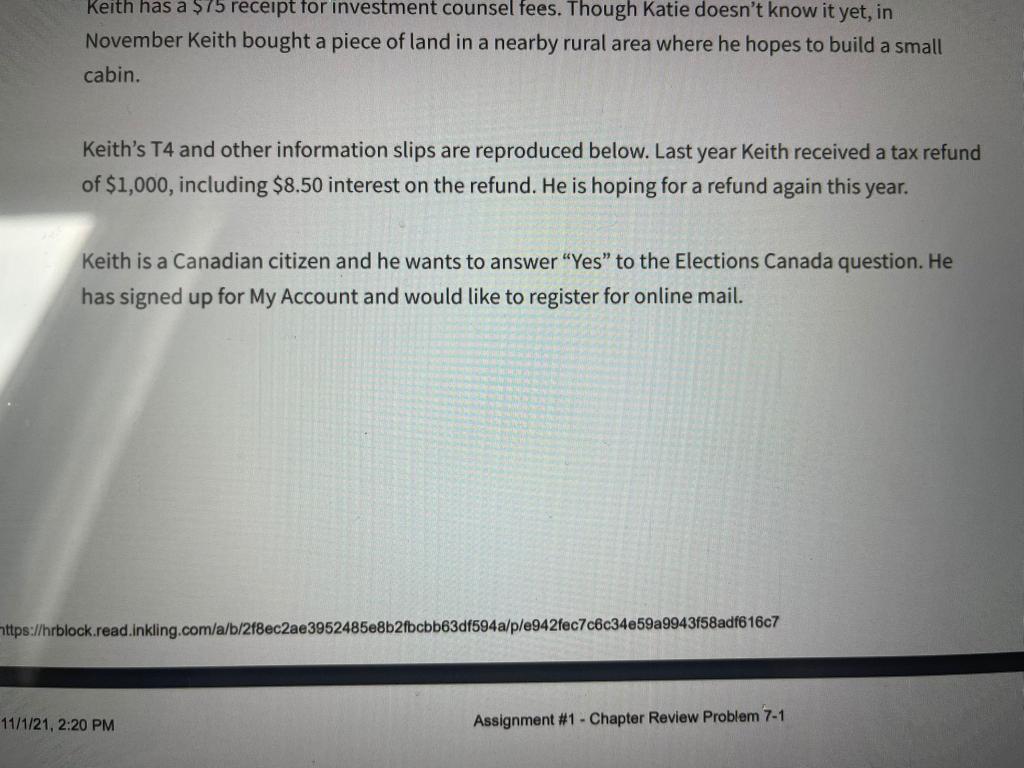

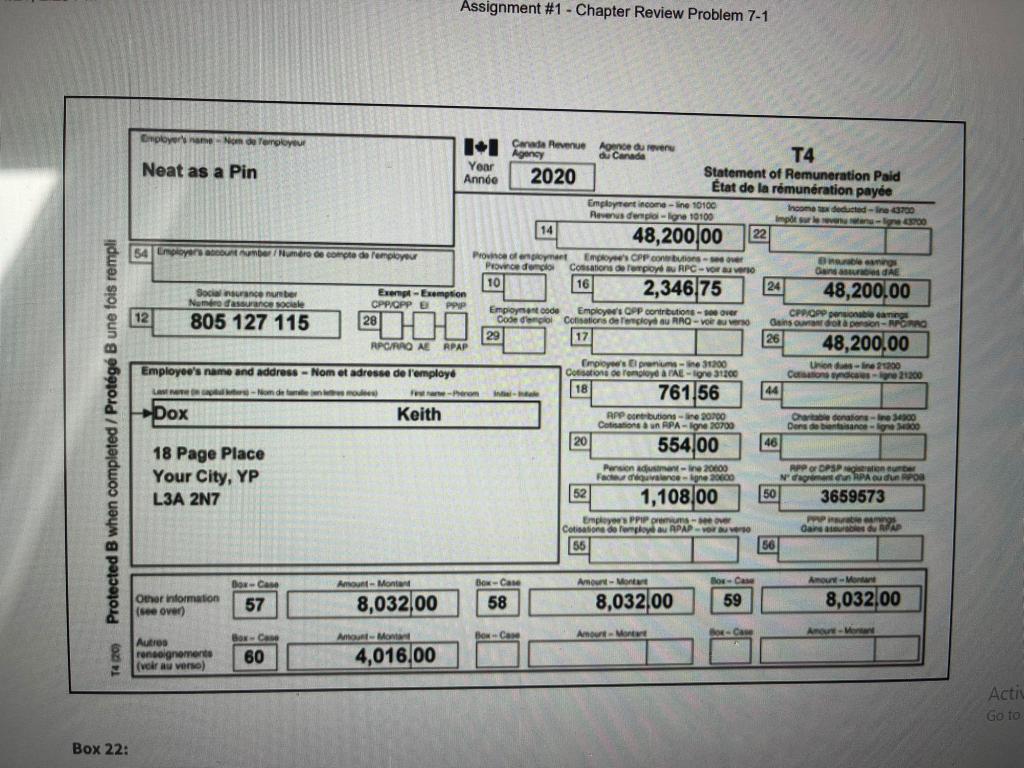

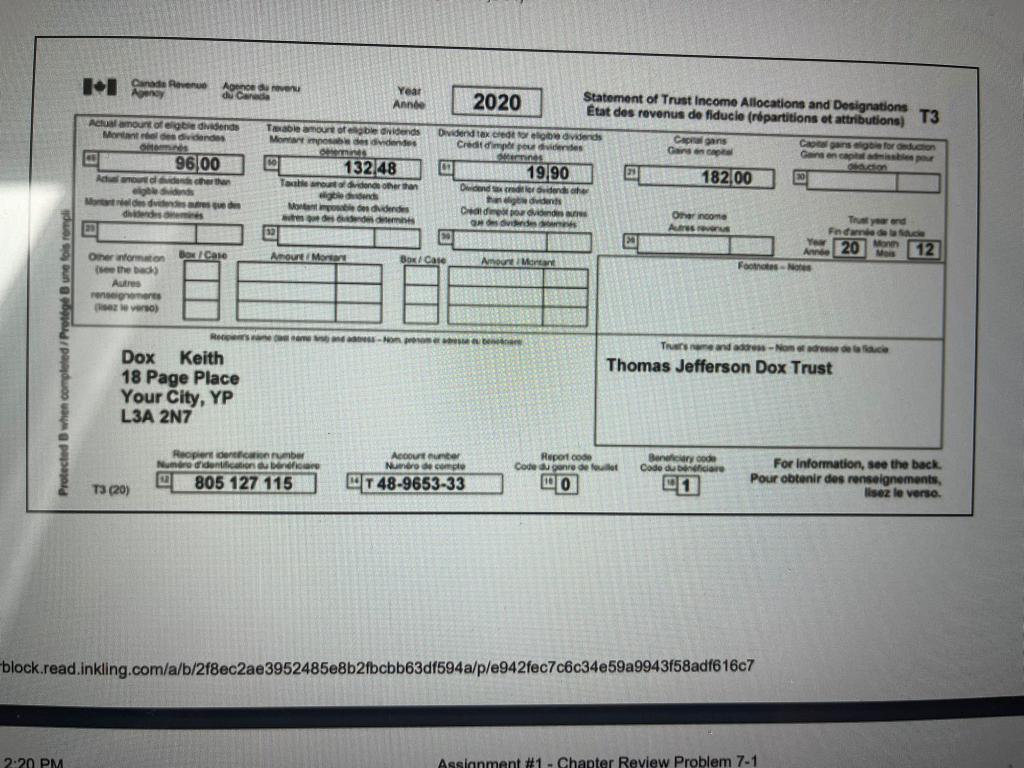

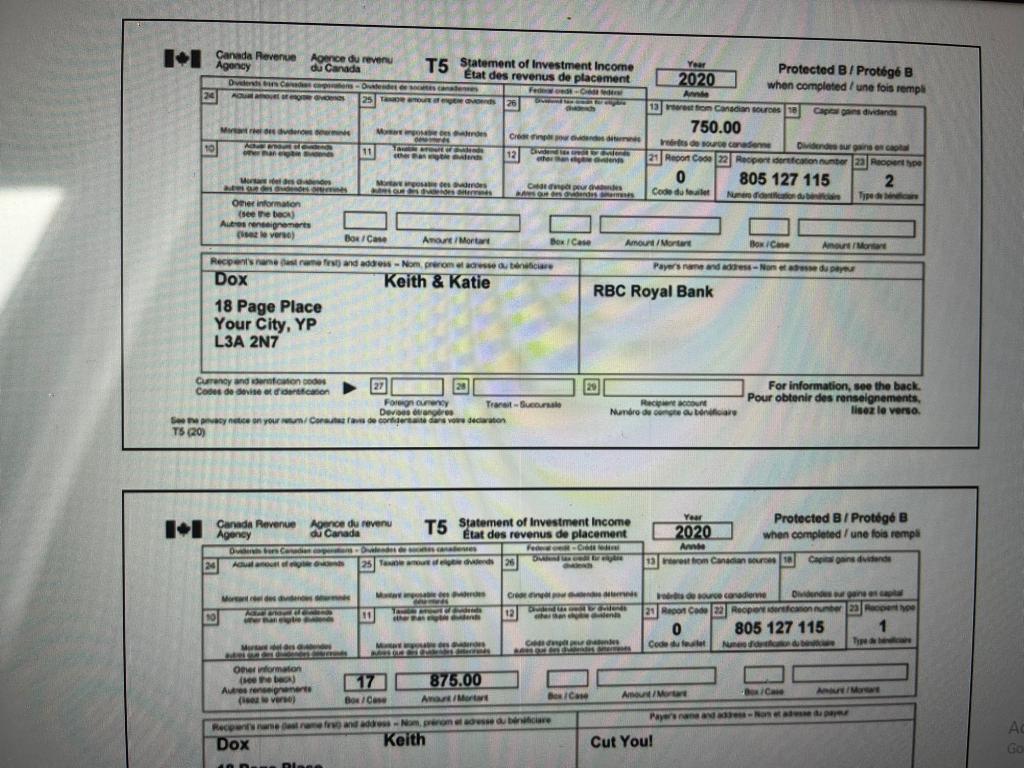

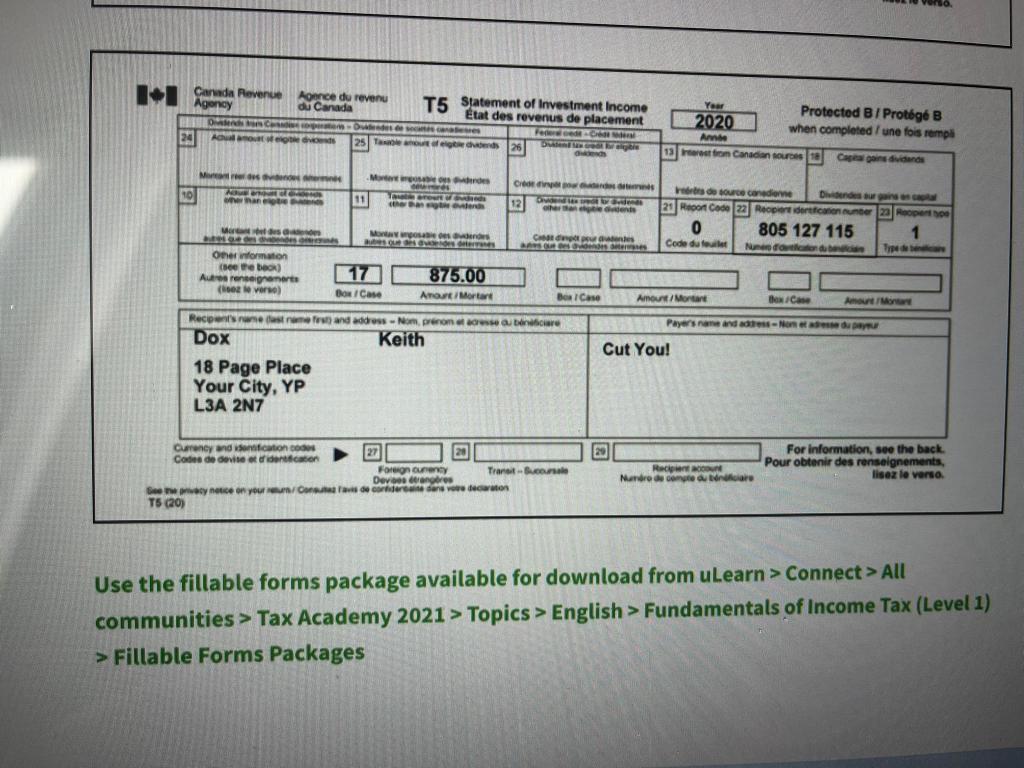

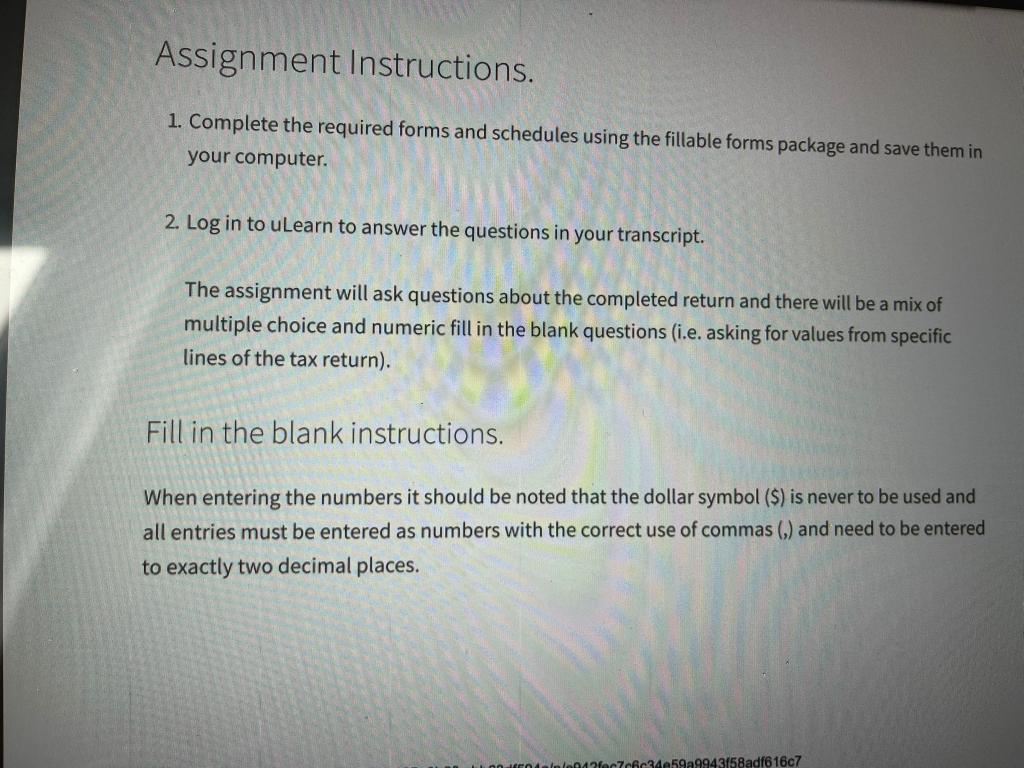

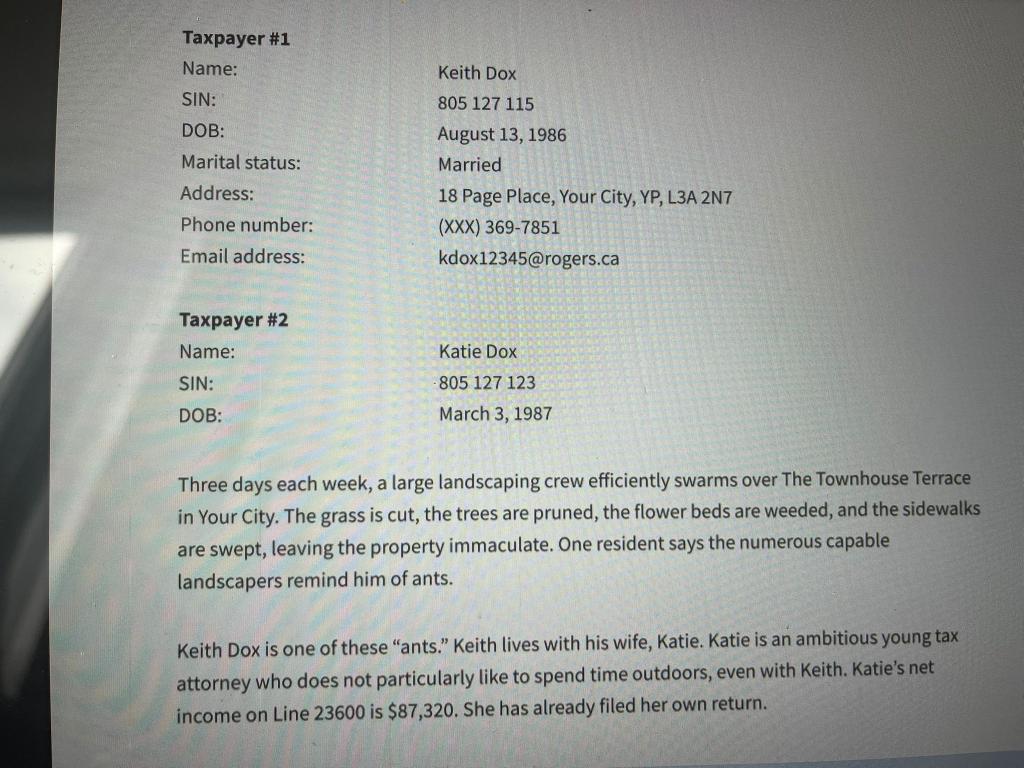

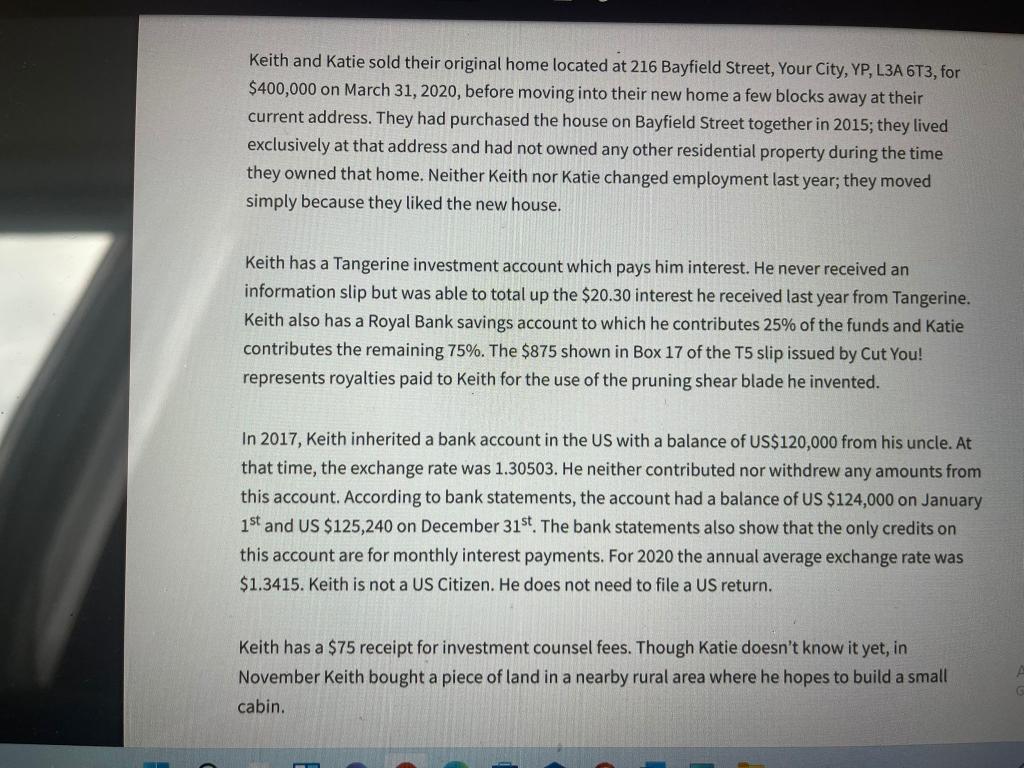

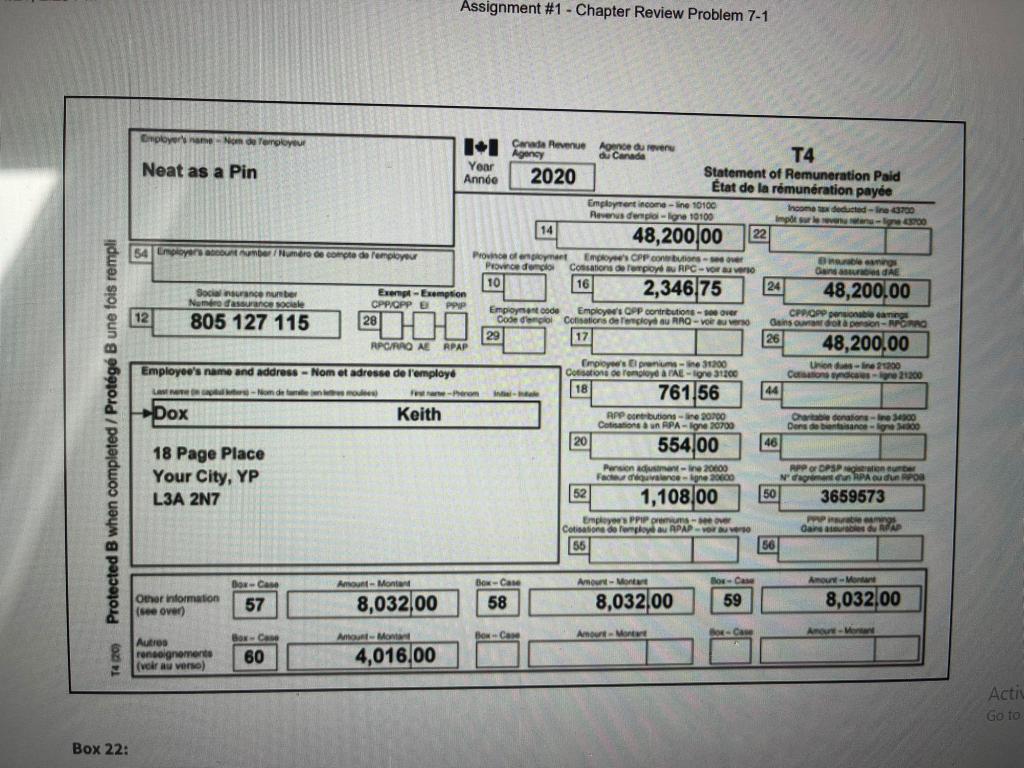

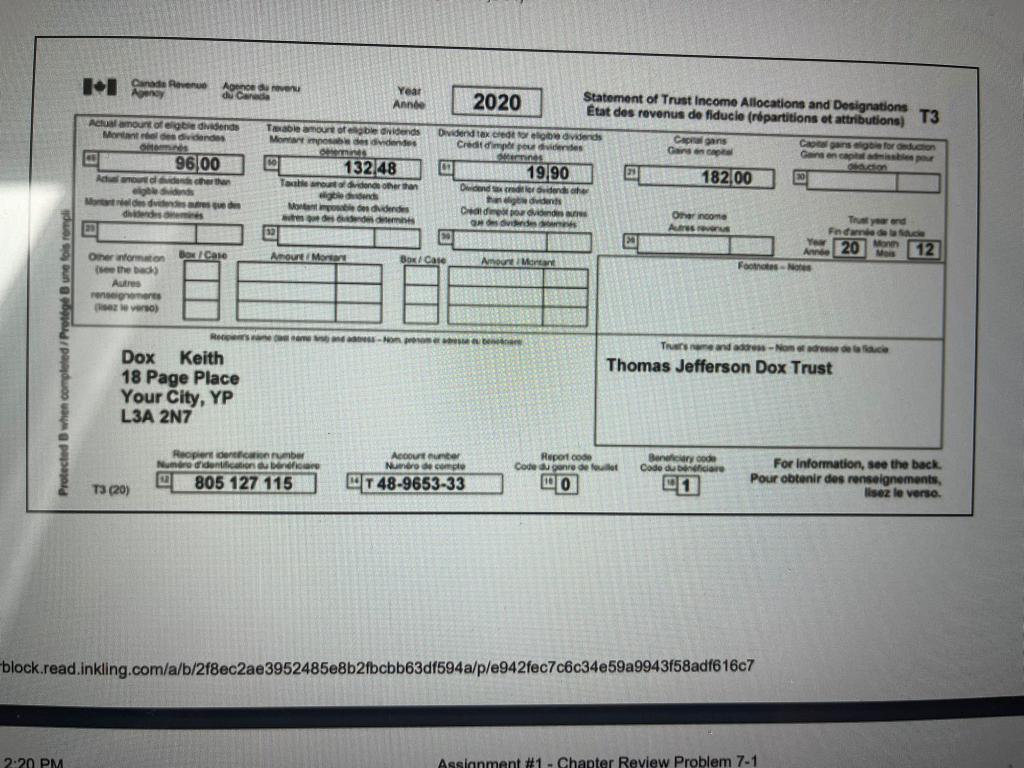

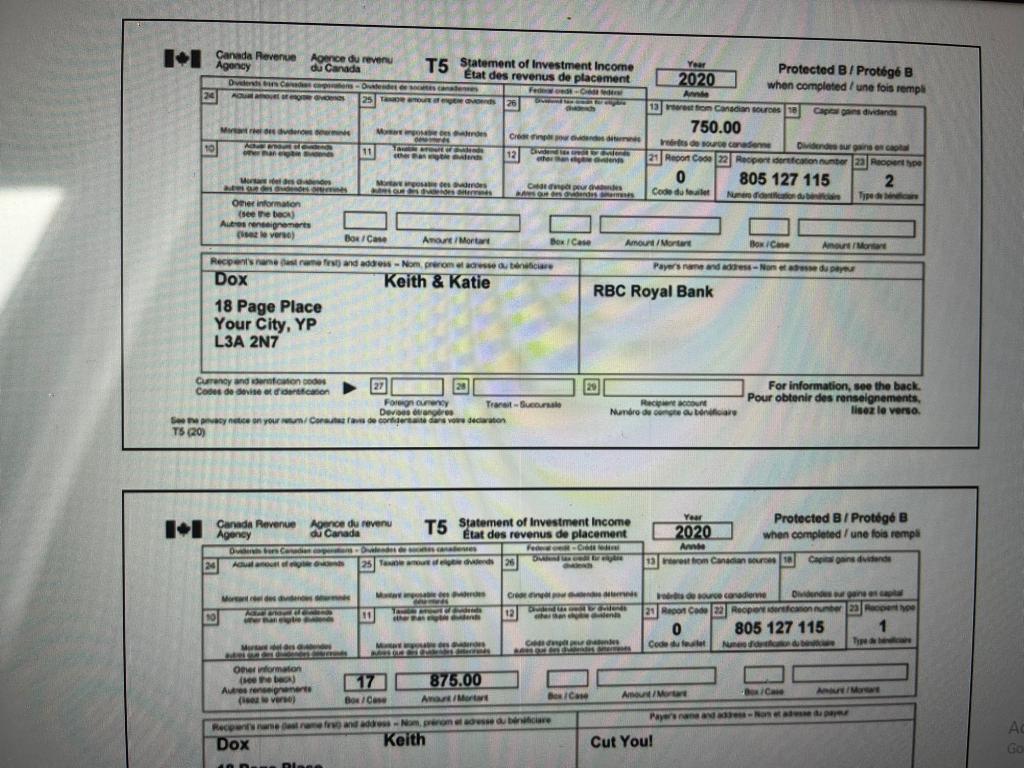

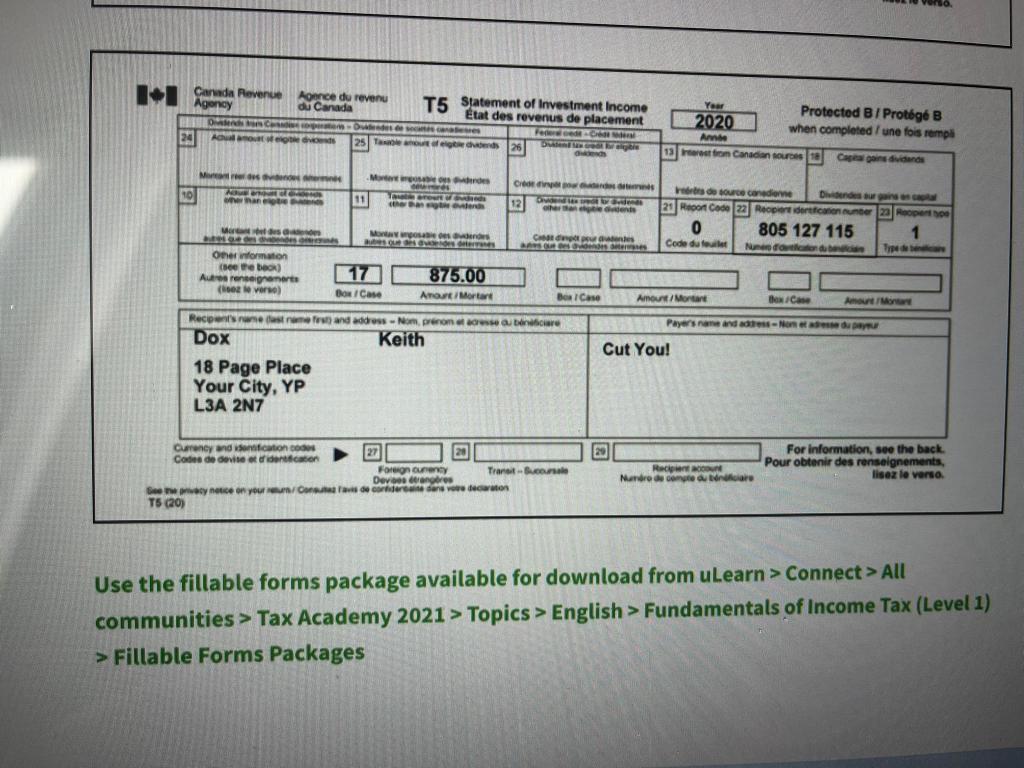

Taxpayer #1 Name: SIN: DOB: Marital status: Address: Phone number: Email address: Keith Dox 805 127 115 August 13, 1986 Married 18 Page Place, Your City, YP, L3A 2N7 (XXX) 369-7851 kdox12345@rogers.ca Taxpayer #2 Name: SIN: DOB: Katie Dox 805 127 123 March 3, 1987 Three days each week, a large landscaping crew efficiently swarms over The Townhouse Terrace in Your City. The grass is cut, the trees are pruned, the flower beds are weeded, and the sidewalks are swept, leaving the property immaculate. One resident says the numerous capable landscapers remind him of ants. Keith Dox is one of these "ants." Keith lives with his wife, Katie. Katie is an ambitious young tax attorney who does not particularly like to spend time outdoors, even with Keith. Katie's net income on Line 23600 is $87,320. She has already filed her own return. Keith and Katie sold their original home located at 216 Bayfield Street, Your City, YP, L3A 6T3, for $400,000 on March 31, 2020, before moving into their new home a few blocks away at their current address. They had purchased the house on Bayfield Street together in 2015; they lived exclusively at that address and had not owned any other residential property during the time they owned that home. Neither Keith nor Katie changed employment last year; they moved simply because they liked the new house. Keith has a Tangerine investment account which pays him interest. He never received an information slip but was able to total up the $20.30 interest he received last year from Tangerine. Keith also has a Royal Bank savings account to which he contributes 25% of the funds and Katie contributes the remaining 75%. The $875 shown in Box 17 of the T5 slip issued by Cut You! represents royalties paid to Keith for the use of the pruning shear blade he invented. In 2017, Keith inherited a bank account in the US with a balance of US$120,000 from his uncle. At that time, the exchange rate was 1.30503. He neither contributed nor