Answered step by step

Verified Expert Solution

Question

1 Approved Answer

TB MC Qu. 09-146 (Static) On December 3, the Celtics... On December 3, the Celtics sold a six-game pack of advance tickets for $3,000 cash.

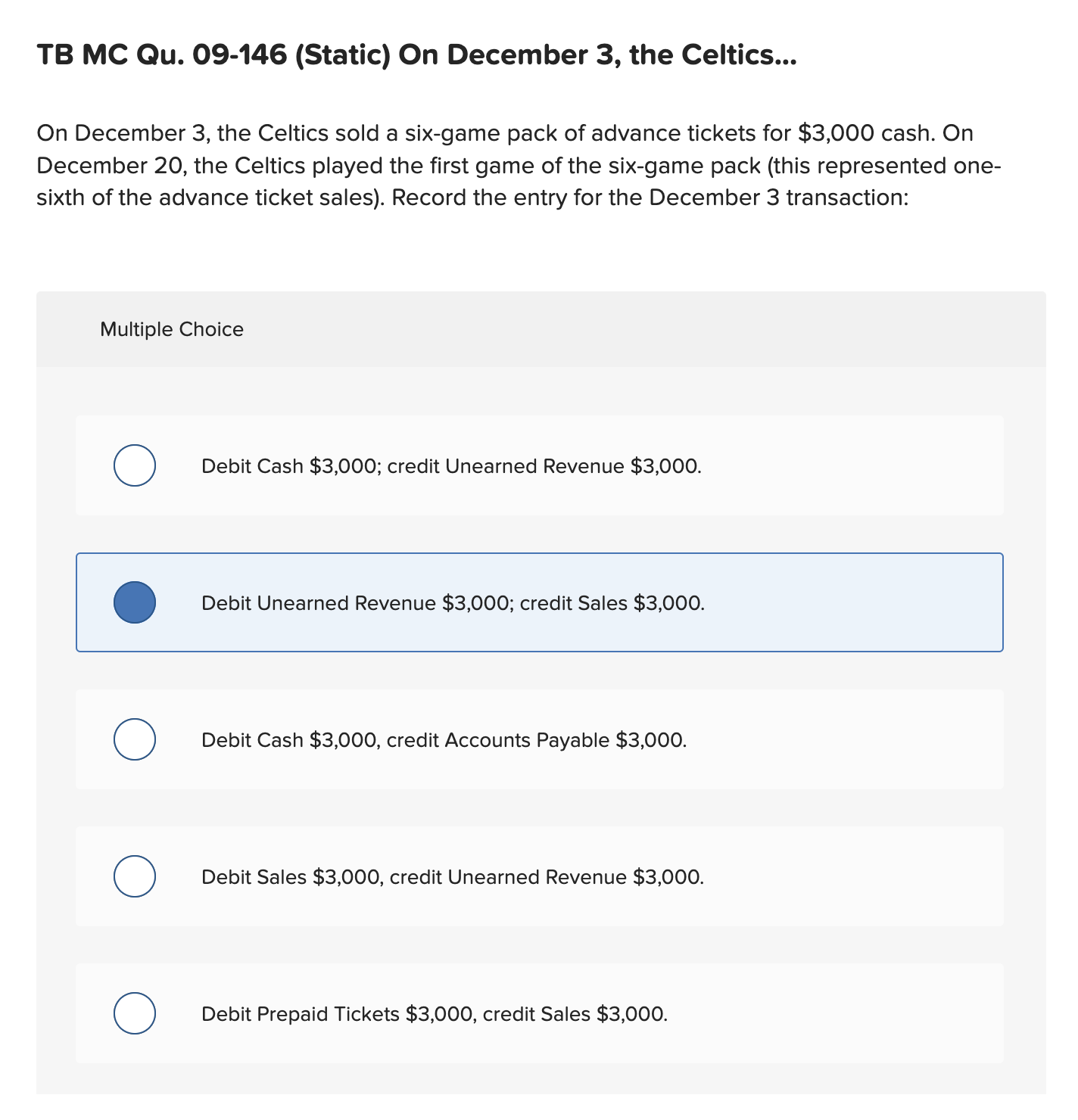

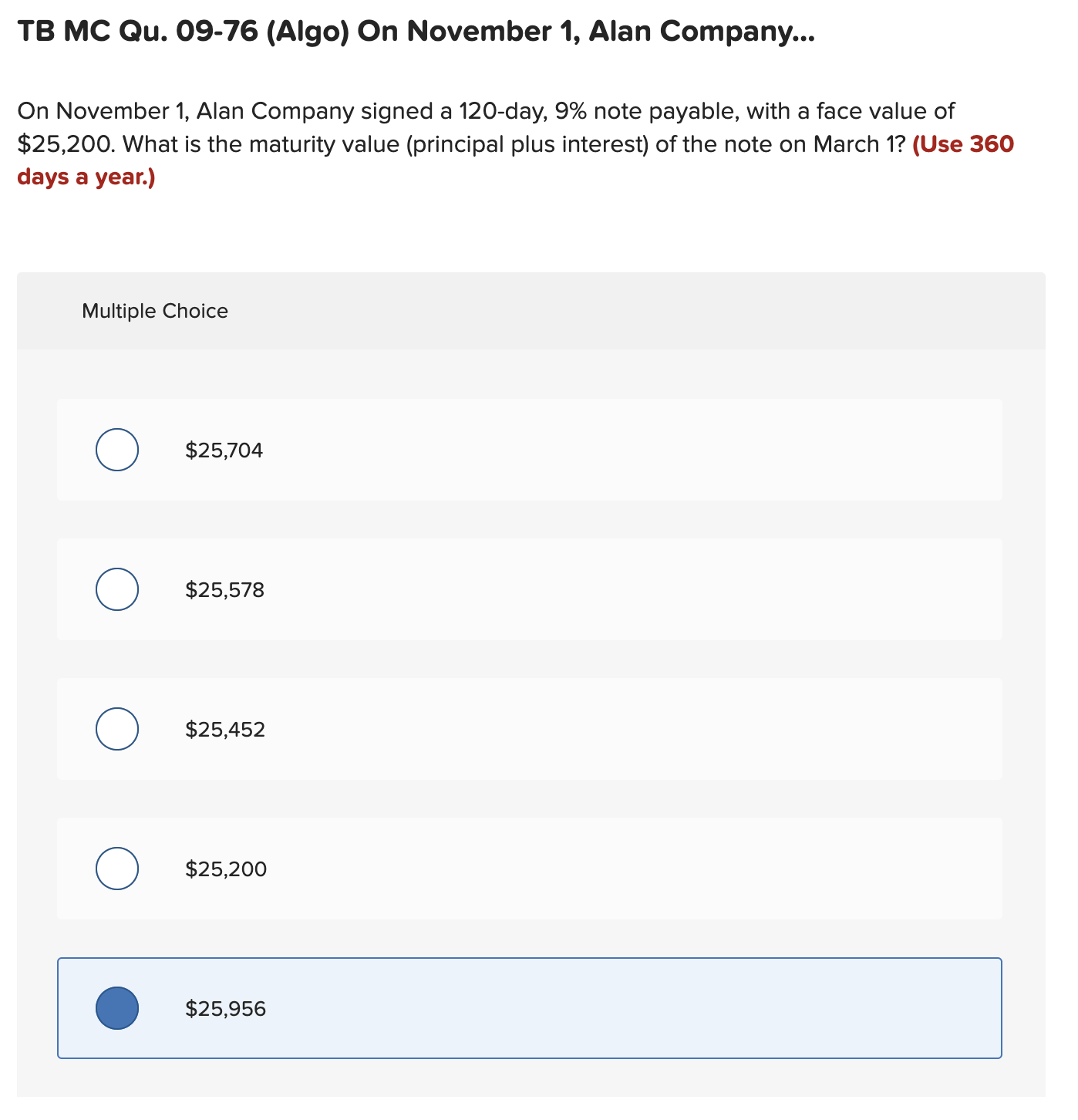

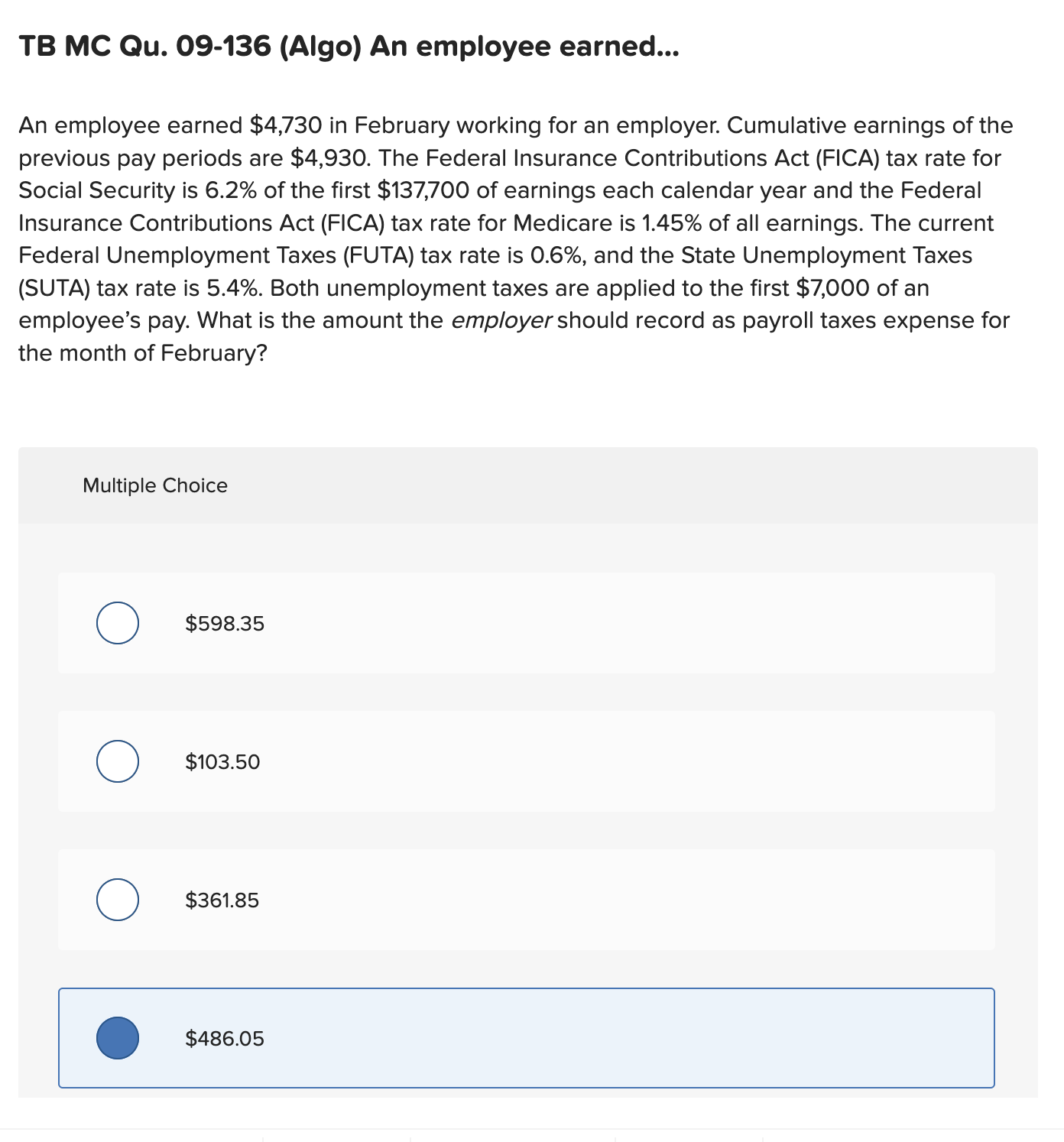

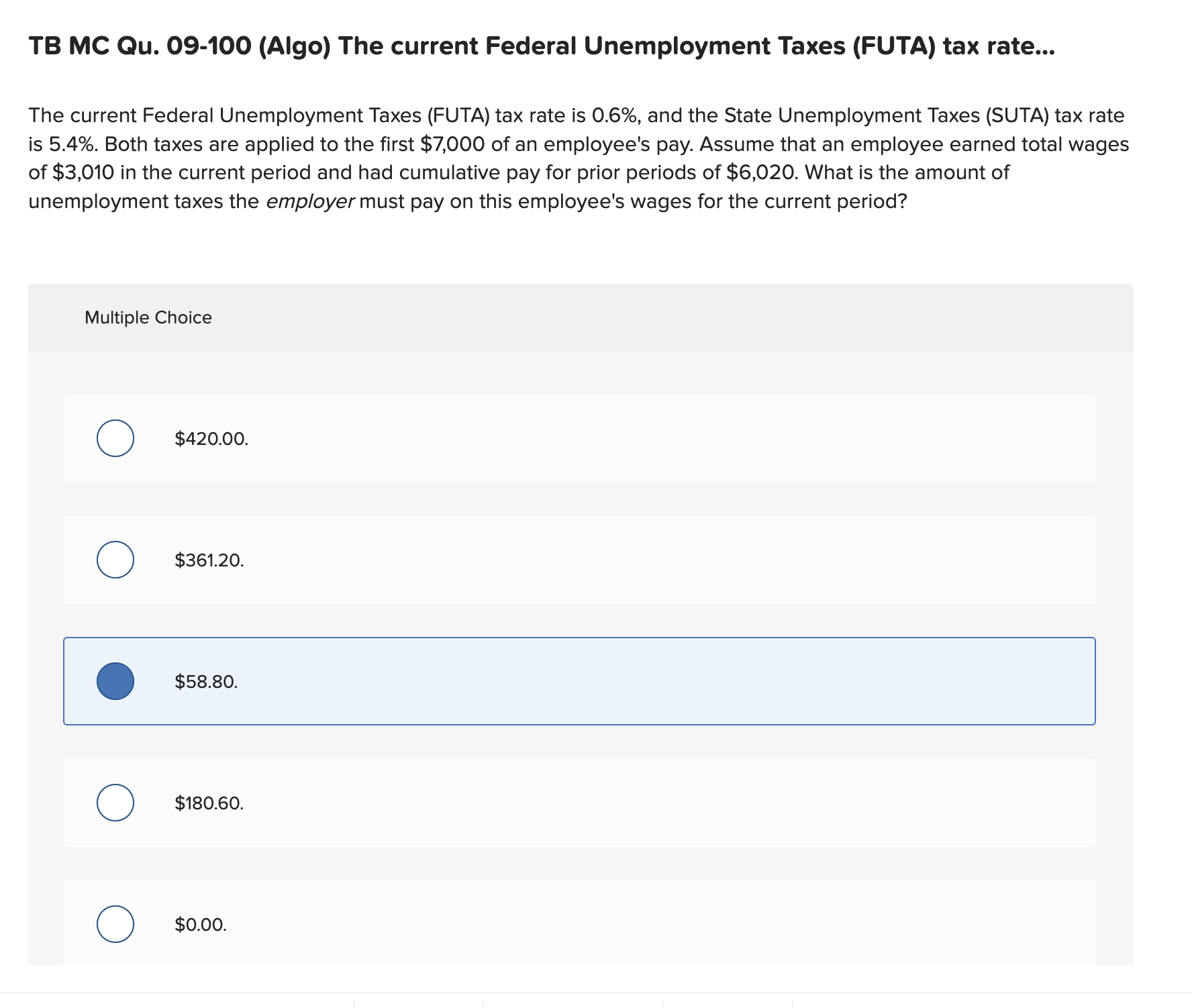

TB MC Qu. 09-146 (Static) On December 3, the Celtics... On December 3, the Celtics sold a six-game pack of advance tickets for $3,000 cash. On December 20, the Celtics played the first game of the six-game pack (this represented onesixth of the advance ticket sales). Record the entry for the December 3 transaction: Multiple Choice Debit Cash \$3,000; credit Unearned Revenue $3,000. Debit Unearned Revenue $3,000; credit Sales $3,000. Debit Cash $3,000, credit Accounts Payable $3,000. Debit Sales $3,000, credit Unearned Revenue $3,000. Debit Prepaid Tickets $3,000, credit Sales $3,000. TB MC Qu. 09-136 (Algo) An employee earned... An employee earned $4,730 in February working for an employer. Cumulative earnings of the previous pay periods are $4,930. The Federal Insurance Contributions Act (FICA) tax rate for Social Security is 6.2% of the first $137,700 of earnings each calendar year and the Federal Insurance Contributions Act (FICA) tax rate for Medicare is 1.45% of all earnings. The current Federal Unemployment Taxes (FUTA) tax rate is 0.6%, and the State Unemployment Taxes (SUTA) tax rate is 5.4%. Both unemployment taxes are applied to the first $7,000 of an employee's pay. What is the amount the employer should record as payroll taxes expense for the month of February? Multiple Choice $598.35 $103.50 $361.85 $486.05 TB MC Qu. 09-76 (Algo) On November 1, Alan Company... On November 1, Alan Company signed a 120-day, 9% note payable, with a face value of $25,200. What is the maturity value (principal plus interest) of the note on March 1? (Use 360 days a year.) Multiple Choice $25,704 $25,578 $25,452 $25,200 $25,956 TB MC Qu. 09-100 (Algo) The current Federal Unemployment Taxes (FUTA) tax rate... The current Federal Unemployment Taxes (FUTA) tax rate is 0.6%, and the State Unemployment Taxes (SUTA) tax rate is 5.4%. Both taxes are applied to the first $7,000 of an employee's pay. Assume that an employee earned total wages of $3,010 in the current period and had cumulative pay for prior periods of $6,020. What is the amount of unemployment taxes the employer must pay on this employee's wages for the current period? Multiple Choice $420.00. \$361.20. $58.80. $180.60. $0.00

TB MC Qu. 09-146 (Static) On December 3, the Celtics... On December 3, the Celtics sold a six-game pack of advance tickets for $3,000 cash. On December 20, the Celtics played the first game of the six-game pack (this represented onesixth of the advance ticket sales). Record the entry for the December 3 transaction: Multiple