Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Taxation QUESTION 3 20 marks, 36 minutes Baela Tully a South African resident, aged 34 works for a sporting goods supply company and sells sporting

Taxation

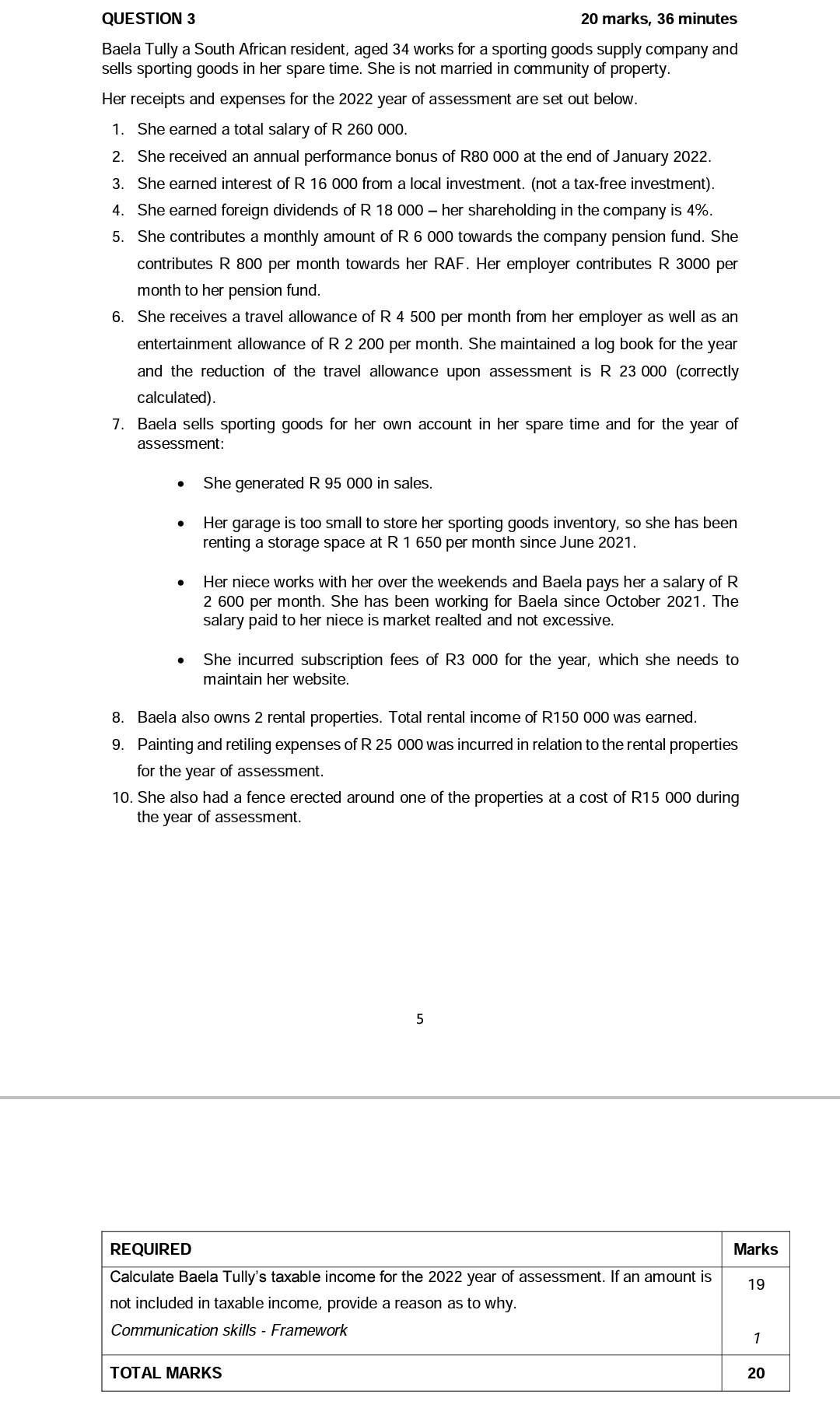

QUESTION 3 20 marks, 36 minutes Baela Tully a South African resident, aged 34 works for a sporting goods supply company and sells sporting goods in her spare time. She is not married in community of property. Her receipts and expenses for the 2022 year of assessment are set out below. 1. She earned a total salary of R260000. 2. She received an annual performance bonus of R80000 at the end of January 2022. 3. She earned interest of R16000 from a local investment. (not a tax-free investment). 4. She earned foreign dividends of R 18000 - her shareholding in the company is 4%. 5. She contributes a monthly amount of R6000 towards the company pension fund. She contributes R 800 per month towards her RAF. Her employer contributes R 3000 per month to her pension fund. 6. She receives a travel allowance of R 4500 per month from her employer as well as an entertainment allowance of R2200 per month. She maintained a log book for the year and the reduction of the travel allowance upon assessment is R23000 (correctly calculated). 7. Baela sells sporting goods for her own account in her spare time and for the year of assessment: - She generated R 95000 in sales. - Her garage is too small to store her sporting goods inventory, so she has been renting a storage space at R 1650 per month since June 2021. - Her niece works with her over the weekends and Baela pays her a salary of R 2600 per month. She has been working for Baela since October 2021 . The salary paid to her niece is market realted and not excessive. - She incurred subscription fees of R3 000 for the year, which she needs to maintain her website. 8. Baela also owns 2 rental properties. Total rental income of R150000 was earned. 9. Painting and retiling expenses of R25000 was incurred in relation to the rental properties for the year of assessment. 10. She also had a fence erected around one of the properties at a cost of R15000 during the year of assessment

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started