withdrew any amounts from this account. According to bank statements, the account had a balance of US $124,000 on January 1st and US $125,240 on December 31st. The bank statements also show that the only credits on this account are for monthly interest payments. For 2020 the annual average exchange rate was $1.3415. Keith is not a US Citizen. He does not need to file a US return. Keith has a $75 receipt for investment counsel fees. Though Katie doesn't know it yet, in November Keith bought a piece of land in a nearby rural area where he hopes to build a small cabin. Keith has a $75 receipt for investment counsel fees. Though Katie doesn't know it yet, in November Keith bought a piece of land in a nearby rural area where he hopes to build a small cabin. Keith's T4 and other information slips are reproduced below. Last year Keith received a tax refund of $1,000, including $8.50 interest on the refund. He is hoping for a refund again this year. Keith is a Canadian citizen and he wants to answer "Yes" to the Elections Canada question. He has signed up for My Account and would like to register for online mail. https://hrblock.read.inkling.com/a/b/2f8ec2ae3952485e8b2fbcbb63df594a/p/e942fec7c6c34e59a9943f58adf616c7 11/1/21, 2:20 PM Assignment #1 - Chapter Review Problem 7-1 Assignment #1 - Chapter Review Problem 7-1 48,200.00 2,346 75 48,200.00 2811 Employer's name de famour I Canada Agence du rever Agency du Canada T4 Neat as a Pin Year Anndo 2020 Statement of Remuneration Paid tat de la rmunration paye Employment income-line 10100 theone weed -Ine 3700 Revenus depogre 10100 14 22 54mployers Combo Numero de corte de l'employeur Province of proyent Employees OPP combineer Ons Procedemplo Cossations poyd RPC-VOR BV Genu DAE 10 16 24 Social neurance number Exempt - Exemption Nando assurance sociale CPPOPP BPP Emponent code 12 CPROPP personas Employees OPP contribution - 100 over 805 127 115 Cose dampio Cotisations de rencov U RRO-vous Gain Guido a pension - RGARO 17 PPGARRO AE PAP Comployee's premiums - 31300 Unino 2200 Employee's name and address - Nom et adresse de l'employe Cotisations de moda TAL-31100 Commons Nice 21200 18 LAN From Dox Keith Cotionen APA-20700 RPP contrbutions - In 2000 Carta donation - 30000 Dons de banden 20 554.00 46 18 Page Place hendustment fra 2000 APP OOPSP Your City, YP Falegne 20000 N'dan PA ou dun POS 52 L3A 2N7 1,108,00 3659573 Employs PPP pre-se over pirms Cotisation de remployu APAP. voru Gang 55 56 48,200.00 