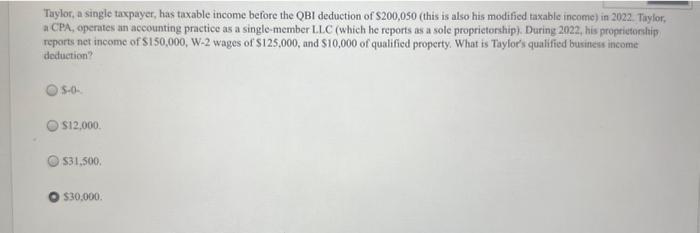

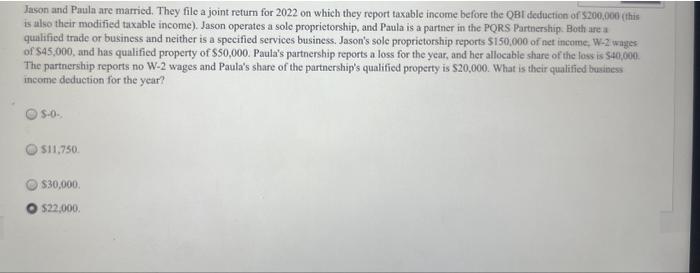

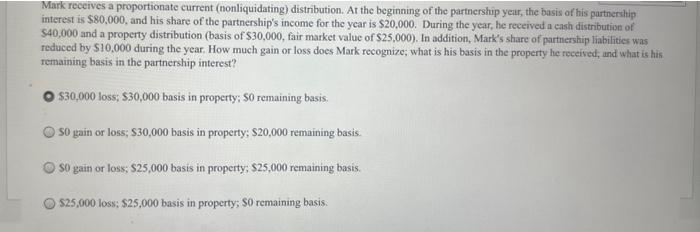

Taylor, a single taxpayer, has taxable income before the QB1 deduction of $200,050 (this is also his modified taxable income) in 2022 . Tiylor, a CPA, operates an accounting practice as a single-member LLC (which he reports as a sole proprictorship). During 2022, his proprictorhtip reports net income of $150,000, W-2 wages of $125,000, and $10,000 of qualified property. What is Taylor's qualified business income deduction? $12,000. $31,500. $30,000. Jason and Paula are married. They file a joint return for 2022 on which they report taxable income before the QBI deduction of 5200,000 (this is also their modified taxable income). Jason operates a sole proprictorship, and Paula is a partner in the PQRS Partnership. Both area qualified trade or business and neither is a specified services business. Jason's sole proprictorship reports $150,000 of net income, W-2 wages of $45,000, and has qualified property of $50,000. Paula's partnership reports a loss for the year, and her allocable share of the loss is $40,000. The partnership reports no W-2 wages and Paula's share of the partnership's qualified property is $20,000. What is their qualified business income deduction for the year? $11,750 $30,000. 522,000. Mark receives a proportionate current (nonliquidating) distribution. At the beginning of the partnership year, the basis of his partnership interest is $80,000, and his share of the partnership's income for the ycar is $20.000. During the year, he reeeived a eash distribution of $40,000 and a property distribution (basis of $30,000, fair market value of $25,000 ). In addition, Mark's share of partmership liabilities was reduced by $10.000 during the year. How much gain or loss does Mark recognize; what is his basis in the property he received, und what is his remaining basis in the partnership interest? $30,000 loss; $30,000 basis in property; $0 remaining basis $0 gain or loss; $30,000 basis in property; $20,000 remaining basis. $0 gain or loss; $25,000 basis in property; $25,000 remaining basis. $25,000 loss: $25,000 basis in property; $0 remaining basis