Question

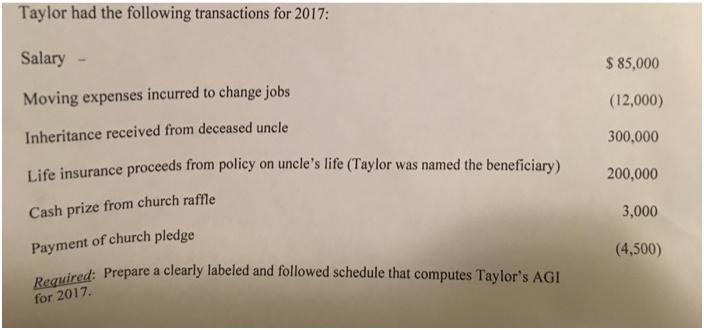

Taylor had the following transactions for 2017: Salary $ 85,000 Moving expenses incurred to change jobs (12,000) Inheritance received from deceased uncle 300,000 Life

Taylor had the following transactions for 2017: Salary $ 85,000 Moving expenses incurred to change jobs (12,000) Inheritance received from deceased uncle 300,000 Life insurance proceeds from policy on uncle's life (Taylor was named the beneficiary) 200,000 Cash prize from church raffle 3,000 Payment of church pledge (4,500) Required: Prepare a clearly labeled and followed schedule that computes Taylor's AGI for 2017.

Step by Step Solution

3.40 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

76000 85000salary3000raffle prize12000moving expe...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

College Accounting A Practical Approach

Authors: Jeffrey Slater

12th edition

978-0132772068, 133468100, 013277206X, 9780133468106, 978-0133133233

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App