Choice Debit Cash \$3,000; credit Unearned Revenue $3,000. Debit Unearned Revenue $3,000; credit Sales $3,000. Debit Cash $3,000, credit Accounts Payable $3,000. Debit Sales $3,000, credit Unearned Revenue $3,000. Debit Prepaid Tickets $3,000, credit Sales $3,000. TB MC Qu. 09-136 (Algo) An employee earned... An employee earned $4,730 in February working for an employer. Cumulative earnings of the previous pay periods are $4,930. The Federal Insurance Contributions Act (FICA) tax rate for Social Security is 6.2% of the first $137,700 of earnings each calendar year and the Federal Insurance Contributions Act (FICA) tax rate for Medicare is 1.45% of all earnings. The current Federal Unemployment Taxes (FUTA) tax rate is 0.6%, and the State Unemployment Taxes (SUTA) tax rate is 5.4%. Both unemployment taxes are applied to the first $7,000 of an employee's pay. What is the amount the employer should record as payroll taxes expense for the month of February? Multiple Choice $598.35 $103.50 $361.85 $486.05 TB MC Qu. 09-76 (Algo) On November 1, Alan Company... On November 1, Alan Company signed a 120-day, 9% note payable, with a face value of $25,200. What is the maturity value (principal plus interest) of the note on March 1? (Use 360 days a year.) Multiple Choice $25,704 $25,578 $25,452 $25,200 $25,956 TB MC Qu. 09-100 (Algo) The current Federal Unemployment Taxes (FUTA) tax rate... The current Federal Unemployment Taxes (FUTA) tax rate is 0.6%, and the State Unemployment Taxes (SUTA) tax rate is 5.4%. Both taxes are applied to the first $7,000 of an employee's pay. Assume that an employee earned total wages of $3,010 in the current period and had cumulative pay for prior periods of $6,020. What is the amount of unemployment taxes the employer must pay on this employee's wages for the current period? Multiple Choice $420.00. \$361.20. $58.80. $180.60. $0.00 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started