76156 TA 20) Protected B when completed / Protg B une fois rempli Amount - Montent Amount Monte Boya Autor Other information (see over) Box Case 57 Box Case 58 8,032.00 8,032.00 59 8,032.00 bor-Case Anne-Marne Amour Monte Ant-MO Box Case Autres renseignements (ver a verse) Box Case 60 4,016,00 Acti Go to Box 22: Darede Revenue A Agence de Card Year Anne 2020 Statement of Trust Income Allocations and Designations Etat des revenus de fiducio (rpartitions et attributions) T3 Actual amount of biedende Mortes dividendes Ons 96,00 Adnoddan cheta Cengan Garson Cao angefordern Table amount of beidends Monat modvided ens DO 132 48 Toximou to do the then dies Mortationem dedes tres de de Dividend tax credt og dverds Creditimp pour desde nes 19,90 Didonda vidonda dividen Odpowded DO 182,00 Morredvidene tres que de dhe One non Autres revenus Tyrond Fndende Yee Anne Footnotes on 2012 Box Case Amount Monat Box Case Anout Maran Onerston see the beds Autres rensername verso) -on-on pa - Pog Turnendates - Nordea Thomas Jefferson Dox Trust Dox Keith 18 Page Place Your City, YP L3A 2N7 Repertoricorumber Numere identifications de 805 127 115 Acourt unter Numero de compte Report code Code du genre det 000 Bechorycode Code dedore 1 CT 48-9653-33 For information, see the back Pour obtenir des renseignements, lisez le verso T3 (20) block.read.inkling.com/a/b/2f8ec2ae3952485e8b2fbcbb63df594a/p/e942fec7c6c34e59a9943158adf616c7 2:20 PM Assignment #1 - Chapter Review Problem 7-1 Year Il Canada Revenue Agence du revenu Agency du Canada T5 Statement of Investment Income Etat des revenus de placement Dvous con Decame Few 20 AGRO 25 NON od 20 26 2020 Protected By Protg B when completed / une fois rempi Meldud Mode 10 an 11 Crowd 12 where the TOTEC ter 19 rest from Canadian Source 1 Cape an dividende 750.00 resource comedie Did surgico 21 Report Code 22 Reciport derfontoral Report the 0 805 127 115 2 Code du er No Type M Mos en des Oralind Cod pro Andes Other information (see treba Autres encrements verse) Box Case Amort / Mortant Box Case Amort/Mortar Bowice Amount Mon Payers and address - None per RBC Royal Bank Recipensament and address - Nom, preron la atenciare Dox Keith & Katie 18 Page Place Your City, YP L3A 2N7 29 Currency and en 27 20 Code de devise at identification Foreign curry Tranet - Sucursale Device angre Sync on your /Corsa de corte dans vowe declaration TS (20) For information, see the back. Pour obtenir des renseignements lisez le verso RE Nundo