HUSBAND

First name: MIKE

Last name: AMIR

Birthdate: June

SIN:

Address: Ave NE Calgary AB TP P

Email Address:

mikeamir@yahoo.com

Mike works at Able Construction Ltd in and received a T

WIFE

First name: LARA

Last name: AMIR

Birthdate: February

SIN:

Email Address:

amirlara@yahoo.com

Lara is a secondyear student in Accounting and Payroll Administration program at Cambroaks, College.

During summertime, she worked at a nearby convenience store to earn some money. The store owner also called her in several times during the rest of the year when he needed someone for weekends. She received a T from the store. Her only other income was from the school grant, for which she has a TA slip. The Cambrooks College also issued a T to her.

Lara wants to transfer as much as possible of her tuition amounts to her husband.

DEPENDANT

First name: JESSI

Last name: AMIR

Birthdate: December

Jessi attends Play and Fun Day Care. The day care fee is $ for

They are all Canadian citizen, and they do not own any foreign property.

In they paid the following medical bills:

tableFeb Jessi,Dental Clinic,Braces,$

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started