Answered step by step

Verified Expert Solution

Question

1 Approved Answer

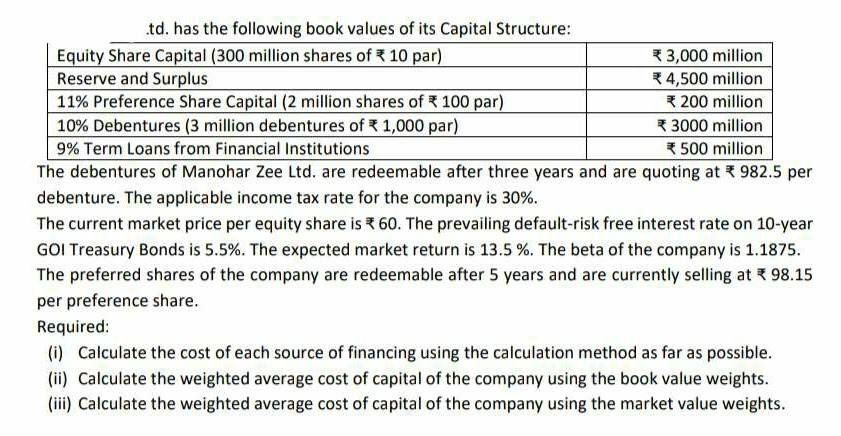

.td. has the following book values of its Capital Structure: Equity Share Capital (300 million shares of 10 par) * 3,000 million Reserve and Surplus

.td. has the following book values of its Capital Structure: Equity Share Capital (300 million shares of 10 par) * 3,000 million Reserve and Surplus 4,500 million 11% Preference Share Capital (2 million shares of 100 par) 200 million 10% Debentures (3 million debentures of 1,000 par) 3000 million 9% Term Loans from Financial Institutions 500 million The debentures of Manohar Zee Ltd. are redeemable after three years and are quoting at * 982.5 per debenture. The applicable income tax rate for the company is 30%. The current market price per equity share is 60. The prevailing default-risk free interest rate on 10-year GOI Treasury Bonds is 5.5%. The expected market return is 13.5 %. The beta of the company is 1.1875. The preferred shares of the company are redeemable after 5 years and are currently selling at 98.15 per preference share. Required: (i) Calculate the cost of each source of financing using the calculation method as far as possible. (ii) Calculate the weighted average cost of capital of the company using the book value weights. (iii) Calculate the weighted average cost of capital of the company using the market value weights

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started