de corte Agency Canada Revenue O busca 24 Aduan revenu du Canada T5 Statement of Investment Income Etat des revenus de placement Free Com 25 med 26 Year Protected B / Protg B 2020 when completed / une fois rempa And 12 rent from Canadian Candande ho 1 MOMS CON Buco condere Didergone E 10 10 de 12 r 21 Report Code 22 Report on 23 0 805 127 115 Merawan MO CA Code de Numero hp Oriomaten Geb 17 875.00 A recente (verse Box Case Ana Maria Besicas Amt/Marco BC More Reconstruowane Nom prerons au beure Dox Keith Cut You! nia GO Il Canada Revenue Agence du revenu Agoney du Canada T5 Statement of Investment Income tat des revenus de placement Em canes Perde 24 Autos 25 Todds 126 Year Protected B / Protg B 2020 when completed / une fois rempi Ande tation Canadian Drapeagan danas 13 More Mode GO . Com rose or condime Diduga 10 han 111 TA terds 12 des Gende 2 Report Code 22 Recorderconen unter Roperto 0 805 127 115 1 Mer Mones Cape ASOS Code du feel Nun folleton Other formation (see te ben Autres renseignements 17 875.00 ( overse) Box Case ArtMotor Bea Case Amouret/Mortare Basic Amount Mon Recipes estan and address - Nom, prenons are Dox Keith Payer's name and ass-Nord Cut You! 18 Page Place Your City, YP L3A 2N7 Currency and Sections 27 rechten Code de devise actor 120 FOON Oy Tranatural Dev.coloro Beyonce on your conta do corretora de carton T5 (20) 20 Racco Nandre ordre For information, see the back. Pour obtenir des renseignements lisez le verso Use the fillable forms package available for download from uLearn > Connect > All communities > Tax Academy 2021 > Topics > English > Fundamentals of Income Tax (Level 1) > Fillable Forms Packages Assignment Instructions. 1. Complete the required forms and schedules using the fillable forms package and save them in your computer. 2. Log in to uLearn to answer the questions in your transcript. The assignment will ask questions about the completed return and there will be a mix of multiple choice and numeric fill in the blank questions (i.e. asking for values from specific lines of the tax return). Fill in the blank instructions. When entering the numbers it should be noted that the dollar symbol ($) is never to be used and all entries must be entered as numbers with the correct use of commas (,) and need to be entered to exactly two decimal places. non fec7cfc34e59a9943158adf616c7 For example if you were to enter the value of "one thousand" into a fill in the blank question the system will only