Answered step by step

Verified Expert Solution

Question

1 Approved Answer

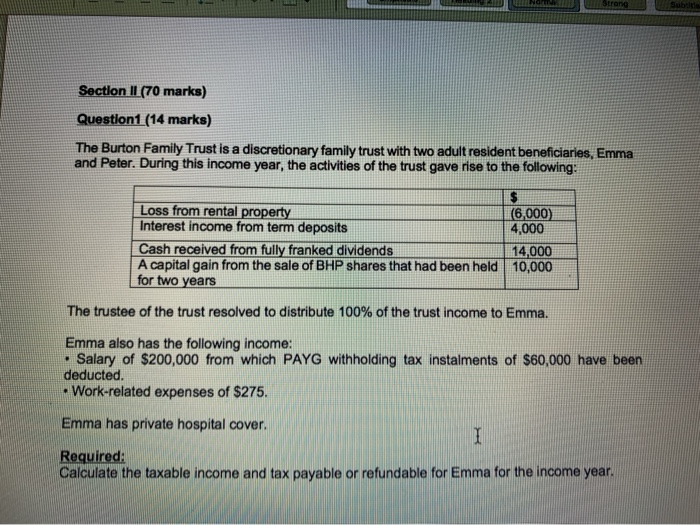

Taxation law 1 Strang Subtitle Section 11 (70 marks) Question1 (14 marks) The Burton Family Trust is a discretionary family trust with two adult resident

Taxation law 1

Strang Subtitle Section 11 (70 marks) Question1 (14 marks) The Burton Family Trust is a discretionary family trust with two adult resident beneficiaries, Emma and Peter. During this income year, the activities of the trust gave rise to the following: Loss from rental property (6,000) Interest income from term deposits 4,000 Cash received from fully franked dividends 14,000 A capital gain from the sale of BHP shares that had been held 10,000 for two years The trustee of the trust resolved to distribute 100% of the trust income to Emma. . Emma also has the following income: Salary of $200,000 from which PAYG withholding tax instalments of $60,000 have been deducted. Work-related expenses of $275. Emma has private hospital cover. I Required: Calculate the taxable income and tax payable or refundable for Emma for the income year Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started