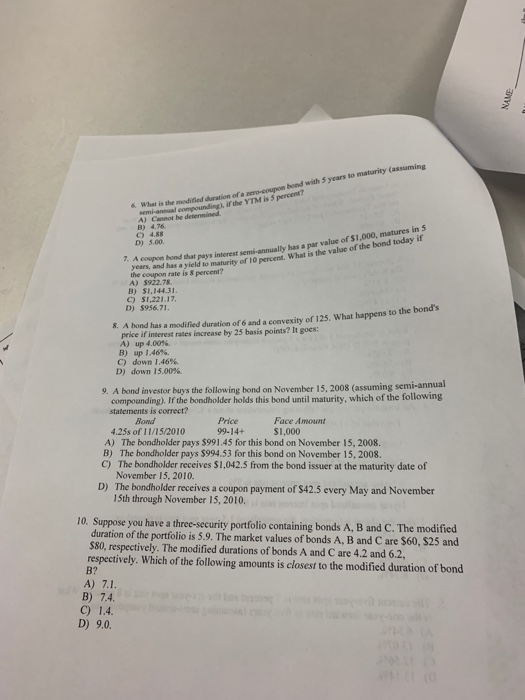

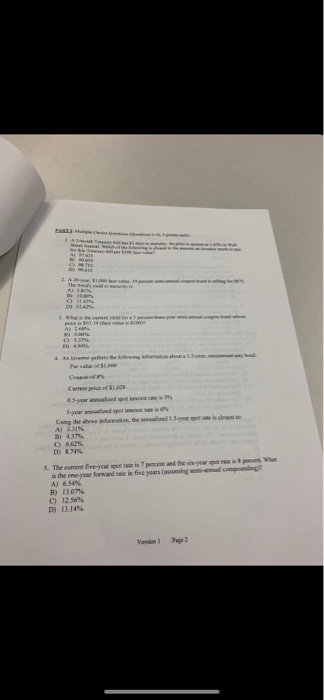

Whar is the modified daration of a aeo-counon bond with 5 years to maturity (assuming semi-anual compounding), if the YTM is 5 percent? A) Cannot be determined. B) 4.76 7. A coupon bond that pays interest semi-annually has a par value of $1,000, matures in 5 years, and has a yield to maturity of 10 percent. What is the value of the bond today if C) 4.88 D) 5.00 the coupon rate is 8 percent? A) $922.78. B) S1,14431 C) $1,221.17 D) $956.71. 8. A bond has a modified duration of 6 and a convexity of 125. What happens to the bond's price if interest rates increase by 25 basis points? It goes: A) up 4.00% ) 1.46%6. C) down 1.46% D) down 15.00% 9. A bond investor buys the following bond on November 15, 2008 (assuming semi-annual compounding). If the bondholder holds this bond until maturity, which of the following statements is correct? Bond 4.25s of 11/15/2010 Price Face Amount 99-14+ $1,000 A) The bondholder pays $991.45 for this bond on November 15, 2008. B) The bondholder pays $994.53 for this bond on November 15, 2008. C) The bondholder receives $1,042.5 from the bond issuer at the maturity date of November 15, 2010 D) The bondholder receives a coupon payment of $42.5 every May and November 15th through November 15, 2010. 10. Suppose you have a three-security portfolio containing bonds A, B and C. The modified duration of the portfolio is 5.9. The market values of bonds A. B and C are $60, $25 and $80, respectively. The modified durations of bonds A and C are 4.2 and 6.2 respectively. Which of the following amounts is closest to the modified duration of bond ? A) 7.1 B) 7.4. C) 1.4. D) 9.0. rd AL 941 ee The ss r is A) 26 O13% 4. Aa ise gathers de fllowig enan hos 1.3m Prle of SLe Cospe of % Canent peice of S142 5aer analeed spot ie e i year ansalied spet inten e is Using the abowe infomaion, the aralined 1.3qear spot se is clesest t A) 3% B 437 % O 662% D) 8.74 % 5. The cunont Evevear seot rate is 7 pence and the sisyear pot rate in 3 pees Wh is the one-year forward rate in five years (ansuming semi-anul compounding A) 6.54% B) 13.07% C) 12.56% D) 13.14% Venion Whar is the modified daration of a aeo-counon bond with 5 years to maturity (assuming semi-anual compounding), if the YTM is 5 percent? A) Cannot be determined. B) 4.76 7. A coupon bond that pays interest semi-annually has a par value of $1,000, matures in 5 years, and has a yield to maturity of 10 percent. What is the value of the bond today if C) 4.88 D) 5.00 the coupon rate is 8 percent? A) $922.78. B) S1,14431 C) $1,221.17 D) $956.71. 8. A bond has a modified duration of 6 and a convexity of 125. What happens to the bond's price if interest rates increase by 25 basis points? It goes: A) up 4.00% ) 1.46%6. C) down 1.46% D) down 15.00% 9. A bond investor buys the following bond on November 15, 2008 (assuming semi-annual compounding). If the bondholder holds this bond until maturity, which of the following statements is correct? Bond 4.25s of 11/15/2010 Price Face Amount 99-14+ $1,000 A) The bondholder pays $991.45 for this bond on November 15, 2008. B) The bondholder pays $994.53 for this bond on November 15, 2008. C) The bondholder receives $1,042.5 from the bond issuer at the maturity date of November 15, 2010 D) The bondholder receives a coupon payment of $42.5 every May and November 15th through November 15, 2010. 10. Suppose you have a three-security portfolio containing bonds A, B and C. The modified duration of the portfolio is 5.9. The market values of bonds A. B and C are $60, $25 and $80, respectively. The modified durations of bonds A and C are 4.2 and 6.2 respectively. Which of the following amounts is closest to the modified duration of bond ? A) 7.1 B) 7.4. C) 1.4. D) 9.0. rd AL 941 ee The ss r is A) 26 O13% 4. Aa ise gathers de fllowig enan hos 1.3m Prle of SLe Cospe of % Canent peice of S142 5aer analeed spot ie e i year ansalied spet inten e is Using the abowe infomaion, the aralined 1.3qear spot se is clesest t A) 3% B 437 % O 662% D) 8.74 % 5. The cunont Evevear seot rate is 7 pence and the sisyear pot rate in 3 pees Wh is the one-year forward rate in five years (ansuming semi-anul compounding A) 6.54% B) 13.07% C) 12.56% D) 13.14% Venion