accept the entry: 1,000.00 as a correct answer. Warning if the the answer to a specific question is "zero" this will also require two decimal places and must be entered as: 0.00 to be marked correct (i.e. the value 0 will not be accepted as correct). A GO Taxpayer #1 Name: SIN: DOB: Marital status: Address: Phone number: Email address: Keith Dox 805 127 115 August 13, 1986 Married 18 Page Place, Your City, YP, L3A 2N7 (XXX) 369-7851 kdox12345@rogers.ca Taxpayer #2 Name: SIN: DOB: Katie Dox 805 127 123 March 3, 1987 Three days each week, a large landscaping crew efficiently swarms over The Townhouse Terrace in Your City. The grass is cut, the trees are pruned, the flower beds are weeded, and the sidewalks are swept, leaving the property immaculate. One resident says the numerous capable landscapers remind him of ants. Keith Dox is one of these "ants." Keith lives with his wife, Katie. Katie is an ambitious young tax attorney who does not particularly like to spend time outdoors, even with Keith. Katie's net income on Line 23600 is $87,320. She has already filed her own return. Keith and Katie sold their original home located at 216 Bayfield Street, Your City, YP, L3A 6T3, for $400,000 on March 31, 2020, before moving into their new home a few blocks away at their current address. They had purchased the house on Bayfield Street together in 2015; they lived exclusively at that address and had not owned any other residential property during the time they owned that home. Neither Keith nor Katie changed employment last year; they moved simply because they liked the new house. Keith has a Tangerine investment account which pays him interest. He never received an information slip but was able to total up the $20.30 interest he received last year from Tangerine. Keith also has a Royal Bank savings account to which he contributes 25% of the funds and Katie contributes the remaining 75%. The $875 shown in Box 17 of the T5 slip issued by Cut You! represents royalties paid to Keith for the use of the pruning shear blade he invented. In 2017, Keith inherited a bank account in the US with a balance of US$120,000 from his uncle. At that time, the exchange rate was 1.30503. He neither contributed nor withdrew any amounts from this account. According to bank statements, the account had a balance of US $124,000 on January 1st and US $125,240 on December 31st. The bank statements also show that the only credits on this account are for monthly interest