Answered step by step

Verified Expert Solution

Question

1 Approved Answer

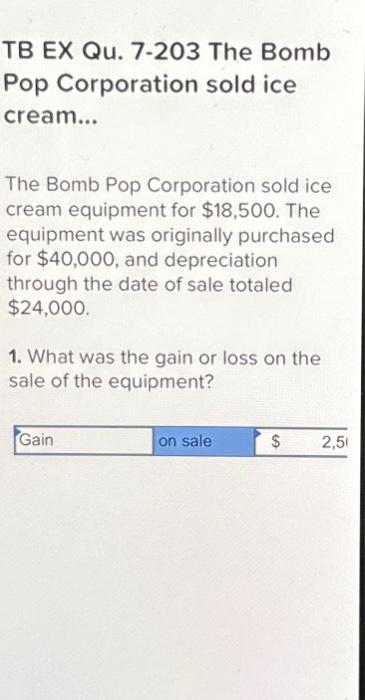

TB EX Qu. 7-203 The Bomb Pop Corporation sold ice cream... The Bomb Pop Corporation sold ice cream equipment for $18,500. The equipment was

TB EX Qu. 7-203 The Bomb Pop Corporation sold ice cream... The Bomb Pop Corporation sold ice cream equipment for $18,500. The equipment was originally purchased for $40,000, and depreciation through the date of sale totaled $24,000. 1. What was the gain or loss on the sale of the equipment? Gain on sale $ 2,5 2. Record the sale of the equipment. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry workshe < 1 Record the sale of the equipment Note: Enter debits before credits. Transaction 1 Gene Record the sale of the equipment. Note: Enter debits before credits. Transaction 1 General Journal Debit Cred

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Gain on sale of equipment can be computed as Sale value Cost Depreciati...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started