Answered step by step

Verified Expert Solution

Question

1 Approved Answer

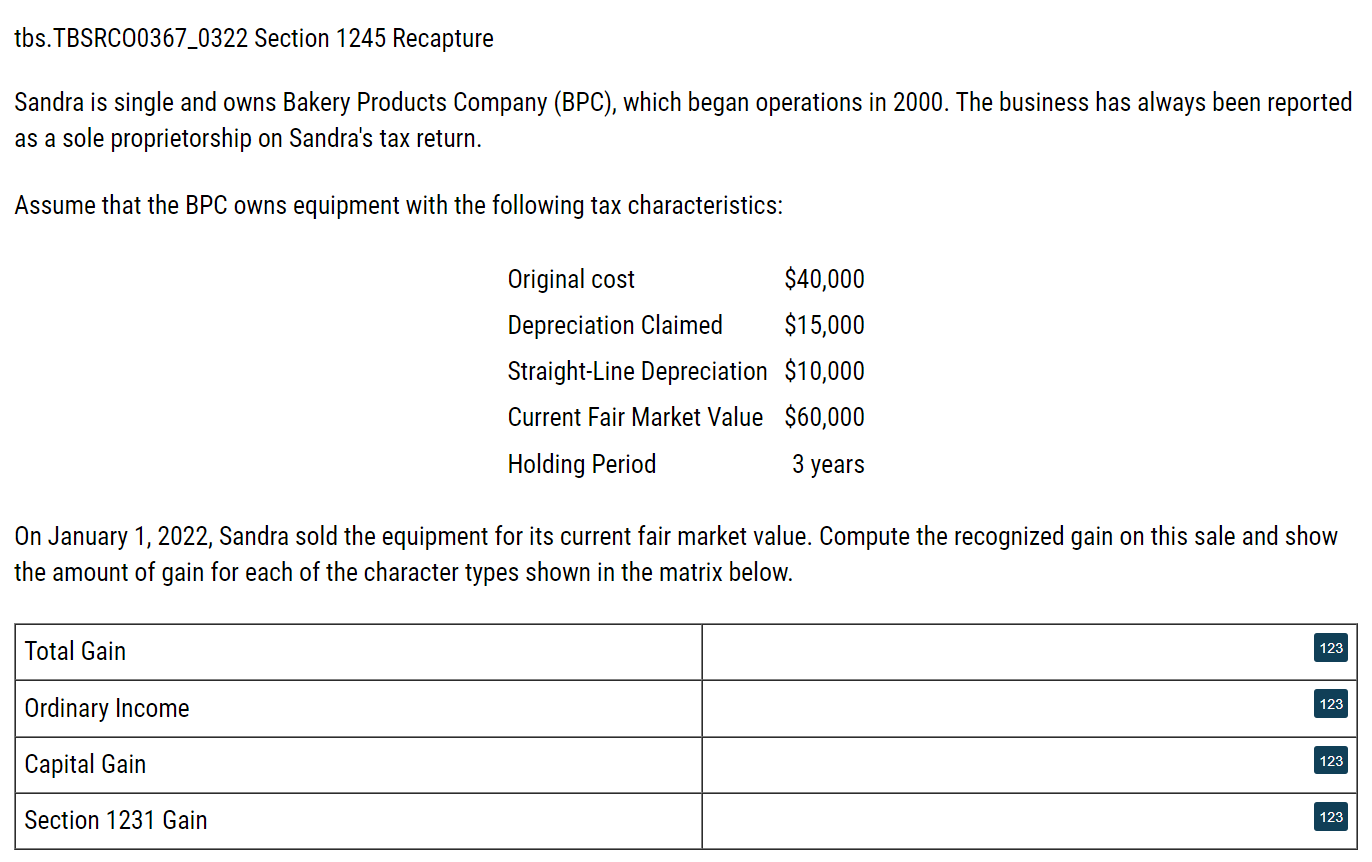

tbs.TBSRC00367_0322 Section 1245 Recapture Sandra is single and owns Bakery Products Company (BPC), which began operations in 2000 . The business has always been reported

tbs.TBSRC00367_0322 Section 1245 Recapture Sandra is single and owns Bakery Products Company (BPC), which began operations in 2000 . The business has always been reported as a sole proprietorship on Sandra's tax return. Assume that the BPC owns equipment with the following tax characteristics: On January 1, 2022, Sandra sold the equipment for its current fair market value. Compute the recognized gain on this sale and show the amount of gain for each of the character types shown in the matrix below

tbs.TBSRC00367_0322 Section 1245 Recapture Sandra is single and owns Bakery Products Company (BPC), which began operations in 2000 . The business has always been reported as a sole proprietorship on Sandra's tax return. Assume that the BPC owns equipment with the following tax characteristics: On January 1, 2022, Sandra sold the equipment for its current fair market value. Compute the recognized gain on this sale and show the amount of gain for each of the character types shown in the matrix below Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started