payments. For 2020 the annual average exchange rate was $1.3415. Keith is not a US Citizen. He does not need to file a US return. Keith has a $75 receipt for investment counsel fees. Though Katie doesn't know it yet, in November Keith bought a piece of land in a nearby rural area where he hopes to build a small cabin. Keith has a $75 receipt for investment counsel fees. Though Katie doesn't know it yet, in November Keith bought a piece of land in a nearby rural area where he hopes to build a small cabin. Keith's T4 and other information slips are reproduced below. Last year Keith received a tax refund of $1,000, including $8.50 interest on the refund. He is hoping for a refund again this year. Keith is a Canadian citizen and he wants to answer "Yes" to the Elections Canada question. He has signed up for My Account and would like to register for online mail. https://hrblock.read.inkling.com/a/b/2f8ec2ae3952485e8b2fbcbb63df594a/p/e942fec7c6c34e59a9943f58adf616c7 11/1/21, 2:20 PM Assignment #1 - Chapter Review Problem 7-1 Assignment #1 - Chapter Review Problem 7-1 48,200.00 2,346 75 48,200.00 2811 Employer's name de famour I Canada Agence du rever Agency du Canada T4 Neat as a Pin Year Anndo 2020 Statement of Remuneration Paid tat de la rmunration paye Employment income-line 10100 theone weed -Ine 3700 Revenus depogre 10100 14 22 54mployers Combo Numero de corte de l'employeur Province of proyent Employees OPP combineer Ons Procedemplo Cossations poyd RPC-VOR BV Genu DAE 10 16 24 Social neurance number Exempt - Exemption Nando assurance sociale CPPOPP BPP Emponent code 12 CPROPP personas Employees OPP contribution - 100 over 805 127 115 Cose dampio Cotisations de rencov U RRO-vous Gain Guido a pension - RGARO 17 PPGARRO AE PAP Comployee's premiums - 31300 Unino 2200 Employee's name and address - Nom et adresse de l'employe Cotisations de moda TAL-31100 Commons Nice 21200 18 LAN From Dox Keith Cotionen APA-20700 RPP contrbutions - In 2000 Carta donation - 30000 Dons de banden 20 554.00 46 18 Page Place hendustment fra 2000 APP OOPSP Your City, YP Falegne 20000 N'dan PA ou dun POS 52 L3A 2N7 1,108,00 3659573 Employs PPP pre-se over pirms Cotisation de remployu APAP. voru Gang 55 56 48,200.00 76156 TA 20) Protected B when completed / Protg B une fois rempli Amount - Montent Amount Monte Boya Autor Other information (see over) Box Case 57 Box Case 58 8,032.00 8,032.00 59 8,032.00 bor-Case Anne-Marne Amour Monte Ant-MO Box Case Autres renseignements (ver a verse) Box Case 60 4,016,00 Acti Go to Box 22: Darede Revenue A Agence de Card Year Anne 2020 Statement of Trust Income Allocations and Designations Etat des revenus de fiducio (rpartitions et attributions) T3 Actual amount of biedende Mortes dividendes Ons 96,00 Adnoddan cheta Cengan Garson Cao angefordern Table amount of beidends Monat modvided ens DO 132 48 Toximou to do the then dies Mortationem dedes tres de de Dividend tax credt og dverds Creditimp pour desde nes 19,90 Didonda vidonda dividen Odpowded DO 182,00 Morredvidene tres que de dhe One non Autres revenus Tyrond Fndende Yee Anne Footnotes on 2012 Box Case Amount Monat Box Case Anout Maran Onerston see the beds Autres rensername verso) -on-on pa - Pog Turnendates - Nordea Thomas Jefferson Dox Trust Dox Keith 18 Page Place Your City, YP L3A 2N7 Repertoricorumber Numere identifications de 805 127 115 Acourt unter Numero de compte Report code Code du genre det 000 Bechorycode Code dedore 1 CT 48-9653-33 For information, see the back Pour obtenir des renseignements, lisez le verso T3 (20) block.read.inkling.com/a/b/2f8ec2ae3952485e8b2fbcbb63df594a/p/e942fec7c6c34e59a9943158adf616c7 2:20 PM Assignment #1 - Chapter Review Problem 7-1 Year Il Canada Revenue Agence du revenu Agency du Canada T5 Statement of Investment Income Etat des revenus de placement Dvous con Decame Few 20 AGRO 25 NON od 20 26 2020 Protected By Protg B when completed / une fois rempi Meldud Mode 10 an 11 Crowd 12 where the TOTEC ter 19 rest from Canadian Source 1 Cape an dividende 750.00 resource comedie Did surgico 21 Report Code 22 Reciport derfontoral Report the 0 805 127 115 2 Code du er No Type M Mos en des Oralind Cod pro Andes Other information (see treba Autres encrements verse) Box Case Amort / Mortant Box Case Amort/Mortar Bowice Amount Mon Payers and address - None per RBC Royal Bank Recipensament and address - Nom, preron la atenciare Dox Keith & Katie 18 Page Place Your City, YP L3A 2N7 29 Currency and en 27 20 Code de devise at identification Foreign curry Tranet - Sucursale Device angre Sync on your /Corsa de corte dans vowe declaration TS (20) For information, see the back. Pour obtenir des renseignements lisez le verso RE Nundo de corte Agency Canada Revenue O busca 24 Aduan revenu du Canada T5 Statement of Investment Income Etat des revenus de placement Free Com 25 med 26 Year Protected B / Protg B 2020 when completed / une fois rempa And 12 rent from Canadian Candande ho 1 MOMS CON Buco condere Didergone E 10 10 de 12 r 21 Report Code 22 Report on 23 0 805 127 115 Merawan MO CA Code de Numero hp Oriomaten Geb 17 875.00 A recente (verse Box Case Ana Maria Besicas Amt/Marco BC More Reconstruowane Nom prerons au beure Dox Keith Cut You! nia GO Il Canada Revenue Agence du revenu Agoney du Canada T5 Statement of Investment Income tat des revenus de placement Em canes Perde 24 Autos 25 Todds 126 Year Protected B / Protg B 2020 when completed / une fois rempi Ande tation Canadian Drapeagan danas 13 More Mode GO . Com rose or condime Diduga 10 han 111 TA terds 12 des Gende 2 Report Code 22 Recorderconen unter Roperto 0 805 127 115 1 Mer Mones Cape ASOS Code du feel Nun folleton Other formation (see te ben Autres renseignements 17 875.00 ( overse) Box Case ArtMotor Bea Case Amouret/Mortare Basic Amount Mon Recipes estan and address - Nom, prenons are Dox Keith Payer's name and ass-Nord Cut You! 18 Page Place Your City, YP L3A 2N7 Currency and Sections 27 rechten Code de devise actor 120 FOON Oy Tranatural Dev.coloro Beyonce on your conta do corretora de carton T5 (20) 20 Racco Nandre ordre For information, see the back. Pour obtenir des renseignements lisez le verso Use the fillable forms package available for download from uLearn > Connect > All communities > Tax Academy 2021 > Topics > English > Fundamentals of Income Tax (Level 1) > Fillable Forms Packages Assignment Instructions. 1. Complete the required forms and schedules using the fillable forms package and save them in your computer. 2. Log in to uLearn to answer the questions in your transcript. The assignment will ask questions about the completed return and there will be a mix of multiple choice and numeric fill in the blank questions (i.e. asking for values from specific lines of the tax return). Fill in the blank instructions. When entering the numbers it should be noted that the dollar symbol ($) is never to be used and all entries must be entered as numbers with the correct use of commas (,) and need to be entered to exactly two decimal places. non fec7cfc34e59a9943158adf616c7 For example if you were to enter the value of "one thousand" into a fill in the blank question the system will only accept the entry: 1,000.00 as a correct answer. Warning if the the answer to a specific question is "zero" this will also require two decimal places and must be entered as: 0.00 to be marked correct (i.e. the value 0 will not be accepted as correct). A GO